SeedBlink Blog

all Things Equity

Investing for positive change: What is impact investing?

Discover the power of impact investing! This guide demystifies the world of socially responsible investing, helping you make a difference.

In today's rapidly changing world, investors increasingly seek deals and opportunities that align with their values.

Impact investing goes beyond traditional philanthropy by integrating sustainable development goals into investment decisions. It’s about investors actively seeking positive impacts, such as climate change, poverty alleviation, gender equality, and access to healthcare and education.

In this article, we will explore the concept of impact investing, delving into its meaning, risks, opportunities, advantages, and disadvantages. We will also delve into the key differentiators, such as environmental, social, and governance (ESG) and socially responsible investing (SRI).

Key takeaways:

- Impact investing allows investors to align their capital with values and pursue positive impacts alongside financial returns.

- This sector is projected to continue its upward trajectory, expecting to reach $955.95B by 2027.

- The landscape has seen significant growth, with the emergence of unicorn impact companies and increased funding.

- Impact investing differentiates from sustainable approaches like ESG and SRI, offering unique focuses and objectives.

Characteristics of impact investing

Impact investing is an investment approach that intentionally seeks to generate positive social and environmental impact alongside financial returns.

The key characteristics of impact investing are:

- Intentionality: Impact investors are deliberate in their search for investments that will create a positive impact. They have clearly defined impact goals and objectives and invest in companies and funds aligned with them.

- Additionality: Impact investors invest in companies and funds that create new value and add to the existing social and environmental good pool. They avoid investing in companies and funds that are simply "business as usual."

- Measurability: Impact investors measure the impact of their investments. They track the progress of their investments toward their impact goals and objectives and make adjustments as needed.

These characteristics distinguish impact investing from other sustainable investment approaches, such as ESG and SRI. ESG investing and SRI focus on integrating environmental, social, and governance factors into investment decisions.

Key differentiators of impact investing

Impact investing is often intertwined with other sustainable approaches, such as environmental, social, and governance (ESG) and socially responsible investing (SRI). While they share common goals of integrating sustainability into investment decisions, they have distinct characteristics and objectives.

While these approaches share common goals of generating positive change, they differ in their specific focuses and implementation.

