Press room

Get to Know the CEE Retail Investor in Tech Startups

SeedBlink, Europe’s tech-focused venture investment and equity management platform, recently marked down the most active year of activity in 2023 with 53 deals across 20 diffеrеnt vеrticals raised by CEE companies, including Dronamics, Alcatraz AI, Swipe, and others.

Sееdblink also rеports €815M in asset ownership and €342M in startup investing mobilized for over 250 companies from 15 countries since it has been active.

SeedBlink was established at the beginning of 2020 and was the first crowd-investing platform on CEE. The democratization of investing in early-stage startups has become accessible to a broader audience via a range of products, financial services, and networks.

In 2024, some of their core goals include plans to expand investment opportunities, including the potential for co-investing in mature companies, developing the secondary market with convertible instruments, and a simplified investment process. A curious fact is that SeedBlink allows individual invеstors to enter with as little as €2,5K.

Delving into the ecosystems’ evolving trends and opportunities, we have prepared a visual overview, drawing insights from tech startups and their investors’ profiles.

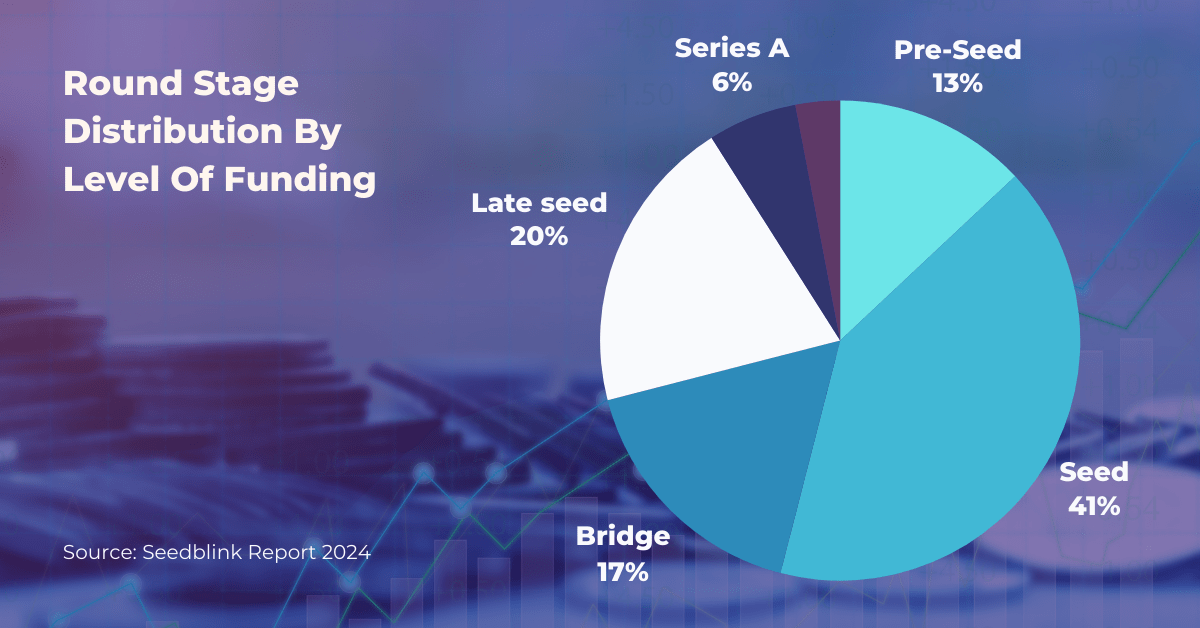

The Largest Share Of Rounds Is For Seed Funding

The platform currently provides three main categories of investment rounds, including VC-backed rounds, Syndicates, and Community Stars, catering to startups ranging from pre-seed to Series B.

Their investment amounts range from €50K to €2M. As of 2023, the top five funded sectors, based on the total amount mobilized, are Enterprise SaaS, AI/ML, FinTech, Marketplace, and MedTech.

