SeedBlink Blog

interviews

ESOPs in Bulgaria: A legal perspective with VC LAW Managing Partner Ivelin Vasilev

How to implement ESOP in Bulgaria. Legal advice from Ivelin Vasilev, Managing Partner at VC Law firm.

Read everything you need to know about how to implement an ESOP in Bulgaria, including insights from lawyer Ivelin Vasilev.

Today, we are happy to introduce you to a new type of discussion on equity ownership from the lawyer's perspective.

To kick things off, we are joined by Ivelin Vasilev, a Bulgarian attorney at law and the Managing Partner of VC LAW FIRM.

Who is Ivelin Vasilev & VC LAW FIRM?

Ivelin is a seasoned lawyer specializing in corporate law who brings a wealth of experience managing intricate legal frameworks that drive business growth and safeguard interests. His expertise spans Mergers and acquisitions (M&A), equity transactions, and the meticulous legal due diligence process.

Ivelin has a proven track record in incorporating investment funds, facilitating complex commercial deals, and guiding company reorganizations with strategic legal oversight.

“I specialize in providing legal advice to investment funds, startups, and rapidly growing companies. My experience includes structuring equity deals, conducting due diligence for investment funds, drafting investment agreements, and submitting necessary documents to the Commerce Register here in Bulgaria.

I've also spent a lot of time on the other side of the table, advising local and international companies through securing equity or quasi-equity investments from investment funds. At one point, I served as the in-house lawyer for an alternative investment fund that won the public procurement for managing one of the funds under the Bulgarian Investment Fund, Innovation Capital. This fund has invested in over 200 companies, and I was involved in structuring the fund itself and securing legally the first 50 or so deals.

_My unique mix of legal expertise and hands-on experience reviewing companies for investment and serving on an Investment Committee has equipped me with a deep understanding of what makes a successful equity deal._”

ESOP in Bulgaria.

Ivelin’s experience is also deeply connected with legal compliance, including GDPR, Employee Stock Option plan structuring, and providing companies with innovative ways to motivate and retain key employees.

This is one reason why we wanted to ask him for his advice on implementing an ESOP in Bulgaria.

“When it comes to employee stock ownership plans (ESOPs), I've noticed that Bulgaria's lack of specific legislation can create uncertainty for investors.

This was somewhat addressed recently with the creation of a new type of company — Variable Capital Company (VCC), allowing for more flexible ESOP arrangements.

As of June 30, 2024, VCCs should be able to be established, as the legislation is expected to be amended. We anticipate that the Commerce Registry will update its website soon to reflect this change in the legislation.

_VCCs are companies that must simultaneously meet two conditions - the annual turnover/asset value must be less than BGN 4,000,000, and the average number of employees must be less than 50. If one of these conditions changes, the company must be reorganized into another type of company (a limited liability company or a joint stock company)._”

The challenge of implementing ESOPs in Bulgaria.

“In Bulgaria, founders typically have to choose between establishing a joint-stock or limited liability company. The latter is more popular due to its lower initial capital requirement. Yet, it's precisely this type of company that presents complexities around ESOPs.

The law here is quite strict, and making someone a shareholder isn't easily reversible, which poses risks if an employee stops contributing to the company or acts against its interests.”

ESOP in Limited Liability Companies.

“Delving into ESOP implementation within limited liability companies reveals innovative approaches to achieve desired outcomes. However, the absence of court rulings leaves uncertainty over these methods.

_This legal ambiguity often leads companies to forgo these innovative solutions to avoid potential legal challenges, opting for simpler options like phantom shares._”

Alternative options — joint-stock companies.

“Joint-stock companies, on the other hand, provide a more adaptable framework.

They allow for drafting articles of association that can include clauses enabling the company to revoke an employee's stock if they act detrimentally to the company's interests. This provision, however, must be explicitly outlined in both the articles of association, the stock agreements, and the subscribed stocks.

_Many clients prefer this structure for its perceived flexibility in managing ESOPs despite the absence of legal validation through court precedents._”

Local trends and the impact of regional culture.

ESOP is gaining more traction in Bulgaria, but the challenge is still the lack of clear legislation. Some company owners worry about what happens if someone leaves the company.

Do they get to keep their shares? This question gets even more complicated when you consider taking a company public, which means selling its shares on the stock market for anyone to buy.

“A common sentiment among Bulgarian companies we work with is a clear preference against employees retaining stock after their employment ends.

_No one really likes the idea of former employees holding onto their shares, and it's a concern we hear across the board._”

Is ESOP popular in Bulgaria?

