SeedBlink Blog

technology Trends

Industry overview: Exploring the Ever-Evolving Fintech Startup Scene

An in-depth analysis of the Fintech startup ecosystem, highlighting key trends, challenges, and opportunities in the industry.

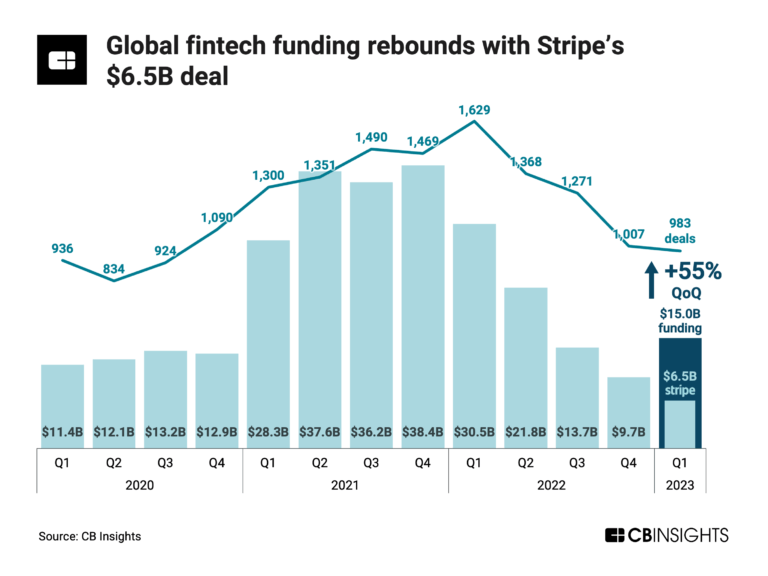

The global Fintech industry had a promising start in Q1'23 after a steady decline in investment activity in 2022.

In Q1'23, the global Fintech industry experienced a 55% quarter-over-quarter growth in funding, driven by Stripe's $6.5B raise. Early-stage deal share reached a record high of 72%. However, unicorn births decreased to just one, a first since 2016. On the bright side, M&A exits increased by 15% QoQ. The banking sector, however, saw the lowest levels of funding and deals since Q2'17.

In this article, we’ll take a quick tour of financial technologies' core elements to discover how they work and what makes them unique. You’ll be able to understand the following:

- The basic terminology used in this industry.

- An overview of its recent market history in 2022 and Q1 2023.

- Have a sneak peek at the Fintech sector in the European startup ecosystem.

- Learn what European investors have an active portfolio on Fintech.

- Discover a few use cases of Fintech across other verticals.

What is Fintech — Financial Technology?

Fintech refers to the technologies and software solutions used to innovate the financial industry. It can include mobile applications up to more complex technologies.

