SeedBlink Blog

all Things Equity

The status of sustainable investing in Europe

Sustainability is becoming a top priority as we face real environmental challenges. How about sustainable investments - is this a thing in Europe?

The world around us is facing more considerable environmental challenges and crises. Climate change is probably the most urgent and pressing, pushing us towards higher global temperatures.

The European community of Investors and startups tries to address this issue to the best of their powers, building sustainable solutions and finding better ways for sustainable investments. This is one of the reasons, today, we want to take you on a little tour around what sustainable investing means in the world of startups and what we can do through funding to save our planet.

What is sustainable investing?

Sustainable investing reflects the capital channelling towards startups and solutions aiming to resolve climate change issues and environmental destruction and focusing on higher corporate responsibility.

Sustainable investing is considered more of a mission or philosophy in the world of angels and venture capital investors. This allows them to look for startups with a positive environmental impact.

"We all have a moral obligation to ensure a better planet for future generations. Therefore, we must ensure that business owners, customers, and investors focus on projects providing a more sustainable and greener world.

Every company can make this happen, not just those in the industry (e.g., food delivery platforms can ensure that all deliveries are made by electric vehicles, that all packaging is plastic-free and made from recycled materials, etc.)."

Thinks Cosmin Manea, an angel investor in sustainable projects.

What Is ESG Investing?

ESG, which stands for Environmental, Social, Governance, shows a company's environmental responsibility. While ESG investments focus on startups and deals that are less harmful to the world around us, sustainable ones choose to invest solely in solutions that have to fight these challenges as a core mission.

Additionally, ESG investing also refers to how investments are made considering the human and financial environment. The popularity of the concept has expanded in the last few years. More individuals and organizations understood the complexity of the problems and the actions needed to create a change around us.

The state of sustainable investing

In building their portfolios, Investors are becoming more aware and focused on their actions' impact on the world we live in. So, it's only natural to see the number of angels and venture capital funds growing worldwide.

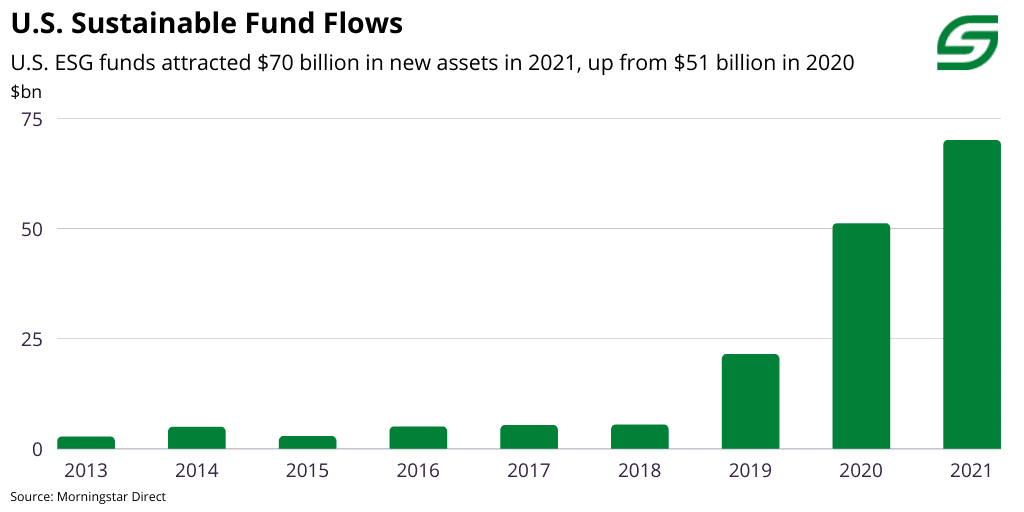

If in December 2020, we could count 4000+ ESG funds, at the end of last year, there were nearly 6000, according to SustainFi. In the US, for example, the volume of assets attracted reached $70B last year, counting an extra $20B compared to the previous year.

