SeedBlink Blog

all Things Equity

The state of European VC: Key findings from market reports

Explore the European venture capital scene and discover the key insights and trends from the latest market reports.

Let’s delve into key findings from recent market reports to get a comprehensive overview of the current state of European venture capital and what we should expect at the end of this year.

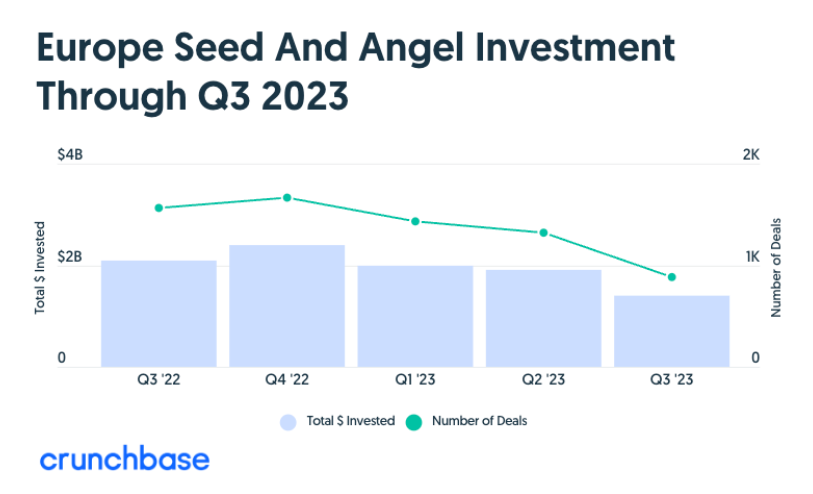

European seed and angel investments in Q3

European seed funding totaled $1.4B in Q3 2023, down from $2.1B a year earlier and around 25% quarter over quarter. This is the lowest level of seed funding in Europe since the start of the current economic downturn.

Source: European Venture Funding by Crunchbase

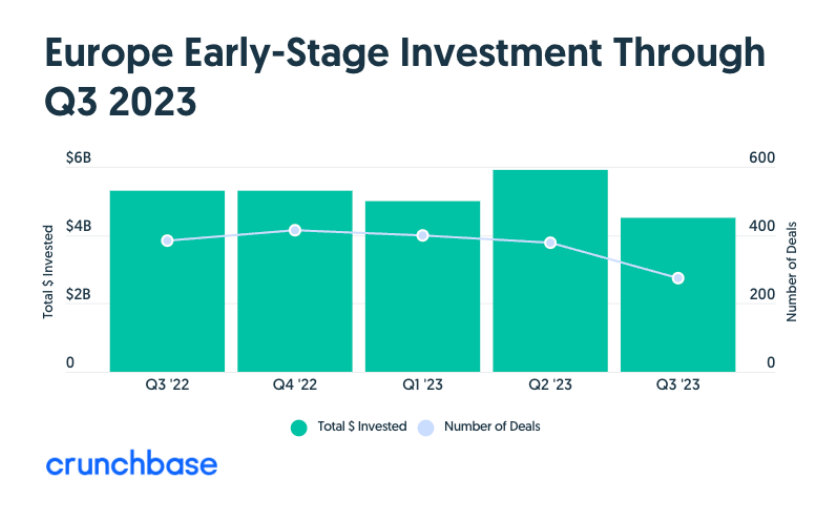

European early-stage investments in Q3

European early-stage funding totaled $4.5 billion in Q3 2023, representing a 25% quarter-over-quarter decline and a 30% year-over-year decline. The largest proportion of early-stage funding was invested in Series A companies, which account for the majority of funding rounds at this stage.

Source: European Venture Funding by Crunchbase

Despite the decline in funding, the numbers are growing steadily from a broader perspective. On top of this, there are still active European investors on the market that want to back early-stage startups.

LocalGlobe and Point Nine Capital are just two of the most active seed investors that continue to seek companies with strong teams, innovative products or services, and large addressable markets. They are followed closely by bigger funds, such as Accel, Index Ventures, Bessemer VC, Balderton VC, and Northzone, in Series A rounds.

