SeedBlink Blog

all Things Equity

The Netherlands: A Hub for Innovation and Entrepreneurship

A journey into the thriving startup ecosystem in the Netherlands, highlighting its unique features, key players, and success stories.

The Netherlands has emerged as Europe's leading hub for innovation, entrepreneurship, and venture capital.

Gefeliciteerd met Koningsdag!

On April 27th, the Netherlands celebrates Koningsdag or Kings Day. This national holiday is a day of celebration and fun, with people taking to the streets to participate in street markets, parties, and parades, as only Dutchies know.

The country has a highly skilled workforce with a strong legacy in science and technology. This, combined with a culture of innovation and entrepreneurship, makes the Netherlands an ideal destination for startups looking to establish a presence in Europe.

Netherlands’ key strong pillars

The Netherlands' vibrant startup scene is known for its innovative companies in Fintech, eCommerce, and HealthTech. This thriving ecosystem can be attributed to a supportive government, top-notch infrastructure, and a highly educated workforce.

The country's strategic location, alongside other strong European tech hubs, brings Amsterdam at the new New Palo Alto table. For example, within a 4 hours rail trip, you can easily travel from Amsterdam to London (the no. 1 tech hub in Europe) or Paris (the no. 2 city to create future unicorns).

The Dutch have a long history of innovation and entrepreneurship, dating back to the 17th century when they founded the first stock exchange in the world in Amsterdam in 1602.

The Amsterdam Stock Exchange, now known as Euronext Amsterdam, is still one of the largest stock exchanges in Europe today. This pioneering activity in finance has set the tone for the Dutch investment landscape, which remains a key driver for the country's economy.

In addition to creating the first stock exchange in the world, the Dutch have also been pioneers in the crowdfunding industry. Symbid, a Rotterdam-based platform, was the first equity crowdfunding platform in Europe when it was launched in 2011.

Since then, the platform has helped to finance hundreds of startups and small businesses, providing them with an alternative to traditional financing methods. Symbid has been a game-changer in the investment landscape, democratizing access to capital and supporting the growth of the startup ecosystem. In August 2022, SeedBlink acquired Symbid in order to accelerate SeedBlink coverage as a pan-European player, broadening its geographic footprint in the CEE and Benelux. The combined forces will help us lead the entrepreneurial ecosystem, by offering a unique digital financing infrastructure, a secondary market and a fast network of professional investors co-investing with individuals throughout Europe.

Here are some key features and characteristics of the Dutch startup ecosystem:

A highly supportive government.

The Dutch government has implemented several initiatives to support startups, such as the Techleap program, which aims to create a strong and thriving startup ecosystem in the Netherlands.

A culture of innovation.

The Netherlands has a long history of innovation, entrepreneurship, and trade, dating back to the Dutch Golden Age. This culture of innovation and risk-taking is embedded in the country's DNA and continues to drive its startup community forward.

A vibrant startup ecosystem.

The Netherlands has a thriving startup ecosystem, with a strong network of incubators, accelerators, and co-working spaces providing access to mentorship, funding, and a supportive community of like-minded individuals.

Amsterdam - a thriving hub for startups and innovation

Amsterdam has a thriving entrepreneurial culture with a long history of innovation and entrepreneurship.

The city is a major startup community thanks to the supportive government that provides various incentives and initiatives for startups to thrive, such as the StartupDelta initiative and the Netherlands Enterprise Agency.

Amsterdam has also been a pioneer in sustainable entrepreneurship, with events such as the Amsterdam Circular Strategy between 2020-2025 and the Sustainable Urban Delta initiative. The city has been actively working towards building a circular economy, with initiatives such as Amsterdam's Climate Neutral 2050 strategy and the Amsterdam Smart City program.

These initiatives have attracted a lot of attention and funding from domestic and international investors, making Amsterdam a significant player in sustainable entrepreneurship.

However, Amsterdam is followed closely by other thriving local communities that are currently on the rise, according to a Sifted & Dealroom report from 2022. North Holland and South Holland are counting 2000 and 1400 startups, followed by North-Brabant, Utrecht, Gelderland, and other major provinces.

Rotterdam - Netherlands’ upcoming growing startup community

Rotterdam is another major city in the Netherlands with a growing startup community. Rotterdam is home to +1600 active startups in industries such as healthcare, smart logistics, and energy transition.

