SeedBlink Blog

all Things Equity

The state of cross-border investments in Europe

Startup investments are becoming more accessible through co-investment platforms, but are investors ready to invest beyond their borders?

Investing today can take a few clicks away through different online platforms and mobile applications. However, despite being more accessible, investors are still reluctant to look beyond the countries they live in to find new opportunities.

Angel investors and venture capital firms traditionally preferred to rely on the options they knew in their locales. This is how the concept of home bias affected how investors decided to build and grow their portfolios.

In this article, we'll explore how investors look at cross-border investments, how they approach them, and the market status in Europe.

What is a home bias for investors?

Investors tend to look for domestic deals, especially when making the first steps in building their portfolios. Home bias is a phenomenon that is often encountered both by angel investors as well as venture capital firms.

The fear of uncertainty when they don't know the local ecosystem, the inaccessibility to regional deals, or how to connect with them are two of the most common reasons investors don't go beyond their country's borders. Other reasons that can lead to more familiar startup investment deals are the lack of data and insights on countries' economic and stability context or the lack of knowledge about how other markets are evolving.

However, the comfort of choosing only familiar deals over international ones has a direct impact on the diversification of its portfolio.

Why invest in cross-border deals?

Growing its portfolio and avoiding risks through diversification is one of the main reasons why investors start looking for more exciting deals, even beyond their country's borders. If you invest money in different industries across multiple countries, there is a smaller chance of losing all your money under one deal.

Besides diversification, some of the main advantages of investing in cross-border deals are:

- A higher exposure as an investor through international deals

- Better and more pipeline of deals

- Better expertise and knowledge alongside foreign angels and VCs

- A broader landscape of role models to follow

In the tech sector, investing in cross-border deals comes more naturally as the startup scales internationally. A typical example is UiPath, struggling to attract its first round of international investors but later became the company everyone wanted to invest in.

Another reason to consider looking at international deals is that you get the chance to co-invest with angels and venture capital firms who already have successful portfolios. We are seeing increasing interest in this area, especially startups announcing their rounds on SeedBlink.

For example, Golee, a sports-tech startup from Italy, makes digital tools to run amateur sports clubs professionally. One of the core investors in their round was the Family Office of the Moratti family, a former owner of Inter Milan, Maria Lucia Chivilo, and the Italian National Venture Capital Fund). If you are passionate about the sports tech sector, follow the investment activity within this area independent of the country they are in, and co-invest next to such investors (SeedBlink solves the how).