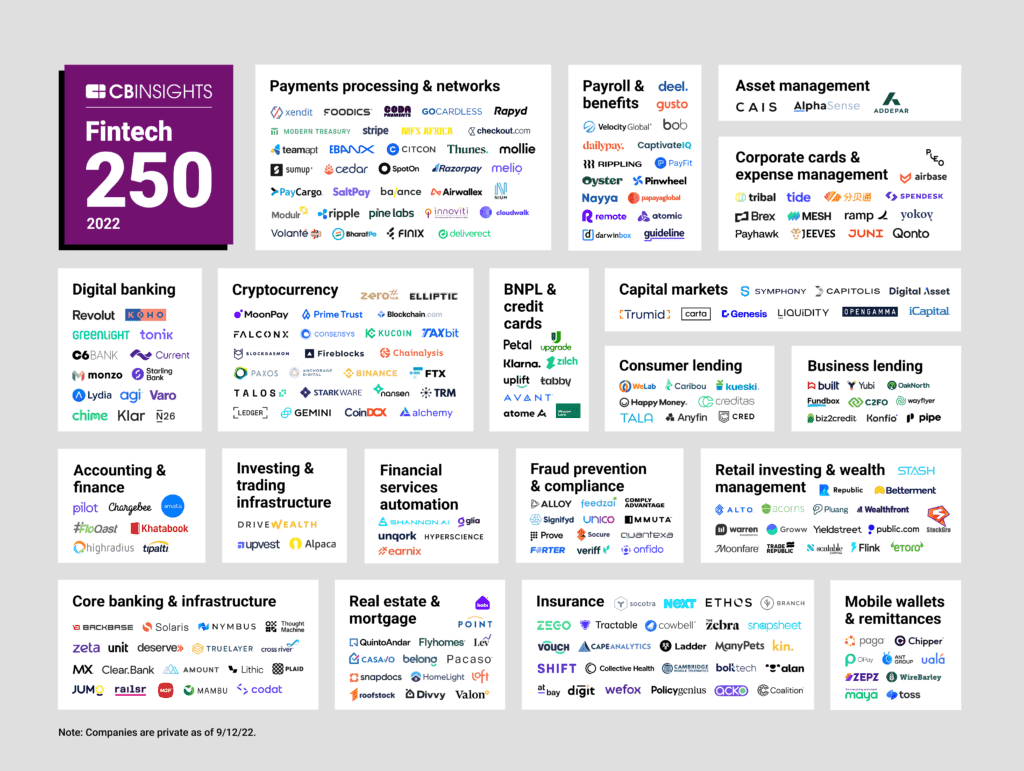

According to CB Insights, some of the most well-known areas include the digitalization of banking services, payment processing & networks, corporate cards & expense management, BNPL & credit cards, new online investment platforms & wealth management, automation of financial services, fraud prevention & compliance, mobile wallets, but also includes cryptocurrencies, digital assets, and trading, and many others.

This is what the complete Fintech landscape looked like at the end of 2022:

Source: Fintech Map - 2022

The State of Fintech in 2023

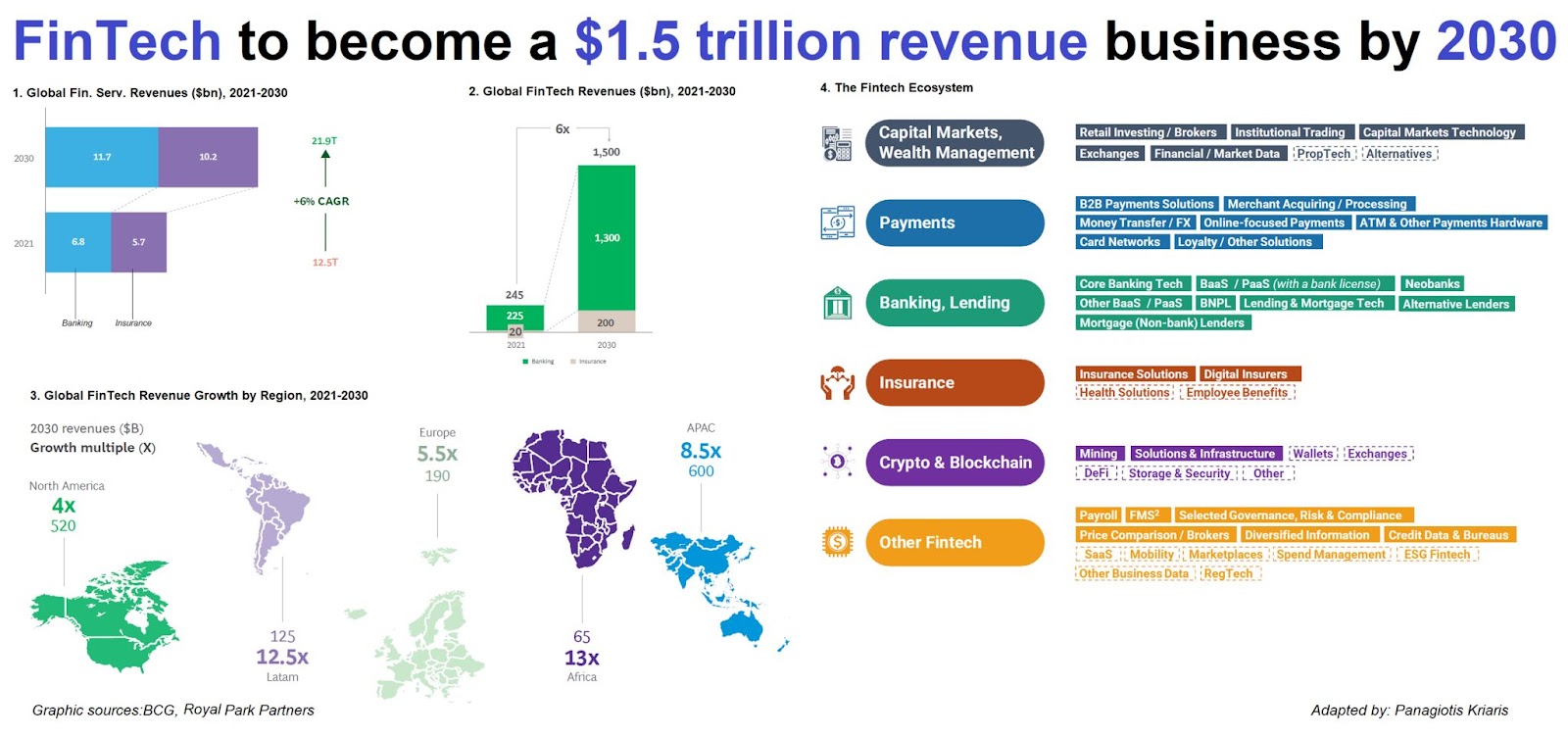

Over the past decade, FinTechs have attracted over $500 billion in funding and represented around 9% of all financial services valuations globally, reaching $1.3 trillion in public valuations in 2021.

