SeedBlink Blog

all Things Equity

A guide on how to prepare for due diligence when fundraising

Understand how due diligence works and what's important for investors and founders at each stage. Learn actionable steps to prepare and ensure a smooth fundraising journey

Fundraising can be an exciting time for founders, but it can also be stressful, as both founders and investors have to go through an evaluation process.

While investors assess the team, the company, its product, and market traction, founders also have the opportunity to evaluate their potential investors to make sure they are the right business and cultural fit for the company. It’s not just about the money but also about who you gather at the table in your board meetings.

It comes as a two-way street, and this is where due diligence comes in.

This article will provide a comprehensive overview of the due diligence process from both perspectives. Founders will discover what information investors typically look for and how to prepare for this stage.

Additionally, investors will find a roadmap to navigate the due diligence process, ensuring they ask the right questions, look at the right data type, and evaluate whether to participate in the fundraising deal.

What is due diligence?

Due diligence - if you have already made your first steps in the world of startups and angel or venture capital funding, you’ll most likely have met this term. In a fundraising process, due diligence is a critical stage, being a detailed investigation undertaken by investors to assess the risks and potential rewards of investing in a company. It's akin to examining a car before you buy it – you want to ensure it runs smoothly without hiding any major issues.

There's also the pre-investment "check" done by fundraising and equity management platforms like SeedBlink, where startups are examined and vetted with a quality check when they apply for a fundraising round on the platform. This is done to pre-assess potential risks to the investor community.

The due diligence process is one of the steps startups must go through as part of the fundraising process. Investors will typically delve into various aspects of your company, including:

- The company’s financial performance (past data and future projections)

- Legal aspects of the company

- The market opportunity you are addressing

- The competitive landscape

- ... and most importantly, your team’s experience in executing the plan

If you are preparing for a fundraising round, it’s highly recommended to anticipate these types of inquiries from investors and have all the documents prepared ahead of time, as well as an answer to possible questions they might have.

This is done through various audits to confirm facts and details about the company investors are about to bet on.

There are various ways for investors to run a due diligence review, depending on your goals, available resources, or how structured they want it to be. Investors can interview all founders and key company employees or use dedicated due diligence software. Depending on the level of detail required, they can follow a clear, structured outline for this process or adapt it according to the dynamics of the conversations.

Why is due diligence Important?

Due diligence comes with the opportunity to present your company's strengths and address potential investor concerns. By presenting all the information investors need and fostering transparency, you increase credibility as well as your chances for a successful fundraising deal with your target investors.

Additionally, due diligence can serve as a self-assessment tool. You can use it to identify potential weaknesses through the process, which allows you to proactively address any shortcomings and refine your strategies before finalizing the investment pitch.

Due diligence is seen by investors more as a risk management tool, as it helps them uncover any potential red flags or problems within the company they want to invest in. Through a thorough investigation, investors gain insights into the company's financial stability, legal aspects, and equity ownership with current stakeholders.

When is due diligence taking place?

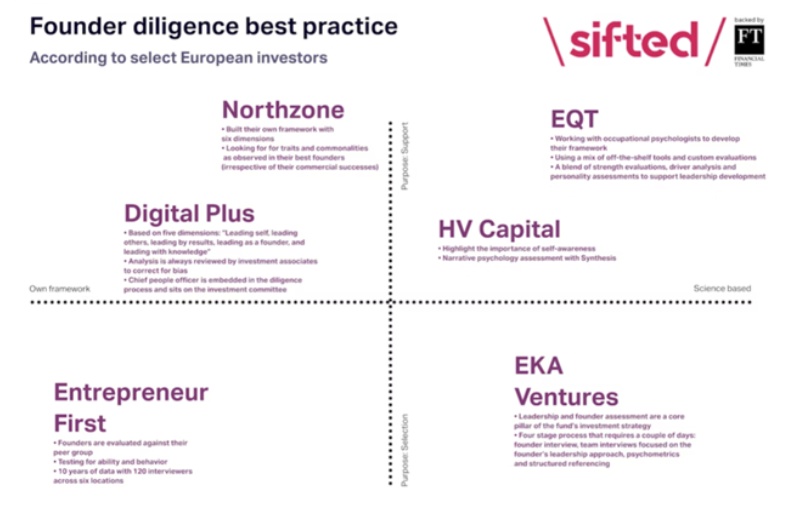

The process takes place before the transaction is signed. In smaller venture capital firms, the review is a straightforward process happening once. Still, bigger ones sometimes choose to split it into two stages, according to Julius Bachmann, who works with European investors and analyzes founder evaluation processes — one focused on individuals and one focused on group dynamics.

