SeedBlink Blog

all Things Equity

The Netherlands - Everything you need to know to build and grow a tech startup

Unfold the Dutch advantage! Discover the information and resources you need to build and grow your company in The Netherlands in 2024.

The Netherlands has established itself as a leading hub for startups in Europe, marking down the first stock exchange in the world and the first equity crowdfunding platform in Europe.

Are you a founder looking to build and grow your company in The Netherlands? This article is a good start to familiarize yourself with the market, see what local support is available through startup programs and accelerators, explore different funding options available, and see what resources you have to take your company to the next stage of growth from a simple idea to become the next unicorn.

Are you an investor?

Stick around to learn about the strong community of startups in local hubs like Amsterdam or Rotterdam, and check out the ecosystem overview guide with dedicated resources for investors.

Overview of the Netherlands startup ecosystem

The country has highly skilled talent, a strong legacy in science and technology, and a culture of innovation and entrepreneurship. Dutch people are well known to foster a culture of innovation and risk-taking.

Is the Netherlands a good country to start a business?

Yes, absolutely, and here are some reasons why:

- A thriving startup ecosystem

- A supportive government

- A wide range of access to funding

- A highly educated workforce

- A friendly business environment

- A leader in sustainability and corporate responsibility

The most crucial aspect of fostering a thriving startup ecosystem isn't just about starting businesses but empowering them to scale. The Netherlands can unlock the true potential for value creation by providing resources and support for growth.

According to a McKinsey report, start-ups founded in the Netherlands have created more than 130,000 local jobs across all provinces and hold the potential to contribute an estimated €250B to €400B market capitalization by 2030.

The Netherlands is also a very friendly startup country that holds the 4th place in start-up value creation in Europe, according to the same McKinsey report.

How many startups are in the Netherlands?

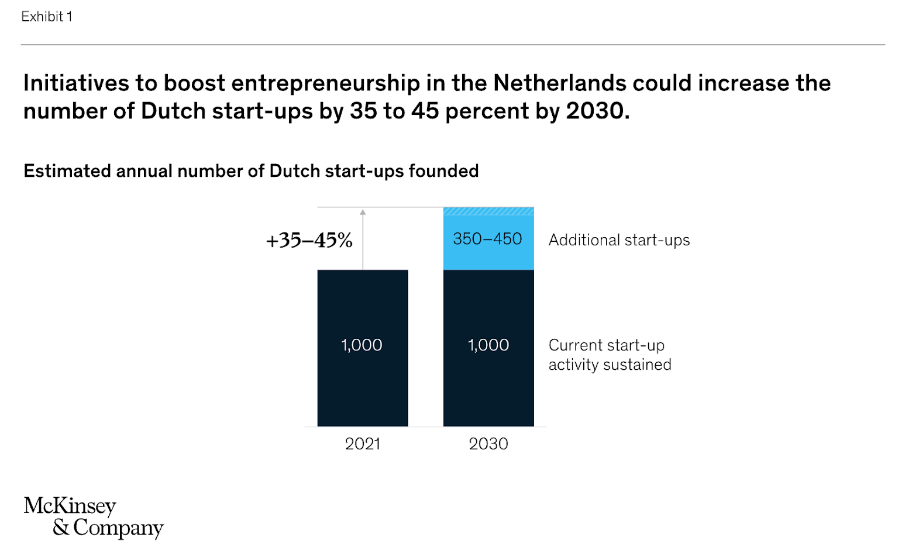

There are approximately 4500 Dutch startups right now, with around 1000 launched in the Netherlands annually and around 900 startups per million residents by 2030. It’s one of the reasons why the country is among the top countries in the European Union.

Source: Building a world-class Dutch start-up ecosystem

This pace of founding puts the Netherlands fifth in the European Union, alongside Estonia, Ireland, Luxembourg, and Denmark, and eighth Europe-wide, alongside Switzerland, the UK, and many others.

How do you start a business in the Netherlands?

As a founder looking to start a business in the Netherlands, it's essential to understand the local legal structures and registration processes. The local government has created a comprehensive guide for founders that is easy to follow as a checklist.

Here is a short explainer video to guide you around some of the most commonly encountered legal structures companies have in the Netherlands.

Begin by selecting the appropriate legal structure for your business. These are the main options and a few important things you should know.

Sole Proprietorship (Eenmanszaak)

It is one of the most common business structures in the country where you, as the sole owner, have unlimited liability, meaning you are personally responsible for all company debts. You also provide all the capital for the business.