With over €3.5BN market value, the city has been the birthplace of several successful startups, including Coolblue, a leading Dutch eCommerce company, and Helloprint, Europe's leading marketplace for customized print products.

Rotterdam is also home to innovative companies such as Mendix, acquired by Siemens in 2018, and Shypple. These success stories have paved the way for other entrepreneurs to start and grow their businesses in Rotterdam.

The city is also known for collaborating with local universities, providing access to top talent and research facilities.

Startup funding landscape in the Netherlands

Over the past decade, the Netherlands has emerged as a vibrant startup hub, boasting a thriving ecosystem and a growing number of successful companies.

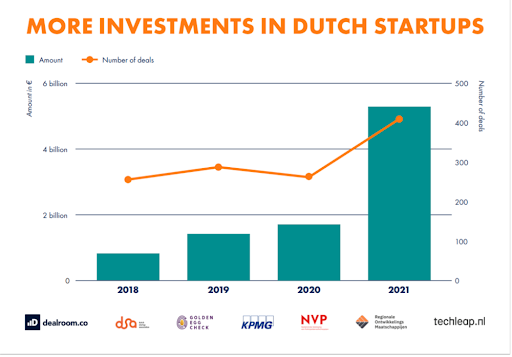

The Dutch startup scene has come a long way since the early days of the internet boom. The level of funding has continued to rise in the past +5 years reaching new records even during the COVID-19 pandemic. According to the Dutch Startup Association, the influx of capital was also supported by a major increase in foreign investments from American investors.

Source: Dutch Funding Landscape by the Dutch Startup Association

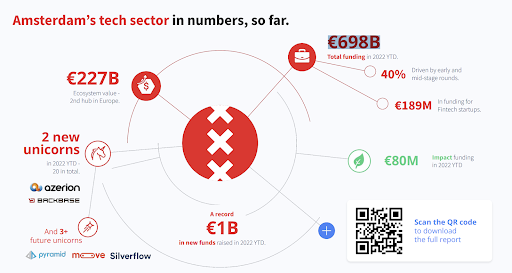

In 2022, the track record was broken only after passing the first two quarters of the year, according to Dealroom. Around June 2022, the local ecosystem was already counting €698B in total funding raised, by early-stage deals and mid-stage rounds.

Source: Amsterdam 2022 H1 Update - Dealroom

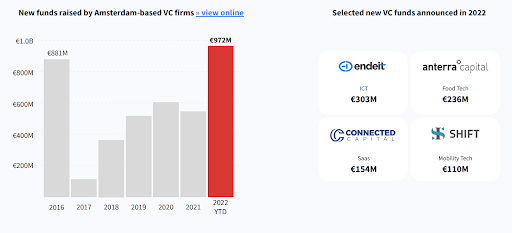

The city boasts several top-tier venture capital funds, such as Endeit Capital, INKEF Capital, and Prime Ventures, that are actively investing in local startups across various sectors.

These funds have seen record levels of dry powder at their disposal, providing ample capital for startups looking to scale and grow. According to Dealroom, Amsterdam-based VC firms have raised €972M in new funds before passing the middle of the year in 2022.

Source: Amsterdam 2022 H1 Update - Dealroom

Dutch venture capital funds

- INKEF Capital — is an early-stage venture capital firm based in Amsterdam. From the very early stages of a technology or life sciences venture, Inkef supports entrepreneurs in building their ideas into successful international businesses.

- Cottonwood Technology Fund — is an early-stage venture capital fund that makes impact investments in Key Enabling Technologies (Deep Tech & Hard Science).

- Prime Ventures (VC) — is a venture capital firm based in Amsterdam, focusing on investing in European companies in the technology and related industries and leverages its capital, experience, and network.

- Endeit Capital — is a venture capital firm based in Amsterdam, investing in technology and artificial intelligence and supporting scale-ups with capital between €5 million and €25 million.

- Slingshot Ventures — is a venture capital fund based in Amsterdam, backing ambitious, talented, and charismatic entrepreneurs and actively helping them accelerate their businesses.

- Volta Ventures — is a venture capital firm that provides seed & early-stage venture capital for internet & software companies in the Benelux region.

- 4Impact — is a venture capital fund investing in digital ventures across Europe that solve problems relating to our environment, health & well-being, and/or inclusion.