However, in the face of a changing macroeconomic environment with factors like inflation, increasing interest rates, energy crises, and conflicts, Fintechs have experienced a decline in valuations and funding, with investors seeking safer bets focused on liquidity, profitability, and sustainability.

Source: Panagiotis Kriaris

Despite the current difficulties, the future of FinTech remains promising, as it currently represents less than 2% of annual financial services revenues globally, and projections estimate that annual FinTech revenues will grow more than sixfold by 2030, reaching $1.5 trillion.

The constant need for more digitalization and innovation has put the industry under pressure and challenges in recent years. COVID-19 has supported adopting more Fintech solutions, making people keen to adopt new contactless payment or digital banking solutions.

The startup landscape is counting +400 unicorns; nearly 50 entered the market in 2022. Even though the valuations and numbers of exits have decreased due to the uncertain times we had this year, the decentralization of the financial industry and modern payment solutions are still on top of the list as the most invested sectors in Fintech.

In 2021, we had new records of companies and deals raised, counting down +700 deals only in European firms, with €26B in total investments. Additionally, the Fintech industry has counted down some of the biggest investment deals in the past year, +60 of them being over €100M, and the largest, counting down €900M.

Source: State of Fintech - Q1 2023

According to the same report, the global funding rebounded in Q1’23, reaching $15B, a 55% increase QoQ, while deal count fell by 2% QoQ. However, Stripe's $6.5B Series I round accounted for over 40% of the quarter's total funding. Early-stage deal share reached 72%, a new high, likely due to investor concerns over inflated valuations and uncertain public markets.

Only one Fintech unicorn was born in Q1’23, an 86% drop in QoQ and the lowest quarterly level since 2016. The total unicorn herd stood at 314 in Q1’23, up 11% YoY, with most of the top 10 unicorns by valuation located in the US or the UK, with 60% providing B2B solutions.

Fintech M&A exits rebounded 15% QoQ to 172 deals in Q1’23, a 34% decrease from their record high of 259 in Q1’22, while IPOs ticked up slightly to hit 4, but SPACs remained at 0. Funding to banking-focused Fintech reached $0.5B in Q1’23, its lowest level since Q2’17, a 64% QoQ decrease, and deal count fell by 16% QoQ.

With more challenging conditions and a focus on fundamentals, European investors have focused on due diligence cycles and relationships with founders. For example, Ansaf Kareem, Venture Partner at Lightspeed Ventures, mentioned in TechCrunch that challenging market conditions are good, as they often create the best companies.

Investors advise companies to focus on fundamentals, save cash, and not hesitate to raise a down round if they believe their idea can change the world.

European Investors Betting on Fintech

The industry has been increasing fast in recent years, so many investors are actively looking to invest in promising startups. European investors, in particular, have shown a strong interest in Fintech and are closely following developments in the industry.

Here are five top investors in Fintech who are at the forefront of this evolving landscape, with their expertise and advice valuable to any entrepreneur seeking to enter this space.

- Speedinvest — Speedinvest is a venture capital fund with more than €1B to invest in pre-Seed, Seed, and early-stage tech startups across Europe.

- Kima Ventures — Kima Ventures is a venture capital firm based in Paris, France, and invests across multiple industries, including Fintech.

- Seedcamp — Seedcamp is Europe's seed fund, identifying and investing early in world-class founders attacking large, global markets and solving real problems using technology.

- NFT Ventures — is a venture capital based in Stockholm, Sweden, and is one of the leading Fintech investors in Northern Europe.

- Point Nine Capital — is an early-stage venture capital fund focused on backing seed-stage B2B SaaS and B2B marketplace entrepreneurs anywhere in the world.

Our list of venture capital funds represents the main examples of investors, giving a general overview of the VC landscape. Many other VCs are investing in Fintech startups.

Fintech is expected to keep growing, especially as the need for more digitalization and innovation puts the industry under pressure and challenges. COVID-19 has supported adopting more solutions, making people keener to adopt new contactless payment or digital banking solutions.

Also, European investors have shown a strong interest in Fintech and are closely following developments in the industry. Despite the challenging market conditions, investors advise companies to focus on fundamentals, save cash, and not hesitate to raise a down round if they believe their idea can change the world.