Source: ESG funds have a momentum

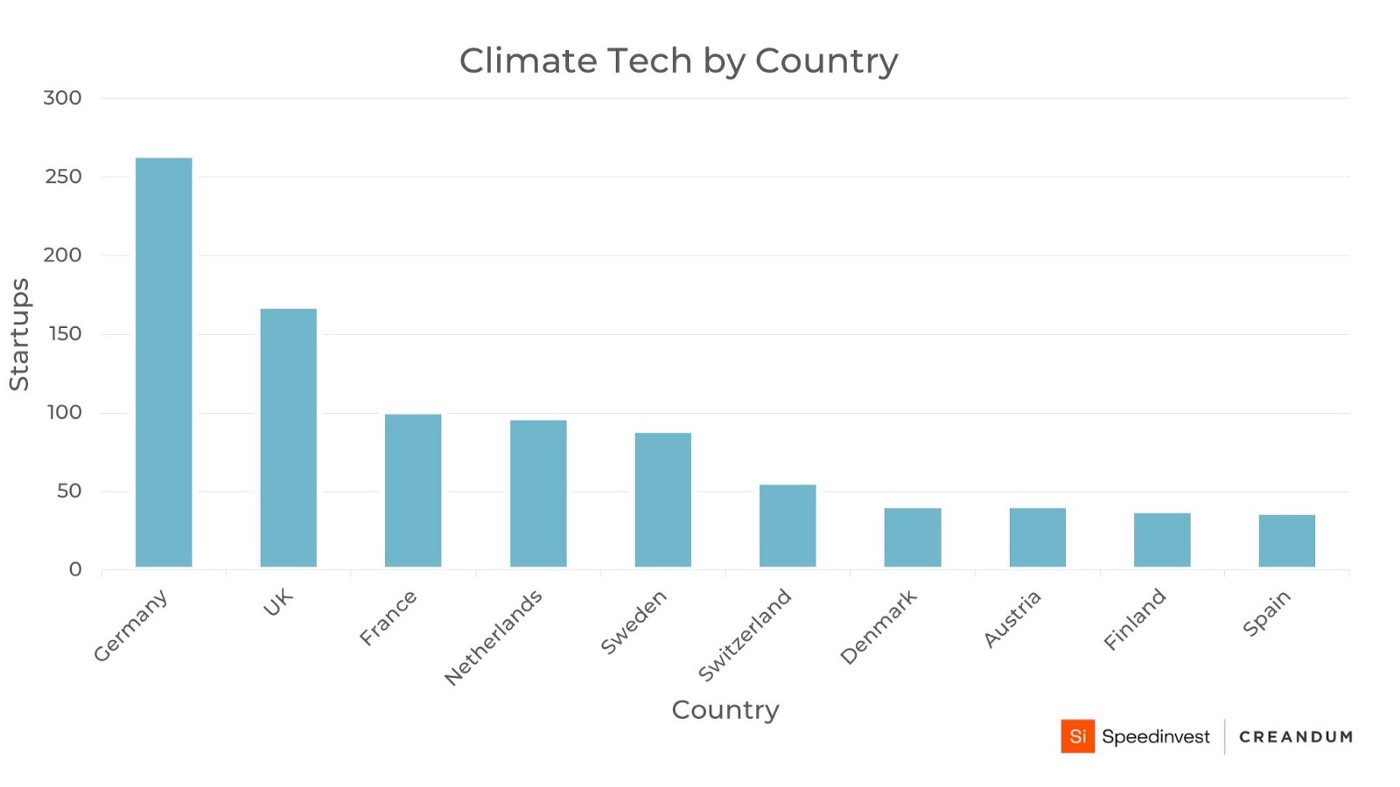

Europe has the strongest ESG assets and investments ecosystem, counting $2.2 trillion of sustainable assets under management at the end of last year. Speedinvest and Creandum put together an initial version of The Climate Tech landscape in Europe in 2021. The report shows us a quick overview of sustainability in different countries and how startup investments evolve.

