SeedBlink Blog

startups And Financing

4 red flags that make startup investors think twice

Explore key red flags for investors in startup ownership, including cap table issues, ESOP concerns, and equity distribution, with VC perspectives.

Raising capital is an essential step for many startups to grow and scale.

However, attracting investors can be a complex and challenging process. They evaluate everything related to your company to identify potential red flags on why they should not invest in it.

In this article, we'll explore some of the red flags you can avoid while managing your cap table across various fundraising rounds, implementing an employee stock option plan, or discussing ownership with your co-founders.

1. Having a “broken cap table.”

A cap table is a ledger showing who owns what in a startup. It includes shareholders' names, the number of shares they own, and their percentage of ownership. This table evolves as the company grows and takes on more investments.

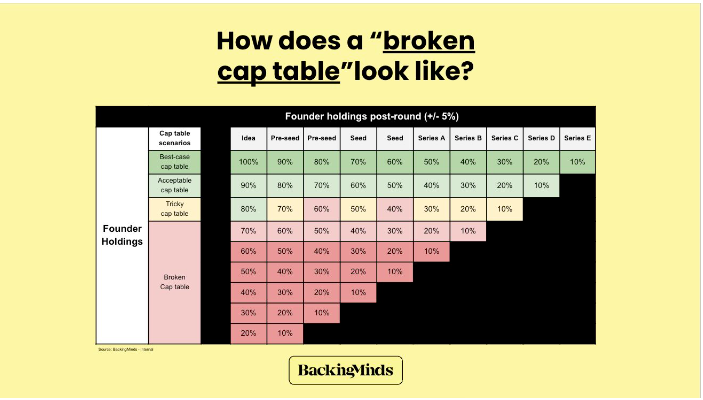

If managed poorly, cap tables can become “uninvestable” even after just one or two early-stage rounds. A "Broken" cap table is a term often used by venture capitalists (VCs), which refers to founders having too little equity and investors having too much relative to the startup's stage and traction.

A cap table is broken when the equity distribution between founders and investors is heavily skewed, disadvantaging the founders. This imbalance is particularly pronounced in the VC model, which relies on startups raising multiple financing rounds to achieve specific milestones.

Source: How does a broken cap table look like — Jasenko Hadzic

The concern over a broken cap table varies across funding stages. Early stages typically allow founders to retain more equity, but the balance often shifts as the company progresses through Series A, B, C, etc.

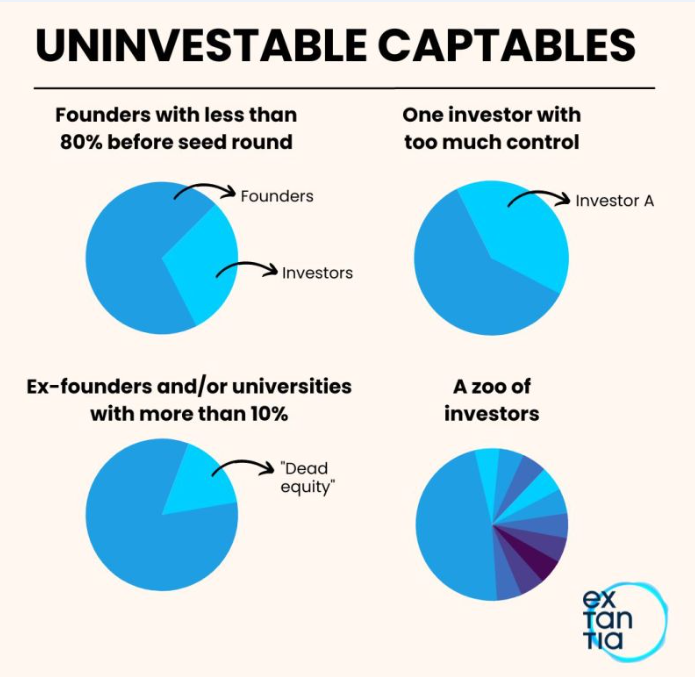

What makes a cap table uninvestable?

Overcomplication, high founder control, and disproportionate investor shares each present unique challenges that can deter potential investors and impact the long-term health and scalability of the company.

Source: How to fix uninvestable/broken cap tables

Overcomplication.

When a cap table includes many small investors, each holding a tiny fraction of the company, it becomes overly complex. This scenario often happens in early-stage rounds driven by angels, which creates a huge complexity and a logistical nightmare, complicating decisions that require shareholder consensus.

Managing a large group of investors with varying interests can hinder the company's agility and ability to make quick strategic decisions. It adds administrative burdens in future funding rounds, from shareholder communication to legal complexities.

Given the diluted and fragmented equity, an overly complex cap table for potential new investors raises concerns about their ability to exert significant influence or achieve meaningful returns.

High founder control.

When founders retain a significantly higher percentage of ownership than is typical for the company's stage, it can signal a reluctance to share equity appropriately. While some control is necessary for founders to steer their company, excessive control can be off-putting.

Investors may view high founder control as a risk, fearing that their ability to guide or influence the company's direction could be limited. They might also be concerned about the company's governance structure and the balance of power.

Disproportionate investor shares.

If existing investors hold an unusually large portion of equity, it could indicate that the company was overvalued in past funding rounds. This scenario suggests that earlier investors paid too much for their shares relative to the company's actual progress or potential.