The key advantage of this structure is that you, as the owner, have complete control over company decisions and are the sole beneficiary of its profits.

Private Limited Company (BV)

It is one of the most popular startup choices due to its limited liability protection. Compared to sole proprietorship, you are not liable for any debts made by the company.

The disadvantage of this type of company is the higher taxes to be paid and the need to list the company's capital every year. As a founder, owning more than 5% means you'll have to pay a 25% tax on profits.

General Partnership (VOF)

This type of company structure applies when two or more persons own the business. In this case, they are jointly and severally liable for the company’s activities, including debts, and every party involved should bring their contribution from all perspectives: money, goods, time, etc.

Once you've chosen your legal structure, register your business with the Dutch Chamber of Commerce (KvK). This registration officially establishes your business as a legal entity in the Netherlands.

Additionally, you must register with the Dutch Tax Authorities (Belastingdienst) to meet all tax obligations, including VAT registration, if applicable.

The Netherlands Startup Visa

If you are not based in the Netherlands and want to move locally or build your startup in this beautiful country, you might want to look at the Netherlands Startup Visa.

This residence permit is specifically designed for ambitious entrepreneurs from outside the European Union (EU) who wish to launch an innovative business in the Netherlands. This visa aims to attract global talent and foster the growth of innovative startups within the country.

According to the local organizations that guide the program, here is what a suitable candidate for the program looks like.

A foreign entrepreneur who wants to launch an innovative startup that introduces a new technology that is not yet known in the Dutch market.

You can learn more about the program, the application process, eligibility conditions, and other particularities from the local government.

How do you grow your company in the Netherlands?

In the early stages of funding, finding the right resources to take you to the next step is important. For some of you, this may be a mentorship program; for others, it may be networking opportunities and potential access to funding from angel investors.

Taking your startup from a simple idea to a fully developed company is not easy, but you should remember you are not alone. As a founder, you have a community of more experienced founders and investors to guide you.

Early-stage

The startup ecosystem in the Netherlands includes a strong network of incubators, accelerators, and co-working spaces that provide access to mentorship, funding, and various resources in all the country's major hubs. Here are some of the resources you can find in the local community:

Startup Amsterdam.

An initiative by the City of Amsterdam to support the local startup ecosystem by connecting startups with talent, investors, and other resources. It offers various programs, events, and a comprehensive guide to starting and scaling a business in Amsterdam.

The Dutch Startup Association.

A non-profit organization that represents and advocates for the interests of startups and scale-ups in the Netherlands. Its mission is to create a favorable environment for startups to grow and thrive, contributing to the country's innovation ecosystem.

Techleap.nl.

A government-backed initiative aimed at helping Dutch startups scale globally. Techleap.nl offers programs focused on scaling, funding, and talent acquisition and provides a platform for connecting with international markets.

Startup bootcamp.

Startupbootcamp is one of the first European acceleration platforms active across 4 continents with over 80 individual startup accelerators. The 3-month accelerator helps promising startups access relevant knowledge, connections, and opportunities in their fields and build a sustainable global business.

Late-stage

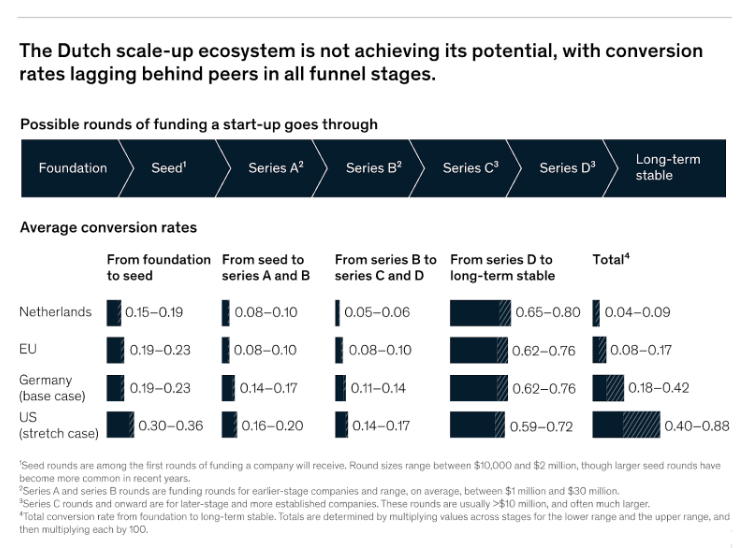

We already know that the value comes from scaleups and large companies that have reached the unicorn level or beyond. However, as your company grows, you might require larger funding stages. It comes with a challenge because the Dutch ecosystem, like many others in Europe, needs more late-stage capital to deploy.

