SeedBlink Blog

editorials

SeedBlink launches all-in-one equity management and investment platform

With the new SeedBlink release, European companies seamlessly access, manage, and trade equity

We are thrilled to share some exciting news with you! At SeedBlink, we’re taking a big step forward with today’s launch of our all-in-one equity management and investment platform.

Since our market entry in 2020, we’ve collaborated with thousands of European startups, scaleups, stakeholders, and investors. One thing they all have in common is the need for a single source of truth for all things equity and, more importantly, the desire to make equity ownership and fundraising strategic and painless at every stage of growth.

Key elements to consider include technology infrastructure, services, knowledge, guidance, and the network.

We had the main ingredients: four years of successful community and VC-backed investments, the expertise of Nimity, SeedBlink’s one-year-old equity management arm, and a deep understanding of European market dynamics and regulations.

That’s why I’m so excited about this release. Here are the four key services at the heart of our all-in-one platform:

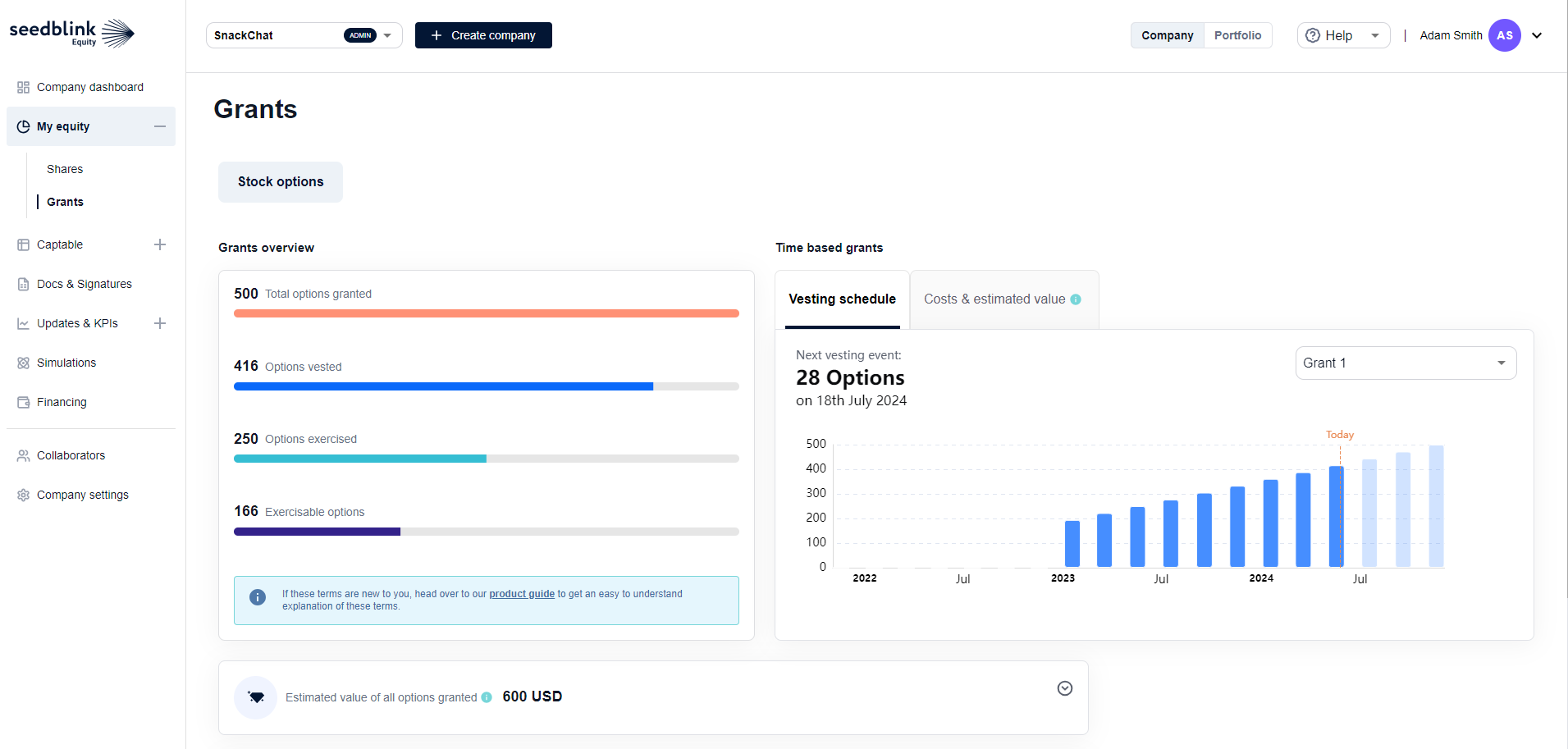

SeedBlink Equity

Drive growth with informed equity choices

This module includes cap table management, locally relevant employee stock option plans, simulations, stakeholder governance, and portfolio management, among other services. It helps companies and their stakeholders manage equity efficiently and transparently, making educated, strategic equity decisions.

Formerly known as Nimity by SeedBlink, this module is now fully integrated under the SeedBlink umbrella. Check out the rebranded demo environment here.

SeedBlink Ventures

Tailored financing solutions for tech companies

Designed to accelerate the fundraising journey for top-tier tech startups, this service provides professional guidance, tools, investment vehicles, and introductions to a network of institutional investors and high-net-worth individuals.

For example, we're offering co-investments through SeedBlink's premium network of investors, with investment solutions ranging from €25k to €5M. Other options include rounds supported by your community through crowdfunding campaigns. Sessions recently chose this option, mobilizing their global community beautifully for an oversubscribed round.

"At Sessions, we prioritize efficiency, productivity, and innovation. Our funding and equity strategy couldn’t be any different. We're thrilled to partner with SeedBlink, which gave us access to diverse funding options and enabled us to provide equity to investors, our top talent, and our user community. We’re essentially taking equity participation and fundraising to the next level. SeedBlink’s all-in-one platform is a big plus, kudos to them for bringing it to the market.” — Radu Negulescu, CEO and Founder of Sessions.

If you’re unsure where to start your fundraising journey or how to find the right lead investor, SeedBlink is a good place to begin. From pitch reviews to warm investor introductions, explore our add-on services.

