Industry trends

Discover the latest in European venture capital for Q3 2024! We’ll cover the rise in VC funding, the hottest regions and industries for deals, and key market trends.

November 7, 2024

·

5

min read

Fundraising remains resilient, with €17.6 billion raised YTD in 2024. In Q3, European venture capital activity has been slower compared to last year, with notable trends in AI and femtech, such as Flo Health becoming the first femtech unicorn in Europe.

Now, let’s dive into the major insights from the latest market report!

Despite the decline in deal volume, certain verticals like software as a service (SaaS), life sciences, and oncology have steadily grown. The UK continues to dominate with several large fund closes, including six vehicles headquartered in London, each raising over €1B.

Additionally, macroeconomic and political factors in regions like the UK are highlighted as key influences on private markets.

The median fund size has increased year over year, but the time it takes to close funds remains long. Despite regional trends, European GPs are resilient to market challenges as fundraising activity continues to align with expectations.

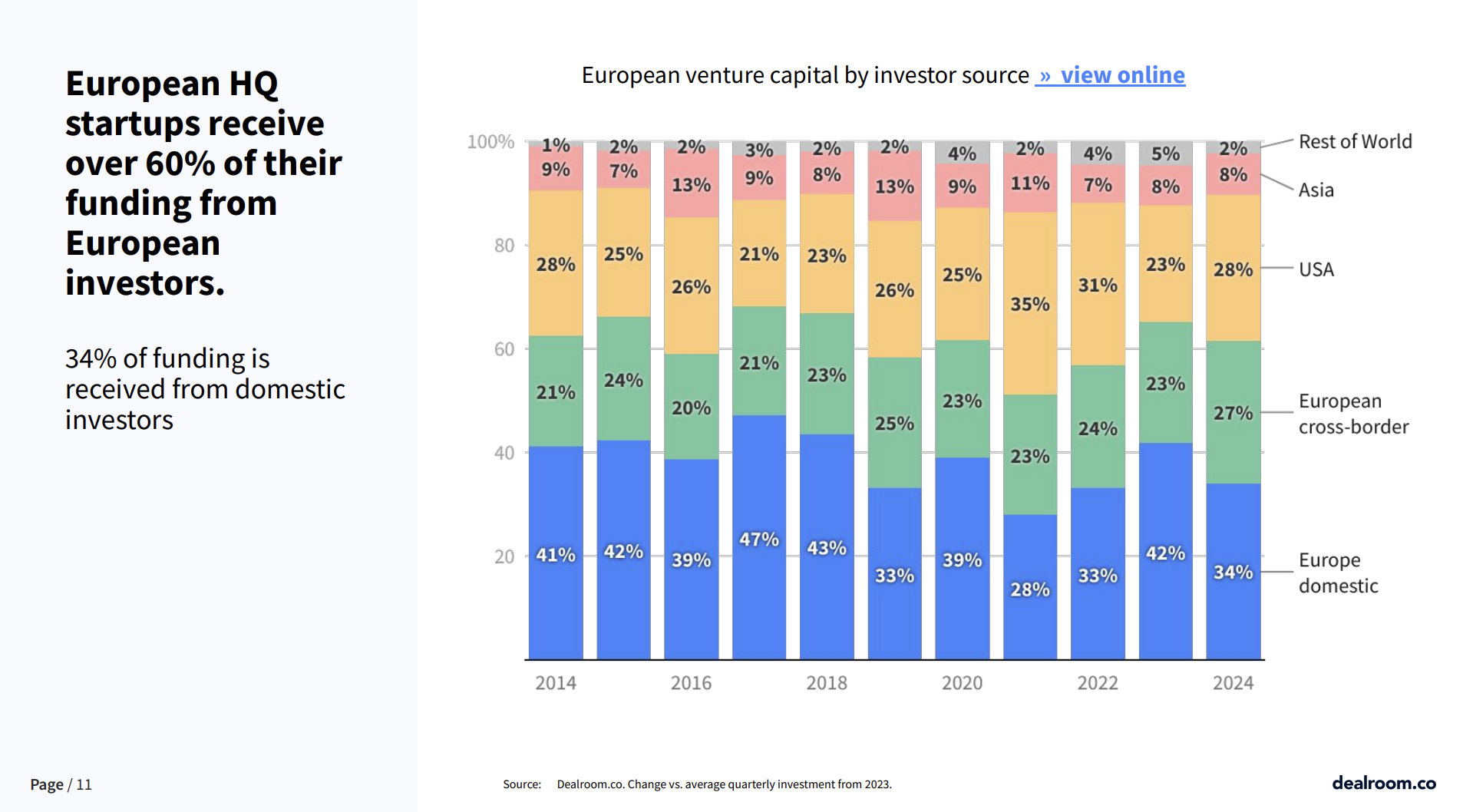

Over 60% of funding for European HQ startups in 2024 originates from European investors, with domestic investors contributing 34%. This trend has remained consistent since 2014, with a growing proportion of cross-border European funding. U.S. investors account for a significant portion, representing 28% of the total in 2024, while Asian and other global investors have maintained smaller but steady contributions.

Source: Europe Tech Update – Q3 2024

Meanwhile, Europe has now created 571 unicorns, according to the same report by Dealroom, with 22 new ones in 2024. Of these, 37 have achieved decacorn status, indicating an increasing presence of high-value companies within the region.

European seed-stage funding hit $1.5 billion across 800 rounds last quarter, a drop from $1.8 billion in Q3 2023. However, it's unclear if this signals a slowdown since seed rounds are often added to the data after the quarter ends, making it too early to draw firm conclusions.

Source: European Venture Funding by Crunchbase

