SeedBlink Blog

editorials

SeedBlink hits €5M in secondary market transactions

Latest posts

SeedBlink hits €5M in secondary market transactions

At SeedBlink, we’ve long believed that access, flexibility, and transparency shouldn’t be reserved for institutions. Also, early liquidity is no longer optional — it’s expected. That’s why we built a secondary market to empower individual investors — and today, we’re excited to announce a major milestone: more than €5 million in secondary transactions across our two secondary investing channels.

As you may already know, we offer two ways to access secondaries:

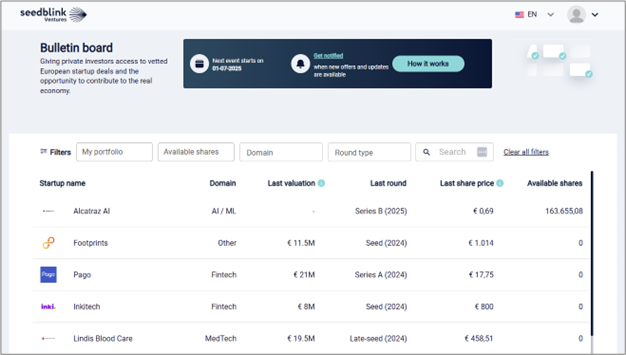

• The SeedBlink Bulletin Board – for buying and selling shares in SeedBlink-funded startups.

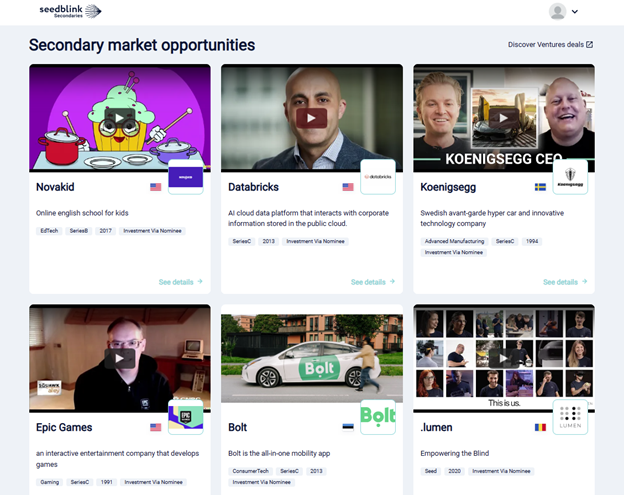

• Secondaries in mature private companies – for investing in high-growth, later-stage firms through trusted partner allocations.

This article explores what’s new, and how you can start using them today for flexible portfolio management.

First, the numbers on the SeedBlink secondary market at a glance:

- €5M+ in total secondary market volume

- €2.15M+ via the Bulletin Board (€1.3M+ traded in 2024 alone)

- Bulletin Board generating returns of 2.5x to 3x for some investors since launch; some deals as large as €100,000; Multiple repeat investors. Now expanded to 80 live offers.

- €3M+ in Secondaries for mature private companies

The Bulletin Board now featuring more offerings

The Bulletin Board allows you to sell or buy shares in companies funded on our crowdfunding platform. With this update, we’ve expanded it to include equity investments across multiple investment vehicles, unlocking access to a broader list of portfolio companies. That means you can now trade shares in 80 private tech companies — including some of Europe’s most promising startups.

For investors - what you can do now:

- Browse and buy shares in companies you missed during primary rounds

- Sell some of your holdings to capture early returns

- Set your own pricing and negotiate directly with counterparties

- Transact digitally – all contracts and payments are automated

💡 Pro tip: Want to improve your chance of a sale on the secondary market? Consider pricing your offer at a 10–30% discount from the last round valuation to make it more attractive to buyers.

Secondaries in mature private companies: Getting exposure to high-growth international companies

If you’re looking to enter mature deals, this channel is for you. Our Secondaries offering lets you invest in late-stage companies like Databricks, Epic Games, Klarna, Bolt, and more - often at exclusive prices through trusted partners.

Our latest addition? Novakid, the fast-growing EdTech series-B company has revolutionized online English learning for children.

How the secondaries market works:

• Check out curated late-stage companies open for secondary acquisition

• Minimum investment starts at just €2,500

• Participate in deals typically reserved for institutional investors

• End-to-end digital transaction process

These opportunities allow you to diversify your portfolio with more mature, de-risked companies — ideal for balancing high-growth early-stage bets.

Why secondary markets matter

Retail and angel investors today don’t want to wait 7–10 years for every exit. With SeedBlink’s growing secondary capabilities, you can now:

• Unlock early liquidity on your terms

• Recycle capital with partial exists to capture compounding gains and diversify risks

• Buy into mature companies you may have missed out on

• Actively manage your portfolio across all stages of growth

Explore SeedBlink’s secondary markets today: Sell or buy shares on the SeedBlink Bulletin Board and invest in late-stage tech leaders via Secondaries.

Reinventing fashion e-commerce: smarter shopping in the AI era

technology TrendsWeekly Digest: curated tech news & food for thought

newslettersInvestor Insight: April 2025 Portfolio Updates

startups And FinancingScaling neurotherapy for autism and ADHD: Brainhero’s impact

startups And FinancingGenerative AI and the future of content creation at scale

startups And FinancingExplore more topics

All things equity

Startups and financing

Technology trends

Interviews

Editorials

Newsletters

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.