SeedBlink Blog

technology Trends

Carbon Market Trading: Opportunities at the intersection of CleanTech & Fintech

Unlock new opportunities in CleanTech Fintech investment by exploring the potential hidden in carbon market trading.

In today's era of increasing environmental consciousness and the urgent need to combat climate change, exploring carbon market trading presents interesting new opportunities. Carbon market trading, or emissions trading, has emerged as a transformative mechanism in the fight against climate change in an accountable, transparent way.

This article will delve into carbon market trading, revealing its immense investment potential and impact on a greener and more sustainable future.

Key takeaways:

- The global carbon market value reached a record of $272 billion in 2020, with the EU Emissions Trading System (EU ETS) being the largest contributor.

- The European carbon market, particularly the EU ETS, is undergoing significant changes to achieve ambitious carbon neutrality goals, such as reducing greenhouse gas emissions by 55% by 2030.

- The voluntary carbon market provides a flexible and voluntary approach for companies to offset their emissions beyond regulatory requirements.

- Participating in the voluntary market allows companies to proactively manage their environmental impact, enhance brand reputation, access economic opportunities, contribute to climate-friendly initiatives, and foster job creation and technological advancements.

Understanding Carbon Market Trading

Carbon market trading establishes a market-based approach where greenhouse gas emissions are assigned a financial value. By trading emission allowances or credits, companies can buy, sell, and transfer their carbon footprint, incentivizing emission reductions and adopting cleaner technologies.

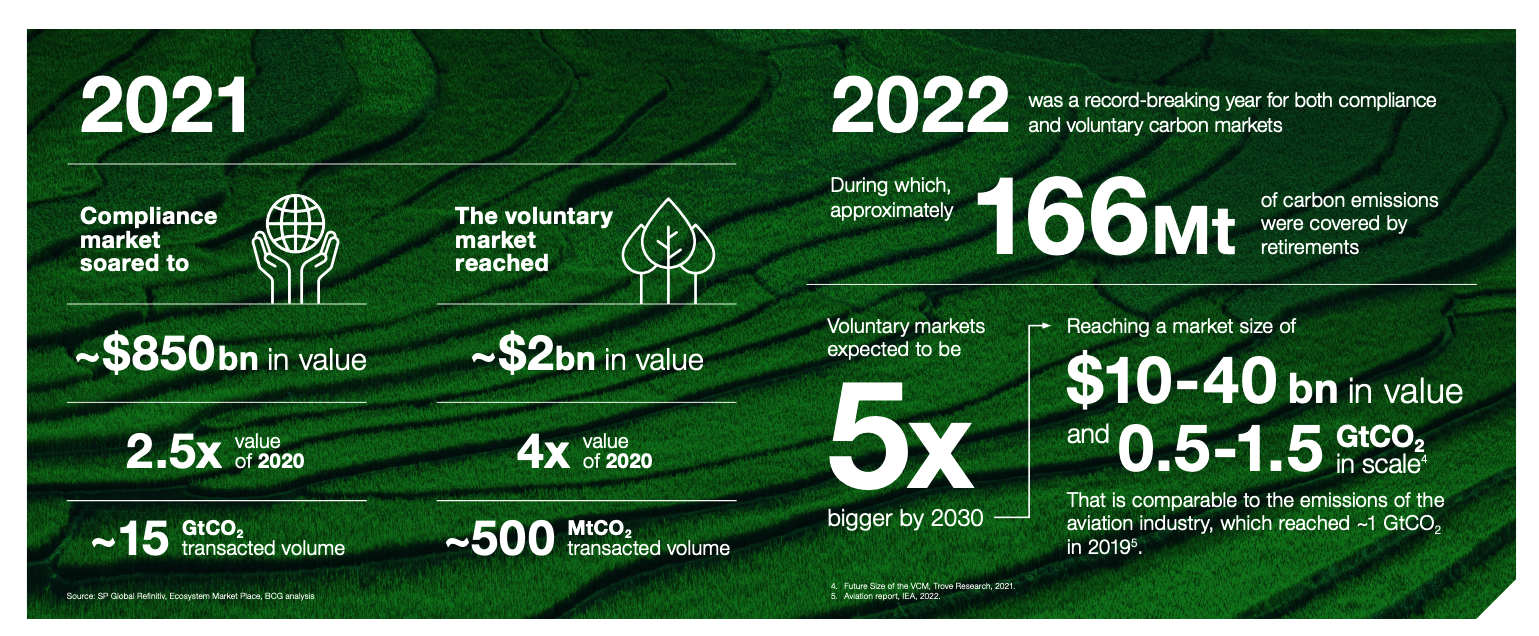

The global voluntary carbon market aims for significant growth.