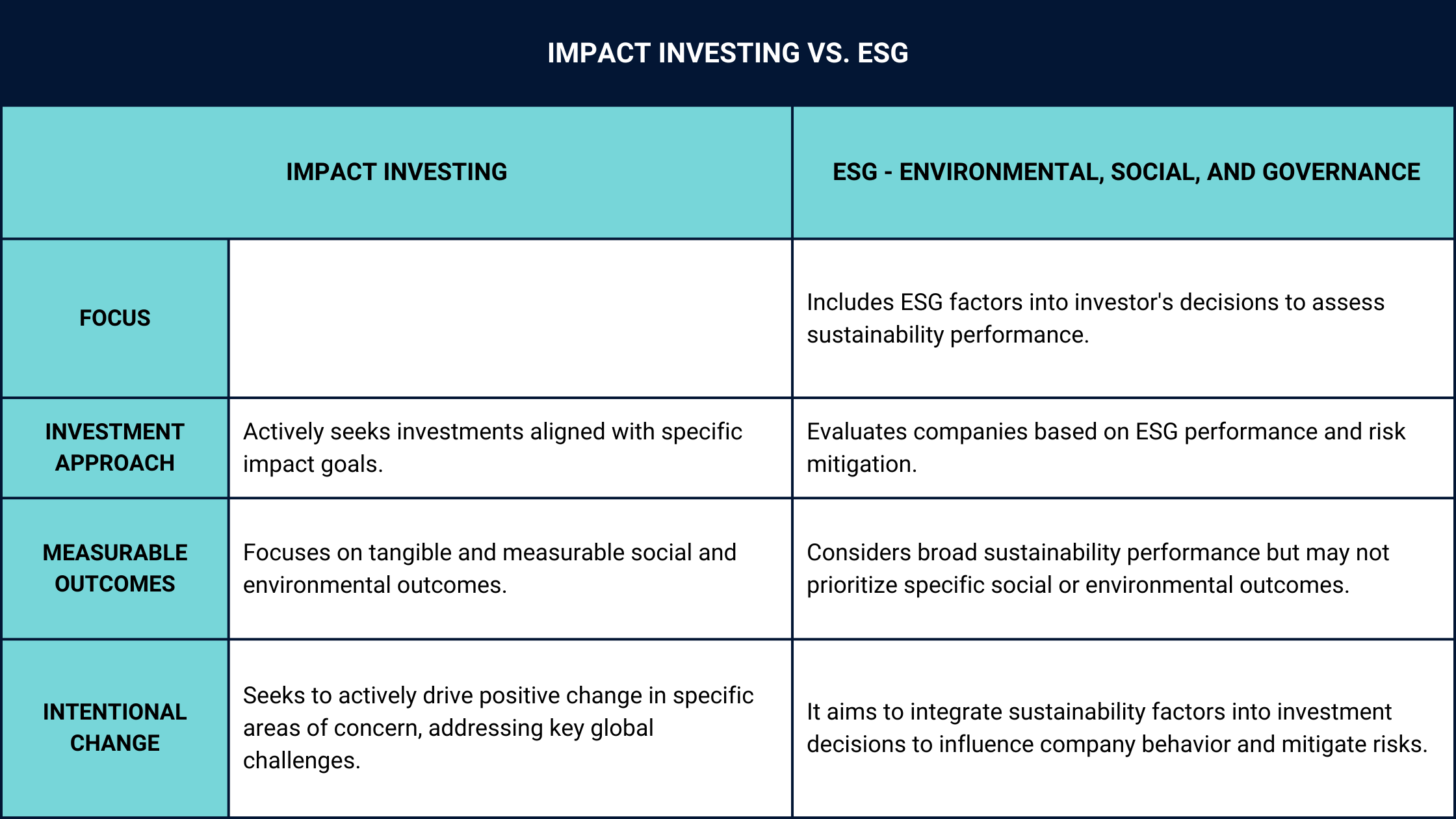

Impact investing vs. ESG

Whether an investor seeks to actively drive measurable change or integrate sustainability factors into their portfolio, both approaches offer opportunities to create a positive impact while pursuing financial returns.

Ultimately, the choice between impact investing and ESG investing depends on an individual's specific objectives, preferences, and desired outcomes.