- Rubio Impact Ventures — formerly known as Social Impact Ventures, is a venture fund focused on early and growth-stage enterprises with a positive impact on society and the environment.

- Peak Capital — is an early-stage venture capital fund based in Amsterdam, Berlin, and Stockholm and has active investments in the Benelux, DACH, and Nordic regions.

- Dutch Founders Fund — is an early-stage VC that primarily invests in marketplaces and network effects across Europe.

- Curiosity VC — is a community-driven venture capital firm based in Amsterdam, focused on early-stage investments in AI-related B2B software companies in the Benelux, Nordics & Baltics.

- Healthy Capital — is a venture capital firm based in Amsterdam, Netherlands. The firm prefers to invest in companies operating in the healthcare, B2B, and B2C sectors.

- HPE Growth Capital — is a pan-European private equity firm focused on early-mid growth capital investments in technology companies with assets under management over EUR 600 million.

- Keen Venture Partners — is a venture capital firm that invests in fast-growing scale-ups across Europe, particularly tech businesses at Series A and B stages.

- Newion — is an independent venture capital fund founded in December 2000 and focussed on companies operating in IT, SAAS, Cloud, and b2b Software.

- Maven11 — is a venture capital firm focused on blockchain projects and invested in seed and pre-seed companies, writing cheques between $250k and 10m.

- Acrobator Ventures — a venture capital firm based in Amsterdam, Netherlands investing in pre-seed and seed-stage deals.

Please note that our list of venture capital funds in the Netherlands is just a summary. While we have highlighted some prominent funds in the Dutch startup ecosystem, many other funds are actively investing in startups. We intend to provide a broad overview of the VC landscape in the Netherlands and showcase the active community of investors in the country.

SeedBlink’s impact on the local ecosystem

SeedBlink announced the acquisition of Symbid in August 2022, the world's first investment crowdfunding platform. This strategic move was part of our goal to consolidate its infrastructure position for European Innovation, growing its venture partners' business in Western Europe.

As one of the earliest investment crowdfunding platforms globally, Symbid was established in 2011 by a group of Dutch entrepreneurs. Over the years, it has gathered a community of 50,000 investors who primarily invest in startups from the Benelux region.

“Both companies have made a name for themselves in providing private investors with access to curated European startup opportunities, so this is a natural move looking for the European consolidation game.

Benelux is on everyone's mind as it remains a strong tech region in Europe thanks to the presence of top tech cities, wealthy countries, a strong government presence, and a well-connected and educated workforce.” says Robbin Hoogstraten, Regional Manager of SeedBlink Benelux.

Before partnering up with SeedBlink, Symbid managed to gather under its community the following results:

- +50K global investors investing primarily in the Benelux region.

- 195 ventures funded.

- €568,000 invested in Benelux-based startups through SeedBlink.

“It is important that tech startups can count on European funding so that we don't lose these companies to the US or Asia.

The growth of the European tech sector looks promising, but the fragmentation of the investment market across countries, each with its regulations, could be more conducive. The challenge is, therefore, to build a European network with local representatives in each country." says Ionut Patrahau, Managing Director & Corporate Development at SeedBlink.

Unicorns & soonicorns of Netherlands

One of the first successful Dutch startups was TomTom, founded in 1991 and became a leader in GPS navigation technology. However, it was in the mid-2000s that the Dutch startup scene began to take off, with the emergence of companies such as Adyen, Booking.com, and WeTransfer.

These companies paved the way for a new generation of startups, many of which have become unicorns - privately held startups valued at $1 billion or more. Among the unicorns that have emerged from the Dutch startup scene are payments company Mollie, eCommerce platform Bloomon, and Fintech firm Bunq.

Notably, some of the founders of these companies, such as Kees Koolen from Booking and Adriaan Mol from Mollie, have also become highly active as investors in the startup community. This trend has not only injected significant capital into the ecosystem but also brought in invaluable experience and mentorship for new and aspiring entrepreneurs.

The Dutch government has proactively promoted entrepreneurship, invested in infrastructure, and created favourable startup policies.

Candidates for the unicorn status

According to Sifted and local investors, among the potential unicorns in the Netherlands are fast-growing scaleups such as:

Klippa

Klippa, a Groningen-based company, employs a combination of artificial intelligence and optical character recognition (OCR) technology to assist companies in digitizing their administrative procedures.