The latest projections suggest a compound annual growth rate (CAGR) of 42.91% between 2022 and 2027. On top of it, the traded volume within the voluntary carbon market is expected to experience a robust CAGR of 14.69%. This shows us the immense potential of the voluntary carbon market in driving meaningful environmental change and fostering a greener future.

The European carbon market is increasingly linked with other global carbon markets, such as China and California. These linkages create new opportunities for international trade in carbon credits and promote global cooperation in mitigating climate change.

However, they also pose new challenges in ensuring the compatibility of different carbon market systems and maintaining the integrity of carbon credits.

10 Advantages Of Carbon Market Trading

The role of carbon market trading in attaining environmental sustainability goals is enormous. Here are some of the most important ones we identified in the quest for a better understanding of this market:

- Provides a transparent and measurable framework for tracking and reducing emissions.

- Allows countries and organizations to set emission reduction goals and track progress.

- Encourages the development of CleanTech solutions and innovation.

- Creates financial incentives for businesses to invest in environmentally friendly technology and practices.

- Fosters cooperation among industry, governments, and financial organizations.

- Encourages information exchange and the implementation of best practices for climate change mitigation.

- Produces economic opportunities.

- Encourages investment in renewable energy and green infrastructure.

- Contributes to the development of new jobs.

- Facilitates the transition towards a greener and more resilient economy.

The European Trading System

The EU carbon market is undergoing significant changes in the coming years as part of the European Union's efforts to achieve its ambitious carbon neutrality goals by 2050. The most significant change is the EU Emissions Trading System (EU ETS) revision.

The European Union Emissions Trading System (EU ETS) is the world's most extensive cap-and-trade system for greenhouse gas emissions and is referred to as the EU trading scheme. The revised EU ETS aims to further reduce greenhouse gas emissions by 55% by 2030, compared to 1990.

Under this program, certain companies and power stations in the EU are assigned a restricted number of emission permits, each representing one ton of CO2 equivalent. These allowances can be purchased, sold, or transferred between participants.

Companies must comply with their carbon credit limits by adhering to certain obligations, which may vary depending on the specific carbon market and regulatory framework. Carbon credits, also known as carbon allowances, act as emissions permission slips issued by national or international governmental organizations.

The first international carbon markets were created under the Kyoto and Paris Agreements. When a company purchases a carbon credit, generally from the government, it obtains authorization to emit one ton of CO2. Carbon money goes vertically from firms to regulators via carbon credits, while companies with extra credits can sell them to other companies.

Source: Understanding Carbon Credits

There are two types of global carbon markets, voluntary and compliance. Carbon credits are generally transacted in the carbon compliance market, while in voluntary markets, transactions are usually performed through carbon offsets.

Obligations & Penalties in Carbon Market Trading Compliance

Companies have several obligations imposed on them to comply with their carbon credit limits. Some common obligations include:

Monitoring and Reporting: Companies must correctly monitor and report their greenhouse gas emissions through the following:

- Measuring emissions from various sources.

- Collecting pertinent data.

- Reporting it to regulatory authorities or market administrators.

Verification and Auditing: In many cases, companies must undergo verification or auditing processes to ensure the accuracy and integrity of their reported emissions data:

- Third-party verification by independent auditors.

- Validation of the emissions data.

- Compliance with carbon credit limits.

Holding Enough Carbon Credits: Companies must possess an adequate number of carbon credits to cover their emissions. These credits can be obtained through various means:

- Purchasing them from the market.

- Receiving allocations from the regulatory authorities.

- Participating in emission reduction projects that generate credits.

Compliance Documentation: Companies are expected to maintain records and documentation demonstrating compliance with carbon credit limits. This includes keeping track of carbon credit transactions, emissions data, and any offsetting activities undertaken.

Penalties for Non-Compliance: Failure to comply with carbon credit limits can result in penalties or fines. Regulatory authorities can enforce compliance through penalties, which serve as deterrents and encourage companies to adhere to their obligations.

The Voluntary Carbon Market

The voluntary carbon market has emerged as a complementary avenue for companies and countries to take proactive steps toward environmental sustainability.

Retirements increased further in 2022, with a record monthly retirement total set in December 2022.

The number of carbon credits granted declined marginally compared to the previous year, with lower credit prices, a greater emphasis on quality inspections, and longer verification processes all contributing to a supply squeeze.

