SeedBlink Blog

all Things Equity

Understand the impact of convertibles on your ownership structure.

Understand the powerful impact of convertibles on ownership structure and the role of bridge rounds in startup financing.

We’ve recently hosted a webinar to discuss the impact of convertibles on startups’ ownership structure. Our guest, Maximilian Schausberger, Managing Director at Elevator Ventures, was joined by Ronald Rapberger, Regional Manager DACH at SeedBlink, and Andrei Hancu, SeedBlink’s General Counsel.

They discussed how convertibles can be an important pillar of startup financing, providing flexibility and bridging equity financing rounds.

During the webinar, they covered:

- A brief overview of convertibles, including terms and market trends;

- Comparing convertibles to other fundraising tools;

- Strategic decision making: When to use convertibles: pros and cons;

- Tools for managing ownership and convertibles - the role of cap tables.

It’s time to delve deeper into the information from this webinar and unpack the most important learnings.

Understanding the ownership structure in tech startups

Understanding equity structure helps founders and investors determine how ownership percentages are allocated and how future funding rounds affect these allocations.

The company's ownership structure is reflected in the cap table, and In the early stages of a startup, the cap table is simple, with just the founders, or maybe the founders and a few initial investors.

However, the cap table becomes increasingly complex as the company advances and raises funds. This complexity necessitates a thorough grasp of how different funding instruments impact other fundraising rounds and how each affects ownership percentages and dilution.

“Understanding the ownership structure is important for every founder, regardless of stage, and it becomes increasingly important as you progress through the rounds," Ronald Rapberger, Regional Manager DACH at SeedBlink.

Types of startup funding rounds

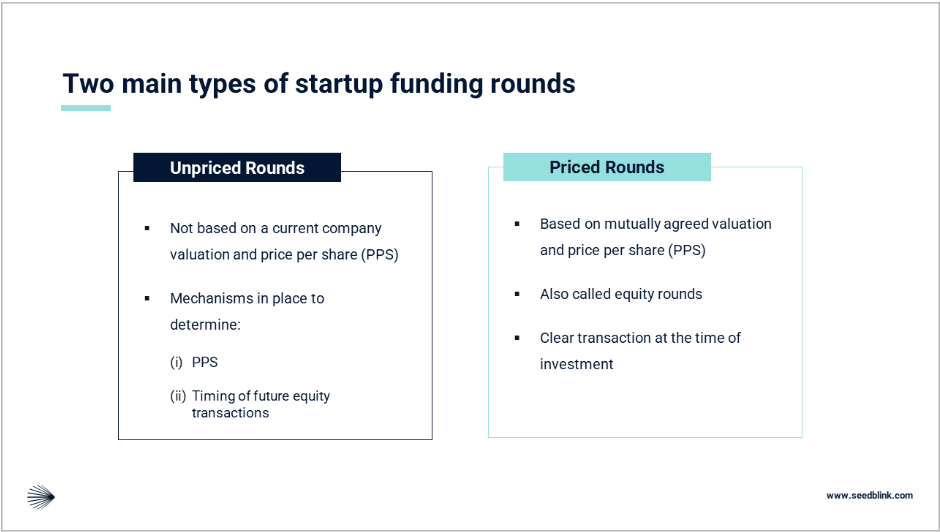

There are two main types of startup funding rounds: priced and unpriced.

Main types of startup funding rounds: Unpriced and Prices. Source: SeedBlink

Priced rounds are straightforward.

The company has a set valuation, and investors receive shares based on this. This clarity allows all parties to understand what is being exchanged—a specific amount of money for a particular amount of equity. Priced rounds provide a clear snapshot of the company's worth at the time of investment, reassuring investors who want to see tangible proof of value before committing their funds.

On the other hand, unpriced rounds occur before or between priced rounds and involve investments made without a current company valuation. These rounds typically use instruments like CLAs or SAFEs, which we’ll talk more about immediately, where investors provide funds in exchange for the promise of future equity.

