SeedBlink Blog

all Things Equity

Europe's venture capital resilience: A 2023 retrospective

insights on long-term growth, emerging sectors, and 2023 investor trends.

The state of European VC: 2023 in a nutshell

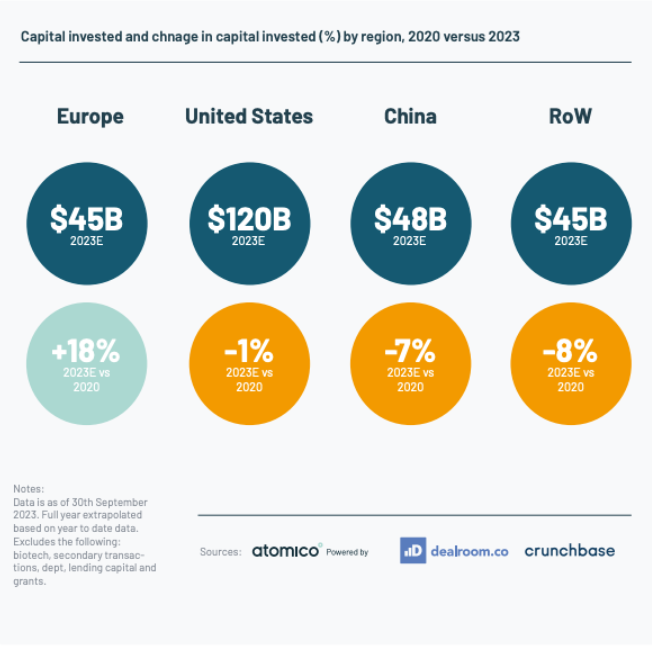

Europe has maintained a positive growth trend and is projected to increase its funding by 18% compared to 2020, according to the State of Tech Report, in 2023, and it has the biggest tech ecosystem value so far.

Europe is avoiding the stagnation seen in regions such as US, China, and the rest of the world, which are expected to match or fall below their 2020 investment levels.

Investment levels have dropped globally. Europe stays positive.

The market reset's significant impact is evident in the short-term performance of venture capital, with one-year VC returns in both Europe and the US now deeply negative due to a rise in down rounds, write-offs, and markdowns.

This trend presents a challenging scenario for investors, though it's not entirely unexpected. However, the true measure of success in venture capital lies in the long-term view, considering that VC returns typically take a decade or more to materialize.

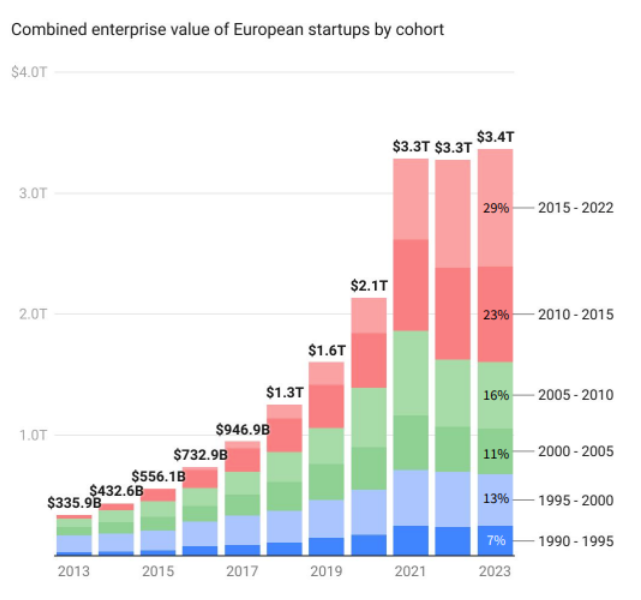

Over the past two decades, European VCs have consistently demonstrated strong performance, often equaling or surpassing benchmarks set by US VCs, European buyouts, and public equities.

