SeedBlink Blog

all Things Equity

SeedBlink Pulse Survey 2023: Navigating the Current Economic Climate through the Lenses of Investors

From prioritizing the business model to investing in emerging technologies, investors seek new ways to tap into growth opportunities. Explore the SeedBlink Pulse Survey for this year, featuring the latest investment trends and strategies to stay ahead of the game.

Investment strategies constantly evolve as the economic landscape shifts and new technologies emerge. This is why we launched SeedBlink Pulse Survey to shed more light on what is shaping the investment landscape in 2023.

We asked 100 sophisticated investors* from 7 countries** to share their insights about the common sentiment over the current economic landscape and what investors should have in mind to build a strong portfolio.

Takeaways from the pulse survey:

- Investors are optimistic about the future, but uncertainty remains: While respondents have expressed cautious optimism about the economy and prospects, a significant minority remains uncertain or pessimistic about the future.

- Interest in emerging technologies and socially responsible investments: Most respondents are interested in investing in artificial intelligence and machine learning, clean energy and sustainability, and cybersecurity and data privacy, among the top verticals for venture investments.

- Early-stage companies are the popular investment targets: Seed, Series A, and pre-seed were identified as the top three company maturity levels that respondents target for venture investments.

- Investors need to stay informed about potential risks and opportunities: Respondents are aware of a range of potential risks, including inflation, recession, market volatility, and geopolitical events, and are considering diverse factors when making investment decisions.

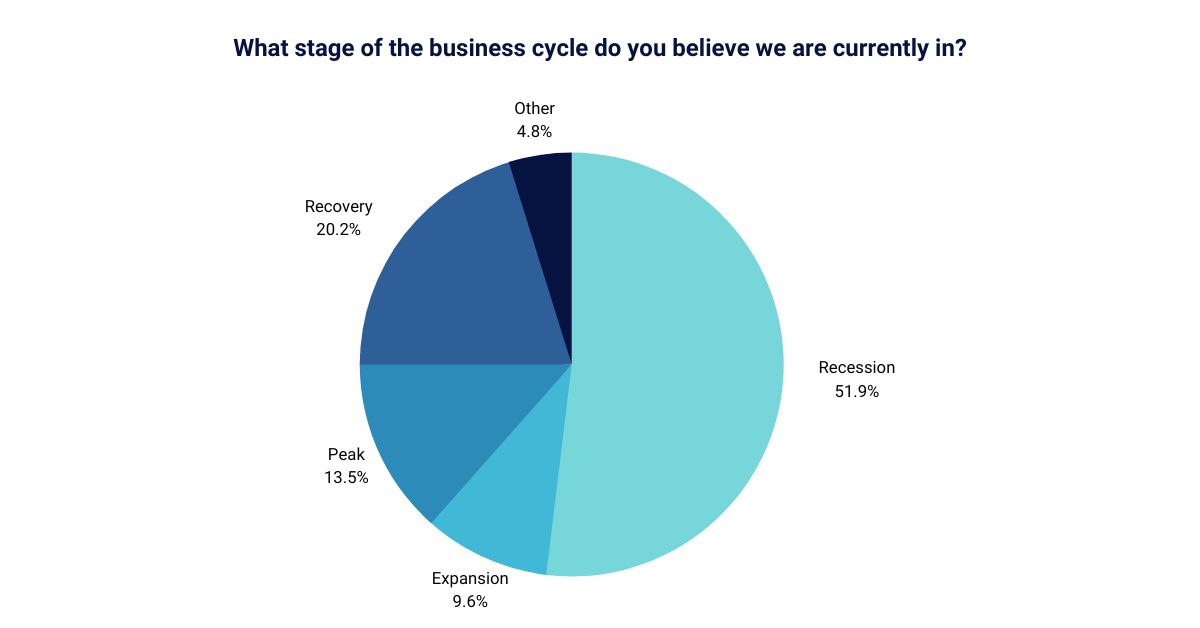

Stage of the business cycle

Our community of investors highlights the need for careful consideration and planning for individuals and businesses in these uncertain times. The results suggest awareness among respondents about the current state and prospects of the economy.