European late-stage investments in Q3

European late-stage funding doubled quarter over quarter, with notable raises in the sustainable energy sector across multiple markets.

Source: European Venture Funding by Crunchbase

Here are some of the top funding deals in Europe in Q3 2023:

- H2 Green Steel (Sweden): $750M

- Northvolt (Sweden): $650M

- Verkor (France): $400M

- Zenobe Energy (UK): $300M

- Pitch (UK): $100M

- DRUID AI (Romania): $30M

These deals show that there is still significant investor interest in early-stage European startups, particularly in the sustainable energy and technology sectors.

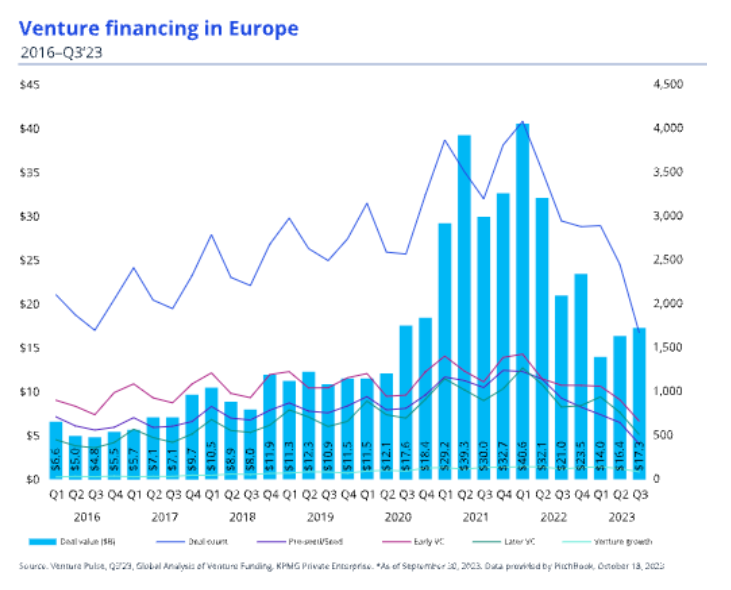

European VC funding in Q3

Quarter-over-quarter, Europe saw a modest increase in VC investment, driven by numerous significant deals. In Q3’23, there were ten transactions worth $225 million or more.

Source: Q3’23 Venture Pulse Report - Europe by KPMG

Due to uncertain market conditions, European VC investors have become more selective. Their focus has now shifted towards more mature sectors and companies showing resilience.

For example, artificial intelligence remains attractive, with startups like Poolside raising $126M. Fintech is following closely, where VC interest remains in B2B fintechs, especially those improving back office functions for small businesses.

Late-stage Fintech avoids funding rounds due to economic conditions and potential undervaluation. The major fintech deals included Defacto, with $182M, and Astaris Capital Management, raising $150M.