It is one of the biggest challenges grown companies face, so they must look for international venture capital funds to invest in late-stage rounds. According to the McKinsey report, local companies are underperforming in scaling to larger markets compared to other European countries and the regular EU average.

Source: Building a world-class Dutch start-up ecosystem

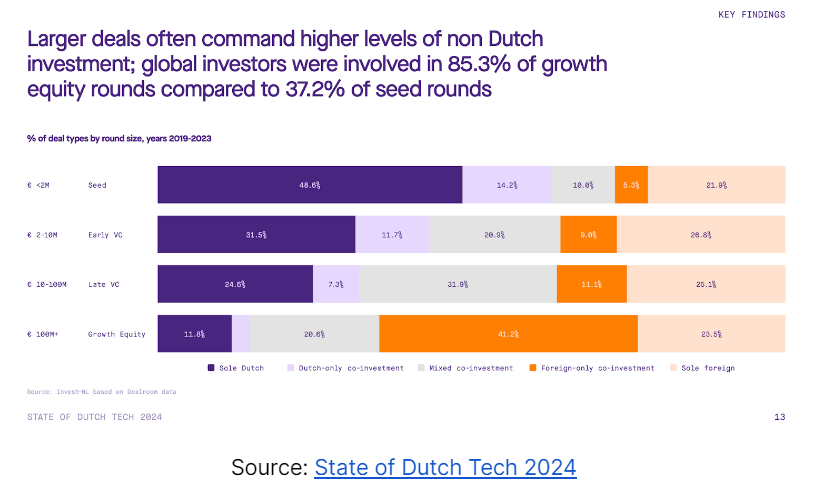

Additionally, the Netherlands also has a high dependency on foreign VC funds for later-stage funding, leaving a clear need for more domestic support. It’s a problem often encountered in many European startup ecosystems, as startups must look for international venture capital funds at late funding stages.

Source: State of Dutch Tech 2024

How do you find investors for startups in the Netherlands?

According to Dealroom, there are around 250 venture capital funds in the Netherlands, and more than 3000 fundraising rounds raised only in the Amsterdam region.

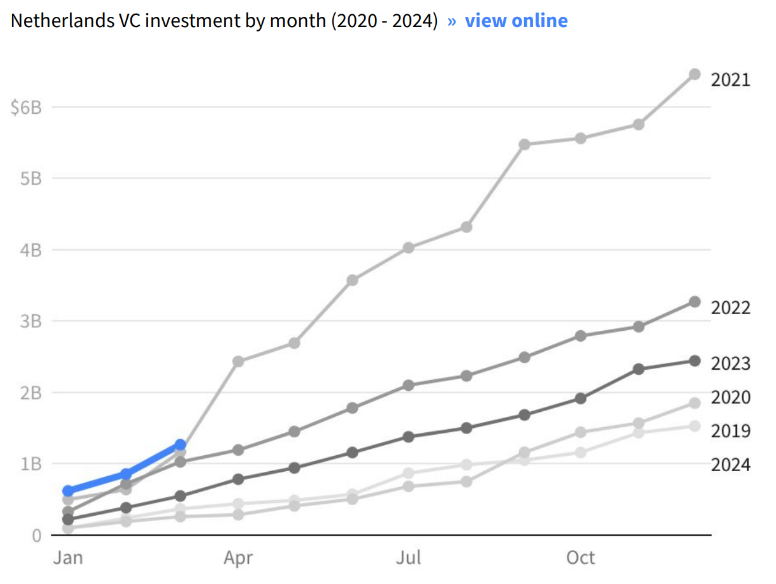

Despite the uncertain times surrounding Europe and the world in the past few years, the Netherlands has a bright fundraising outlook for 2024. Venture capital investment is up 2.2 times yearly, currently outpacing even the global boom from 2021 and 2022, and is more active than ever.