- 52% of respondents believe the economy is currently in recession.

- Only 20% think we are in a recovery cycle, and 14% consider we are in a peak period.

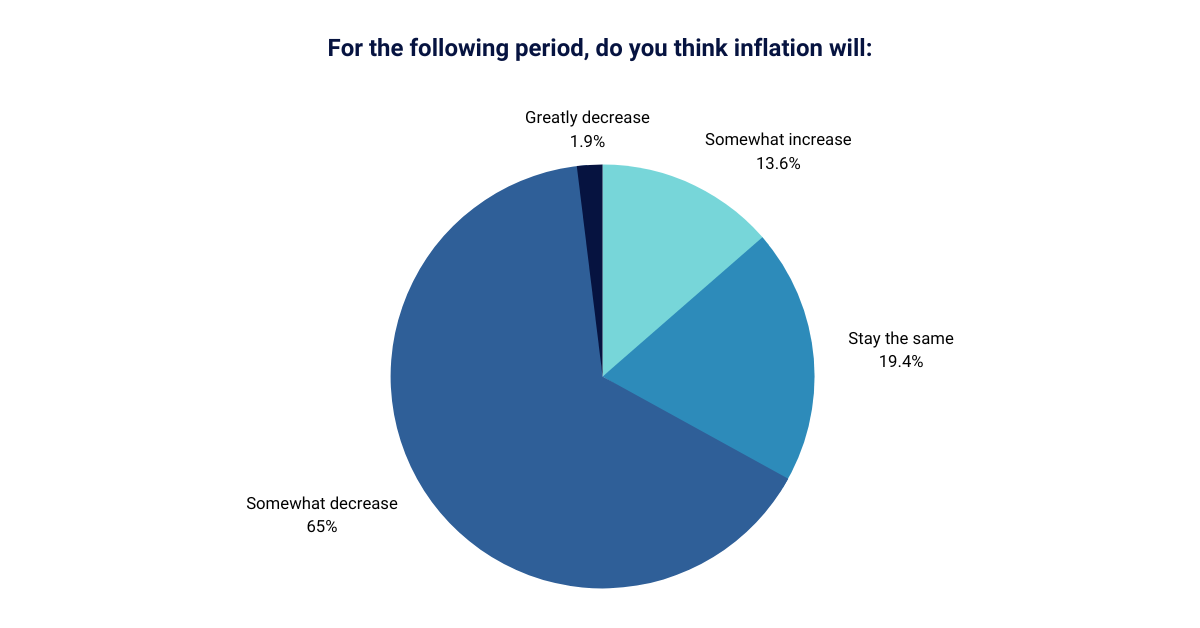

Evolution of inflation

More than half of our community of sophisticated investors (65%) think the economic situation will improve. In contrast, inflation still holds uncertainty in investors’ minds, and some (14%) think this will increase in the following period.