Fintech Startups Who Are Raising Funding on SeedBlink

On the SeedBlink platform, many Fintech startups are looking to raise investment. Pensify and Ondato are raising a round on our platform alongside Woli, Finquare, and Income which successfully closed rounds in the past two years.

Ondato

Ondato is a tech company specializing in KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance management using advanced AI solutions. The company aims to provide the best compliance service centre where businesses can find tailored solutions to their needs.

Ondato's vision is to allow businesses to focus on their core activities without worrying about the complexities of compliance. With the help of cutting-edge technology, Ondato simplifies and automates compliance procedures, ensuring that businesses meet regulatory requirements efficiently and effectively.

Ondato is raising a round on SeedBlink, targeting €4.025.000, with €3.525.000 pre-committed money and OTB Ventures as lead investors.

Pensify

Pensify is a startup to revolutionize the pension industry by providing cross-border products that increase retirement savings for working individuals across Europe. The founders were inspired by their struggles to set up a pension plan for their Dutch SME company and discovered that many SME employers faced the same issue. Pensify aims to use innovation to tackle the outdated pension industry and provide solutions to help individuals save for a happy retirement.

Pensify is raising a round on SeedBlink, targeting €600.000, with €500.000 pre-committed money and OTK Capital, as the lead investor.

Doorway

Doorway is an Italian-based company that aims to provide access to venture capital investments to a broader audience of investors. They believe that venture capital is an asset class with the potential to generate significant returns and act as a growth engine for an innovative, sustainable, and inclusive economy. Doorway is raising a round on SeedBlink, targeting €2.018.500, with €1.718.500 pre-committed money and CDP Venture Capital SGR as the lead investor.

SeedBlink and Doorway have also partnered to provide investors with unique access to high-potential investments in international tech startups and scale-ups.

Learn more about SeedBlink x Doorway.

Fintech Startups Who Raised Funding on SeedBlink

These promising startups have caught the attention of investors, demonstrating their potential for growth and disruption in their respective industries.

They have successfully raised a previous round of funding on the SeedBlink platform and are paving the way for innovative ideas to flourish in the competitive business landscape.

Woli

Woli is a neobank explicitly designed for the digital native generation, including kids and teens. The mission of Woli is to create a banking experience that is both memorable and relevant for this generation, with a focus on empowering them with financial freedom. The platform offers a comprehensive banking solution that includes a powerful debit card, tailored offers for teens, and a financial education platform.

Woli just had an active round on the platform, targeting €1.000.000 and closing the round at €982.500. The round started with €800.000 pre-committed money, and the lead investor was Eleven Ventures.

Income

Income is an alternative investment platform and mobile app that enables investors to invest in loans worldwide. The platform democratizes investing in alternative assets through a novel use of technology and implementing security features previously available only to institutional investors. It creates value by facilitating transactions between retail investors, institutional investors, and loan originators.

Income had an active round in 2021, targeting €1.250.000 and closing at €1.200.000. The round started with €900.000 pre-committed money and added €350.000 raised through SeedBlink.

Income is already available on the secondary market. If you want to learn more about Income and join their growth journey. Check the last valuation of Income, share price, and available selling offers on the bulletin board!

Finqware

Finqware is a cloud-based SaaS product for large companies, built from scratch as an enterprise-grade secure platform with a special focus on reliability and scalability. The platform is the first open banking solution for treasury, accounting, and collections automation.

Finqware had an active round in 2022, targeting €450.000 and closing at €509.000. The round started with €250.000 pre-committed money and added €200.000 raised through SeedBlink.

SeedBlink

SeedBlink has also been raising its rounds on the platforms for two years, with the last public round available in 2021. In the last round, SeedBlink raised €3.000.000, with €1.900.000 pre-committed money.

SeedBlink, alongside the abovementioned startups, is also available on the secondary market. If you want to learn more about our platform and join the growth journey. Check SeedBlink’s last valuation, share price, and available selling offers on the bulletin board!

Conclusions:

SeedBlink’s community of Fintech startups continues to grow as more solutions start to be developed in Europe, and their round goes live on the platform. So take a look at the new investment opportunities from the platform, and create your investor profile today!

- The Fintech industry has been growing rapidly in recent years, and European investors have shown a strong interest in Fintech and are closely following developments in the industry.

- Top investors in Fintech in Europe include Speedinvest, Kima Ventures, Seedcamp, Balderton Capital, and Index Ventures.

- COVID-19 has supported adopting more solutions, making people keener to adopt new contactless payment or digital banking solutions. The startup landscape is counting +400 Fintech unicorns, and nearly 50 entered the market in 2022.

- The global Fintech industry rebounded in Q1'23, with a 55% quarter-over-quarter funding growth driven by Stripe's $6.5B raise.

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.