“Companies were eager to use ESOPs as a tool to hold onto their current team members and to bring new talent on board. It really took off as a strategy for reaching those goals, with many businesses looking to implement it. However, things started to shift after August 2023.

Now, the companies interested in setting up ESOPs tend to be those looking to bring specific experts into their fold, like a sought-after C-level executive or a top-notch senior developer. These professionals often request ESOPs, prompting companies to contact us for help setting them up. But it's more of a reaction to these individuals' demands rather than companies actively pursuing this strategy on their initiative.

_The landscape has indeed changed. Many companies are seeing their teams shrink, with fewer developers than in previous years, and overall, they've become more cautious about expanding their teams. While some have started hiring again, there's a noticeable slowdown. In this climate, the interest in ESOPs is primarily driven by the need to meet the demands of exceptional talent looking for equity in the company._”

ESOP vs. salary.

Many lean towards salaries and direct remuneration instead of shares for a straightforward reason.

This preference is particularly strong among individuals prioritizing stable income to meet their day-to-day needs or having financial obligations that can't wait for the potential long-term gains from equity.

“We often encounter specialists who join a company's team not primarily for the salary but because they believe in the company's vision and potential. These individuals, typically occupying C-level positions or being senior developers, have likely secured substantial career earnings.

With financial stability already in their back pockets, they're more interested in opportunities to invest emotionally and intellectually. They strongly prefer ownership and a stake in the company's future.

This mindset is commendable and is an effective strategy for startups looking to attract top talent.”

Fundraising rounds, investors, and ESOP.

According to Ivelin, the effectiveness of Employee Stock Ownership Plans hinges significantly on two main factors:

- the type of fund involved

- the specifics of the deal at hand.

“A smart fund that might propose an investment with the foresight that the company will likely undergo several funding rounds. They'd want to know how many employees the company plans to hire in each phase and how the ESOP pool will adjust accordingly.

Now, imagine a small business with ten employees receiving a 1M EUR investment. The fund could advise preparing to hire 20 more employees for specific departments while considering the need to expand the team by 80 in future funding rounds.

As the company's valuation increases, the proportion of shares allocated to the ESOP should decrease, reflecting the rising value of each share.

In the initial round, the company might allocate 10% of its capital to the ESOP, followed by 3% in the next, and perhaps 1-2% in subsequent rounds, depending on the anticipated funding stages.

_This strategic approach helps prevent future disputes and ensures all parties agree on the company's growth and handling of ESOP dilution._”

However, Ivelin says it's rare to see such proactive investor involvement in the planning of ESOPs in Bulgaria.

“Few cases exist where founders actively seek and incorporate investors' advice into their ESOP strategies. And when advice is given, it's not always taken to heart.

The dynamic between the investment fund and the founders is, therefore, crucial. When both parties are astute and cooperative, it can lead to a fruitful partnership, paving the way for seamless future investment rounds.

_This approach ensures that subsequent investors are informed about how their capital will be utilized and whether it will be affected by the ESOP dilution._”

Legal particularities for ESOP in Bulgaria

Several unique considerations must be remembered when setting up an ESOP in Bulgaria. These aspects reflect Bulgarian companies' nuanced approach to ESOPs, which balances employee incentives with the company's strategic needs and legal framework.

We asked Ivelin to help us contour the most important ones you need to know about.

- Conditional share acquisition: Many Bulgarian ESOPs incorporate a provision where employees can acquire shares or stocks only a short period before a liquidity event, such as the company being acquired or going public through an IPO. This approach ensures employees have a stake in the company's success without immediate share ownership.

- Vesting periods: ESOPs often include vesting periods, after which employees earn the right to acquire shares. However, equity ownership is contingent upon a liquidity event, aligning employee incentives with long-term company performance.

- Dividend equivalents: Employees may receive payments equivalent to dividends if they were actual shareholders before a liquidity event. Despite the lack of formal stock ownership, this provides a tangible benefit during the vesting period.

- Share transfer mechanisms: At the time of a liquidity event, qualified employees can receive their vested shares or stocks. This critical moment transforms their potential earnings into actual ownership, potentially leading to significant financial gains.

- Pricing and acquisition of shares: Unlike the U.S. model, where employees often buy stocks at a discount, Bulgarian companies typically grant options as a gift without requiring any payment from the employee. This generous approach enhances the attractiveness of ESOPs as a component of employee compensation.

- Profit realization: If an employee acquires shares shortly before a liquidity event and sells them during this event (e.g., an IPO or acquisition), they may realize a profit. This profit is then subject to taxation, just like any other income, underscoring the financial implications of participating in an ESOP.

Connect with Ivelin:

Learn more about ESOP.