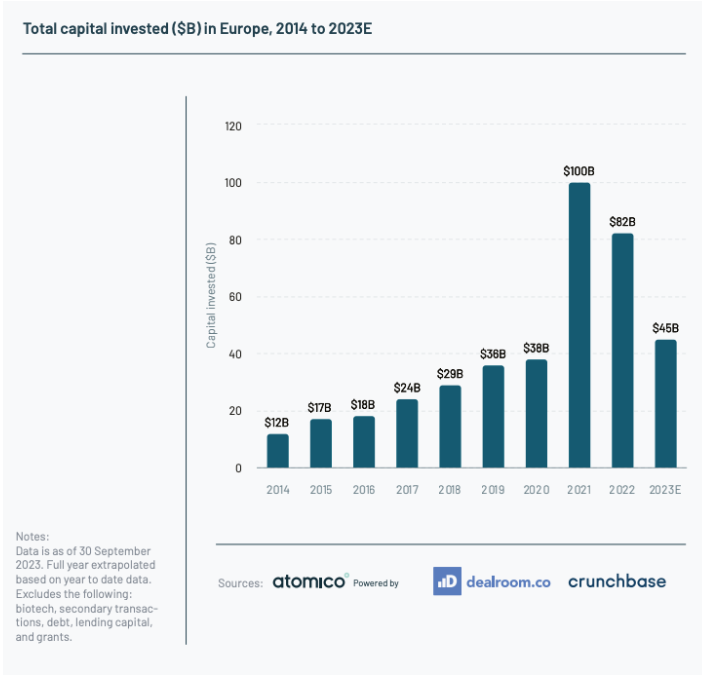

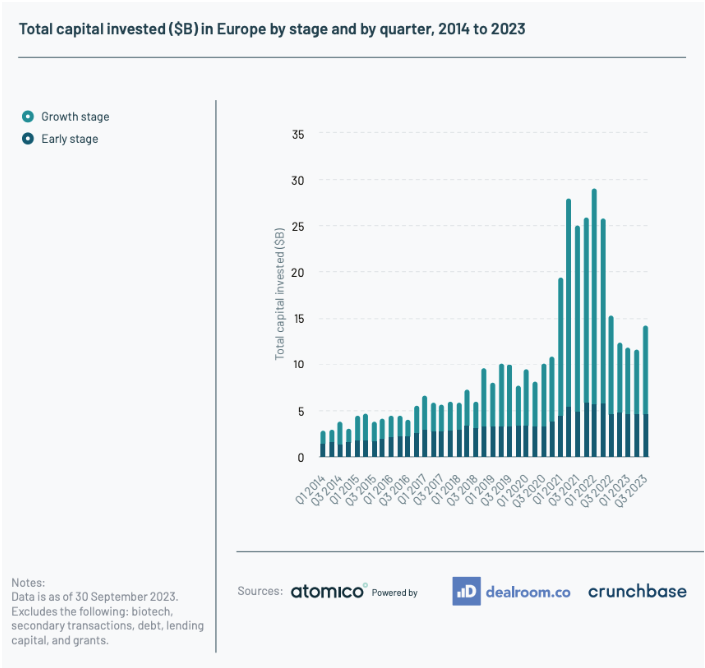

Getting close to $45B of capital invested in 2023

The European tech ecosystem experienced a significant slowdown in investment in 2023, with total capital inflows estimated to reach around $45 billion. It marks a decline of over 55% from the record-breaking year of 2021 when investment volumes surpassed $100 billion for the first time. This year's figures also represent a steep drop of 38% from 2022's total of $82 billion.

This slowdown is understandable, given the broader macroeconomic shifts.

It led to a decrease in investor appetite for high-risk, high-growth investments. While the decline is substantial, it's crucial to acknowledge that 2023 still ranks as the third-largest year in total capital invested, surpassing the 2014 figures by fourfold. It suggests the slowdown may correct the long-term growth trend in European tech investment.

Europe has found a funding equilibrium.