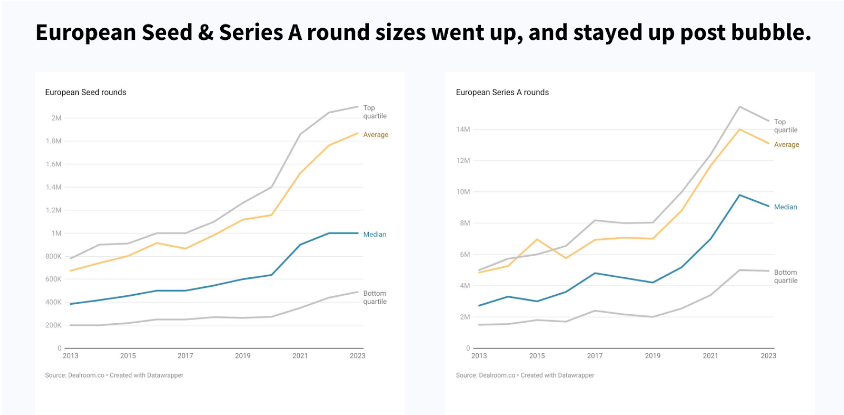

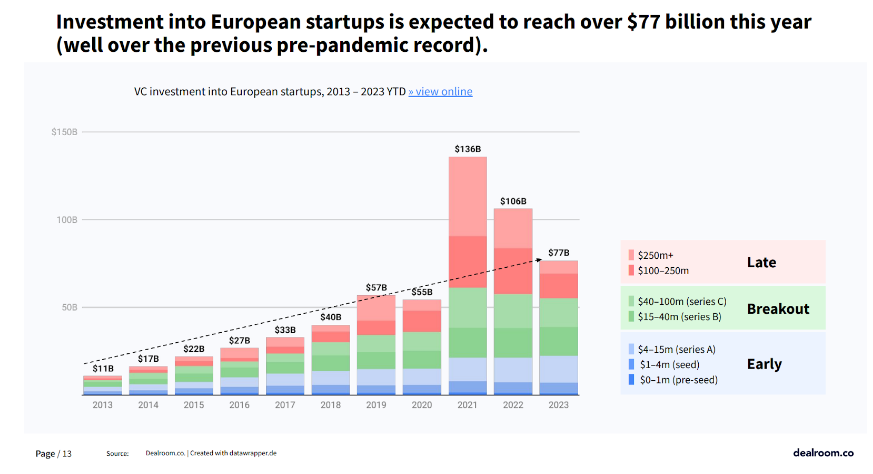

However, not all the predictions are bad. Looking at the big picture landscape, you’ll find that European startups and the VC investments they attracted have larger figures than pre-pandemic years. The market is regulating itself and growing more naturally without overinflated valuations and hype-driven transactions.

Source: European Venture Capital in 2023

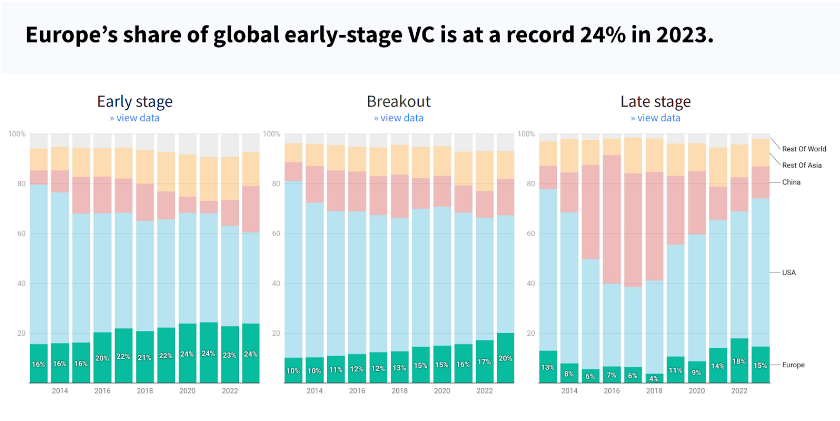

Europe also leads the way globally, claiming a bigger piece of the global early-stage pie in venture capital. So far, it has reached a new record of 24%, compared to previous years.