Source: The voluntary carbon market: 2022 insights and trends

Voluntary Carbon Market vs Mandatory Market

Unlike mandatory carbon markets that impose legal obligations on companies to comply with emission limits, the voluntary carbon market offers flexibility and a voluntary approach for organizations to offset their emissions voluntarily.

This market allows businesses to purchase carbon credits from projects that have generated verified emission reductions or removals. This enables them to offset their emissions and contribute to global emission reduction efforts.

5 Benefits of Participating in the Voluntary Market for Companies

The voluntary market allows companies to offset their emissions beyond regulatory requirements voluntarily. This helps bridge the emissions gap by encouraging additional reductions and other benefits, such as:

- Participation in the voluntary carbon market enables businesses to manage their environmental effect proactively and comply with sustainability goals.

- Voluntarily offsetting emissions demonstrates corporate social responsibility and enhances brand reputation.

- Participation in the voluntary market opens up economic possibilities.

- Companies may contribute to and invest in climate-friendly initiatives, fostering innovation in renewable energy, afforestation, and energy efficiency.

- Investing in these initiatives helps to create jobs, progress technology, and foster the growth of sustainable habits.

CleanTech Fintech Investment Opportunities

The intersection of CleanTech and Fintech is paving the way for a new era of carbon market trading.

Despite overall global VC investment falling amidst geopolitical and economic uncertainties, specific sectors like Fintech and Cleantech have remained resilient and continue to attract significant interest from investors. In Q2'22, the Americas and Europe stood out, with the Americas attracting $66.2B and Europe attracting $27.2B in VC funding.

European CleanTech Fintech use cases demonstrate the diverse applications of financial technology in driving sustainable solutions across energy, carbon markets, supply chain management, and impact investing. They contribute to developing a greener economy by promoting clean energy, carbon reduction, energy efficiency, sustainable supply chains, and responsible investing.

These are some of the most famous European CleanTech Fintech use cases are:

Green Energy Financing Platforms.

CleanTech Fintech firms are creating platforms that connect investors with renewable energy projects, allowing people and organizations to engage directly in clean energy ventures.

Lendahand (Netherlands) — is a crowdfunding platform that allows investors to fund renewable energy projects in emerging markets. They enable individuals to invest in solar, wind, and hydro projects, supporting sustainable energy generation in regions that need it the most.

Carbon Offset Marketplaces.

CleanTech Fintech startups are creating digital marketplaces that facilitate the buying and selling carbon credits.

ClimateSeed (France) — ClimateSeed is a digital platform that connects businesses seeking to offset their carbon emissions with carefully vetted environmental projects. They enable companies to calculate and offset their carbon footprint by investing in high-quality carbon credits from certified projects worldwide.

Sustainable Supply Chain Financing.

CleanTech Fintech startups are focusing on sustainable supply chain financing solutions.

Circular IQ (Netherlands) - Circular IQ provides a platform that enables companies to assess, manage, and improve the sustainability of their supply chains. Their software allows businesses to measure environmental performance, identify sustainability risks, and collaborate with suppliers to drive sustainable practices throughout the supply chain.

Impact Investing Platforms.

CleanTech Fintech firms are creating investment platforms focusing on impact investing in environmental and sustainable projects.

Trine (Sweden) - Trine is an impact investment platform that connects individuals with investment opportunities in solar energy projects in emerging markets. They allow investors to finance solar installations in off-grid areas, providing clean energy access to communities and generating positive environmental and social impact.

Planboo — Using Technology & Carbon Financing to Fight Climate Change

Planboo is a climate tech company focusing on tropical regions' biochar production. Biochar, derived from organic materials, is a carbon-rich substance that aids in carbon removal from the atmosphere. Planboo utilizes an accredited tracking system to ensure the transparency and reliability of biochar production, providing certified carbon removal credits and direct finance to areas most in need.

Planboo has an active round, targeting €330.000, with €200.000 pre-committed money, and Rockstart as the lead investor - an AgriTech fund based in Nordics and active in Benelux and worldwide and specialized in pre-seed.

--

Carbon market trading presents a transformative mechanism in the fight against climate change, offering unique opportunities for CleanTech Fintech investment and promoting a greener and more sustainable future.

With its ongoing revisions and ambitious goals, the European carbon market demonstrates the region's dedication to combating climate change.

As the global community recognizes the urgent need for carbon removal and emission reductions, carbon market trading becomes vital in achieving a more sustainable future for future generations.

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.