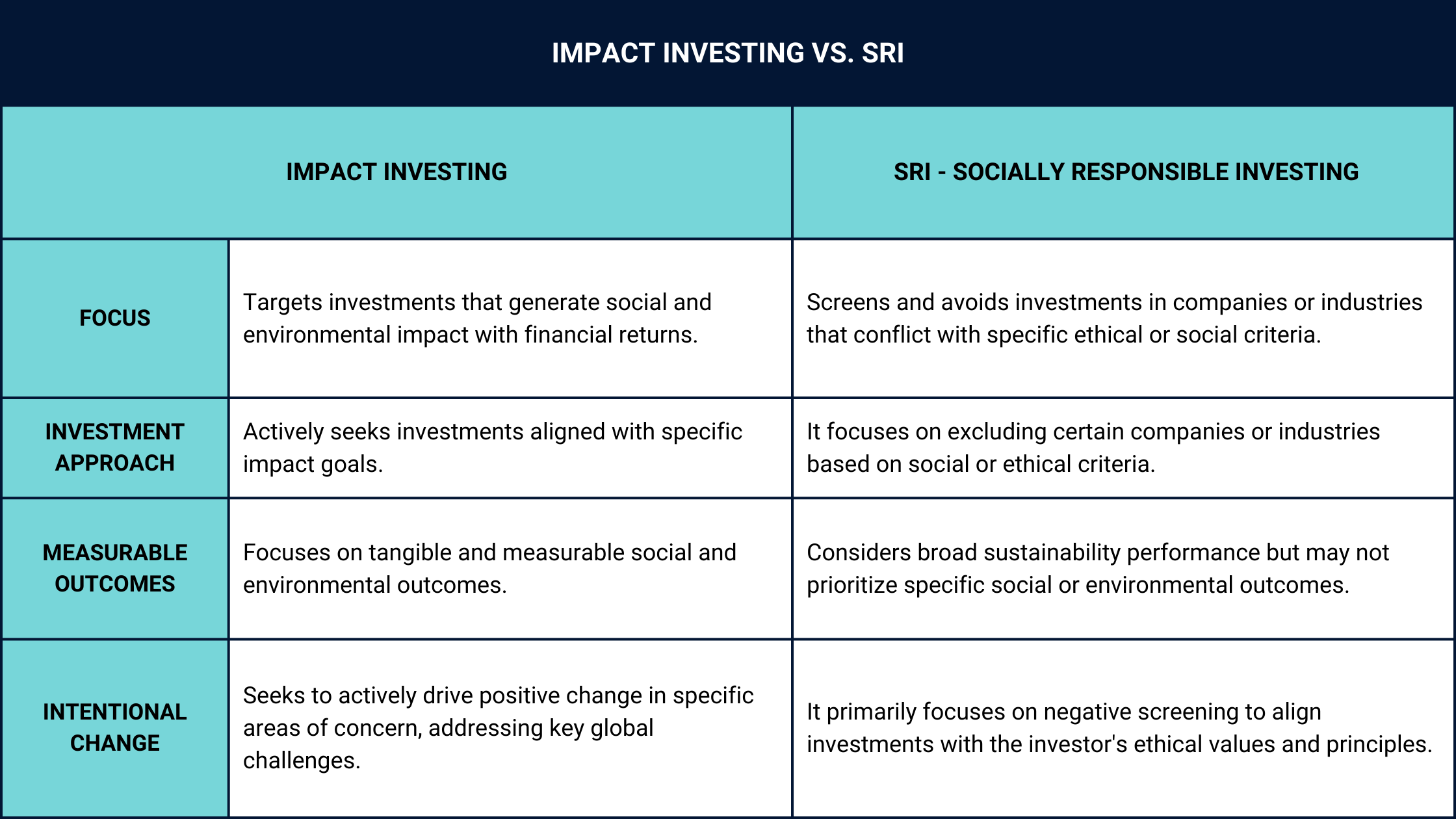

Impact investing vs. SRI

While both seek to align investments with ethical and social considerations, they have different approaches and objectives.

While impact investing focuses on creating measurable positive change through intentional investments, SRI primarily emphasizes negative screening to exclude assets conflicting with specific ethical criteria.

Both approaches provide avenues for incorporating values into investment decisions, and the choice between impact investing and SRI ultimately depends on an investor's preferences, deals, and desired outcomes.

In conclusion, impact investing offers a unique opportunity to combine financial success with meaningful social and environmental results. Impact investing can disrupt the economic environment and generate good change on a global scale as more investors understand its potential.

Risks & opportunities of impact investing

This sector offers a unique blend of risks and opportunities that investors should consider when aligning their capital with their values.

By understanding and evaluating the advantages and disadvantages of impact investing, investors can make informed decisions and align their investment strategies with their desired impact goals.

Advantages of impact investing

Social and environmental impact.

One of the primary advantages of impact investing is the ability to create positive change in the world. Investors can contribute to solutions for pressing global issues, such as climate change, poverty, and inequality.

Financial returns.

Contrary to popular belief, impact investments can generate competitive financial returns.

Many studies have shown that companies with strong environmental, social, and governance (ESG) performance often outperform their peers in the long run, potentially leading to attractive financial gains.

Risk mitigation

Impact investing can help mitigate risks associated with traditional investments.

By considering environmental and social factors, investors gain insights into potential risks that may affect the financial performance of companies, such as regulatory changes, reputational damage, or supply chain disruptions.

Innovation and long-term thinking

Impact investments often focus on disruptive and innovative solutions. By supporting these ventures, investors contribute to developing groundbreaking technologies and business models that can drive sustainable change.

Additionally, impact investing encourages a long-term perspective, fostering portfolio stability and resilience.

Disadvantages of impact investing

Limited investment opportunities

Despite the growing interest in impact investing, the universe of investment opportunities may still be relatively limited compared to traditional markets.

This can present challenges in achieving diversification and may require investors to be patient in finding suitable investments that align with their specific impact goals.

Measurement and reporting challenge

The impact of investments can be complex, as there needs to be a standardized framework for measuring and reporting social and environmental outcomes.

This lack of uniformity can make it difficult to compare and evaluate the effectiveness of different impact investments.

