SeedBlink Blog

all Things Equity

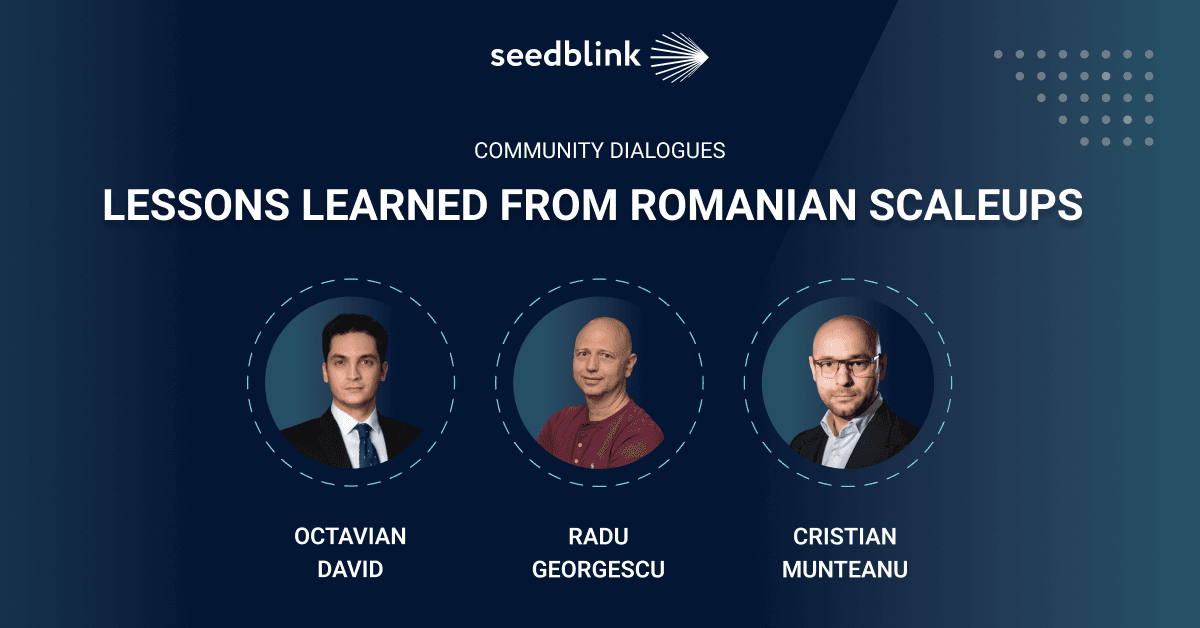

Tech Investors Academy: 5 Key Lessons Learned From High Growth Romanian Scaleups

Welcome to the Tech Investors Academy by SeedBlink, where knowledge-sharing and community engagement take center stage.

This article presents you with the key takeaways from the first session of Community Dialogues, namely “Lessons learned from high growth Romanian scaleups," an enlightening discussion together with:

- Octavian David, a trusted investor and member of our SeedBlink community;

- Radu Georgescu, serial entrepreneur & the visionary Founder of SeedBlink;

- Cristian Munteanu, Founder & Managing Partner at Early Game Ventures.

Stay tuned as we unveil the key insights gleaned from this dynamic and knowledge-packed session, providing you with invaluable knowledge to navigate the venture startup investment world.

Lessons Learned From The Worst Investments

Investing in startups is often likened to holding a lottery ticket. While it can offer incredible opportunities for exponential growth and financial success, it is important to acknowledge that not all investments will yield the desired outcomes.

Just as not every lottery ticket leads to a jackpot, not every startup investment will result in a resounding success.

- Invest in things you understand and know what is happening in that market. Investing in a sector where you don’t have experience might lead you to bad decisions and lose your money.

- Identify if founders are lying and if it’s about their statement or your bad judgment.

“You shouldn't think only in terms of single investments, but in terms of portfolio. What makes the difference between an angel investor and somebody just throwing money away, an angel investor distributes capital and builds a portfolio." says Cristian Munteanu, Founder & Managing Partner at Early Game Ventures.

How to Identify Potential in Early-Stage Companies

Some investors invest in multiple failures and multiple success stories. And some investors invest in one company, grow it up to the sky, and never actually study it. However, they end up being highly successful, as well.

Both approaches are good. You just have to find your way.

- Tech is not king anymore, as it was ten years ago. Today, business execution is the key.

- An investment thesis is a business statistic and a portfolio-building strategy.

- An investment thesis reflects who you are, your preferences, and your risk-taking appetite.

- Your investment thesis changes with time.

“In today's world, what I'm investing in and looking for in a company is _spotless business execution ability. _

I'm searching for teams that can execute a business, and that's probably 80% of the investment decision. The other 20% is the patience, market, timing, and founders who understand that well.” says Radu Georgescu, serial entrepreneur and the visionary Founder of SeedBlink

Angel Investment Thesis vs. VC Investment Thesis

There are three practical approaches to an investment thesis: people, tech, and markets. Some investors choose people as the key factor, and some investors choose tech as the secret sauce that drives the world.

Venture capital funds, such as Sequoia, preach about markets as the way to go. So, if you find a big enough market with a startup that tries to change anything, to invest in that.

- Angel investors don’t always need an investment thesis at all.

- There are venture capital funds that raise multiple funds without having a thesis.

- Your investment thesis should reflect your beliefs, values, and thematic approach.

- You could invest chaotically but opportunistically and still find success.

- Having a concentrated portfolio in a specific sector is like having a sword with two cutting edges. Generate profitable returns if the industry is performing well. Or you could lose everything if anything happens.

- Diversification is a critical factor in having a well-built and fruitful portfolio. Put your eggs in different baskets and diversify your portfolio.

High-Profile Sectors to Invest in 2023

- European startups within the Cybersecurity industry with enterprise-level security solutions.

- AgriTech solutions that don’t have a hardware component and with scalable solutions, in Romania, in particular.

- Fintech with smart contracts as part of the blockchain trend.

- ...and understand the geopolitical dynamics that need solutions to keep our internet connected but separated simultaneously. Right now, you have the Russian internet and the internet in China, the US, and Europe, and we need solutions for a connected but individual future, as well.

Where to Look For Advice as an Angel Investor

- Look at two major trends in the current market and where they overlap to find new opportunities.

- Investors should look at the shopping list of corporate companies and talk to M&A representatives with lists of companies to acquire.

- These lists are not public or private but are the best source to predict the future and get your multiples.

- Once you access these lists, talk to investment bankers and get more insights from them.

- Remember that lists get old once in a whole, so you must stay connected to the ecosystem.

- Investing in startups is also about networking. Having access to the right people will give you valuable insights.

Whether you're an aspiring investor or a seasoned professional, these takeaways are bound to enhance your understanding and inform your investment strategies. However, investing in startups involves inherent risks, and it is essential to recognize that trends in the startup landscape are subject to fluctuations.

The information provided in this article or any investment-related content should not be considered financial advice or a recommendation to invest in any specific company or industry. Investors must conduct their own thorough research and due diligence before making investment decisions.

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.