Source: European Venture Capital in 2023

VC deal activity in Q3

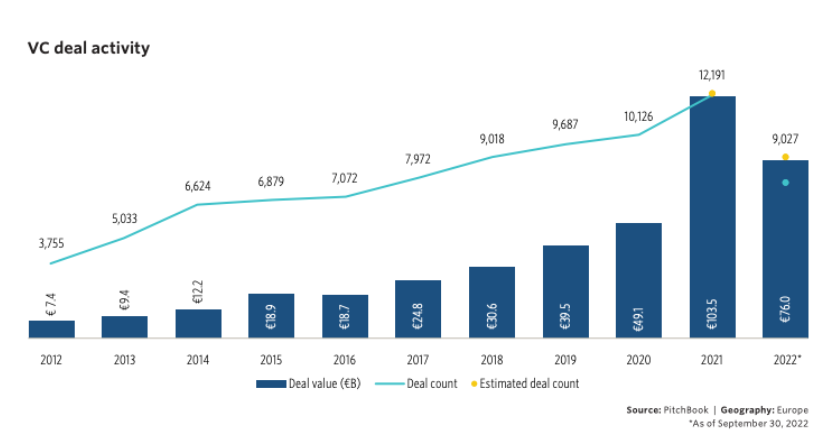

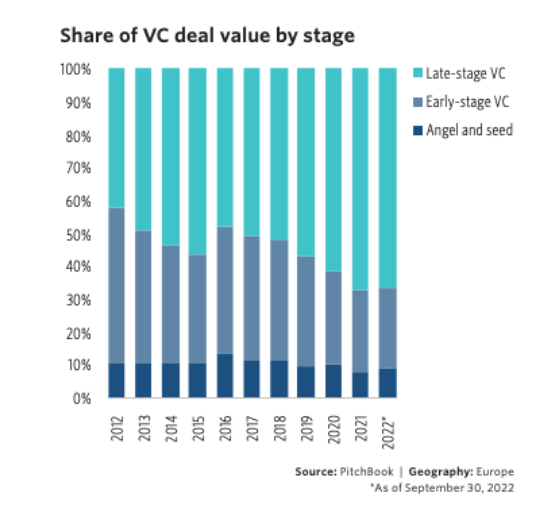

European venture capital (VC) deal value reached over €76.0B, keeping pace with the previous year despite economic challenges and volatile financial markets. However, Q3 saw a significant drop in deal value, decreasing 36.1% quarter-over-quarter to €18.4B — the lowest figure since Q4 2020.

Source: European Venture Report Q3 by Pitchbook

This decline reflects the anticipated downturn in deal-making activity amidst global economic pressures such as record inflation, interest rate hikes, and a negative outlook on publicly listed tech stocks with high valuations and weaker growth forecasts.

Source: European Venture Report Q3 by Pitchbook

These factors have made capital more scarce and fundraising challenging within the VC ecosystem.

First-time vs. follow-on rounds

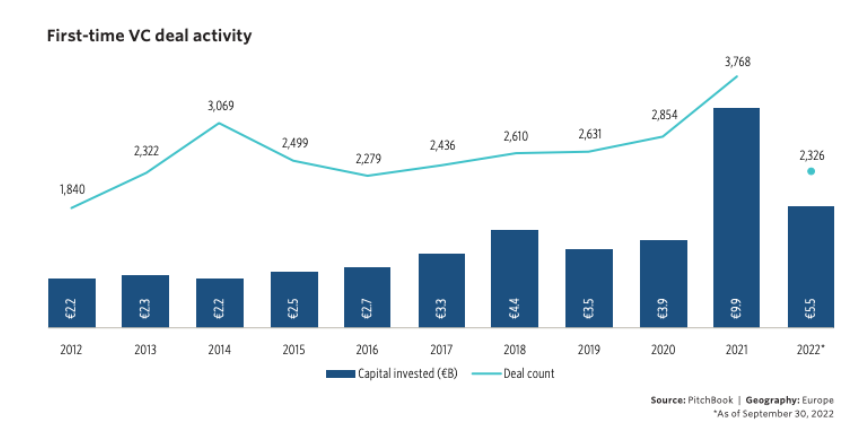

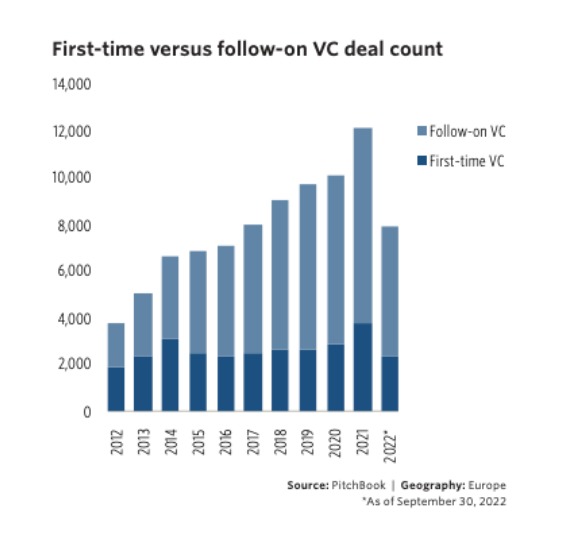

Despite the current market challenges, first-time VC deal activity has remained strong through Q3 2022.