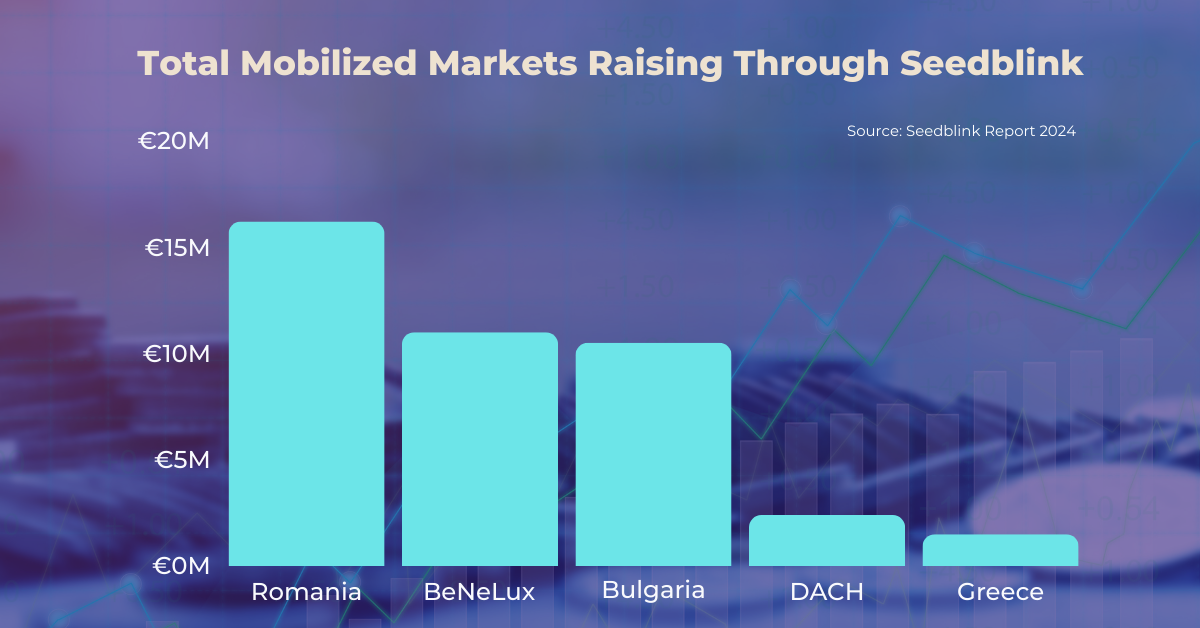

Romania Is The Top Mobilized Market

Romania secured an overall of €2M through SeedBlink only, while the BeNeLux region takes the second place, reaching €670K. Bulgaria and Greece also managed to raise substantial amounts through the platform. Moreover, one of the Bulgarian rounds attracted the largest individual investment in SeedBlink’s history with the amount of €500K.

As key insights from the Romanian market, SeedBlink shares that investing in startups is attractive to retail investors, as well as the need to make investment decisions deal-by-deal and to create diversified portfolios.