If you want to learn more about employee stock option plans, ESOP tax advantages, fundraising rounds, industry trends, and a snapshot of the venture capital market right now, prepare for your fundraising round; we’ve got you covered. Check out our dedicated page on ESOP Design Programs.

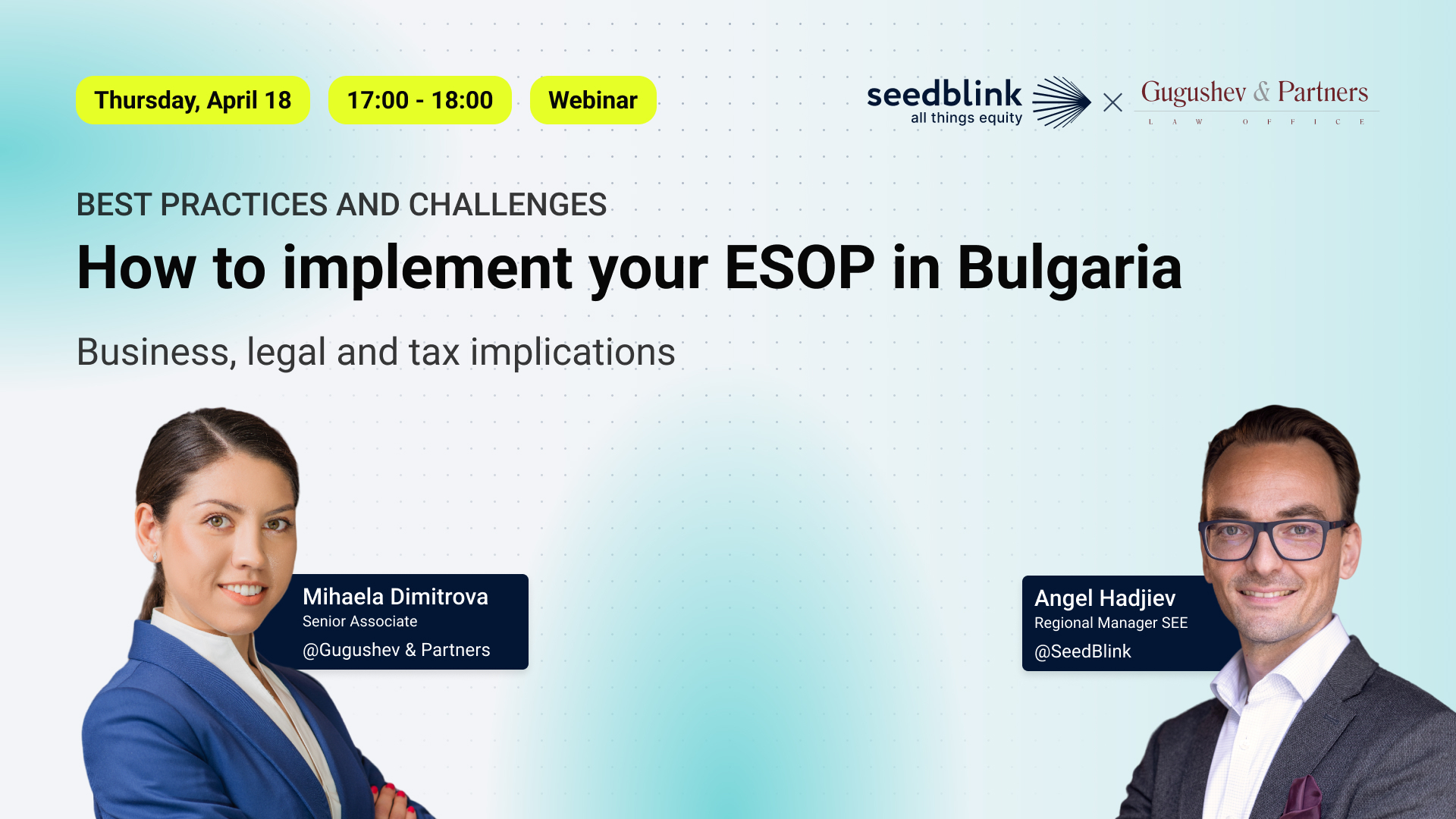

Join our upcoming webinar on How to implement an employee stock option plan in Bulgaria in collaboration with Gugushev & Partners.

This program simplifies the process of creating and managing Employee Stock Option Plans (ESOPs) for Bulgarian companies by leveraging the experience of legal, tax, and digital management specialists, providing founders with the tools and expertise to implement effective ESOPs tailored to Bulgaria's specific legal and tax environment.

Register here for the webinar.

Participation is free of charge.

Places are limited.

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.