SeedBlink Blog

all Things Equity

The Founder Factor on Startup Success: Solo vs. Co-Founders

Explore the pros & cons of solo founders vs. multiple founders, key factors to consider, and how your choice impacts raising capital for your startup.

The age-old question of whether to embark on the entrepreneurial journey as a solo founder or with co-founders has long been a debate among founders worldwide.

The decision can have significant implications for the startup's overall success, shaping its growth dynamics, decision-making process, and resilience in the face of challenges.

Studies point to the pros and cons of both camps. For example, Paul Graham, the co-founder of YCombinator, thinks that solo founders have a 2.3x higher chance of being in the top 10% of successful startups than teams with four or more founders. Research from The Wharton School at the University of Pennsylvania shows that solo founders take 3.6 times longer to outgrow the startup phase than a founding team of two.

Meanwhile, success stories abound for both scenarios. So take everything with a grain of salt and analyze everything from your perspective. In this article, we will explore the pros and cons of the solo founder vs. co-founders' question of life and provide insights to help you make the best choice for your startup journey.

Key takeaways:

- Both solo and multiple-founder startups have their unique advantages and challenges.

- Founders should carefully evaluate various factors, such as personal strengths and weaknesses, work style, the nature of the business idea, and the ability to manage and delegate tasks, to determine which option best aligns with their vision and strategy.

- When raising capital, founders should consider investor preferences and prepare to address any concerns about their choice of being a solo founder or having multiple founders. For co-founders, make sure you are aligned on your fundraising strategy.

Advantages and disadvantages of being a solo founder

As a founder, it's essential to consider the advantages and disadvantages of solo and multiple-founder startups. Each option has unique benefits and challenges; the best choice depends on your personality, skills, and goals.

Advantages of being a solo founder

Being the only founder for your startup has advantages that can appeal to certain entrepreneurs. According to a study by First Round Capital, companies with more than one founder outperformed solo-founder companies by 163% in revenue.

Here are some of the benefits of going solo:

- Full ownership of the business — As a solo founder, you control your company’s mission, vision, strategy, and core decision-making. It empowers you to make quick decisions and guide your company in the direction you believe is best.

- Clear management roles — You don't need to spend time managing relationships with co-founders, allowing you to concentrate more on building the business. It can lead to a more streamlined organizational structure and efficient decision-making process.

- Flexibility — As a solo founder, you can change the business model, strategy, or product offering without convincing or negotiating with others. It can be beneficial in rapidly changing market conditions or when pursuing new opportunities.

While there are advantages to being a solo founder, it's important to recognize that this path also comes with challenges, such as a higher workload, potential skill gaps, and the responsibility of facing difficult decisions alone.

Consider these factors and evaluate your strengths, weaknesses, and goals before embarking on the solo founder journey.

Disadvantages of being a solo founder

Here are some disadvantages to consider before choosing the solo founder path:

- A higher workload — As a solo founder, you must wear multiple hats and handle all aspects of the business, including marketing, finance, operations, and product development. It can lead to a higher workload and increased stress levels.

- A limited perspective — A team of co-founders can bring diverse perspectives, experiences, and ideas to the table, leading to more innovative solutions and better decision-making. As a solo founder, your decision-making process may be limited to your perspective and knowledge.

To counter this, choose your first key hires carefully and rely on them also for strategic decisions. Empower your team with all the tools they need to succeed, including equity compensation.

- A higher risk for burnout — The high workload and stress of managing all aspects of the business alone can lead to burnout, potentially impacting your physical and mental health and the sustainability of your startup.

"The low points in a startup are so low that few could bear them alone. When you have multiple founders, esprit de corps binds them together in a way that violates conservation laws. Each thinks, 'I can't let my friends down.' It is one of the most powerful forces in human nature, and it's missing when there's just one founder."

Source: Paul Graham on How to Start a Startup.

Examples of successful companies founded by solo founders

While less common than co-founder teams, solo founders have demonstrated their ability to build successful companies through their vision, perseverance, and adaptability.

These entrepreneurs have defied conventional wisdom and overcome the challenges of starting a business alone to create some of the world's most influential and valuable enterprises. Companies like Amazon, founded by Jeff Bezos, and Alibaba, founded by Jack Ma, are inspiring examples of what a solo founder can achieve.