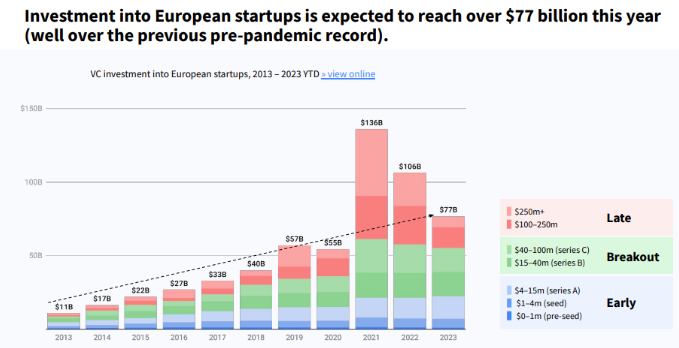

While investment in the European tech ecosystem has slowed since 2021, there have been encouraging signs of resilience. The total investment volume has remained stable for the past five quarters, indicating the sector's underlying fundamentals remain strong. This stability is particularly notable given the broader global financial market turbulence.

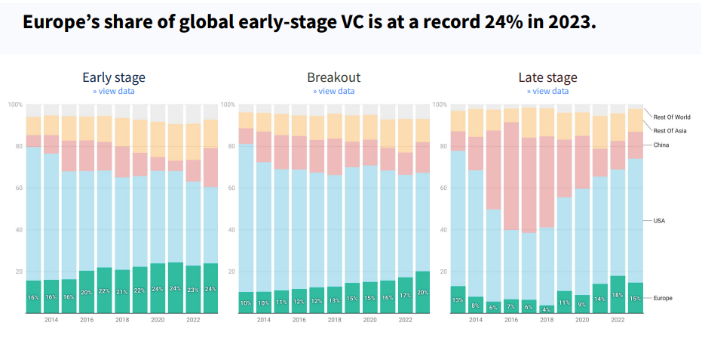

Early-stage investment has been a key driver of this resilience.

Despite the overall slowdown, funding for early-stage startups has remained relatively powerful. It reflects the continued attractiveness of Europe's startup scene, home to many promising companies with the potential to disrupt industries and create new jobs.

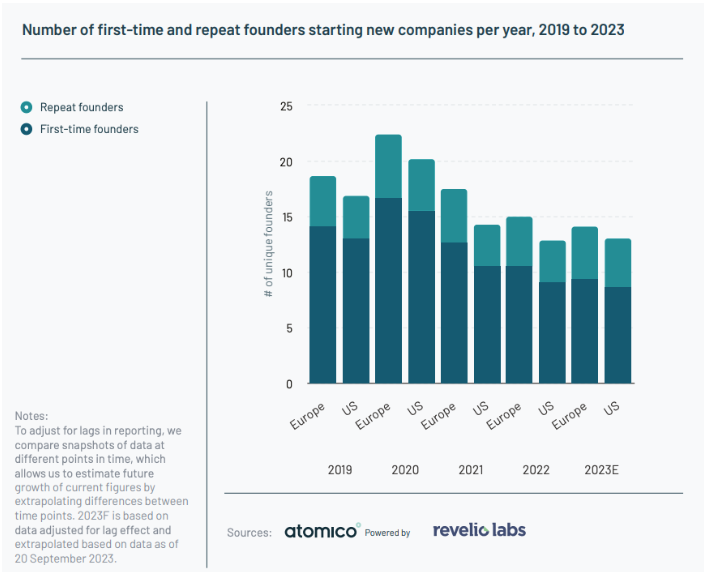

Outpacing US in new tech founders despite slowdown.

