SeedBlink Bulletin Board

Early liquidity for tech startup investments.

Access early liquidity events through SeedBlink's bulletin board. Control your assets in a fully digital environment.

Features & benefits

Fully digital

End-to-end process backed by SeedBlink's technology and staff. Automatically generated offers, contracts, negotiations, payments, and more.

Complete control

Safely sell or buy assets while maintaining full decision-making power. You will receive support at every step of the process and notification of your bulletin board transactions.

Quarterly events

Submit offers, access them, and negotiate them at any time. At the end of each quarter, in a month timeframe, payments and paperwork will be finalized.

Early liquidity

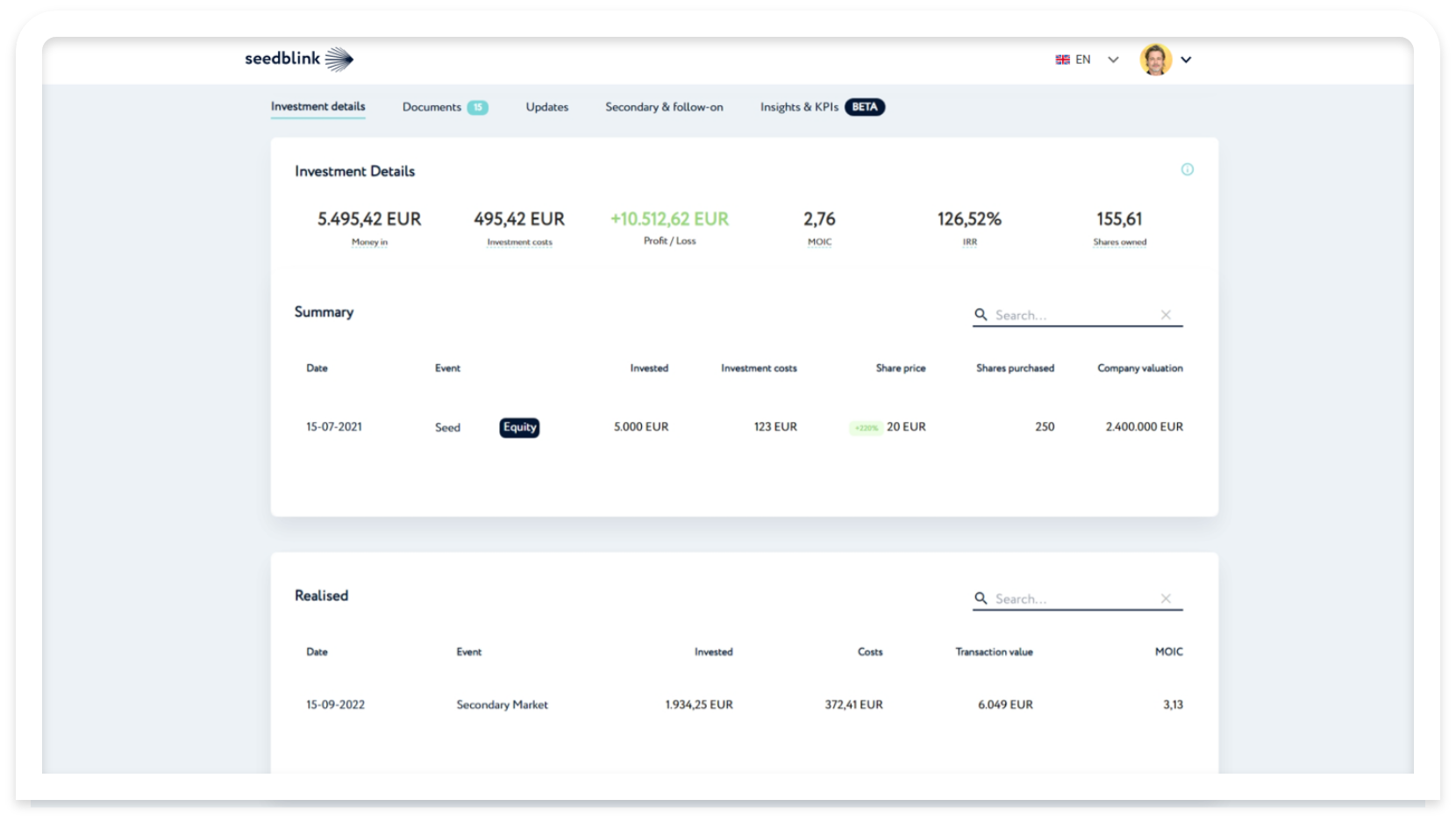

Using SeedBlink's bulletin board, investors now have easy access to early liquidity. Liquidity is not guaranteed through the bulletin board.

Vetted opportunities

Access a trusted portfolio of European tech startups that are supported by venture capitalists, family offices, and business angels. Trade shares with savvy tech investors to diversify your portfolio.

Licensed platform

SeedBlink is authorised under the ECSPR by the Financial Supervisory Authority (FSA) to operate across the EU and is listed by the European Securities and Market Authority (ESMA) as a crowdfunding service provider.