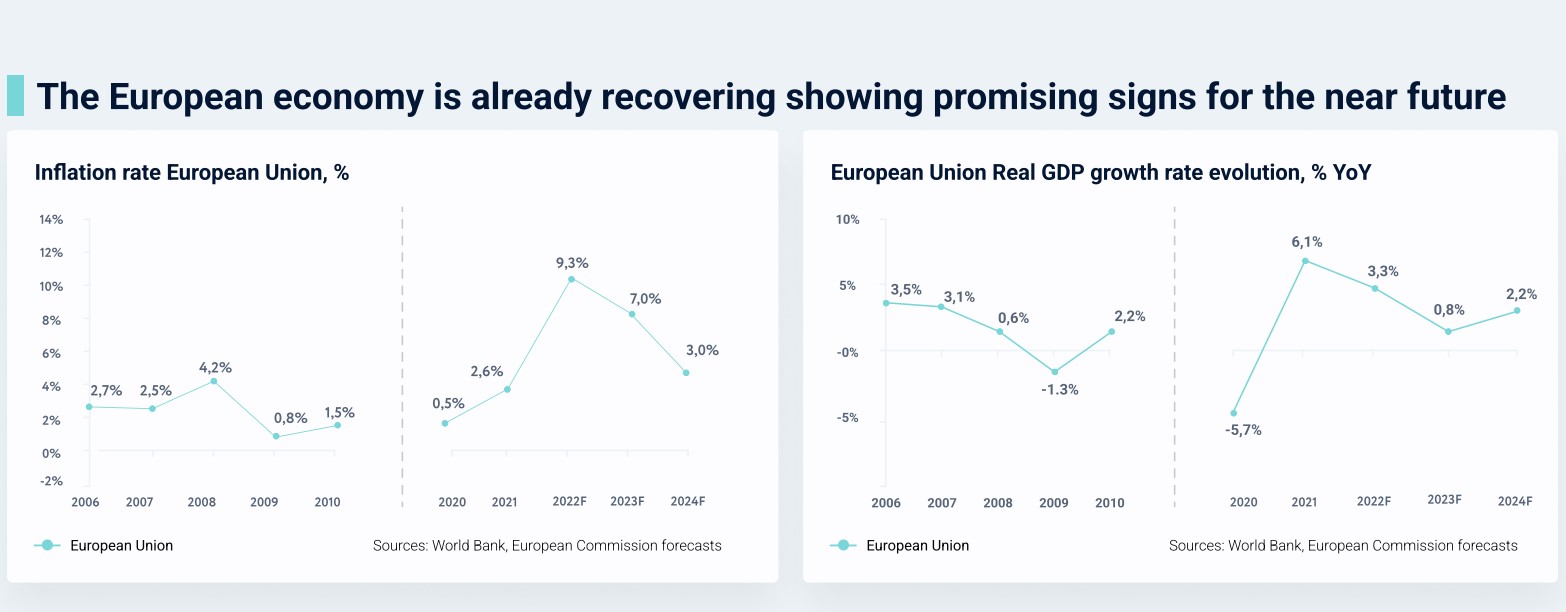

The positive trends are also enforced by the economic projection from the SeedBlink Three Years Report, published together with our partner, Horvath, an independent German consultancy firm. To better understand how to prepare for the future, we compared the economic dynamics from 2008 to our current timeline.

Source: SeedBlink Three Years Report

- The European inflation rate is expected to drop to 7% in 2023 and even more in 2024 (4%). Additionally, the European real GDP growth rate is expected to continue to decrease even more in 2023 (0.3%).

- However, it is still an increase compared to 2020 (-5.7%), showing us that our current difficult times are less damaging compared to 2009 (-4.3%), with the economy already entering the recovery phase.