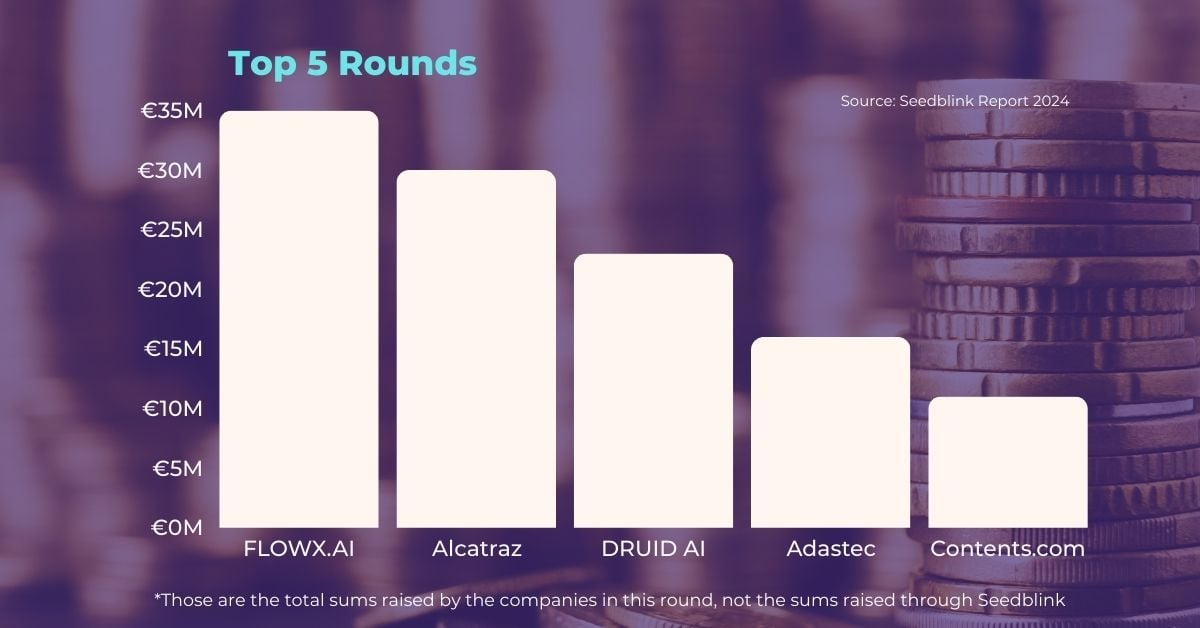

Flowx.AI Is The Leading Company, Raising Through Seedblink

More than 50 deals were raised through SeedBlink for 2023, with 53 newly funded companies and 6 follow-on rounds, including companies as FLOWX.AI, Dronamics, and Alcatraz AI, across 20 different tech verticals. Moreover, two financing rounds secured over €1.5M each in funding.

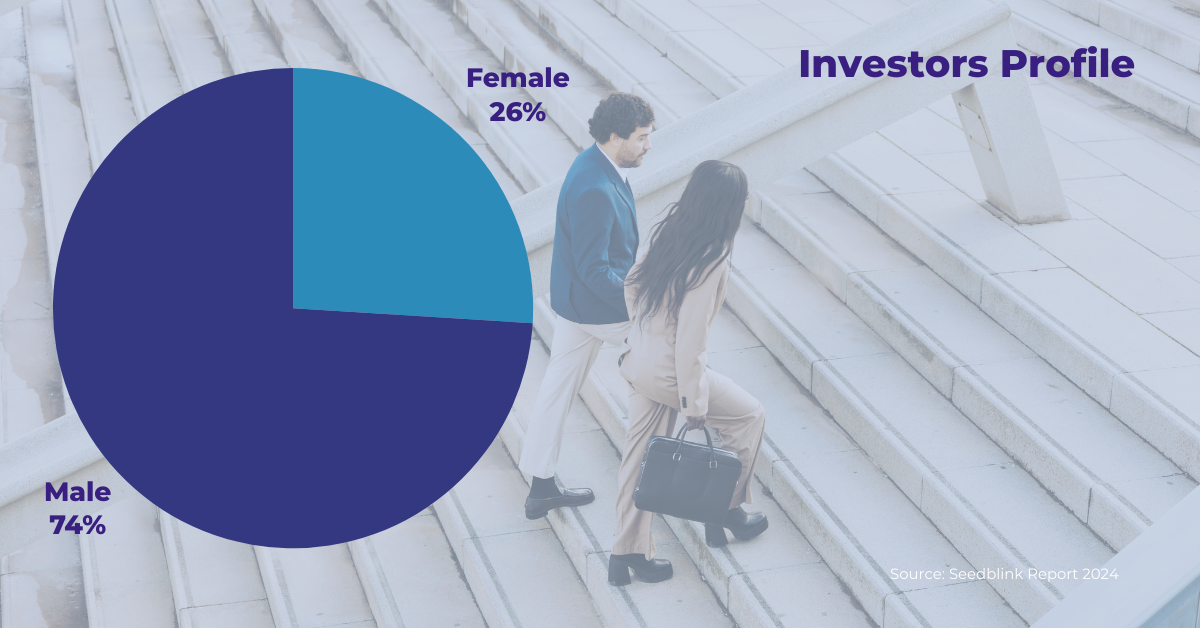

Community Of Investors

47,5% of active investors made more than one investment through SeedBlink, while up to 8% of them had financed more than 10 companies and diversified their portfolios.