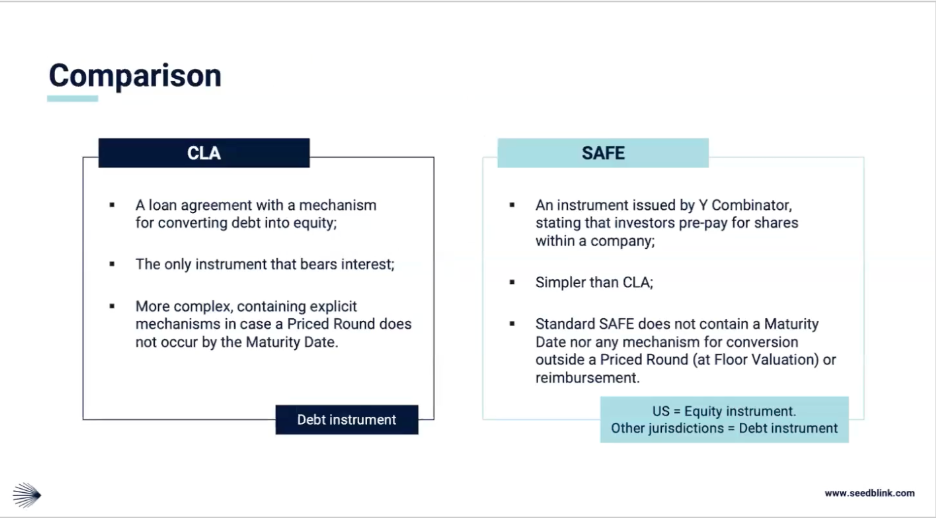

CLA vs SAFE comparison. Source: SeedBlink

The conversion into equity happens during a subsequent priced round, with terms predefined to protect the interests of early investors, such as valuation caps and discounts.

Unpriced rounds offer flexibility and speed, which can be critical for startups needing quick capital infusions to reach milestones or bridge the next significant funding event.

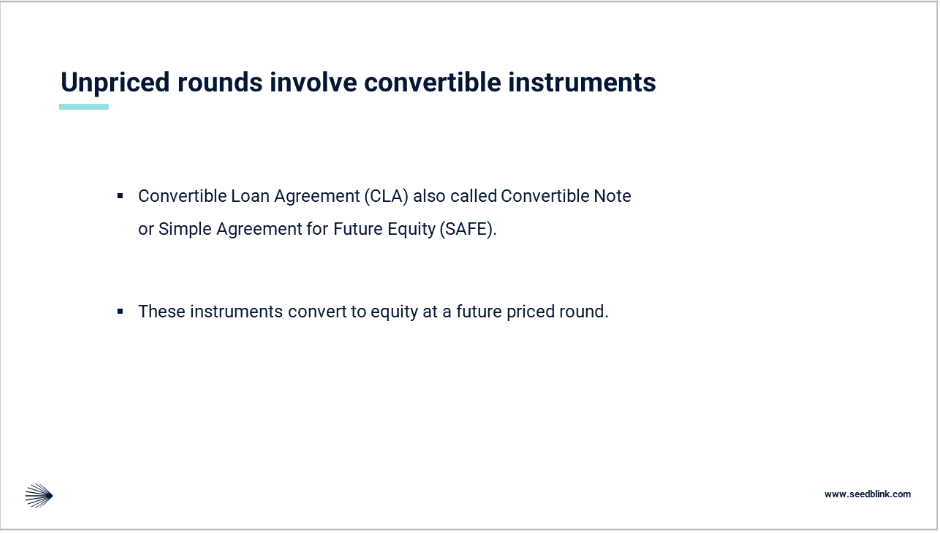

Connection between funding rounds and convertibles. Source: SeedBlink

What is a convertible note

Convertibles are loans from investors that convert into equity. They’re a common way for investors to invest in early-stage startups, particularly pre-valuation ones. A short-term loan will convert into equity upon a triggering event, usually a subsequent funding round.

"_Convertible instruments, the most common ones, are convertible loan agreements (CLAs), also called convertible notes, or simple agreements for future equity (SAFEs). SAFE instruments always come back to equity at future priced rounds,_” Andrei Hancu, SeedBlink’s General Counsel.

The debt-to-equity conversion mechanism means that the loan amount the investor provides converts into company shares at a predetermined valuation cap or discount rate. A setup like this allows startups to delay valuation discussions while securing necessary funds. For investors, this offers the potential for equity ownership in the future, providing upside potential if the company's valuation increases.

"Some of the investors want to reserve rights in future equity rounds. So, they can reserve a preemption right or other shareholder-specific rights,” Andrei Hancu, General Counsel, SeedBlink.

A valuation cap sets a maximum company valuation at which the loan converts into equity, ensuring that early investors benefit from investing at a lower valuation if the company grows rapidly. Similarly, discounts offer investors shares at a reduced price compared to future investors, rewarding them for the additional risk of investing early.