Jeff Bezos & Amazon

Amazon was founded by Jeff Bezos in 1994 as an online bookstore.

Since 1994 until today, Amazon has evolved into the world's largest online marketplace, a cloud computing giant, and a major player in the media and entertainment industries. Bezos's vision and relentless focus on customer-centricity have driven Amazon's success and established it as a global powerhouse.

Although the company has grown significantly and added numerous top-level executives over time, Bezos was the sole founder responsible for the inception of Amazon.

Jack Ma & Alibaba

Alibaba is a company founded by Jack Ma in 1999 with a vision to create a platform that connects small Chinese manufacturers with buyers worldwide.

Today, Alibaba is one of the world's largest e-commerce platforms and has diversified into numerous other sectors, including cloud computing and digital media. At the same time, Jack Ma has since stepped down as the company's executive chairman; his leadership as the solo founder played a critical role in shaping the success of Alibaba.

Their accomplishments highlight the potential for success that lies in the hands of determined, passionate, and resourceful individuals who dare to take on the entrepreneurial journey single-handedly.

Advantages and disadvantages of having multiple founders

In entrepreneurship, multiple-founder startups have gained a reputation for leveraging diverse skill sets, experiences, and perspectives to drive innovation and growth.

"Most successful startups have multiple founders. Building a great company is hard, and it’s nice to have someone to help with the workload, provide moral support, and bring a different set of skills to the table."

Source: Sam Altman, former president of Y Combinator and CEO of OpenAI

Advantages of having multiple founders

When considering the path of entrepreneurship, it's important to recognize the benefits of forming a multiple-founder startup, as it can provide a strong foundation for growth and success.

- A diverse range of skills — Multiple founders can bring various skills and expertise to the table, which can help address different aspects of the business more effectively. It can lead to better decision-making, increased innovation, and improved overall performance.

- Shared responsibilities — With more people involved, founders can distribute tasks and responsibilities, reducing individual workloads and stress levels. This division of labor allows each founder to focus on their strengths and contribute more effectively to the company's growth.

- Better decision-making — Multiple founders can contribute different perspectives and ideas, leading to more robust discussions and well-rounded decision-making. It can help avoid group thinking, challenge assumptions, and uncover new insights or opportunities.

Startups with multiple co-founders attract investors' attention.

Another advantage you might attract by partnering up with other co-founders is getting investors' attention easier for your startup's first fundraising rounds.

Many investors prefer to invest in startups with multiple founders, as it demonstrates the ability to build a team, share responsibilities, and mitigate risks. It can make it easier to secure funding and attract value investors.

“Although there are cases where solo founders excel, I've heard stories of startups collapsing due to the founder's burnout or unforeseen circumstances. Thus, having a team of at least two individuals is preferable.”

Says Pawel Zylm, an angel investor from Poland.

Disadvantages of having multiple founders

While having multiple founders has advantages, it's essential to recognize that it also comes with challenges, such as potential conflicts, decision-making delays, or equitable distribution issues.

It's important to consider these factors carefully and evaluate your strengths, weaknesses, and goals before partnering with others. Here are some disadvantages to consider before teaming up with other co-founders to build a company:

- Founder conflicts — Multiple founders can have different visions, priorities, or working styles, leading to disagreements and conflicts. If not resolved effectively, these disputes may harm the business or lead to the departure of one or more founders.

- Delays in decision-making — With more founders, the decision-making process may become slower as everyone needs to be consulted, and consensus must be reached. It can lead to delays in execution and may hinder the startup's agility in responding to market changes.

- Equity distribution & dilution of ownership — Dividing equity among multiple founders can be challenging and may lead to disagreements or resentment if not handled carefully. With more founders, each individual will likely have a smaller ownership stake in the company. It can impact the level of control each founder has and reduce the potential financial rewards if the company succeeds.

Before embarking on any fundraising initiative, make sure you understand dilution scenarios and that all co-founders are on board with what you plan to raise and through which investment vehicles.

Examples of successful companies founded by multiple founders

The success of many multi-founder companies has demonstrated the power of collaboration and shared vision to drive innovation and growth.