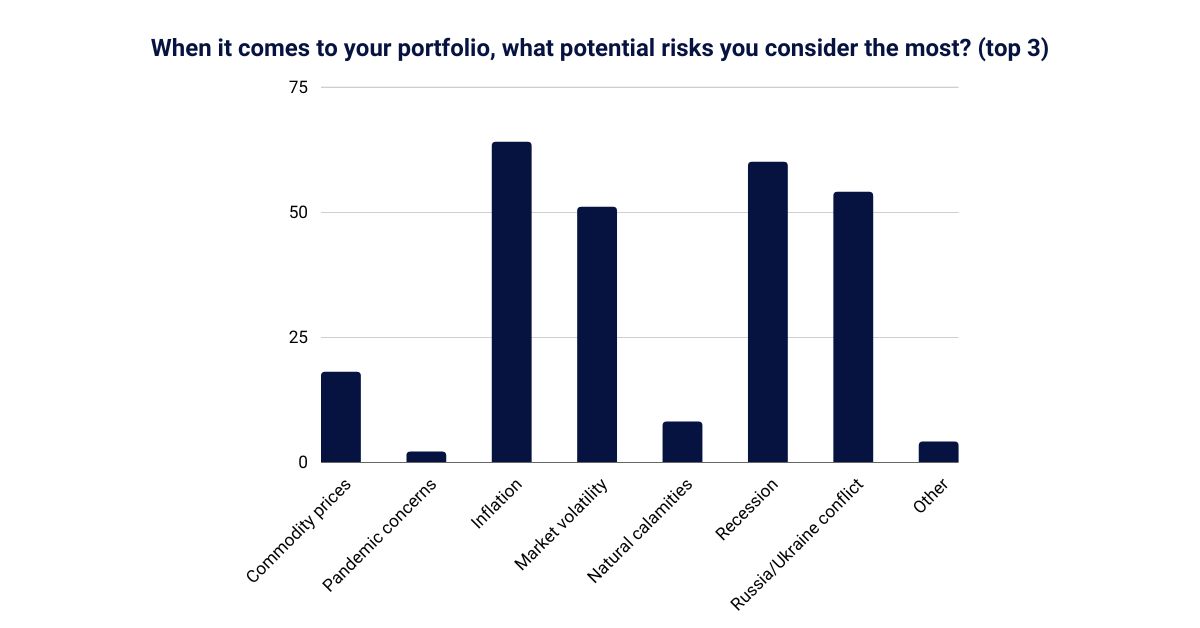

Potential risks for investors' portfolios

These findings indicate that investors are aware of potential risks and are taking a proactive approach to managing their portfolios.

Inflation, recession, the Russia/Ukraine conflict, and market volatility were identified as the top potential risks affecting respondents' investment portfolios.

Among the most cited factors that can impact startups and implicitly investment portfolios, sophisticated SeedBlink investors mentioned inflation (62%), followed closely by the recession (60%), Russia's war on Ukraine (54%), and market volatility (51%).