Source: Founder diligence in venture capital by Sifted

Types of due diligence.

The due diligence process gets more elaborated as the startup grows and in the later funding stages, and this can reflect over multiple business areas.

Below, we have put together the perspectives of investors and founders on the most common types of due diligence and the things they might ask you about.

Also, you can think about due diligence in these terms:

- Hard due diligence --> about the quantifiable facts and numbers of the company, analyzing tax records, legal documents, and financial statements. Think of it as building a strong foundation based on hard facts.

- Soft due diligence --> about the intangible aspects of the company, revealed by conducting interviews and discussions with founders and team members. Here, investors assess the human potential and the company's potential for innovation and growth.

📌 Founder tip: No feedback is better than the direct one from another fellow founder. So, don’t be afraid to connect with other entrepreneurs from the VC’s portfolio and ask for feedback on the due diligence process, as well as post-investment collaboration.

1. Team Due Diligence.

Investors, especially those investing through venture capital firms, usually perform a background check on the company’s founders and the other core team members. The people behind the business are an important piece of the puzzle because the investment is also about those running the company, not just the product.

Team due diligence is about assessing the human capital that drives the company forward. Here are some key aspects to consider:

- Experience --> Do the founders and key team members possess the necessary skills and expertise to execute the company's vision?

- Leadership --> Does the team demonstrate strong leadership qualities, such as decisiveness, strategic thinking, and the ability to inspire others?

- Culture fit --> Does the team's culture align with the investor's values and investment philosophy?

- Track record --> What is the team's history of success and failure in previous companies?

- Passion --> Are the founders and team genuinely passionate about the problem they're solving and committed to the company's long-term success?

Here is how you can show the strengths you and your co-founders have in building and growing this company:

- Relevant experience --> Present the team's educational background, prior work experience, and specific industry expertise relevant to the company's focus.

- Collaboration --> Show examples of how the team works effectively and leverages each other's strengths.

- Passion and vision --> Conveying the team's genuine enthusiasm for the company's mission and their dedication to the long-term vision is crucial.

- External references --> Be prepared to provide investors with references who can speak to the team's past performance and work ethic.

- Transparency --> Be upfront about any potential weaknesses or areas where the team is actively building expertise.

2. Financial due diligence.

Financial due diligence is one of the most technical areas that can highlight some of the most important risks of your investment. Financial due diligence is the backbone of any investment decision. Usually, depending on the financial risks encountered during the due diligence process, this might even be a dealbreaker.

Investors analyze financial reports and accounting files to determine if the flashy numbers from the pitch deck reflect reality and to ensure it is a profitable investment for them to make.

Here are some key areas that both founders and investors have to pay attention to:

- Financial statements --> Look at the historical financial statements, including income statements, balance sheets, and cash flow statements.

- Profitability and growth --> The company's profitability margins, revenue streams, and past growth trends to gauge its financial performance.

- Cash flow management --> How efficiently does the company manage its cash flow and ability to meet its financial obligations?

- Burn rate & runway --> What is the rate at which the company spends cash and the time they have left with the current funding?

3. Market due diligence.

Market due diligence is a comprehensive analysis of the target market, the competitive landscape, and the overall viability of the company's product or service.

This type of due diligence is about assessing the opportunity and risk associated with the target market. Same as with financial statements, you need to do this type of analysis regardless if you’re taking an investment or not. When fundraising, though, you are probably “forced” to do this in a more disciplined way. Here are some key areas to investigate:

- Market size & growth --> Evaluate the size of the target market, its growth potential, and any emerging trends that could impact the market's future.