European startups raised $4.5B in early-stage funding last quarter across over 290 rounds. Notable deals include Paris-based Newcleo securing $151M for atomic energy and Munich's Marvel Fusion raising $70M for laser fusion energy. ESG compliance company Osapiens from Germany raised $120M, led by Goldman Sachs.

Source: European Venture Funding by Crunchbase

Late-stage funding for European startups dropped 57% year-over-year, reaching $4.2B across over 70 rounds in the third quarter.

Noteworthy deals include Berlin-based DefenseTech company Helsing raising $488M, women’s Health app Flo Health securing $201M, becoming Europe’s first FemTech unicorn, and Munich-based fitness company Egym landing $200M.

Source: European Venture Funding by Crunchbase

In Q3 2024, VC investment in Europe slowed down, partly due to the typical summer holiday period in August. Despite the slowdown, the quarter still saw ten significant megadeals over $150M, including a $484M raise by Germany’s DefenseTech company Helsing and $386M by France’s gaming company Voodoo.

Source: European Venture Pulse Q3 by KPMG

The SpaceTech sector also drew attention, with Italy’s D-Orbit securing $166M. AI investments shifted towards vertical integration and niche applications, with defense-tech companies like Helsing capturing investor interest.

However, CleanTech investments declined as VCs prioritized profitability and quicker returns. The Health and BioTech sectors saw renewed interest, with notable deals like $200M for the UK’s Flo Health and $150M for Germany’s Catalym. The UK’s VC scene showed cautious activity, favoring later-stage companies, while Germany had a strong quarter, including Europe’s largest VC deal of $484M by Helsing.

The Nordics region experienced a quiet quarter, though early-stage funds raised capital at a healthy pace. AI, defense-tech, and biotech are expected to remain strong sectors heading into Q4.

European startups raised $11.3B in Q3 2024, marking the lowest quarterly total for venture capital in Europe and globally in four years. Although summer often sees a slowdown in investment, this decline reflects a broader dip in VC activity across the board.

Source: Europe Tech Update – Q3 2024

European venture capital investment in 2024 is tracking on par with 2023 levels and remains ahead of the totals from 2019 and 2020, indicating resilience despite broader market fluctuations.