Market volatility.

As with any investment, impact investments are subject to market volatility and economic fluctuations. Investors should be aware that the value of their investments may fluctuate and may experience periods of lower returns or even losses.

The state of impact investing

Before delving into impact investing, let’s look at its core principles. It involves allocating capital toward ventures, organizations, and funds that generate measurable social and environmental benefits alongside financial returns.

Impact investing has become a tool that allows investors to support causes they care about while pursuing economic returns. The global impact investing market size grew from $420.91B in 2022 to $495.82B in 2023 at a compound annual growth rate (CAGR) of 17.8% and is expected to grow to $955.95B in 2027.

“We see impact investing, in the venture capital context, as a superior investment strategy because it addresses the most pressing problems in the world. Startups that solve meaningful problems experience the highest growth and generate the highest returns for their investors - this has always been the case!

We are now at a point where, especially in the EU and US, the most pressing problems relate to impact -- reducing negative impact and maximizing positive impact. Individuals, organizations, and regulators are slowly but surely accepting this and creating an environment where solving such problems will be generously rewarded!

We invest in European digital tech startups that solve meaningful problems for the Planet or People. For us at 4impact, the case for digital tech and impact is also a very clear one. Many unsustainable behaviors, be they committed by individuals or organizations, come from bad decision-making due to complexity. Digital technologies, and by that I mean smart software solutions, are best suited to informing better, more sustainable decision-making at scale.

Oh, and digital technologies have generated some of the highest venture returns to investors in history! They can, therefore, attract a lot of much-needed capital.

Sustainability and impact are becoming driving forces of our societal, political, and economic thinking, and digitization continues to shape our lives. This is why we invest in the intersection of digitization and sustainability.” Sven Meyer, Associate at 4Impact.

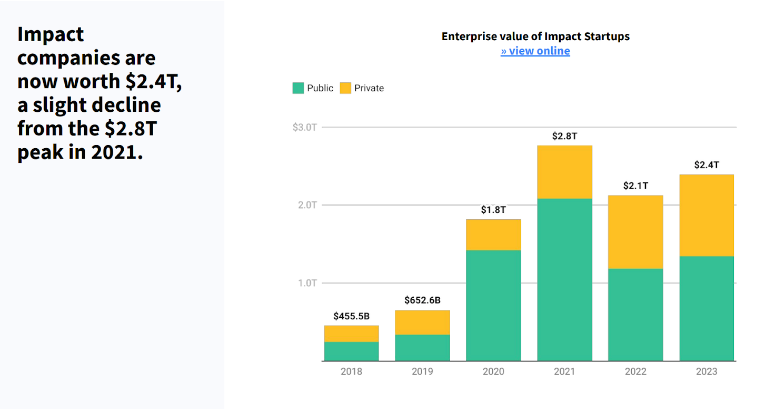

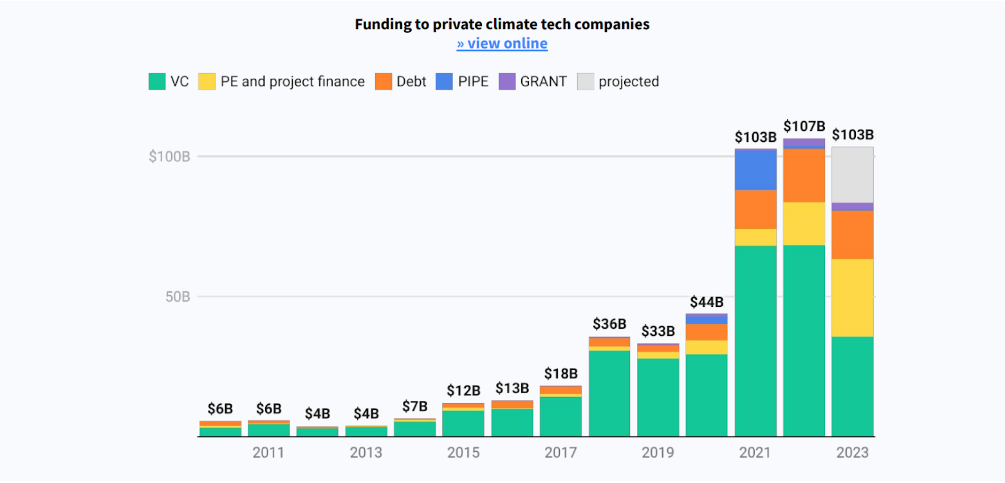

Additionally, there's a significant slowdown in impact VC funding globally despite the urgent need for progress on Sustainable Development Goals (SDGs). Impact startups raised ~$41 billion in 2023 (projected), a 36% drop compared to 2021-2022, mirroring the global VC funding decline (35%). This is concerning because none of the 17 SDGs are expected to be achieved in 2023.

