SeedBlink Blog

all Things Equity

A beginner's guide to startup funding term sheets - before fundraising

Explore the language of startup funding: discover what a term sheet is, its significance in the investment process, and its role as a foundation for future negotiations.

The legal or financial terms used in fundraising can be intimidating initially, especially for early-stage startups and entrepreneurs. When you bring your startup to investors, you must understand their language and the wording used in private equity and venture capital.

This article will explain what a term sheet is, why it differs from other investment documents, and what you need to know about it.

What is a term sheet?

A term sheet is a crucial starting point for nearly all venture capital and private equity transactions. It outlines the key terms and conditions of the investment and serves as a roadmap for the structure of the deal, including details on the parties involved, timelines for due diligence, and the deadline for closing. While not typically legally binding (except for certain sections), it sets the foundation for the upcoming negotiations and legal agreements.

The term sheet sets the groundwork for ensuring that both parties are on the same page regarding the investment and helps to prevent misunderstandings later in the negotiation process.

It typically includes details about investment amount, equity stake, voting rights, and other key terms governing the relationship between the investors and the company. A term sheet covers the main financing aspects and facilitates the execution of the final transaction documents, serving as a template or the starting point for other detailed, legally binding documents (e.g., SSHA).

A term sheet is typically signed after preliminary discussions between the investor and the company (once both parties agree on the terms) and before the commencement of detailed due diligence. It helps solidify investors' understanding of the potential return on investment. It shows the principal components for the proposed investment, such as commercial terms (e.g., the investment amount, the company's valuation, the equity the investors will receive), and any investors’ rights and protection they might have (e.g., liquidation preference, pre-emption rights, lock-up period, reverse vesting, drag along/tag along, put option, right of first refusal).

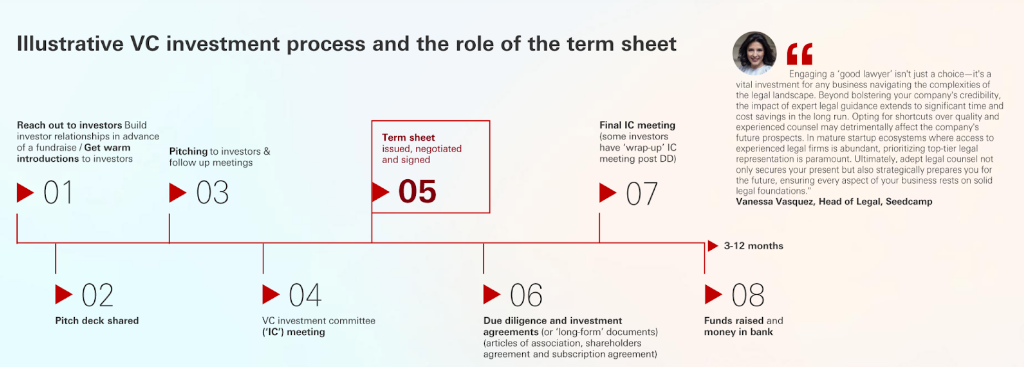

Source: Venture Capital Term Sheet Guide 2024 by HSBC Innovation Banking

For example, the liquidation preference right determines who gets paid first and how much they get paid in case of exit events (e.g., sale of the company, transfer, disposal, or similar, of all or substantially all of the shares or assets in the company, liquidation, dissolution or winding-up of the company).

The term sheet also outlines governance rights, such as your involvement in the company's decision-making, board composition (the investors usually require a board seat), and information rights, as well as any restrictive covenants applicable to the company’s founders.

On the other hand, a term sheet helps companies understand what they're giving up in exchange for the investment during the fundraising process. It details how much the equity of the company's existing shareholders will be diluted by bringing on the investor.

The valuation determines your company's worth, and future funding rounds could further dilute your ownership.

Look at these points to ensure you manage your equity efficiently through multiple fundraising rounds and maintain enough control over the company's direction.

What does the structure of a term sheet include?

The structure of a term sheet can vary depending on the terms agreed upon between the parties. However, a few key terms are important and should be taken into account.

Let’s briefly tour the core components a term sheet should have!

Parties

Any document starts with the details of each part involved in the fundraising process, where you describe the target company, any existing shareholders, details about the founders, and details about investors.

Current capitalization table

A cap table captures the current & envisaged capital structure and percentage of shares. For example, Founder A has a 50% stake, and Founder B has a 50% stake. When an investor joins, you need to know where everyone is staying and how much ownership percentage each part gets in view of the current round.