Source: Europe Tech Update – Q3 2024

So far in 2024, European startups have raised over 2,000 funding rounds of $2M or more, making the venture industry more active than any time before 2021. This highlights the continued strength of the startup ecosystem in the region.

Early-stage European VC, including pre-seed, seed, and Series A, has remained relatively stable over recent years, reflecting consistent funding levels. In contrast, breakout-stage investments (Series B and C) have shown steadiness in recent quarters.

However, late-stage investments (above $100M) have experienced a noticeable slowdown in Q3 of 2024, with a clear dip compared to earlier peaks in 2021, when late-stage funding saw significant spikes.

Source: Europe Tech Update – Q3 2024

The UK, Germany, and France remain Europe's top venture-funded countries in 2024. The UK leads with $12.4B, despite a 9% drop from 2023. Germany and France followed with $6.6B and $6B, respectively, showing mixed trends, with Germany experiencing a 6% increase and France a 13% decline. Notably, the Netherlands saw a significant 31% rise in VC investment, while Sweden saw the steepest drop of 56%.

Source: Europe Tech Update – Q3 2024

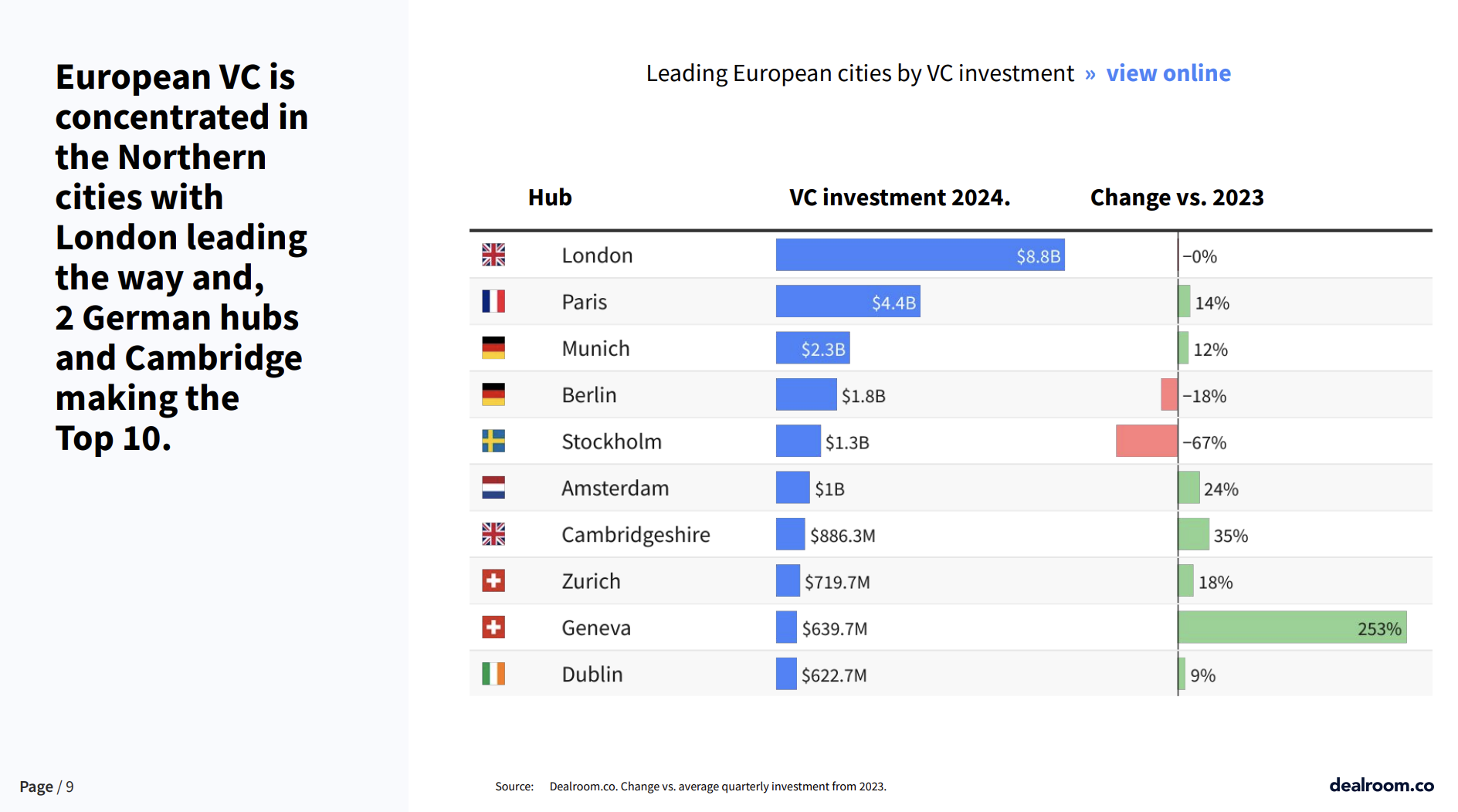

On a city level, London is Europe's dominant VC hub, maintaining a stable $8.8B in 2024. Paris and Munich follow with $4.4B and $2.3B, respectively. While Stockholm experienced a 67% decline, Cambridge and Zurich saw notable growth at 35% and 18%. With a 253% increase, Geneva stands out as an emerging hub, while Dublin continues to show steady growth.

Source: Europe Tech Update – Q3 2024

In terms of VC fund-raising, Europe is projected to have $33.9B in dry powder by the end of 2024, with $27B raised so far. While this is slightly lower than the peak of $42.1B in 2022, it reflects a strong trajectory compared to previous years, indicating sustained investor confidence in the European startup ecosystem.