Usually, investors have a discount applied to the price per share that investors have in the priced round. As the investors back the company early, they will get a discount in return. Eventually, they will get more shares for the same money to buy cheaper.

Convertible loans vs equity rounds in fundraising

Convertibles and equity rounds represent two distinct fundraising approaches, each with advantages and considerations. As mentioned earlier, convertibles are debt instruments that convert into equity at a later stage, typically during a subsequent funding round.

Convertibles allow startups to delay valuation discussions and raise capital quickly, which can be crucial for meeting immediate funding needs or bridging the gap to the next major funding milestone. The flexibility and speed of convertible loans make them attractive for early-stage startups or those facing market uncertainties.

Equity rounds, however, involve selling a portion of the company's shares directly to investors at a set valuation. They provide immediate clarity on the company’s worth and the equity stake investors receive in return.

Equity rounds tend to be more complex and time-consuming due to the need for extensive due diligence, negotiations on terms, and formal valuation processes. However, they offer a clear and straightforward ownership structure from the outset, which can be reassuring for founders and investors looking for transparency and stability.

One key consideration in choosing between convertible loans and equity rounds is the potential impact on the company’s cap table and the timing of fundraising. Convertible loans often include terms like valuation caps and discounts to incentivize early investors, but these can also complicate future equity rounds if not managed properly.

_“From the investor perspective, if you give money to a company, you want to be a shareholder. When times were different, and market sentiments were positive, you would expect another fundraising round to come in 12-18-24 months. Today, the sentiment has changed, and we’ve seen that fundraising is not easy anymore. Raising priced rounds for higher valuations has become difficult, even for good companies. This is one of the reasons why interest rates are going up on convertibles, and the maturity dates are rather closer. We’ve seen 36 months as well, but rather leaning towards a 12-month maturity date,_” Maximilian Schausberger, Managing Director at Elevator Ventures.

This timing pressure can create urgency for startups to raise subsequent equity rounds at favorable valuations, highlighting the need for strategic planning and market timing in using convertible loans as a fundraising tool.

Advantages and disadvantages of convertible loans

Advantages of convertibles

"_The argument for a convertible, that it is a faster and easier negotiation about certain terms is certainly right. It's easier than a full equity round, but it's only to a certain extent free from valuation discussions because when you’re discussing the cap, you’re indirectly discussing a rough direction on where you think the next round might be. So, this is something that everyone has to have in mind!_,” Maximilian Schausberger, Managing Director at Elevator Ventures.

- Delayed valuation discussion: Allows startups to postpone valuation until a later funding round, which can be advantageous for early-stage companies or those expecting significant growth.

- Speed and flexibility: Requires less negotiation and due diligence than equity rounds, enabling faster access to capital.

- Lower upfront costs: Typically involves fewer legal and administrative expenses, making it more cost-effective initially.

- Investor incentives: These can include attractive terms like valuation caps and discounts, which provide potential upside benefits to early investors.

Disadvantages of convertibles

“_If new investors come in for a priced round and see that there is a huge stack of convertibles waiting to be converted at different cap prices, the dilution that will occur will be much higher than the investor might be comfortable with,_” Maximilian Schausberger, Managing Director at Elevator Ventures.

- Risk of significant dilution: If the company's valuation does not increase as expected, converting debt to equity can substantially dilute the founders' ownership.

- Uncertainty in future funding rounds: Existing CLAs with various caps and discounts can complicate negotiations with new investors, potentially deterring them.

- Conversion pressure: The need to convert debt to equity within 12-36 months can create urgency and additional stress to secure favorable valuations.

- Complexity in cap table management: Multiple convertible notes with different terms can add complexity to the cap table, requiring careful management to avoid adverse impacts on future fundraising efforts. Use simulation tools to see how equity allocations will look in the next fundraising rounds and how they’ll reflect in your cap table.

For more insights, watch the whole SeedBlink webinar on The impact of convertibles on your ownership structure.****

Get professional advice on how to best structure your next round

Bottom line, don't panic about fundraising. Be strategic about it.

Get advice not only on how to pitch your company and which investors to target, but also on how to structure your deal effectively. For comprehensive support, check out SeedBlink's Fundraising as a Service. Investment experts will help you navigate every aspect of the fundraising process, taking into account factors such as your stage of development, current ownership structure, growth potential in the current market situation and company vision.

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.