Preferred types of investments for the near future

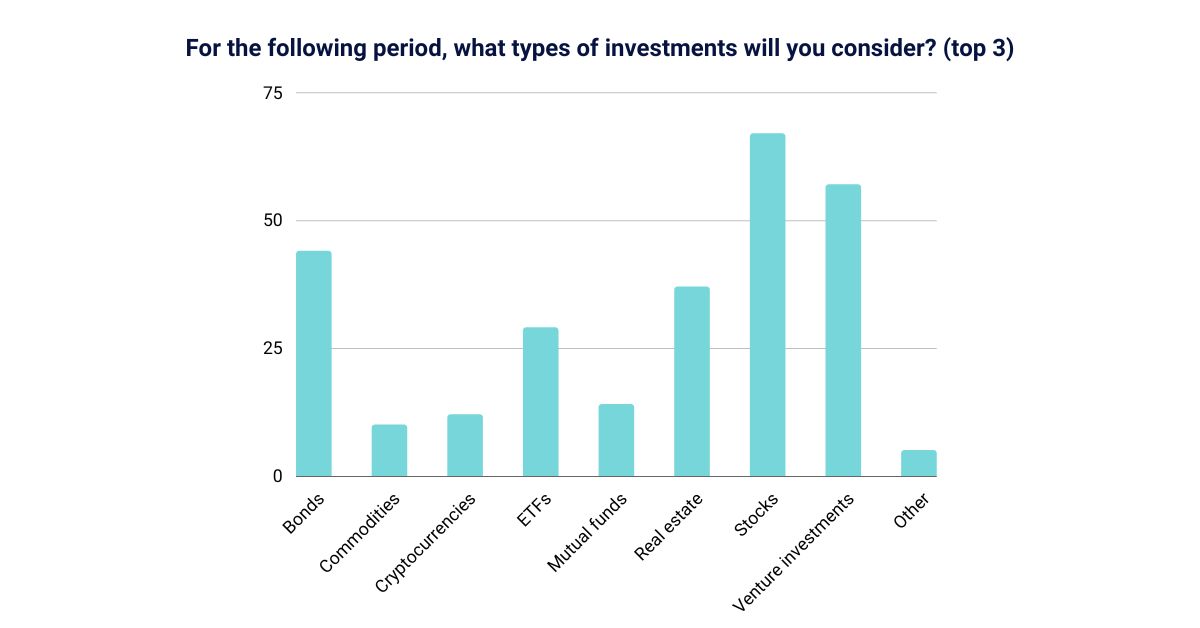

Our community is considering a mix of higher-risk and lower-risk investments as they plan their investments for the future, with stocks and venture investments being more popular options.

By diversifying their investments, investors can mitigate risks and achieve more balanced returns.

Stocks (64%), venture investments (57%), and bonds (42%) are the top three types of investments respondents consider for the following period.

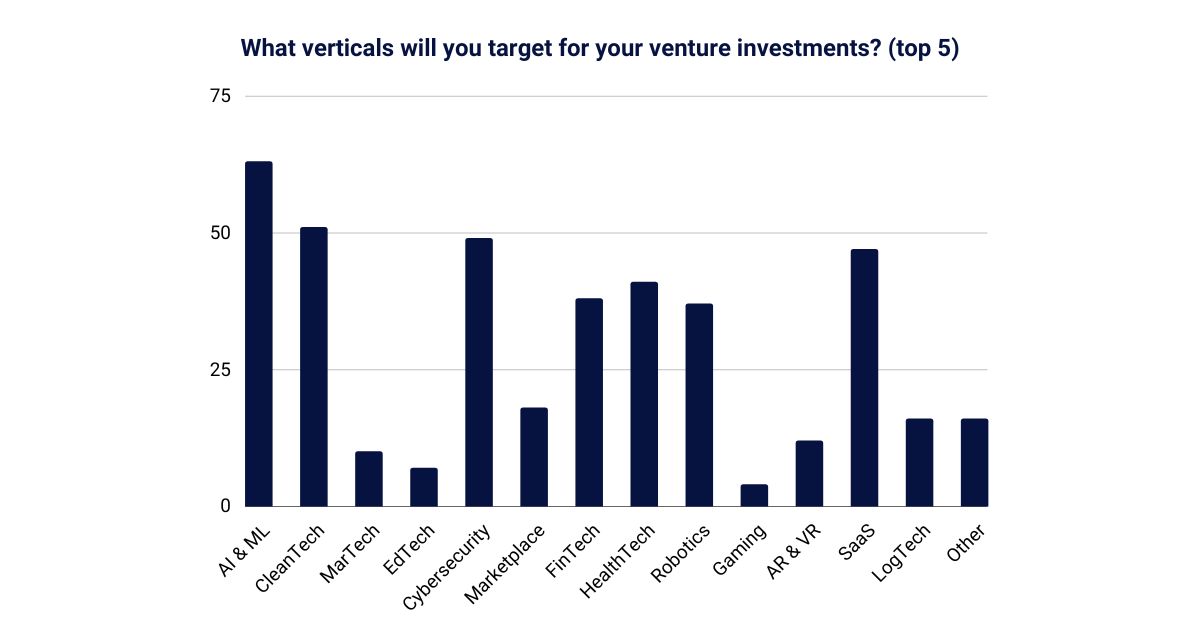

Target verticals for further venture investments

These findings highlight investors' increasing interest in emerging technologies and sustainable investments. Most respondents identified artificial intelligence and machine learning (61%), clean energy (49%), cybersecurity, and data privacy (47%) as the top three verticals for venture investments.

Sustainability has momentum with investors worldwide, and a main trend is also identified in SeedBlink Three Years Report. Europe became the second fastest region in the world for impact startups, after the US, and already has 51 sustainable unicorns, of which 11 were added in 2022.