The report also includes an illustrated version of the eight areas generating opportunities from The European Green Deal report, published by the European Union in 2019.

Source: The Growth and Future of Climate Tech Startups in Europe

The western European countries are currently holding more than half of the current community of climate tech startups, according to Speedinvest and Creandum. They are followed closely by the Nordic countries, with +30% of the market, showing only 7% for Southern Europe and 3% from Eastern European countries.

Is sustainable investing going to be the norm?

We continue to face different challenges of the climate change crisis, naturally leading to the development of newer and better solutions. Looking at the near future, while having this in mind, we would most probably see more investors joining the community of active and sustainable players.

While it's difficult to state that sustainability will become the norm in 100% of the cases, there are current indicators that the market will change. The European Green Deal and the other regulations imposed by the European Union will clarify what's right and what's not and what we can do to protect our environment.

"The European Green Deal is an opportunity to improve the health and well-being of our people by transforming our economic model.

Our plan sets out how to cut emissions, restore the health of our natural environment, protect our wildlife, create new economic opportunities, and improve the quality of life of our citizens. We all have an important part to play, and every industry and country will be part of this transformation."

Shares President Ursula von der Leyen and Executive Vice-President Frans Timmermans

10 sustainable startups to follow in Europe

The new wave of European startups focusing on climate change issues is growing fast, as more solutions are available. According to Sifted and Dealroom, these are the top 10 companies with the highest potential in scaling globally and reaching unicorn status.

- Deepki (France) — SaaS solution for the real estate industry aiming to offer a better option in reducing negative climate impact.

- Ÿnsect (France) — A solution dedicated to producing mealworms in vertical farms.

- InnovaFeed (France) — A similar solution to Ÿnsect, which focuses on insect farming solutions to create pet and aquaculture nutrition.

- Go Sharing (Netherlands) — A startup owning a fleet of different electric vehicles that can be rented across Europe from countries such as The Netherlands, Austria, Turkey, Germany, or Italy.

- Sunfire (Germany) — The company offers electrolysis solutions and helps the production of renewable hydrogen. This is the most promising source of clean energy that will change heavy industries, such as steel production.

- Perpetual Next (Netherlands) — A solution focusing on recovering carbon from organic waste and transforming it into biocoal.

- VanMoof (Netherlands) — One of the European electric bike producers that manage to expand its business and attract several funding rounds.

- Swappie (Finland) — A marketplace for used electronics that focuses primarily on smartphones, a huge source of CO2 emissions.

- Volta Trucks (Sweden) — We've seen several manufacturers of electric cars, but the competition for electric trucks is also growing. Volta Trucks is working on a model that would be able to drive up to 200km on a single charge.

- Newcleo (UK) — A producer of smaller nuclear reactors targeting ships and islands developed by an ex-employee of CERN.

5 European VC investors focused on sustainable startups

- Speedinvest — According to Dealroom, Speedinvest it's the current most active European investor in climate tech deals. The venture capital firm invests in early-stage startups in different European countries and has backed startups such as .planetly, TIER, YardLink, refurbed, POROTECH, tulipshare, Sylvera, and many others.

- Bpifrance — The investor behind Deepki, the second most active venture capital fund in Europe, with 10+ current deals in its portfolio. The investors also backed startups such as Kyotherm, Green Yellow, or NAWA Technologies.

- Norrsken VC — A group of investors coming from Sweeden who have backed up a series of sustainable solutions, such as a green battery factory, an electric vehicle manufactured, a sustainable investing platform, a food tech company, and a few others.

- Climate VC — This year, a new European venture capital fund launched in London plans to invest €41 million in the next three years.

- Future Energy Ventures — The venture capital firm based in Germany invests in sustainable solutions across Europe that generate cleaner and renewable energy.

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.