With a significant portion of equity in the hands of previous investors, new investors might need more influence over company decisions. This situation can also lead to power imbalances, where a few investors have disproportionate control, potentially leading to conflicts and strategic misalignment.

2. Implementing Employee Stock Option Plans the wrong way.

Employee Stock Option Plans (ESOPs) are vital tools in a startup's arsenal to attract, retain, and motivate employees. Investors view a well-structured ESOP as a sign that employees will likely be committed and motivated. However, when poorly structured, they can become significant red flags for potential investors.

Employee stock option plans are often a requirement from venture capital investors when raising a round they are leading.

What does an inadequate ESOP look like?

Having allocation of too much or too little ownership.

An ESOP pool that's too small can fail to incentivize employees adequately. Conversely, overly generous allocations can lead to significant equity dilution, which is particularly concerning for future investors.

Investors are wary of ESOP pools that could lead to significant dilution of their shares. They prefer a balanced plan that is generous enough to motivate employees but not so large as to dilute future investments.

You are overlooking frontline contributors.

In many startups, the real value drivers are employees directly involved in product development, sales, customer engagement, and other operational roles. These team members are often on the frontline, directly contributing to the company's growth and revenue.

Consider implementing a sales-driven ESOP plan or focusing on employee performance to motivate those pushing the boat forward. How equity is distributed within a startup says much about the company’s values and approach to rewarding and recognizing contributions.

Poor vesting schedules.

Unfavorable vesting terms, either too lenient or too strict, can be problematic. Too tolerant, and employees might gain significant equity without long-term commitment; too strict, and it could deter potential talent.

Lack of transparency.

Implementing stock option plans for employees that are not communicated or understood by employees can lead to disillusionment and mistrust, undermining the very purpose of having them implemented.

As the company evolves, so too might the need to revise the ESOP structure. Founders should be prepared to adjust in response to company growth, market changes, and feedback from employees and investors.

3. Frequent changes in equity structure

Regular adjustments in equity structure can be symptomatic of deeper problems within a startup, indicating underlying issues or reflecting uncertainty.

Constantly changing equity structures can signal a lack of clear direction or strategy. It may indicate that the startup is still trying to find its footing or cannot commit to a long-term plan. These could also range from internal disagreements and strategic misalignments to financial instability or reactive decision-making.

Investors seek stability in their investments.

Frequent equity changes can indicate that a startup lacks a stable and reliable foundation, which is crucial for long-term growth and success.

While some flexibility in equity structure is understandable, especially in the early stages, ensure it’s not becoming a constant pattern. Keep a stable equity structure, discuss changes with your investor, and use dedicated software to ensure all changes are aligned and performed efficiently.

4. Founders disagreements over equity.

Conflicts over equity distribution are particularly concerning as they go to the heart of the startup's financial and ownership structure. These disagreements can arise from varying perceptions of value contribution, future direction, or personal aspirations.

Frequent and unresolved disputes among founders can erode investor confidence. Investors seek stability and a cohesive team that can weather the ups and downs of the startup journey together.

Create clear agreements from day one of building your startup and discuss openly and transparently with all your co-founders everything related to performance, roles, equity, decision-making, involvement, and everything in between. Remember to document these on paper to have a source of truth for when discussions arise.

8 VC's expectations for equity ownership in a fundraising round.

- Clarity and Simplicity: VCs prefer cap tables that are straightforward to understand. A clear picture of the current ownership structure, including the percentage holdings of founders, employees, and previous investors, is essential.

- Fair valuation: VCs expect the cap table to reflect a fair and realistic company valuation. Overvaluation in previous rounds can be a red flag, suggesting future funding rounds might be challenging.

- Room for future growth: The cap table should show enough room for new investors to come in without excessively diluting existing shareholders. VCs often look for a balance that rewards earlier risk-takers while still offering attractive terms to new investors.

- A fair & transparent ESOP: The ESOP pool should be large enough to incentivize current and future employees. VCs typically expect to see an ESOP pool representing around 10-20% of the company's equity, depending on the stage of the business.

- A clear vesting schedule: Standard practice is a four-year vesting period with a one-year cliff, ensuring that employees are committed to the company for a reasonable period.

- Long-term alignment: VCs look for ESOPs that align with the company's long-term goals. The plan should be structured in a way that motivates key employees to contribute to the company’s growth effectively.

- Dilution from previous rounds: They assess how much the founders and early investors have been diluted in previous rounds. Excessive dilution can be a concern as it may affect the founders' motivation and control.

- Potential for future rounds: VCs evaluate the equity ownership structure with an eye on future funding rounds. They prefer a structure that allows for additional capital infusion without causing excessive dilution for all parties involved.

Future thoughts

VCs approach a fundraising round with a keen eye on the cap table, ESOP, and equity ownership. They look for fairness, clarity, and structures that align the interests of founders, employees, and investors.

For founders, this means being mindful of how equity is allocated from the start, how ESOPs are structured and managed, and how each fundraising round impacts the overall equity distribution. Prepare your company’s cap table and ESOP to meet these expectations, ensuring that the equity ownership balances motivate internal stakeholders and attract external investment.

---

Avoid having red flags while presenting your company for a fundraising round in front of investors.

Use Nimity to simplify all things equity so you can focus on what matters more for your startup.

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.