How does it work

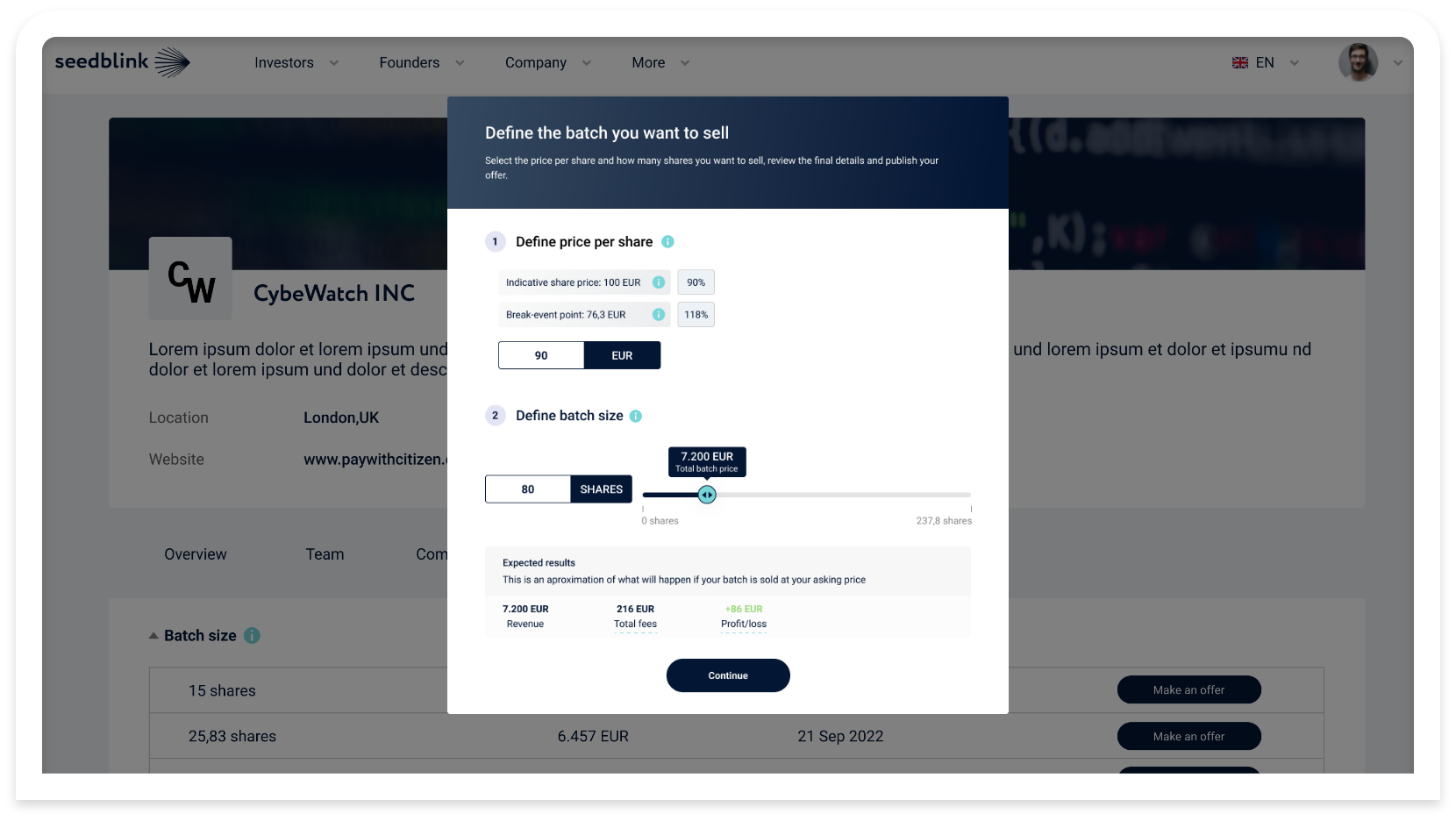

You can now access early liquidity through SeedBlink Bulletin Board and sell the shares you now possess from your SeedBlink portfolio. Choose a business where you have assets, specify your offer (including the number of shares to be sold and the price per share), and publish it. Your offer will be made public to verified potential buyers after first being made known to the investors who supported the same company as you.

Investors' thoughts

Having control over their liquidity. See more from the investors who already participated within SeedBlink Bulletin Board.

Frequently asked questions

Everything you need to know about Bulletin Board.

When can I access the SeedBlink Bulletin Board?