Notable examples, such as Google, co-founded by Larry Page and Sergey Brin, and Apple, co-founded by Steve Jobs and Steve Wozniak, demonstrate how effective partnerships can lead to groundbreaking products and services that revolutionize entire industries.

Google — Larry Page and Sergey Brin

https://www.youtube.com/watch?v=x2WDVG0dvnE

Founded in 1998, the company began as a search engine and has since grown into a global technology giant, offering numerous products and services across various sectors, such as advertising, cloud computing, hardware, software, and more.

Page and Brin's collaboration and shared vision have played a crucial role in shaping Google into the innovative and successful company it is today.

Microsoft — Bill Gates and Paul Allen

https://www.youtube.com/watch?v=Xjq0kljBZnY

Bill Gates and Paul Allen founded Microsoft in 1975. The company initially focused on developing and selling a version of the BASIC programming language interpreter for the Altair 8800, an early microcomputer. Today, Microsoft is a worldwide corporation and a dominant player in the software industry, with products such as Windows, Office, and Azure.

Gates and Allen's partnership laid the foundation for Microsoft's success, and the company has expanded its offerings to include hardware, cloud computing, gaming, and more.

Let's add SeedBlink to that list, as a great example of a multi-founder company with a track record of success.

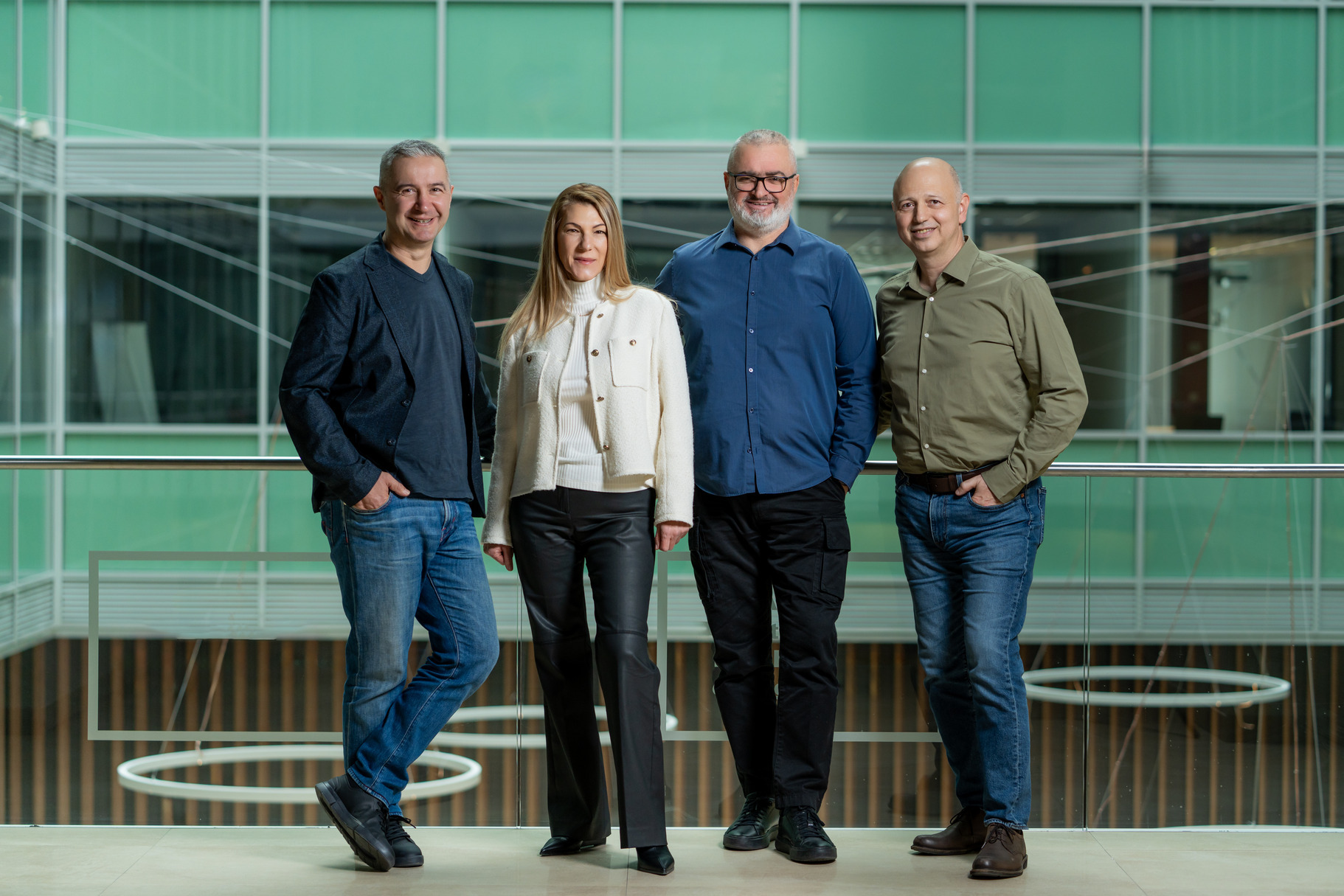

SeedBlink’s founding team (from left to right): Andrei Dudoiu, Carmen Sebe, Ionut Patrahau, Radu Georgescu.

Factors to consider when choosing between solo founder vs. multiple founders

Yes, we know, the decision to pursue entrepreneurship as a solo founder or with other founders is a challenging one. The final call should be based on a thorough evaluation of all the factors that have a significant impact and a careful consideration of your strengths, weaknesses, and preferences.

Let's recap the most important factors that founders have in mind as they go through this debate.

Nature of startup idea.

Evaluate the complexity of your business idea, as more complex ideas require a wider range of expertise that co-founders with diverse backgrounds could more effectively address.

If your business idea is in a specialized or niche industry, partnering with co-founders with specific knowledge may be beneficial.

Proficiency and knowledge.

Evaluate your skills and expertise and identify gaps that might be better addressed by partnering with others with complementary abilities.

Decision-making preferences.

Reflect on your decision-making preferences, as solo founders have more autonomy, while multiple founders need to collaborate and reach a consensus on important decisions.

Ability to manage and delegate tasks.

Having multiple founders can facilitate the distribution of tasks and responsibilities, allowing each founder to focus on their areas of expertise.