Klippa's solution is used in some of the world's most popular expense management systems. OCR technology transforms typed, handwritten, or printed text into machine-encoded text.

Catawiki

Catawiki is an online auction platform based in the Netherlands that sells rare and unique items, such as art, antiques, collectables, and jewellery.

The platform attracts millions of users from around the world who come to buy and sell unique items in over 80 different categories.

Crisp

Crisp is an app-only supermarket for ultra-fresh food. The marketplace stocks >2000 products from more than 650 farmers, growers and makers and runs on proprietary software, enabling zero inventory and negative working capital.

Sendcloud

SendCloud is an all-in-one shipping platform that connects online retailers to shipping carriers to save them time and money.

Otrium

Otrium is an online fashion outlet marketplace which tech-enables designer brands to turn unsold inventory into an opportunity,

Framer

Framer is a Dutch software company that provides a design and prototyping tool for creating interactive user interfaces for web and mobile applications.

The platform allows designers to create responsive layouts, add animations and interactions, and test their designs across different devices and platforms.

What is next for the Dutch ecosystem?

The Netherlands has set its sights on achieving strategic autonomy and tackling global challenges, according to The State of Dutch Tech. However, it must first keep pace with more successful ecosystems outside the EU.

Firstly, there needs to be a realignment of strategic tech policy, with the needs of entrepreneurs taking center stage in a more integrated approach. The support for Deep tech must also be improved to increase the efficiency of tech transfer, business support, and funding for Deep tech ventures to deliver more impact at scale.

Additionally, the country needs a smarter way to access capital. Knowledge-sharing and co-investment among investors should be part of the process if the local community wants to accelerate growth. Increasing the number of startups in the Netherlands and connecting the local community of entrepreneurs is also critical. These steps can potentially empower the Netherlands' ecosystem and guide it toward a thriving future.

Why invest in the Netherlands?

“Over the past 15 years, the ecosystem in The Netherlands has improved significantly.

First, universities across the country have become a great breeding ground. Stakeholders understand the importance of creating the optimal climate for tech companies to scale. Across the board, I’ve seen great programs and initiatives for improving access to capital, market, and talent.

Bearing in mind, we have yet to be there compared to some other key markets, we can today celebrate success stories such as Adyen, Mollie, and ElasticSearch. As director of the LOEY foundation, I am very proud to see that many entrepreneurs have embraced the pay-it-forward culture and are active participants in the ecosystem, supporting young entrepreneurs to become successful.

There is a lot of excitement across a broad range of market segments, from Climate Technology to Deep tech. I welcome everyone to visit The Netherlands and don’t stop in Amsterdam. You might enjoy Groningen, Wageningen, Eindhoven and Delft!" says Edwin Hengstmengel, Partner at Endeit Capital.

“Investing in local startups is much more than just that one ticket you give to one startup team. Investing locally is unleashing a trickle effect that provides opportunities for everyone locally. It’s empowering a new generation of founders, which will go on to invest and nurture the ecosystem; one check invested locally can make a massive difference.” says Andres Campo, an angel investor in the Netherlands.

“The Netherlands has a real entrepreneurial ecosystem. Also, the cost of living is still reasonable, and with a huge pool of talent, the Netherlands belongs to the global innovation top-5 countries in the world.

The Netherlands is a front-runner in life sciences, biotech, SaaS companies, Deep tech innovations, and agriculture startups." says Alain le Loux, General Partner - Cottonwood Technology Fund

“There are interesting opportunities for investors to invest in Dutch tech.

There’s a large funding deficit, bigger than in other European countries, especially in the scaleup phase. Banks haven’t adjusted as well to funding asset-light, tech-driven business models as they have in other European countries. This provides opportunities for professional investors to fill that gap. Especially in sectors like fintech, health tech, and climate tech, the Netherlands shows a lot of innovation that could benefit from greater capital support along the growth journey.

The Netherlands has a skilled and knowledgeable workforce with an open and international approach.

Everyone speaks English.

This allows for building growth-oriented international companies, especially since the Amsterdam region is buzzing with startup activity. The city is a great attraction to international tech talent because it’s being perceived as a great place to live.” says Ernst Rustenhoven, Consumer VC Investor at Slingshot Ventures.

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.