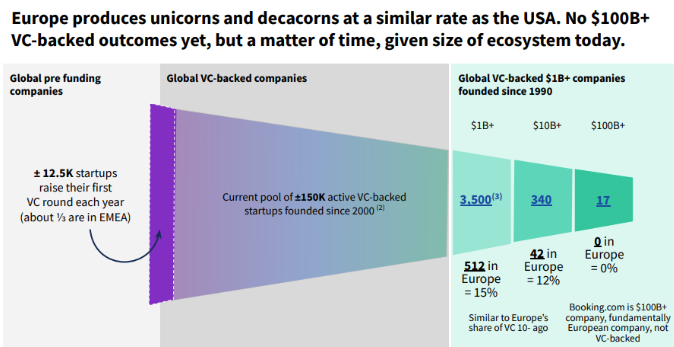

Europe currently surpasses the United States in the share of global early-stage VC, in the speed of unicorn production, launching new startups, and many other areas.

Although there has been a recent slowdown in startup formation, it's primarily attributable to a reduction in first-time founders, while the proportion of experienced founders remains consistent.

This situation indicates a group of committed entrepreneurs prepared to meet more stringent requirements for securing funding, recruiting talent, and acquiring customers.

Hopes for 2024

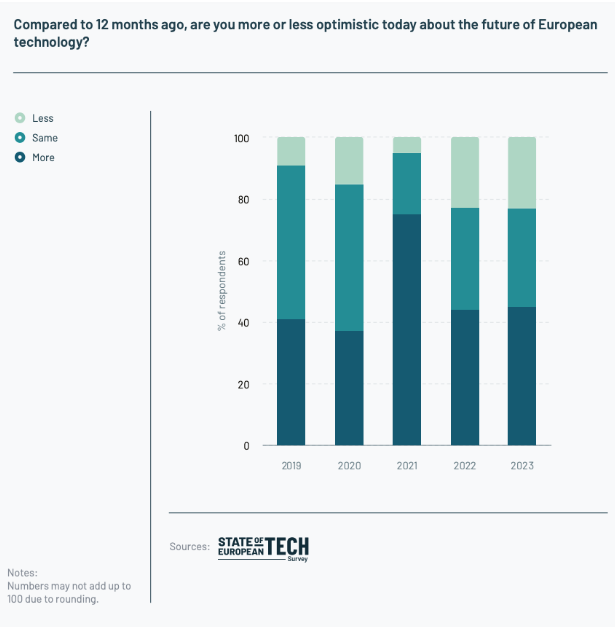

Amidst the ongoing economic volatility and concerns about market conditions, investors are surprisingly optimistic about the future of dealmaking.

A stable positive sentiment

This year, the State of Tech Survey revealed that 89% of global VCs and 87% of European VCs anticipate increasing deal volume in 2024 compared to 2023. It marks a significant shift from last year when only 66% of European investors predicted a better dealmaking environment. However, despite this optimistic outlook, lingering concerns remain about the potential impact of factors such as declining exits, negative VC returns, and a trend of US investors withdrawing from the European market.

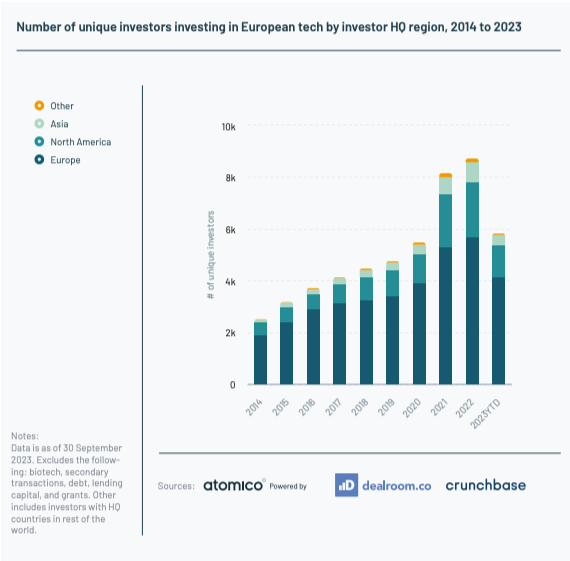

There is a lot of dry powder.