In terms of their profile, male investors are surpassing female ones. Despite that, there has been a noticeable rise in the number of women investors over the past five years.

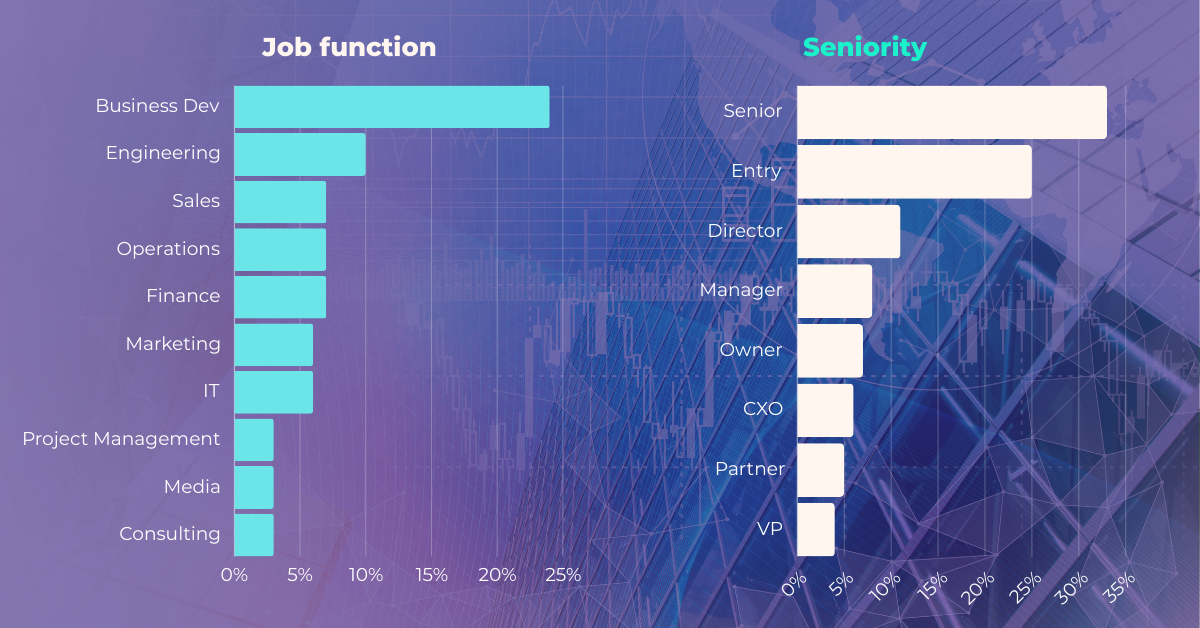

Business developers and engineers are forming the core of the active investors in Seedblink, while sales, operations, and marketing have similar shares.

Average Investment on European Level is €5,6K

The largest investor portfolio value on SeedBlink is over €900K with 49 investments, the average being €6,2K for a retail investor and €44K for a sophisticated investor with 25% of all portfolios including 5 or more companies.

PublishedFebruary 01, 2024

Share on

Be the first to know all about tech-trends, European growth, investments, and get exclusive access to all resources offered by our community!

Tudor Goicea

Co-founder of Aqurate

-

As a startup founder, I am happy to witness SeedBlink’s dedication to expanding their support for early-stage companies beyond funding, towards a healthy equity management via Nimity. A solution to help better navigate relations with stakeholders, employees and future investors is needed in Europe. Less admin work and bringing transparency to the cap table are immediate benefits I was able to test.

Delia Iliasa

Managing Partner

SanoPass

SeedBlink is a transparent solution that connects entrepreneurs with great business plans, with investors, at different stages in their development. It is a great tool for us, a democratization of access to funding, I would say.