Leading European Venture capital funds such as Speedinvest, Norrsken VC, Astanor Ventures, or Blue Horizon Ventures actively invest in sustainable startups. Additionally, sustainability became a main topic of interest for the SeedBlink investors’ community. Here is what Cosmin Manea, an active angel investor in sustainable projects, shares with us:

“We all have a moral obligation to ensure a better planet for future generations.

We must ensure business owners and investors focus on projects building a more sustainable and greener world. Every company can make it happen, not just those in the industry.“

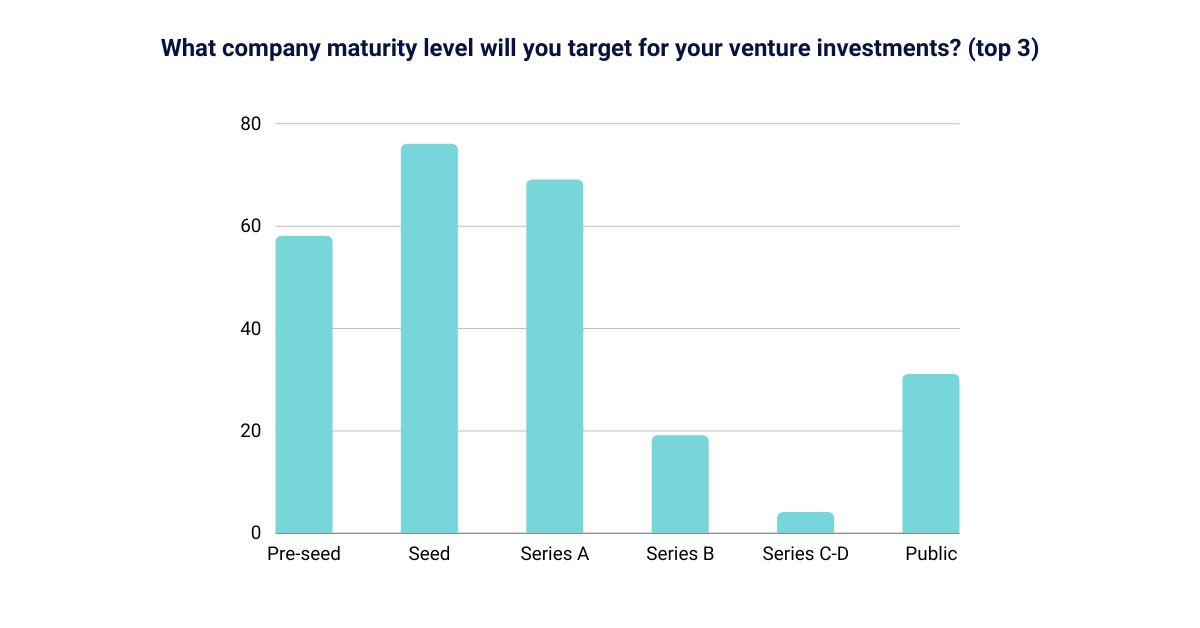

Investor preference for company maturity levels

SeedBlink’s Pulse Survey highlights the willingness of investors to take on higher risk in exchange for the potential of higher returns. By investing in early-stage companies, investors may have the opportunity to get in on the ground floor of promising ventures and potentially benefit from their growth.

However, it is important to note that investing in early-stage companies also comes with higher risks, so investors should carefully consider their options and conduct thorough due diligence before making any investment decisions.

Seed (73%), Series A (66%), and pre-seed (56%) were identified as the top three company maturity levels that respondents will target for venture investments.

Investment geographical focus

SeedBlink Pulse Survey shows that geography is not necessarily a core factor when making investment decisions, and our findings suggest that respondents have varying investment strategies and preferences where:

- 62% would pick local startups.

- 52% would also choose global opportunities.

- 48% would also go for regional investments.

We addressed them a multiple choice question since some investors may prefer only one geographical area, but others may look for other factors in their investment thesis and invest across various regions.