As an industry standard, HSBC Innovation Banking recommends that founders include a cap table in the term sheet and create an exit waterfall that takes the cap table and evaluates the distribution to different shareholders’ classes, liquidation preferences, and priority stakes.

Closing schedule and terms

This section usually captures the tentative closing date and any other additional conditions or terms that ensure the protection of all stakeholders.

These terms state what needs to happen and when before the closing and may refer to the due diligence process run by investors, which covers a few basic legal, financial, and technical checks on the company and its founders. These terms are further detailed in the transaction documents and can be found as conditions precedent prior to closing (conditions that must be satisfied by a party to the transaction; otherwise, the other party is not obligated to close the transaction).

Commercial terms

It covers all the commercial elements required for the funding process and contains the following:

- The pre-money valuation of the company which raises the funding.

- The price per share is the pre-money valuation divided by the company's total number of issued (outstanding) shares.

- The structure of the financing and how much money each party will bring.

- The post-money valuation includes the pre-money company’s valuation plus the new investment amount.

Representations & Warranties

This section includes key elements (e.g., regarding the company's corporate status), which the company states here but has not yet been officially proven (the proof usually comes later, during the due diligence process).

These statements are made by the parties involved (usually the company and its founders) to assure the investors about the accuracy of certain facts (legal and business aspects, which will be further detailed in the transaction documents) and the condition of the company at the time of signing the term sheet.

Diversity

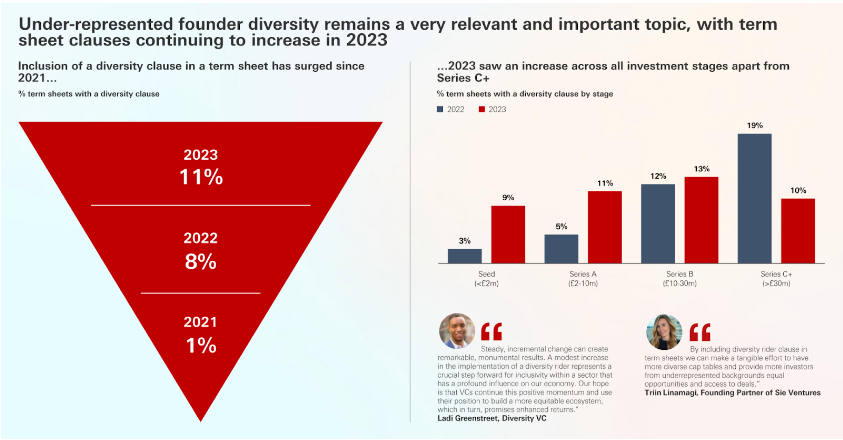

Founder diversity has become a new section of European term sheets in the last few years, and according to HSBC Innovation Banking’s report on term sheets, it has increased from 1% in 2021 to 11% in 2023.

Source: Venture Capital Term Sheet Guide 2024 by HSBC Innovation Banking

Confidentiality

While the term sheet document is usually a non-binding agreement, all parties involved are expected to maintain the confidentiality of the investment and not disclose any sensitive information without the investor’s approval.

Miscellaneous

This section usually covers any terms about the marketing and communication activities connected with the funding, possible trademarks for the company, or other information about the startup’s obligations to protect the investors.

If previously agreed upon, the time frame after the document expires can also be mentioned.

Investor rights & Investor protection

Another important section introduces the type of rights and protection investors will have after joining the funding round.

The list below covers some of the standard and essential ones:

- Pre-emption rights — are the most important from a commercial perspective and refer to opportunities for existing investors to join future financing rounds. It does not mean that investors should invest more money, but they have the right to maintain their ownership if they want.

- Down-round protection — refers to the company's value decreasing after the initial investment, one of an investor's greatest fears. The company protects the investor by allocating additional shares for the shareholder to obtain such shareholding as if having made the initial investment round at the new subscription price per share agreed for the subsequent down-round.

- The lock-up period — refers to an interval after a new investment round when the company's founders cannot sell their shares. The company's dependency on the founders will decrease in time, but typically, the founders are committed to staying and contributing for a certain period after the investment.

- Reverse vesting — brings a sensitive clause that protects the investment if the founders decide to step down. This clause means that founders accept not to have access to their shares until the lock-up period ends. Like vesting, they get access to a specific percentage each year, so the investors can buy the unvested shares if the founders leave.

- Right of first refusal — if a shareholder wants to sell their shares, investors and the other shareholders can buy them on the same terms, pro-rata. In this case, the investor (together with the other shareholders) is the first to get the news and has a specific time frame to decide.