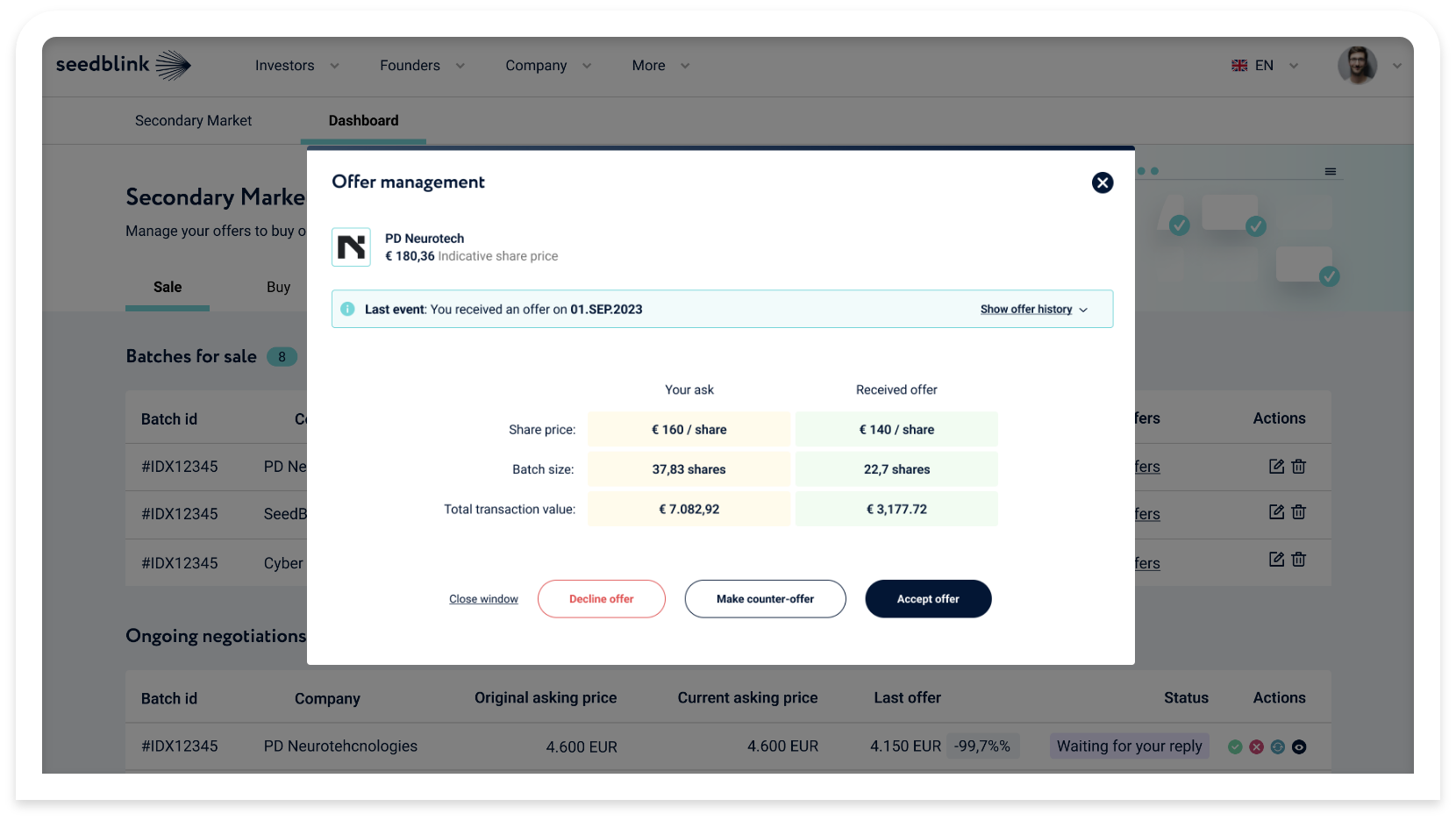

There are two stages in the SeedBlink Bulletin Board. First stage: Intention & negotiation. • The bulletin board is accessible around-the-clock and without any time restrictions. • Sellers who want to access liquidity through the Bulletin Board may post an offer at any moment. • Buyers can access such offers in real-time and indicate interest. • In the first phase, negotiations will take place and a final agreement may be reached. • The platform will generate the assignment agreement when both parties have accepted an offer, that need to be signed by both. Second stage: Bulletin Board Event. • At the end of each quarter, a Bulletin Board event lasts for one month. • During this time, the transfer between the buyer and seller will be finalized. Payments will also be made, and the last set of paperwork will be signed. • A next event will be used to close any offers that were not finalized during the Bulletin Board event.

What are the fees I should expect?

SeedBlink will charge a 3% transaction fee (with a minimum of €30 per transaction) for both buyers and sellers on the Bulletin Board. The carry fee will be applied to any profits the Seller makes, if any. Keep in mind that not all shares will qualify for the Bulletin Board, and even if they do, demand will determine whether it is possible to buy and sell shares.

How does SeedBlink handle confidentiality when it comes to the Bulletin Board?

The buyers and sellers are not made aware of any participant's identity. Personal information will only become visible after accepting the offer.

Can't find answer? Access our Help center.

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.

Investing in start-ups involves risks, including loss of capital, illiquidity, dilution, lack of dividends. It is suitable only for investors capable of evaluating and bearing those risks. In any event, it should be done only as part of a diversified portfolio (meaning a portfolio in which investment in start-ups represents only a fraction of the total investments or assets). Before investing please read the risk warnings available at https://seedblink.com/generalterms as well as the risks related provisions of the investment facilitation agreement that will be provided to you for the relevant round. SeedBlink is not responsible for any information provided by the start-ups, even if distributed through or by SeedBlink. SeedBlink does not endorse any start-up for investment nor does it advise you on the merits of your investment. Seedblink does not provide to you any other advisory services. The decision to invest is yours only. If you require help in evaluating a decision to invest, you should consult a professional adviser. The messages and documentation you receive from SeedBlink or the start-ups have been neither verified nor approved by the Romanian or the European authorities. Nothing in this message shall be considered an offer to sell, or a solicitation of an offer to buy, any security to any person in any jurisdiction to whom or in which such offer, solicitation or sale is unlawful.