Ioan Iacob

Founder

FLOWX.AI

We really loved the SeedBlink journey. We reached our fundraising goal within hours of launching. About 100 investors joined our vision and invested almost $2 million in FLOWX.AI through the Private Deal Room. At the same time, working with SeedBlink to prepare for the funding round was an excellent exercise for our entire team, and we received and felt the support from the SeedBlink team members who took on an advisory role.

Dan Vidrașcu

CEO

VOXA

SeedBlink made the (investment) process run smoothly. We appreciate all the support SeedBlink's professional team has provided.

Tinu Bosinceanu

Founder and CEO

Upgrade Education

It's important to look for and choose a platform that you resonate with, that shares your mission with, a platform & its people with which you feel you can have good working relationships. we got an excellent relationship going forward; we talked a lot and we were in touch on a lot of matters and I think this was important. Having people who believe in your idea is of great help.

Kimmo Rytkönen

Founder and CEO

Income

Running the financing round was like any other fundraising; we had to be active in our community as well as in SeedBlink's investor community. After the launch, everything happened very quickly, and SeedBlink organized several pitch events for investors, which we found very useful for the round momentum.

Svilen Rangelov

Founder and CEO

Dronamics

We immediately clicked with the SeedBlink team as their fundraising expertise was immediately obvious and their no-nonsense approach really appealed to us. After all, fundraising is only a means to an end, and we liked how the SeedBlink team was really focusing on supporting us and on getting things done.

Mihai Darzan

Founder

Procesio

Our main expectation has been to raise the amount we were aiming for, and both rounds launched on Seedblink exceeded our targets, so we’re very happy with that! Even though the launched funding campaigns have been purely crowdfunding rounds, we are thrilled to actually receive extra support from some of the investors, who have chosen to get involved and help us generate product awareness, whenever they can.

Catalin Mester

Founder

Voxa

I am recommending SeedBlink without hesitation, to every founder that raises capital, especially early-stage tech startups. SeedBlink is a crowd investment platform that will also provide their startup with visibility, for Angels and VCs.

Dragoș Iliescu

Founder and CEO

Brio

In the early stages, we have been funded by several early (angel) investors, and one and a half year ago through an equity crowdfunding campaign on SeedBlink. Of course, this impacted our growth in many positive ways, partly due to the cash influx that, evidently, was sorely needed, but in a larger part due to the fact that our responsibility towards our shareholders has become more stringent and explicit, becoming embodied in our market approach.

Costin Tudor

Co-founder and CEO

Undelucram

Given the accelerated growth we observed at the end of last year and the beginning of 2021, we want a new capitalization, quickly. This is a bridge round that we will use for one year, and the advantages that SeedBlink offers are the speed at which we were able to list for financing and the experience that we gain as a result of this public listing, similar to a listing on the stock exchange.

Diwaker Singh

Co-Founder & CEO

Crikle

As a platform that only serves technology ventures, SeedBlink can connect the start-up with more than just money. SeedBlink investors are primarily technocrats who understand the objectives of the fundraising company and are also able to post-funding contribute with business opportunities. The minimum investment threshold, and technology focus, differentiates SeedBlink from other fundraising platforms. A perfect fit for a technology start-up seeking intelligent funding.

Florin Stoian

Co-Founder & CEO

Milluu

SeedBlink boosted our brand exposure and facilitated the financial support we were seeking. Having a campaign on the platform allowed us not only to meet a team of professionals - that guided and helped us prepare the necessary materials - but also opened doors for increasing our brand awareness and have discussions with VCs & angel investors we have never reached before. This campaign gave us the encouragement we needed to push the product further, while the record-breaking fundraising (only 2 hours from the launch of the campaign!) was a great confirmation that our product is needed in this market and that we should continue innovating.

Raluca Jianu

CEO & Co-founder

Epic Visits

SeedBlink has created a vital ecosystem for startups at the beginning of their journey by equipping entrepreneurs with expertise, encouraging honest and sometimes uncomfortable but necessary discussions about risks and vulnerabilities through a suite of tools, and facilitating connections with investors who share the founders' vision and can contribute to their success. I have greatly appreciated the constant support of Eric and the entire team at all stages of the campaign. Thank you so much!

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.