The pool of investors, including investors exclusively focused on Europe, has never been deeper. The number of unique investors in European tech has risen consistently over the past decade. VCs have raised more than $50B in new funds locally since 2021.

“There are more and more people becoming interested in angel investing. If we compare the numbers from when we started six years ago and today, we see that interest has tripled.

However, there is also an important difference in the type of angel investors. Previously, they were high-net-worth individuals with significant amounts of money to invest in different assets.

Today, that is not the case. Now, they are mid-level professionals with the means to invest and the desire to do it because they have seen what’s possible. Some of them are entrepreneurs that launched their own business and now have the power to invest.”

Says Milen Ivanov, Managing Partner at Sofia Angel Ventures

Europe’s next hot destination.

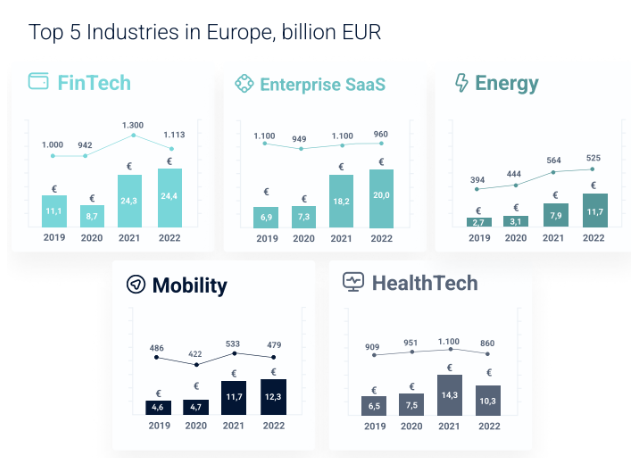

From Fintech & Enterprise Software to AI & Climate Tech

Last December, we were looking at Fintech, Enterprise SaaS, and Energy as the most invested industries in Europe. This year, we’re completely changing the gears.

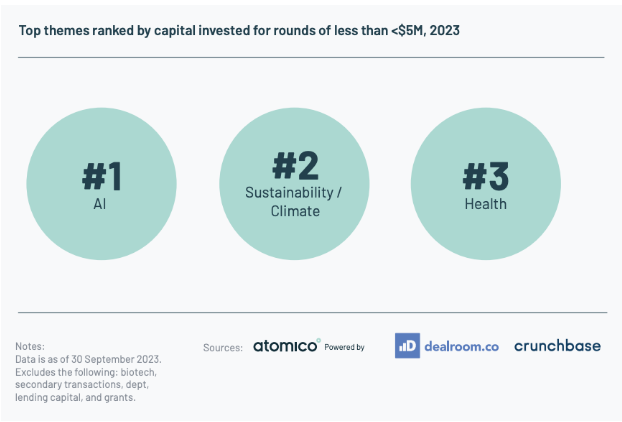

The superstars of 2023 — AI, Sustainability & HealthTech

The recent slowdown in overall Seed investments in Europe should not deter investors from seeking opportunities in emerging technologies like AI. The growth in this sector and the development of a strong ecosystem of AI-focused growth-stage companies provide attractive opportunities for investors.

The European tech sector is also witnessing a notable shift in investment focus, with a significant portion of capital now directed towards climate tech. In 2023, the Carbon and Energy sector, encompassing climate tech, has accounted for 27% of all capital invested in European tech, more than doubling its share of investment since 2021.

HealthTech keeps a strong plane in the top five industries.

HealthTech was listed among the top five industries in 2022 of the most invested industries in Europe. This year, it went two positions up, securing its place as the third most funded sector and the second industry for attracting tech talent.

European regions and flywheel effects

Various European regional ecosystems are under a flywheel effect after having local unicorns rising.