- Competitive landscape --> A thorough analysis of existing competitors, their strengths and weaknesses, and the company's unique value proposition within the market is essential.

- Customer needs --> Asses the product-market fit of the company with the target customer’s needs, pain points, and buying behavior.

- Regulatory environment --> Be aware of relevant regulations or legal considerations that could impact the company's operations within the target market.

Here are some steps you can take to present this type of information in a confident and concise manner:

- Clearly articulate the specific problem your company solves and the target market experiencing that problem.

- Present data and insights from market research reports, industry trends, and customer surveys to validate the market opportunity.

- Explain how your product or service stands out from the competition and offers a unique value proposition to the target customer.

- Outline your plan for reaching your target market and acquiring customers effectively.

4. Technical Due Diligence.

For technology-driven companies, due diligence dives deep into the inner workings of their technology infrastructure, assessing its functionality, security, and scalability.

Technical due diligence is one of the most challenging jobs, perhaps more so for smaller investors who have a non-technical background.

Don’t panic if you are not an engineer or developer turned investor because there are ways to approach due diligence through external providers that ease your work.

Here are some key areas to focus on:

- Technology stack --> Look at the programming languages, frameworks, and libraries used to build the product to assess its maintainability and scalability.

- System architecture --> Analyze the system's overall architecture, including its security measures, data storage solutions, and disaster recovery plans.

- Code quality --> A review of the codebase by technical experts can uncover potential bugs, security vulnerabilities, and inefficiencies that could impact future development.

- Scalability & future roadmap --> Understand the technology's ability to handle future growth and the company's plan for ongoing technical development.

Companies can ease the process and:

- Provide detailed documentation outlining the technology stack, system architecture, and development processes.

- Be prepared to facilitate code reviews by qualified technical experts hired by investors.

- Explain the security measures in place to protect user data and system integrity.

- Outline your plan for scaling the technology as the company grows and the user base expands.

5. Legal due diligence

Your next job here is to spot how the company complies with applicable regulations (either domestic, or international) or if it’s sensitive to different types of liabilities.

The GDPR system in Europe is the most generic example we can discuss here, but the process can vary depending on the vertical where the company is playing. You want to avoid all sorts of constraints and understand the real implications of the investment over future actions and development of the company.

For investors, legal due diligence is about mitigating risk and ensuring the company operates within the legal framework. Here's what investors prioritize:

- Company structure and legal standing --> A comprehensive analysis of corporate records, including shareholding structure, shareholder meetings, board meetings, or other relevant details

- Contracts & agreements --> A review of key contracts, such as employment agreements with key employees, intellectual property licenses, and commercial/customer agreements, helps identify potential liabilities or restrictions.

- Intellectual property --> Assess the company's ownership of intellectual property (patents, trademarks, copyrights) and potential infringement issues related to third parties' intellectual property.

- Regulatory compliance --> Understand any jurisdiction/industry-specific regulations or any potential licensing requirements.

- Dispute Resolution/Litigation --> Uncover pending lawsuits, judgments, or other legal matters that could impact the company's future.

Founders can ensure a smooth legal due diligence process by taking these actions:

- Organize legal documents --> Ensure all relevant legal documents, such as incorporation documents, contracts, and IP registrations, are organized and readily available for review.

- Be transparent --> If there are any outstanding legal issues, be transparent with investors and have a plan for resolving them.

- Seek professional help --> Throughout the process, you can consult with a lawyer to address potential questions and concerns if you need clarification.

Facts about due diligence

1. Due diligence takes time.

Once you start reviewing facts and people, remember it takes a lot of time to gather and interpret all the required information. If financial, technical and legal reviews are all part of the process, expect an even longer period to assemble all the puzzle pieces.

Due diligence can take a few weeks and up to a few months.

The length of the due diligence process also depends on the startup’s vertical or company internal dynamics. Highly regulated industries need more time to comply with specific conditions, hot markets with various deals taking place each day put more pressure to get it done ASAP, and how people move to resolve these audits impacts the timeline.

2. Due diligence looks at the ins and outs of your company.

Due diligence focuses on core aspects like financials and legal matters, but much valuable information can also be found beyond the standard checklist we discussed above. Here are a few unconventional areas that can give investors more insights about founders.