Investors can diversify their portfolios by considering different geographical focuses and tapping into new growth opportunities. It’s important to note that investing in regional or global markets also comes with higher risks, so investors should conduct thorough research and consider their options carefully.

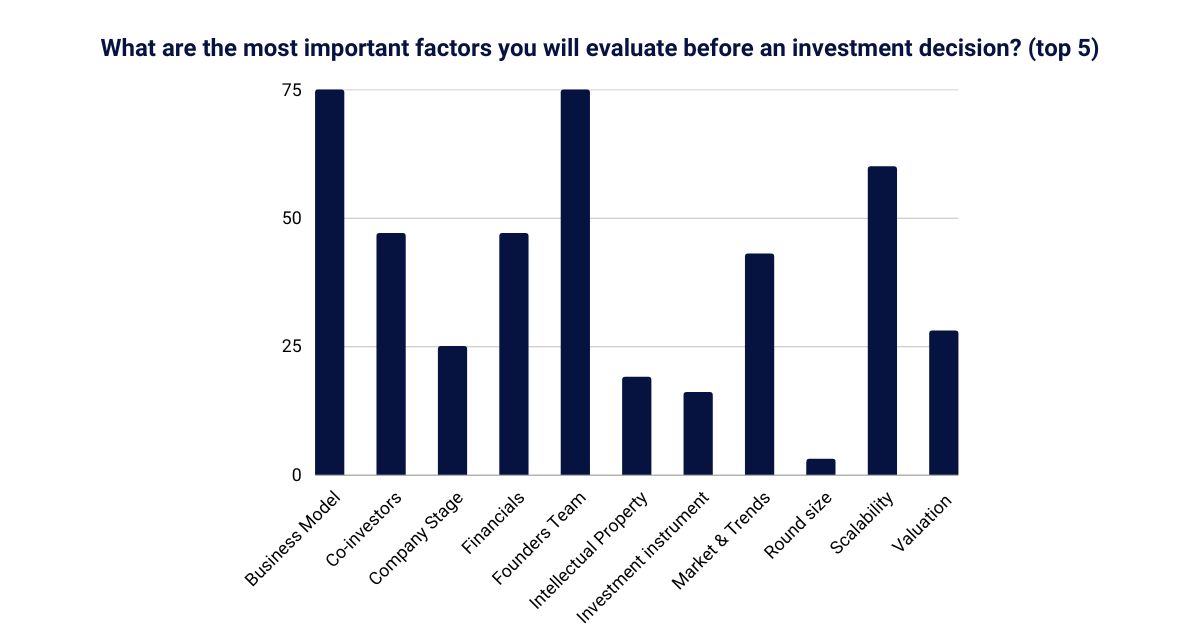

Top factors to consider before an investment

Investors prioritize the business model (72%) and the capabilities of the founders' team (72%) when evaluating investment opportunities and looking for opportunities that can scale and grow (58%).

It's important to note that other factors, such as market trends and competition, should also be considered when evaluating investment opportunities.

We are closing SeedBlink’s Pulse Survey with a few thoughts shared by Mila Petrova, Founder of Team Up & Member of CEO Angels Club and one of our active investors, summarizing the hidden opportunities behind uncertain times.

“In 2021, we have seen a lot of optimism and urgency in investing.

When there is an economic downturn, investor optimism drops. On the other hand, good startup companies have not disappeared. When they invest now, there is less urgency, and startups must be more convincing and more careful with their money, which is healthy.

Those who support the down market are taking a position. Of course, there is a risk, but there is also the opportunity to thrive when the economy picks up again.”

----

Notes

*Sophisticated investors = high net worth individuals with a higher tolerance for investment risk, extensive work experience, and possessing a high degree of financial knowledge and expertise.

**Investors based in the following countries: Romania, Italy, Greece, Netherlands, Bulgaria, Belgium, and Malta.

The statistics presented in the graphics represent the number of answers and should not be construed as representing any other data or information.

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.