SeedBlink Blog

all Things Equity

Founder Equity Split — Is equality the best decision?

Maximizing Startup Success: The Key to Effective Founder Equity Splits

Founder equity splits are a critical decision for startups, but is equal the best option? Learn how to split equity fairly and effectively in this comprehensive guide.

One of the most important decisions that founders have to make is how to split equity among themselves. This decision can significantly impact the company's success, so it is important to get it right.

Is an equal equity split the best decision?

The short answer is that it depends.

There is no one-size-fits-all answer to this question. The best way to determine how to split equity is to consider the specific circumstances of your company and your team.

What does an equal split look like for startup co-founders?

In a startup with two co-founders, an equal equity split would mean that each co-founder owns 50% of the company's equity and e 50% of the voting rights.

In a startup with over two co-founders, an equal equity split would mean that each co-founder owns a similar percentage of the company's equity.

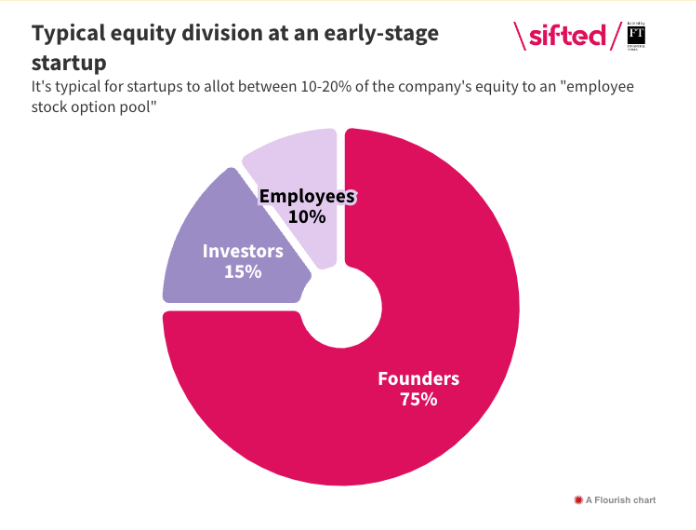

A part of the company’s ownership also goes to your investors if you plan to raise funding and to your employees if you consider implementing an employee stock option plan (ESOP).

Source: How much equity should you expect from an early-stage startup?

For example, The founders of Google, Larry Page and Sergey Brin, and the founders of Airbnb, Brian Chesky, Joe Gebbia, and Nathan Blecharczyk, split the equity equally. However, both groups also agreed to a weighted voting structure that gave each group 50% voting power. It allowed them to maintain control of the company, even though they owned a smaller percentage of the equity.

Reddit is another example that opted for an equal split for co-founder shares. The company went to Y Combinator with two co-founders, Steve Huffman and Alexis Ohanian. Still, Aaron Swartz later joined it, taking an equal proportion of the resulting company.

Equal equity splits are most common in startups with two or three co-founders. As the number of co-founders increases, achieving an equal equity split becomes more difficult. Each co-founder's contributions to the company may vary and have different risk tolerances.

Advantages of equality in equity split

- It’s a straightforward approach. An equal split is the easiest way to divide equity among two founders. There is no need to negotiate or debate how much equity each founder should receive.

- It shows trust and respect. An equal split shows that both founders trust and respect each other equally. It also shows that they are both committed to the company's success.

- It can help avoid conflict. An equal split can help to avoid conflict and resentment between founders. If both founders own an equal share of the company, they are less likely to feel treated unfairly.

Why equal equity splits can be problematic.

However, it is important to note that an equal split is not always the best option for two co-founders. There are a few cases where splitting equity differently may be more appropriate. Here are a few examples:

One founder has contributed more to the company than the other.

For example, one founder may have developed the original business idea, while the other joined the company later. In this case, it may be fair to give the founder who contributed more to the company a larger equity share.

One founder has more expertise or experience than the other.

For example, one founder may have a strong track record of success in the startup industry, while the other has yet to gain prior experience. In this case, it may be fair to give the founder with more expertise or experience a larger share of the equity.

One founder is taking on more risk than the other.

For example, one founder may be quitting their job to work full-time on the startup, while the other can keep their current job. In this case, giving the founder taking on more risk a larger share of the equity may be fair.

Equal equity splits can lead to conflict among founders.

If one founder feels he is not compensated fairly, it creates tension within the team.

Equity split and future scenarios.

What happens if a founder leaves the company?

It is important to plan what happens if a founder leaves the company before it is acquired or goes public. This plan should address whether the founder can keep their equity and what shares look like for the other co-founders.

What happens if the company is acquired or goes public?

The founders typically sell their equity shares when a company is acquired or made public.

How will you resolve disputes?

There will inevitably be disagreements among founders from time to time. It is important to have a process for resolving disputes fairly and amicably. This process could involve mediation, arbitration, or binding arbitration.

Alternatives to equal equity splits

There are several alternatives to equal equity splits, including:

- Weighted equity splits: Weighted equity splits take into account the contributions of each founder. For example, a founder who contributes more time and resources may receive a larger equity share than a founder who contributes less.

- Cliff vesting: Cliff vesting is a strategy in which founders do not immediately earn their full equity stake. Instead, they must make it over time by meeting certain milestones. It can help to mitigate the risk of a founder leaving the company early.

- Options pools: Options pools are a way to reward employees for their contributions to the company without diluting the equity of the founders. Options give employees the right to purchase company shares at a set price in the future.

5 tips and tricks for splitting equity with co-founders

- Be transparent and honest with each other about your contributions to the company and your expectations for the future.

- Write down everyone’s expectations. What are your goals for the company? How much time and resources are you willing to commit? What skills and experience do you bring to the table? You can negotiate an equity split once you understand each other's expectations.

- Consider your contributions to the company. How much has each founder contributed to the company regarding time, resources, and expertise? Founders who contribute more should generally receive a larger share of the equity.

- Be willing to compromise. It is unlikely that you will all agree on everything, so be prepared to give and take.

- Get everything in writing. Once you have reached an agreement, write it in a shareholder agreement, and make sure it’s also reflected in your cap table. It helps to avoid any disputes down the road.

Which option is right for you?

The best way to determine how to split equity is to consider the specific circumstances of your company and your team. Have a frank and open discussion about your contributions, expertise, roles, and risk tolerance, and you can develop a fair and beneficial equity split for everyone involved.

If you plan on raising money from investors, consider a weighted equity split and/or an options pool.

One last thing: if you need help splitting equity with your co-founders, it is a good idea to seek professional advice from an attorney or accountant specializing in startup law or accounting.

An attorney can help you to develop an equity split that is fair and beneficial to everyone involved.

Looking for an easy-to-use equity management solution?

Whether you need to manage your cap table, perform simulations to understand the impact of future fundraising rounds, or manage an ESOP, SeedBlink has got you covered.

Get started today with Seedblink's equity management platform.

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.