Customer experience.

Traditionally, due diligence focuses on a company's internal operations. However, founders can spark things by gathering testimonials, showcasing positive customer feedback, and demonstrating market validation and - ideally - also product-market fit.

On the other hand, investors can benefit from directly interacting with existing customers to measure their satisfaction, understand buying behavior, and assess potential churn risks.

Digital footprint.

If, as a founder, you proactively address negative online reviews, you are on the right path, as this shows accountability in front of investors. They can look into the company’s social media engagement, online reviews, and brand reputation to assess their understanding, passion, and level of involvement in getting to know their customers.

Company culture.

Founders can showcase their company culture by facilitating interactions with team members during due diligence. It allows investors to assess team dynamics, communication styles, and overall employee morale.

For investors, observing interactions within the team can reveal potential red flags or hidden strengths that traditional due diligence methods might miss.

Sustainability, impact, and ESG factors.

According to European Women in VC, 80% of European investors are now embedding impact investing as part of their strategy and considering a company's impact on the environment, social responsibility, and corporate governance practices.

As a founder, you can highlight any sustainability initiative, diversity, or inclusive policy to show your commitment to ethical business practices.

The benefits of due diligence

Due diligence isn't just a box to check; it's a valuable exercise that benefits founders and investors. While it may seem time-consuming, a thorough due diligence process can yield various benefits.

Here's a closer look at the specific benefits founders and investors can get from a thorough due diligence process:

For companies

- Due diligence helps identify areas for improvement in your company and current strategy, allowing you to present a more compelling case to investors.

- Open communication during due diligence creates trust with investors and positions your company for a successful funding round.

- Identify potential weaknesses and address them proactively before finalizing your investment pitch.

- A thorough due diligence process can attract investors who fit your company's culture and long-term goals well.

For investors

- It allows investors to identify potential risks, liabilities, or other problems hiding in the company before accepting the transaction.

- It helps investors avoid money losses, direct conflicts with founders or team members, or getting involved in a larger public incident.

- A clear picture of all the items can speed up the transaction and simplify the process.

- It sets realistic expectations and provides a sense of security for everyone.

The downside of due diligence

While due diligence is a mandatory step in the fundraising process, it has challenges. Both founders and investors should be aware of the potential downsides associated with the process.

Here's a breakdown of some drawbacks that founders and investors might encounter during due diligence:

For companies

- Due diligence can be lengthy, requiring significant time and resources from founders who may already be stretched thin.

- Sharing sensitive company information can be a concern, especially if the fundraising round is unsuccessful.

- A thorough due diligence process can reveal a misalignment between a founder's vision and an investor's expectations, leading to a failed fundraising attempt.

For investors

It’s a process that requires a lot of time and creates stressful situations for those involved, mainly from the startup.

- It can be extended for a longer period or developed in connected areas.

- It doesn’t guarantee complete risk elimination; unforeseen circumstances can still arise.

- Poorly negotiated terms or unclear information can cause damage to both parties.

- Extensive due diligence can lead to "deal fatigue" for investors, potentially causing them to lose interest.

- If the deal highlights any red flags, the investment may be reconsidered.

What happens after due diligence

There is no established rule about how investors use the results of these audits. Some share them with the company's founders; others don't. The due diligence process gives investors critical data, allowing them to make the best decision for their upcoming investment.

Ultimately, based on the due diligence results, investors will decide to invest or not, and if they do, the next step in the process is to receive a term sheet from their side. Stay tuned as we’ll continue to explore term sheets in a series of dedicated articles on the SeedBlink blog.

📌 Founder tip: If an investor decides not to invest in your company after the due diligence process, don’t let yourself get discouraged. Ask them for more feedback, learn from this experience, and see how you can improve your current strategy!

A better understanding of your next due diligence

We hope we have given you a picture of what due diligence looks like for startups and how to better prepare for it. At the same time, you have also discovered what happens after due diligence and what you should know about it.

Reach out to the SeedBlink team for further advice on how to best prepare for a fundraising round.

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.