Source: Europe Tech Update – Q3 2024

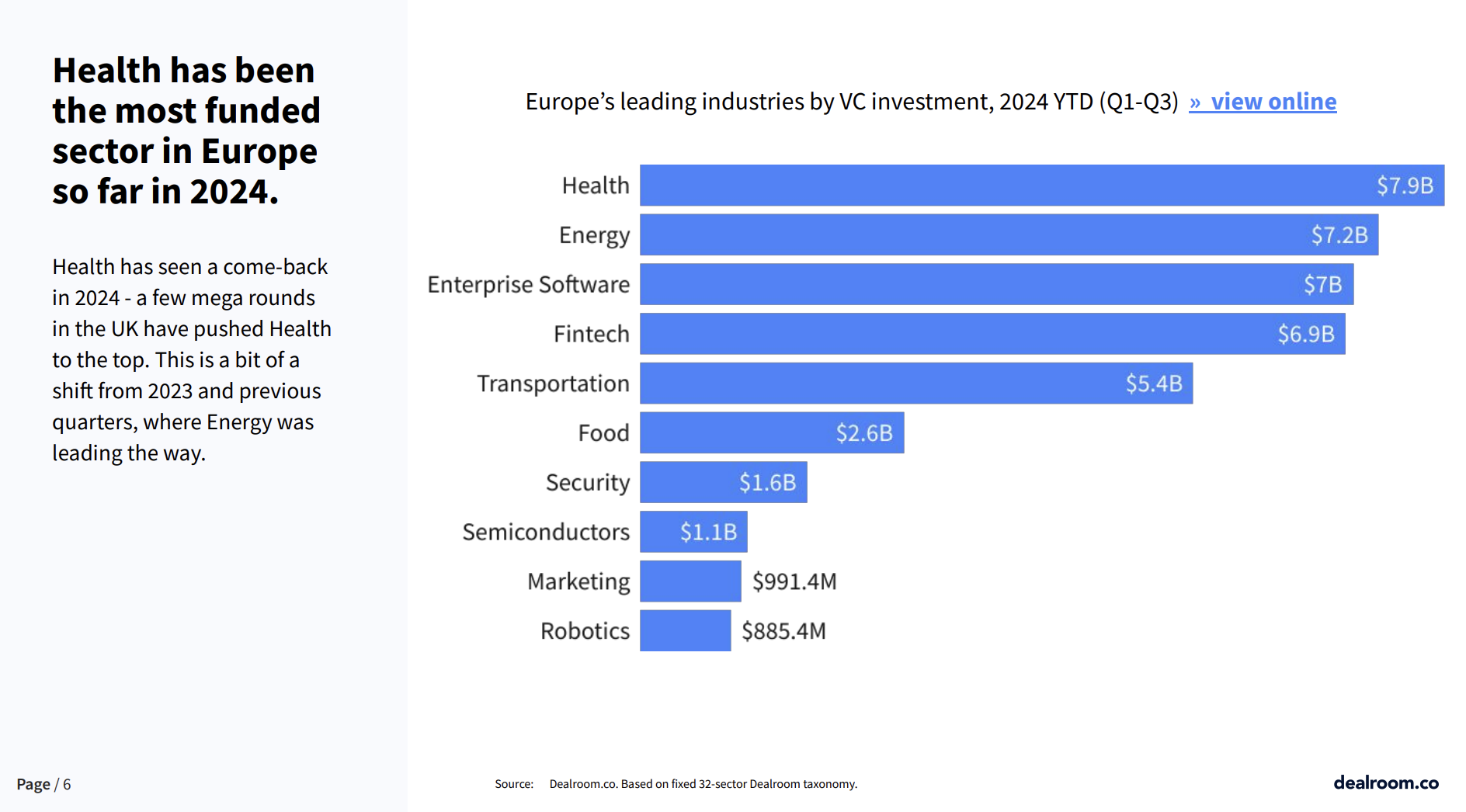

In 2024, the Health sector has come back as the most funded industry in Europe, securing $7.9B in venture capital so far, surpassing Energy, which raised $7.2B. This is a significant shift from last year when Energy consistently led funding rounds. The revival of health funding is partly due to several large-scale rounds in the UK.

Source: Europe Tech Update – Q3 2024

Other key industries attracting significant VC investment include Enterprise Software, with a total value of $7B; Fintech, worth $6.9B; and Transportation, counting down the value at $5.4B.