The state of cross-border investment deals in Europe

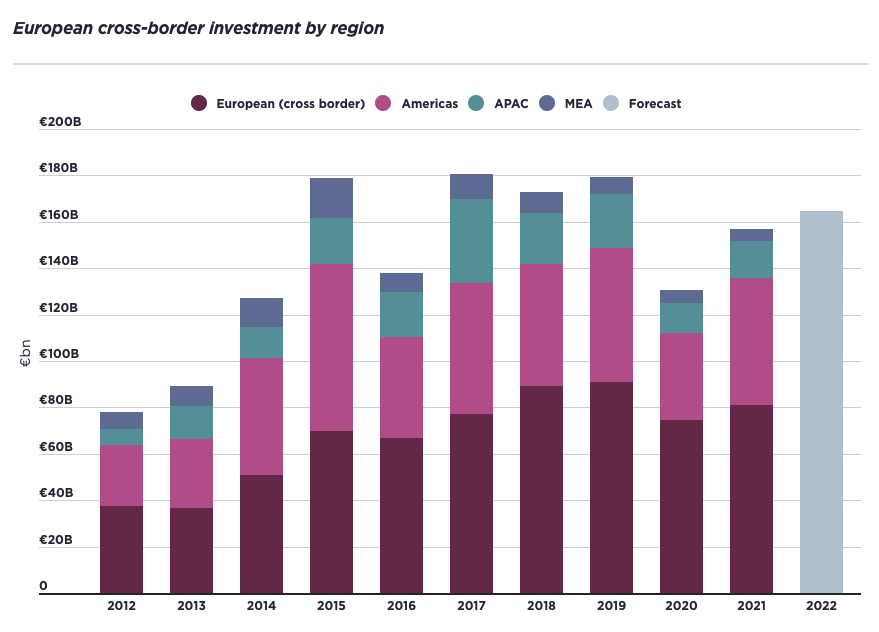

The European startup ecosystem entered the year in full force, reaching a new record in venture capital funding at +$20B in the first three months. While seed funding saw a slight decrease in the volume of investments, early-stage and later-stage deals, which are more popular for cross-border investments, grew substantially.

On top of this, the number of international investments coming to Europe also started on a good path, regaining the lost advantage during the two pandemic years. For example, US investments closed at €160B, a 20% increase compared to the previous year.

Source: Spotlight European Cross Border Investment

The western part of Europe is still attracting the majority of the attention of international investors, with the UK, Germany, France, Spain, and the Netherlands leading the way. However, countries from Central and Eastern Europe, such as Poland, have shown significant signs of traction and success stories to follow.

We can't ignore the war in Ukraine that marked the beginning of this year and the rising inflation taking the news. These events started to raise questions in investors' minds about what might happen next, but there are a few benefits on why some of them still choose to invest in uncertain times. Borys Musielak from SMOK Ventures in Poland reinforces this and talks about the untapped potential these events might have for the future.

"I think once the current events in Ukraine go back to normal, there will be a massive potential to rebuild the country.

Ukrainians are great tech professionals working for Silicon Valley companies for the past ten years. I think they have a considerable amount of expertise, and the process of rebuilding the country will give them unique opportunities.

There were many legacy systems in the country, but they will be able to skip a few steps and have the chance to build a system from scratch."

While initially, international investors paused their activity or pushed back in some cases, after three months since the war began, they started to regain trust in European investments.

Additionally, investors are betting that this will only make investing in this part of the world more interesting. Once the war is over, there will be countless opportunities to rebuild the country, and all the startup ecosystems around will benefit from a higher international influx of capital.

Unified regulations for private equity deals

The investment landscape was heavy and characterized by multiple bureaucratic processes making it difficult for individual investors to invest easily in numerous deals, especially outside the country.

The European Union is constantly trying to bring more flexibility and transparency to cross-border pan-European investments. The recent European Crowdfunding Regulation that came into place at the end of last year facilitates the investments powered by individual investors across the Union.

The new regulations will empower European startups to raise money in a more friendly context, without the need to have their round pass through local restrictions from different countries. Co-investment platforms, such as SeedBlink, come to bring modern solutions for smart and fast investing.

A unified currency and less financial volatility

Countries in the European Union have the main advantage of adhering to a single currency for all financial transactions in each country and beyond borders. This makes it easier for investors to follow.

Additionally, the ongoing innovation from the Fintech sector aims at decentralizing the industry even more. For example, The European Central Bank is considering rolling out a digital Euro version. Multiple other countries worldwide are looking to explore their digital currency, according to the Unchain Festival Fintech Market Report.

The right moment to co-invest with other investors

With a European ecosystem on its way to becoming democratized and global investors becoming more interested in cross-border deals, what better time to join the movement?

Our mission here at SeedBlink is to empower access to deals from Europe, led by local investors, and not only. There are currently 11.300+ investors from over 60+ countries, as part of our community, with +€72M mobilized investments next to institutional investors in over 60 companies from 15 countries.

At SeedBlink, you can find a modern platform that helps you:

- Define your investment thesis.

- A list of pre-vetted startups through a rigorous selection process.

- Build and manage European deals from your portfolio.

- Dedicated post-investment support

- An exclusive community of like-minded investors.

- Dedicated local offices in Romania, Bulgaria, and Greece (we are extending this every quarter).

Our community of investors continues to grow as more startups are joining the platform for a co-investment deal. Keep an eye out for new investment opportunities, and create your investor profile today!

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.