Source: Netherlands Q1 2024 report by Dealroom

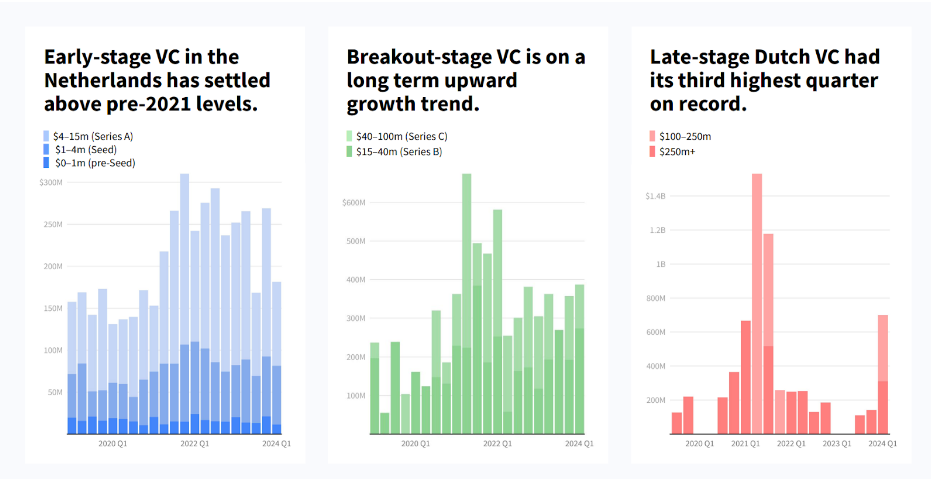

If we look across all the stages of growth, we notice that early-stage funding has settled above pre-2021 levels, and late-stage has its highest quarter

on record.

Source: Netherlands Q1 2024 report by Dealroom

Check out the SeedBlink European VC network featuring all the local venture capital funds, and let us help you in your fundraising journey. We’ll help you find the right lead investor for your upcoming round!

Growing your startup through employee equity incentives - ESOP in the Netherlands

ESOPs allow startups to attract and retain top talent by offering employees a stake in the company's future success. Employees and early collaborators are motivated to contribute to the company's growth and profitability by providing stock options aligning their interests with the founders.

This sense of ownership can lead to increased productivity, innovation, and commitment, which are some of the building blocks for the growth of a startup.

Types of ESOP in the Netherlands

Culturally, Dutch ESOP practices emphasize consensus-building, social dialogue, and collaboration between employers and employees. Employee ownership is common in the Netherlands, particularly in large companies, though the prevalence and structure of ESOPs can vary by industry, company size, and ownership. Dutch startups can choose from various types of employee stock option plans to incentivize their employees.

Phantom plan.

The phantom plan is a cash-based incentive allowing companies to motivate their team without equity transfer. The cash bonus amount is derived from the value of company shares (either full value or appreciation over time).

Phantom or virtual plans are ideal for early-stage because they are less complex as legal procedures have lower taxes and administrative costs. The company doesn't transfer ownership, offering more flexibility on equity ownership and voting rights.

STAK.

The STAK plan is locally known as the “Stichting administratiekantoor plan” and is a trust set up by the company that allows employees to own the so-called depository receipts (DRs). Put simply, DR-holders have the financial rights of a shareholder without the decision-making powers.

STAK is an alternative well-suited for growth-stage and mature startups with headquarters in the Netherlands that want to give their people company shares but want to keep the decision-making rights with the company.

SAR.

SAR (Share Appreciation Rights) is a cash bonus based on the increase in the value of a company’s shares over a set period. Unlike stock options, SARs don't require employees to pay an upfront cost to acquire them. They simply benefit from the stock price growth if they exercise the SARs.

SARs don't dilute ownership by issuing new shares, which can help young startups looking to maintain control. There are also lower administrative costs compared to traditional stock options.

Founders can set vesting schedules, determine the underlying number of shares for the SAR, and choose the exercise window.

ESOP.

Offering equity through the traditional ESOP approach grants employees the right, but not the obligation, to purchase company shares at a pre-set price (exercise price) during a specific timeframe (exercise window).

This incentivizes employees to hold onto their options until the stock price increases, allowing them to profit from the difference between the exercise and market prices.

The new Dutch tax legislation has made stock options more attractive for startups and smaller businesses that want their team to own company shares (after exercise).

Let’s meet in the Netherlands!

We can’t talk about the beautiful Dutch community without witnessing it with our own eyes. This is why, this year, we have packed our bags and got ready for the upcoming Upstream Festival Rotterdam.

We’ll be in Rotterdam between May 28th and May 29th, featuring a series of activities, including a keynote speech by Radu Georgescu, SeedBlink’s Chairman of the Board, and an exclusive event on golf & fundraising readiness as a pro.

Join us at Upstream Rotterdam.

Last but not least, our colleagues from SeedBlink Netherlands are always available to chat with you and guide you in the fundraising journey. If you are unsure who you should contact, meet Robbin Hoogstraten, our Regional Manager of Benelux.

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.