As an investor, we offer opportunities to diversify your portfolio with access to private VC-backed companies fundraising in Europe, from pre-seed to Series B+, extending to community discoveries and a bulletin board with portfolio companies where you can buy shares from other investors.

SeedBlink Syndicates

Pool investors under a single line in your cap table and streamline the fundraising journey

This new service allows angel investors and founders to pool and deploy capital within their own networks, fostering collaborative investment opportunities. You can aggregate smaller tickets, share deals with your network, and let them co-invest on a deal-by-deal basis, efficiently and cost-effectively.

From deal creation and sharing, pooled investment structures, investor communication, and portfolio management to automated workflows, all in one place – we help you save time and money by eliminating intermediaries, regulatory complexity, and low-tech administration.

"We found a strong partner in SeedBlink, who provided the syndicate investment vehicle and infrastructure to make this happen efficiently. We were able to aggregate our preferred angel investors and close the round quickly. We applaud the availability of the nominee vehicle among other investment options to meet the needs of startup funding at every stage of growth." — Mihai Gavan, CEO and Co-Founder of FoodFix

SeedBlink Secondaries

Strategic liquidity for shareholders

We announce another exciting new module that facilitates equity trading, offers early liquidity for vested shares, and supports portfolio diversification strategies. This allows companies to run end-to-end secondary market transactions for their early investors and employees.

Incentivizing employees with ESOP is a great way to increase engagement, but in some cases, it’s beneficial to unlock early liquidity and create opportunities for new investors through secondaries. Our partnership with Accumeo plays a key role in bringing this service to market.

Doubling down on processes and automation

You may not be as interested in the "behind the scenes" details, but digitizing, automating, and centralizing operations in the equity management and fundraising industry is essential.

When you are just starting out, additional manual work is the last thing you want on your plate. As you scale and complexity increases, automation becomes critical. As a core part of the modules described above, we have focused on improving these aspects with our all-in-one modular platform.

These "routine" processes are essential for effective stakeholder governance and streamline investment and equity management for all stakeholders: companies, investors, employees, and collaborators.

We are committed to supporting technology companies throughout their growth journey, with equity management functionalities, diverse investment vehicles, and a robust roadmap. Stay tuned for more updates and details!

In the meantime, if you’re looking to get ready for funding rounds, access the right investors, or seamlessly manage equity, get started free with SeedBlink today.

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.