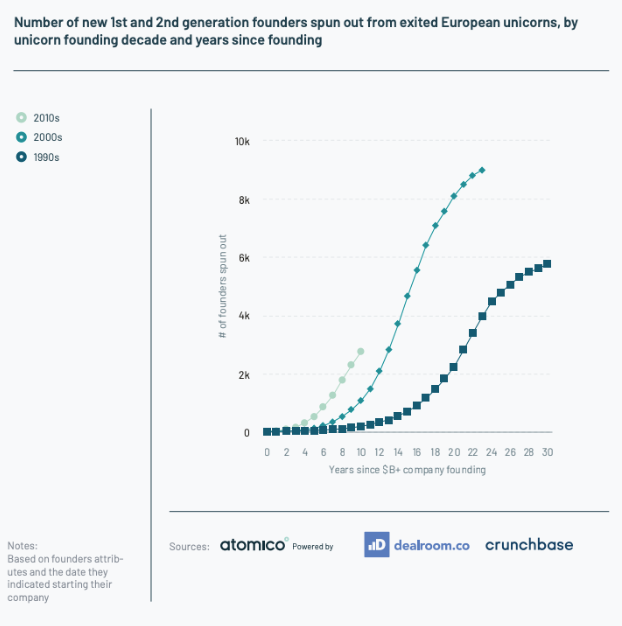

The trend is driven by the established knowledge and networks these individuals bring. It’s particularly evident in the case of alumni of European exited unicorns founded during the 2000s, of which nearly 9,000 new companies have been initiated, a staggering 50% increase compared to the unicorns founded in the 1990s. This network effect will likely significantly impact Europe's tech sector in the coming years.

“What we see today is the result of a very long process that started with very big companies that succeeded. There is a new trend: angel investors are very attracted by cross-border investments.”

Says Borys Musielak, Managing Partner at SMOK Ventures

What’s behind the European fundraising decisions?

Despite the common question of what founders want from their VCs, there's a surprising discrepancy between founders' and VCs' perceptions.

While VCs prioritize building early relationships with founders (29%), founders emphasize finding investors who align with their vision/purpose (36%). Founders also value industry expertise (22%) and a strong connection with their investment partner (28%).

Interestingly, both founders and VCs attach little importance to aspects like the diversity of the investment team, founder experience, and brand affinity. It suggests that founders seek genuine understanding and support from their VC partners rather than superficial factors.

Future thoughts

Despite global economic headwinds, Europe's venture capital scene has shown remarkable resilience, even slightly surpassing last year's funding levels. Investors should note this unique trajectory Europe is on.

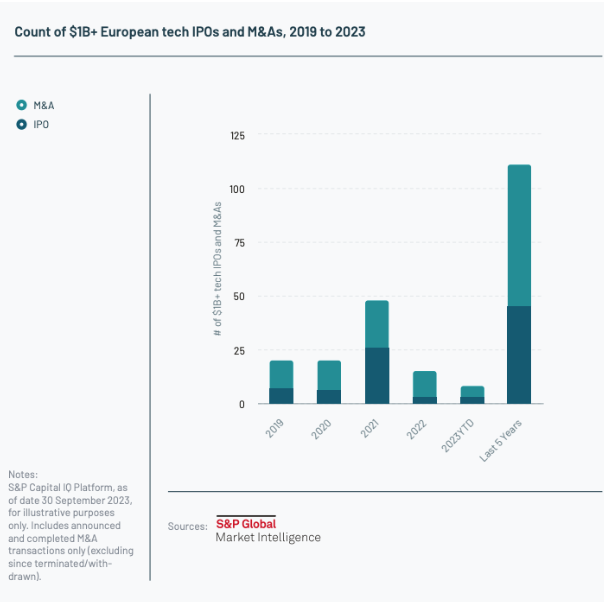

2024 is expected to be a better year for tech startups because software sales are expected to increase, venture capital investments are expected to increase, and the IPO market is expected to improve.

Right now, companies are closing the year with optimistic predictions for next year, where software sales are expected to grow, and AI to have a significant impact on it. AI-powered automation is expected to make startups more efficient, reducing burn rates and improving profitability ratios.

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.