Source: Impact Startups 2023 - Dealroom

In Europe and this sector, there are a few notable movements. Europe surpassed the US as the top founder of impact startups in 2023 and is showing more signs of resilience during the downturn compared to other regions of the world.

Other significant highlights are:

- Europe holds the highest share (over 30%) compared to the US (under 10%).

- Low- and middle-income countries (LMICs) have a minimal share (5%) despite their vulnerability to climate change and large populations.

- Climate tech dominates impact investment, with areas like carbon capture, lab-grown meat, and hydrogen seeing strong growth.

- Climate tech VC funding is down 35% from 2022, but other funding sources, such as private equity, project finance, and debt, are also filling the gaps.

"At Impact X Capital, we see impact investing as a catalyst for social change.

By strategically deploying our capital into companies led by underrepresented entrepreneurs, we create a double bottom line: fostering positive change while shaping a future that reflects diversity, equity, and shared pride in the world we collectively build." Eric Collins, CEO of Impact X Capital.

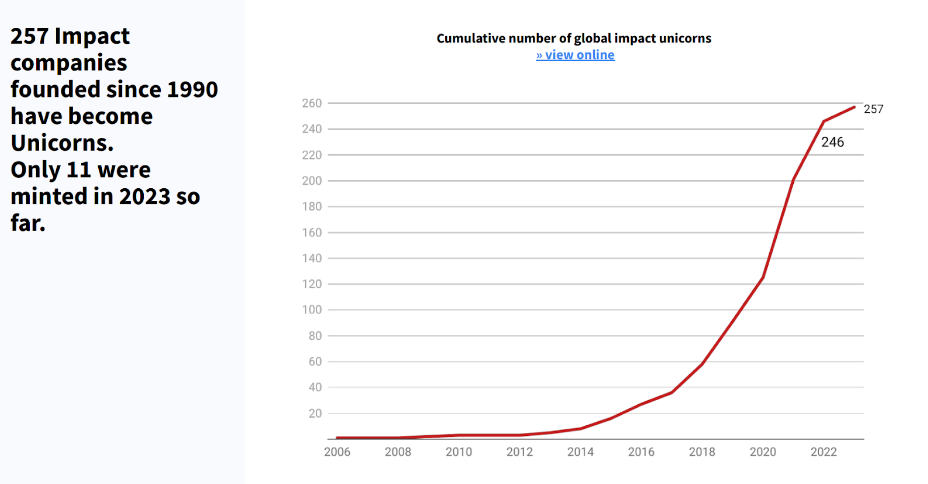

Over the past three decades, the landscape has witnessed significant growth and success. A remarkable testament to this is the +200 impact companies that have attained unicorn status.

Source: Impact Startups 2023 - Dealroom

The commitment towards sustainable development is evident as Climate Action and Affordable and Clean Energy remain among the most funded Sustainable Development Goals in 2022 and 2023, according to Dealroom.

What conclusions can we draw from here? Europe has and will continue to have a deep focus on addressing environmental challenges and promoting clean and accessible energy sources.

“The Future is Sustainable.

State-led initiatives regarding sustainability have been growing in number and importance. New regulations, definitions, methodologies, and classifications have appeared. This has consequences: It may be challenging for non-impact or non-sustainable companies to keep up and adapt to a new, more sustainable market.

Meanwhile, for impact-driven companies, this change may imply just a few tweaks and little adaptation, in fact, new regulations entail a more solid foundation where to establish the impact ecosystem.

These regulations and initiatives span from tax-related and financial regulations to specific market regulations such as manufacturing, transportation, climate-related regulations, labor laws, circular economy, trade, waste, etc.

