SeedBlink Blog

all Things Equity

Employee ownership in Europe: evolution, trends, and future expectations

The current landscape and future trends of equity ownership in Europe, from market dynamics to regulatory impacts and investment strategies, are here.

While employee stock option plans (ESOP) might not yet be as popular in Europe as it has been in the United States, it has made significant progress in recent years.

In Europe, employee share ownership (ESOP) has grown significantly in recent years in terms of the ownership stake held by employees and the number of companies offering ESOP schemes.

Equity ownership plans in European companies

This trend is driven by the constant search for good talent, with European startups using stock options to attract and motivate key employee members. The 2024 Global Talent Trends study by Mercer highlights four key trends shaping the People agenda in 2024, focusing on:

- productivity with AI

- fostering trust through fair pay and inclusion

- building resilient cultures

- designing adaptive and digitally fluent organizations.

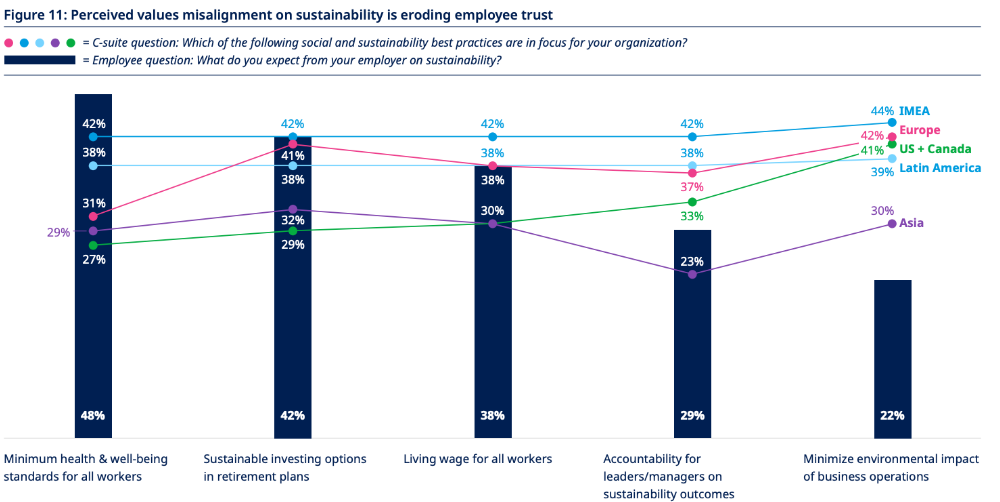

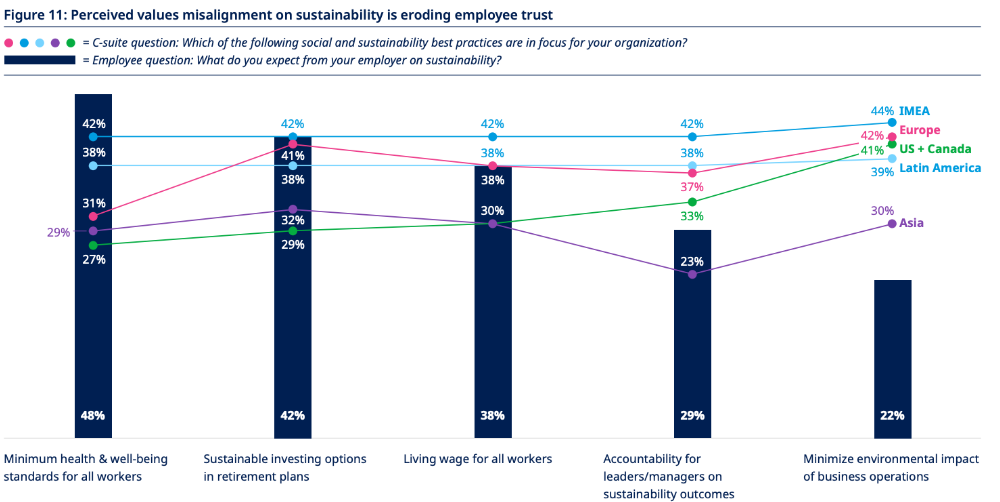

The dynamics between employees and companies are undergoing a significant shift. A key driver of burnout is a disconnect between an employee's values and their employer's. Diversity, Equity, and Inclusion are three main factors influencing their sense of belonging.

Source: 2024 Global Talent Trends study by Mercer

Trust is built when companies prioritize employee health by offering basic benefits like healthcare, yet only a third currently do so. Similarly, employees value sustainable investment options, a strategy many HR leaders acknowledge as effective.

Equity ownership plans in startups and small businesses

In 1992, the European Council recognized that dedicated incentive legislation is the key success factor for developing employee share ownership. Since then, European countries with incentive legislation have increased from 15 to 20, where the Baltic states have the most favorable environment to support startups' implementation and usage of a stock option plan.

Traditionally, early growth-stage European startups will max out at 10% in stock options allocated to employees, but over the past five years, these numbers have steadily been on the rise, with later-stage growth companies upping the numbers between 15%-17% at a Series D round.