Source: European Venture Report Q3 by Pitchbook

This consistency demonstrates that stakeholders actively seek, evaluate, and invest in new VC deals. Investors with available funds view the current market, characterized by softer valuations and reduced competition, as an ideal time to invest in startups several years away from exiting and looking to disrupt sectors over the next seven to ten years.

Source: European Venture Report Q3 by Pitchbook

These companies, in turn, are expected to consider near-term market volatility as part of the economic cycle and not something that will impact their long-term success.

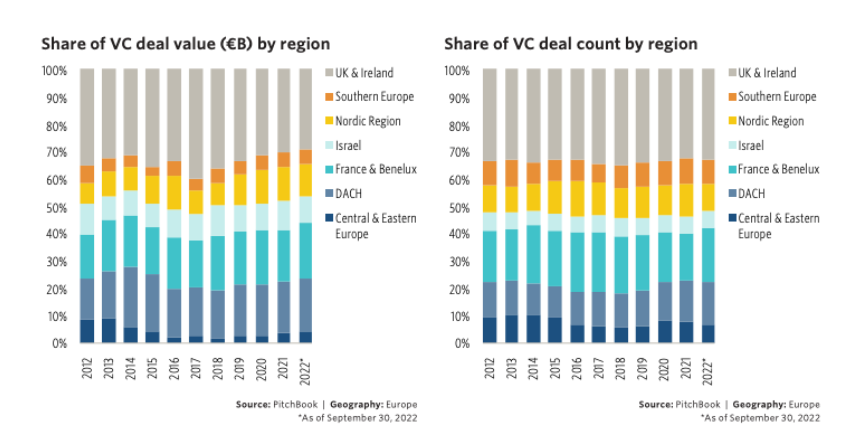

Top 3 European regions in VC deals

Source: European Venture Report Q3 by Pitchbook

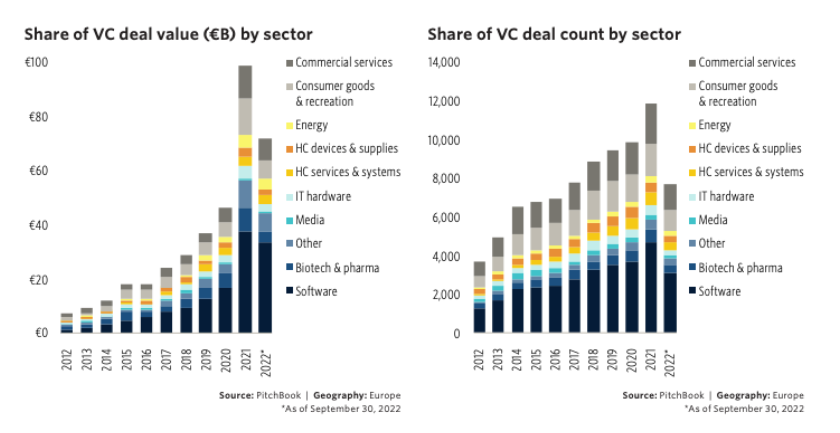

Top 3 industries in VC deals

Source: European Venture Report Q3 by Pitchbook

Expectations for Q4

The current market reports suggest that VC funding in Europe will remain suppressed in Q4’23 due to ongoing challenges companies face in securing investments. The high-interest rate environment may result in diminished VC fundraising activities, potentially impacting the VC market over the long term.

Nonetheless, sectors such as artificial intelligence (AI), Cleantech, Health and Biotech are expected to maintain their appeal to VC investors despite the overall slowdown in investments.

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.