As a solo founder, you must manage all aspects of the business, which may lead to a higher workload and potential burnout.

Long-term goals and visions for the company.

Evaluate your long-term vision and goals for the business and whether they align better with being a solo founder or collaborating with others.

Recommendations for founders to consider when raising capital

As mentioned at the beginning of this article, your choice of one or more founders will also affect how investors view your company and analyze the opportunity.

Consider investor preferences.

Research your target investors' preferences based on past investments and be prepared to address any concerns they may have about your choice of being a solo founder or having multiple founders.

Show a clear division of roles and responsibilities.

When raising capital, it's important to evaluate your strengths and weaknesses and those of your potential co-founders.

Investors want a well-rounded team with complementary skill sets that can effectively address various business challenges. If you cover all critical areas as a solo founder, demonstrate that to potential investors.

Clearly outline each founder's role and responsibilities if you have multiple founders and showcase complementary skills in your pitches. This will show investors you have a well-organized team with a defined structure, ensuring that all critical business areas are covered.

Demonstrate effective decision-making and conflict resolution.

One concern investors may have with multiple founders is the potential for conflicts and slower decision-making processes. Be prepared to provide examples of how you and your co-founders have successfully navigated disagreements and made crucial decisions.

If you're a solo founder, emphasize your ability to make informed decisions independently while being open to external input and advice.

Showcase past successes and teamwork.

Regardless if you are one or a team of founders, you need to be able to work with a team. Highlight any previous successful collaborations or ventures that show your ability to work well together and deliver results. Provide examples of how your combined skill sets have led to innovative solutions and growth.

Future thoughts

The decision to pursue entrepreneurship as a solo founder or with multiple founders is crucial for the business’s survival and requires careful consideration of various factors.

Because each entrepreneur's personality, skills and goals are unique, there is no one-size-fits-all answer to the question of sole founder vs. co-founder. The optimal choice will depend on several factors, including the nature of the business, the industry landscape, and the individual's capacity for collaboration and risk-taking, as well as who your potential co-founders are.

Subscribe to our newsletter and stay tuned for similar updates and insights into European startup news, equity trends, VCs, and investment opportunities.

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.