- Drag along — defined as an obligation, all shareholders in a company have to sell their shares on the same terms, pro-rata, to the same acquirer in case the majority shareholder wants to sell. It protects everyone from small shareholders who refuse to sell their shares in an acquisition offer, blocking the deal for everyone else.

- Tag along — defined more as a right, this allows minority shareholders (including investors) to sell their shares to the same acquirer on the same terms in case the shareholders want to sell them.

- ESOP — ESOP means employee stock option plan, and its mention in a term sheet document ensures that the company will establish one after the investment. ESOP is mandatory to retain and incentivize team members.

- Put option — it gives holders of the option the right, but not the obligation, to sell a specified amount of their shares at a specified price within a specified time frame. This means that investors can exit the company whenever they want; for example, it can be agreed that the investors have a put option right, according to which founders must buy all the investor’s shares for the nominal value.

- Reserved matters — investors don’t want to interfere with founders' decisions and day-to-day operations but have a list of decisions or voting rights they could use; these are reflected as actions that the company, its directors and shareholders must not do without the explicit approval of the investors or by at least a certain proportion of specific persons.

- Restrictive covenants — a clause that protects the company by ensuring that if founders leave, they cannot start a competing company or take employees to another firm. It covers both the investment and the other co-founders. The restrictive covenants apply for the duration of the founder’s employment with the company, typically 24 months after it expires.

- Information rights — This part ensures that investors have the right to receive regular status updates from the company, such as quarterly reports based on a template provided by investors or any information about the business and a potential new financing round.

An example of a term sheet template

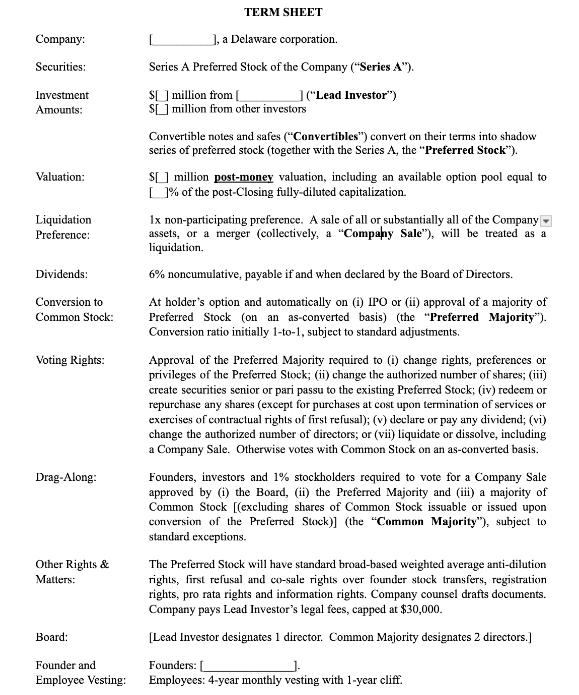

Y Combinator also has a good example of what a term sheet template for a Series A round should look like.

Source: Y Combinator - Series A Term Sheet Template

Now, let’s closely examine each of these elements as reflected in the Y Combinator template to understand their meaning and what you should know about filling them in.

- Investment amount: The amount of money the investor is willing to invest in the startup.

- Valuation: The pre-money (company valuation before investment) and post-money valuation (pre-money valuation + investment amount) of the startup.

- Liquidation preference: A clause that determines the order and amount of payments to preferred shareholders in the event of a liquidation event, such as the sale, merger, or dissolution of the company. It specifies the priority of returns, ensuring that preferred shareholders are paid before common shareholders.

- Dividends: These are the payments made to shareholders out of the company's profits or reserves.

- Voting rights: The rights and privileges that shareholders have in voting on corporate matters. These rights determine how much influence shareholders have over the company's decisions, including the election of directors, approval of major corporate actions, and other significant business matters or reserved matters.

- Drag-along: A provision that allows majority shareholders to compel minority shareholders to join in the sale of the company under the same terms and conditions. This right ensures that if the majority shareholders decide to sell their stake, the minority shareholders must also sell their shares, facilitating a smoother and more straightforward sale process.

- Board: The number of board seats that the investor will have and who will fill those seats.

- Vesting: The period of time over which the employees’ shares will vest in case of an employee stock option plan or a specified period during which founders cannot leave the company in the case of reverse vesting.

A better understanding of your next term sheet.

We hope this has provided you with a clearer understanding of term sheets and how to prepare for them as a founder. A well-crafted term sheet is essential for bringing both parties together for meaningful discussions and thorough negotiations before fundraising. While our recommendations offer a solid starting point, we're here to help if you have any further questions. Reach out to the SeedBlink team for expert guidance on getting ready for your next fundraising round.

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.