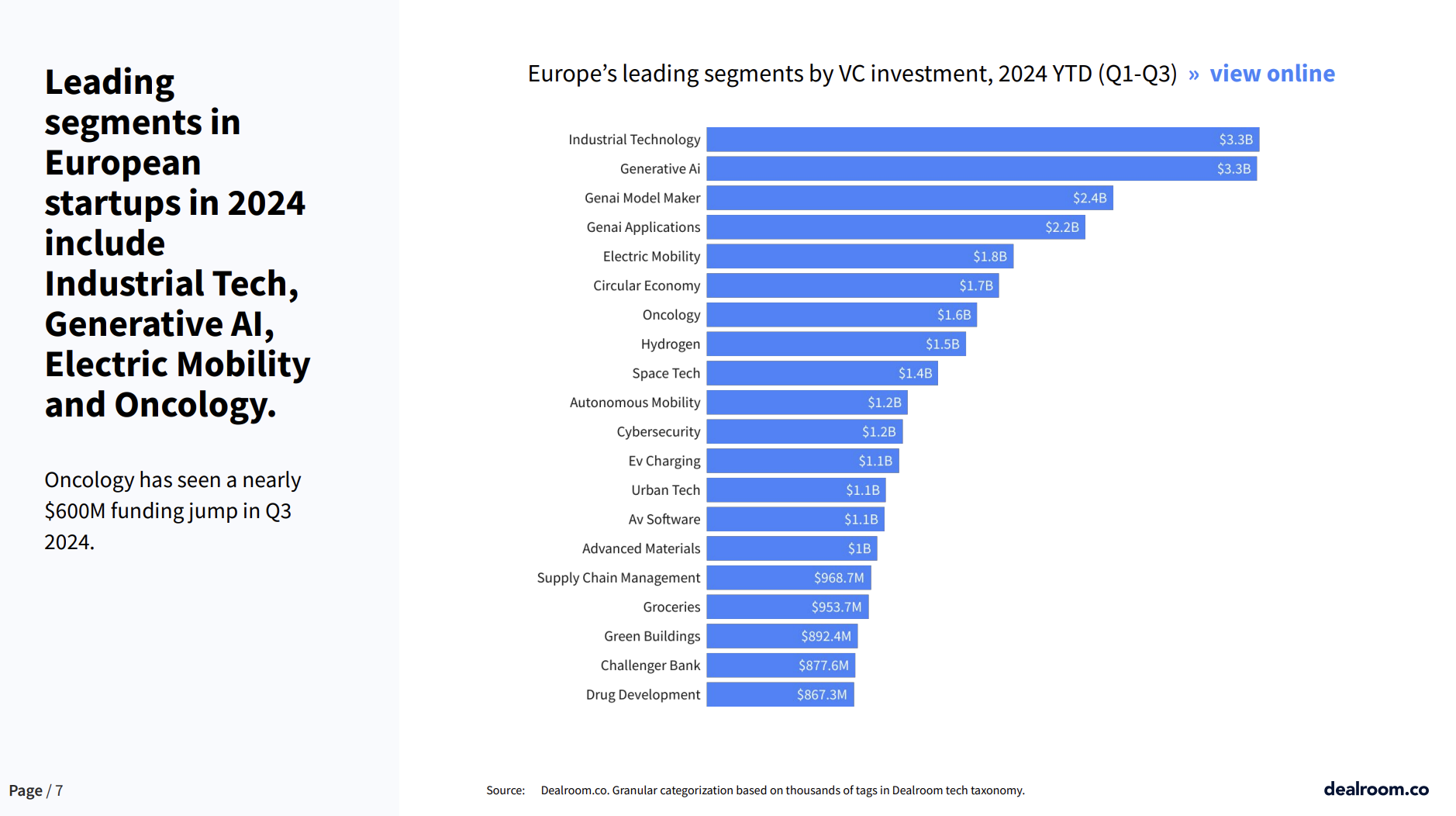

Europe's top VC investment segments for 2024 (Q1-Q3), with Industrial Technology and Generative AI leading at $3.3B each. Other key sectors include GenAI Model Maker and Applications, Electric Mobility, and Circular Economy. Oncology stands out with $1.6B in funding, experiencing a significant $600M surge in Q3 2024. The chart also highlights investments in emerging fields like Space Tech, Hydrogen, Cybersecurity, and Autonomous Mobility, each attracting over $1B.

Source: Europe Tech Update – Q3 2024

Expectations for Q4 of 2024 in European venture capital markets are cautiously optimistic, based on several key trends from the Q3 2024 European Venture Report. Despite a slower start in fundraising compared to 2023, the YTD total of €17.6B indicates that fundraising could close the year 4.8% higher than the previous year.

Source: European Venture Report Q3 2024

Despite a growing number of emerging firms in the ecosystem, most capital (64.8%) continues to be allocated to experienced managers, while first-time funds show less resilience.

First-time funds have raised €1.8B YTD, a 30.8% decline compared to 2023. However, with several large vehicles still open, additional capital could close before year-end.

Source: European Venture Report Q3 2024

The UK continues to dominate the European venture capital landscape, particularly in fundraising, with €7.4B raised YTD in 2024. This represents over 41.8% of the total capital raised in Europe and is more than double the amount raised in France & Benelux, the second-largest region.

The UK’s fundraising performance is further reflected by the large size of funds, with six of the top 10 largest closed funds YTD being UK-based. These include Index Ventures Growth VII and Atomico VI, which exceeded €1B.

Other regions seeing positive trends include the Nordics, Southern Europe, and Central and Eastern Europe, all of which are tracking higher year over year.

If you want to connect with these investors or check out other active investors in the region, check out the European VC Network list covering venture capital funds from SEE, DACH, Benelux, and others.

At the same time, we strongly encourage you to consider more flexible funding options for your next round, such as SeedBlink's syndicate infrastructure with its rolling facility.