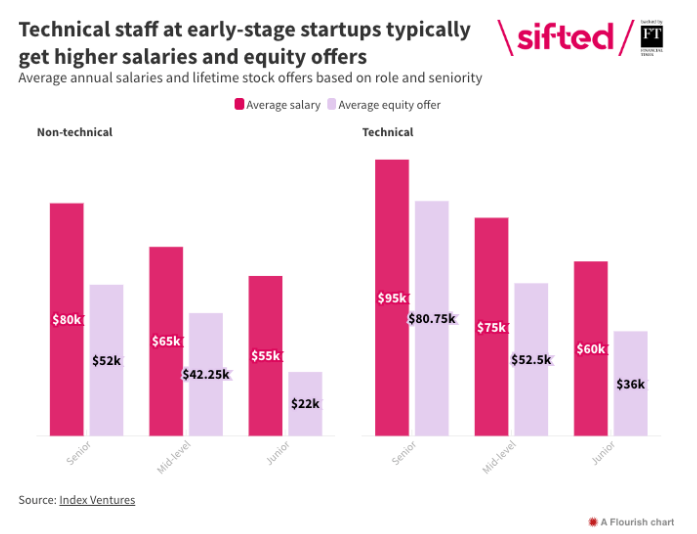

This development is particularly pronounced in technical roles, particularly in upper management, where the lion's share of options is heading.

Europe is finally starting to embrace stock options for employees, with average employee ownership at late-stage startups rising from 12% in 2017 to 16% this year.

This development is driven by the maturity of the European ecosystem, with bigger exits leading to a broader range of more savvy, switched-on investors who realize that the pie size is more important than the share.

Here is what the current situation looks like from multiple factors, according to the same research of Index Ventures.

The lack of legislation has led to a geographically unbalanced development of ESOP in Europe, with a significant lag between leading (North/Western) and lagging (South/Eastern) European countries.

This gap is detrimental to both employees and employers, as it leads to negative discrimination and thwarts the mobility of workers within the EU.

Despite the challenges and the lack of a unified European standard for implementing an employee stock option plan, Europe has a growing interest in equity ownership.

Besides the countries already having a clear framework for ESOP implementation, several countries are making considerable steps forward, such as:

- Germany adopted new reforms for employee stock ownership plans.

- The Netherlands has the STAK framework that is often used in the Netherlands to organize employee participation.

- Bulgaria added a new type of company VCC - Variable Capital Company, allowing for more flexible ESOP arrangements.

- Latvia and Lithuania have adopted new legislation in recent years, according to Index Ventures.

Romania has also a pretty flexible environment for the implementation of stock option plans, and if you are interested in studying the process step by step, here is a comprehensive guide we have prepared to guide you in this journey.

Equity ownership in funding rounds

Seed rounds

Setting aside 10% of the company's equity for employee stock options at the seed round is common practice.

It’s because early-stage companies often have limited cash resources, and stock options can be a valuable way to attract and retain top talent. However, some accelerators, such as Y Combinator and The Family, now advocate for a larger % ESOP size of 20%.

The debate is necessary to attract top talent in competitive industries.

Series A and beyond

In the US, ESOPs have increased from 10% at seed to 15% at Series A.

The equity ownership plans then grow with each funding round, reaching 20% or even 25% by Series D. This ensures that employees have a meaningful stake in the company as it grows and becomes more successful.

Source: Index Venture — ESOP analysis

In Europe, ESOPs remain at 10% throughout all funding rounds.

It’s a critical issue in the European startup ecosystem, as European employees end up with only half as much ownership in later stages compared to their US counterparts.

The right ESOP size for your company will depend on several factors, including the industry you are in, the stage of your company, and the composition of your founding team.

Source: How much equity should you expect from an early-stage startup?

However, a good rule of thumb is to aim for an ESOP size of 10-15% at seed and to increase the ESOP size with each funding round.

When a founder or cofounders of a startup are planning how to divide the ownership of their company, they need to consider three main groups and the industry’s best practices: the founders (75%), the employees (10%), and the investors (15%).

Future thoughts

With the proliferation of startup communities and the venture capital landscape in multiple areas of Europe, the need for a unified framework is becoming more and more stringent.

“Bulgaria just passed legislation formalizing the use of ESOP programs in a new type of business entity focused on startups. Founders need to understand that ESOP allows you to motivate, hire, and retain strong talent that won’t be incentivized by just instant monetary rewards like salaries.

People want to have a stake in something that is going to become bigger, and ESOP allows them to invest in their own future – one that they can control. And because it’s such a powerful tool, founders can also keep the discipline of burning cash early on to a minimum so that they can maximize their chance of bigger success.”

Says Hristo Borisov, the co-founder and CEO of Payhawk.

Additionally, the need for more education on why implementing an employee stock option plan is beneficial for your startup companies also requires more effort, according to our community of investors.

“General awareness for both founders and team members could boost adoption. Founders should learn that having a smaller share of a bigger pie is ultimately better. Team members should understand that ESOP is not a given, i.e. it does not come for everyone by default. So you should prove your commitment and dedication first and then qualify for this shared ownership instrument.”

Says Svetozar Georgiev, Co-Founder at Telerik and Partner at Eleven Ventures.

“To increase ESOP adoption, we need a shift in the ESOP perception. ESOP is an investment opportunity and gives you ownership of what you build.

To achieve it, we need more transparency and education around successful exits and how they would help create long-term wealth creation for employee-owners. We might also need some changes in the legal and tax framework.”

Says Hristo Pentchev, Site Lead and Director of Product Development Operations and Technical Programs at Leanplum, a CleverTap company.

Next step: Implement your ESOP.

We hope this article offered you a better perspective on European companies implementing employee stock option plans in different countries, their role across different growth stages, and why investors see it as a core part of the fundraising journey.

Remember, you are not alone on this journey.

SeedBlink has gathered a team of experts, with financial and legal advisors, to help you learn everything you need to know about legal aspects, tax treatment, filing your taxes, and how to design and implement an ESOP.

Enhance your employee engagement with our ESOP Design program.

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.