This makes impact investment “future-proof.”

Generational Shift and Growing Trends.

In a recent Forbes article and multiple market platforms, top trends include purpose-driven and sustainability-related startups. People are starting to care whether your business is trying to make a difference. This has its roots in the growing awareness of the need to address social and environmental challenges.

As more people become aware of our problems, they are also increasingly interested in finding solutions that generate both financial returns and positive impacts, especially among Gen X and Millennials.

At a human level, impact investing is also quite fulfilling,”

Lorenzo Guerra Bautista, Investment Director at Creas.

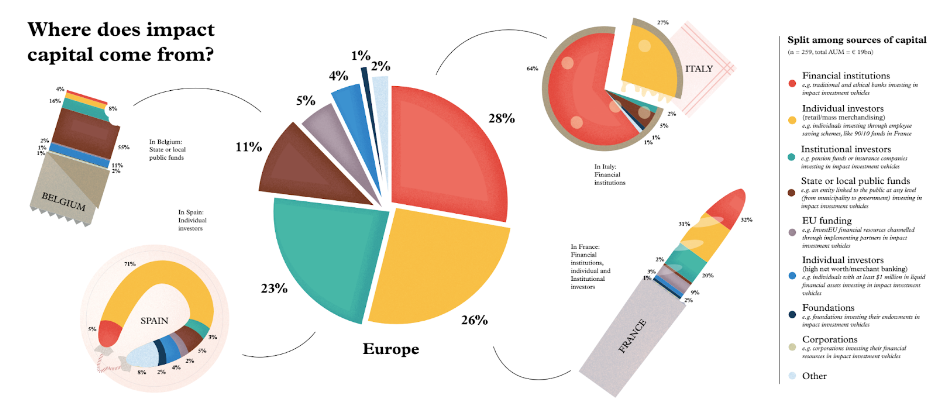

Europe is leading globally in impact investing, counting more than 60% of the global efforts. Most European investments were deployed nationally, but a surprising 16% has been invested cross-border.

In 2023, Climate tech investors raised $10.9B, a much slower fundraising pace than the last two years. However, a lot of dry powder from this sector is still available to deploy.

Source: Impact Startups 2023 - Dealroom

Beyond VC funding, climate tech companies raised nearly $50B in other private financing, a historical high. Private funding is projected to be on par with 2021-2022.

Source: Impact Europe - Accelerating Impact 2022

The average of mainstream impact investing is estimated to be €17.8T, the sustainable/ESG investment reached €3T (17%) in 2021, and the latest Global Impact Investment Network (GIIN) market sizing estimated the impact investing market (direct and indirect investments, including listed assets) to be 562.9 billion.

Italy, France, and Spain are the biggest European countries aiming for constant and better impact investing efforts.

Source: Impact Europe - Accelerating Impact 2022

These achievements and ongoing support reflect the increasing recognition of the potential for impactful investments to drive positive change while delivering financial success.

Measuring your impact

Measuring the impact of impact investments can be challenging.

However, investors can use a few frameworks and tools to measure impact. For example, the Global Impact Investing Network (GIIN) has developed the IRIS+ system, a widely used framework for measuring and reporting social and environmental impact.

“I recommend to startups and their investors to use the 3Ms” — Measure. Monitor. Manage.

"When intentional about it, devise your strategy for your stakeholders and build a process around measuring, monitoring, and managing that will inevitably lead to higher value generation.

You want to deliver the best outcomes for stakeholders. That creates value for them; thus, the market rewards your company with a high valuation."

Says Galina Markova, Impact Angel Investor

Impact investors typically measure the impact of their investments in terms of the following:

- Outputs: The number of people served, reduced pollution, etc.

- Outcomes: The changes in people's lives or the environment attributable to the investment.

- Impact: The broader social and environmental changes attributable to the investment.

Future thoughts

Impact investing is a growing field, and there is an increasing body of research on the impact of impact investments. Studies have shown that impact investments can generate competitive financial returns while creating a positive social and environmental impact.

The future of impact investing is bright, and it is up to all of us to embrace this transformational strategy and help build a more sustainable and inclusive society.

For more information and details about the European startup ecosystem, technology trends, insights into venture capital, and investment opportunities, subscribe to our newsletter.

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.