SeedBlink Blog

all Things Equity

Startup scene à la Française: explore France's tech & VC landscape

Discover the rise of France's dynamic startup ecosystem, its unicorn club, and the reasons to invest in this thriving tech landscape.

France is more than just a pretty picture of wine and romance – it's got a vibrant startup scene that's catching the globe's attention.

In recent years, France has become a hotbed for entrepreneurial spirit and innovation. From cutting-edge tech companies to creative ventures, the French startup ecosystem is flourishing. It's not just the Eiffel Tower reaching for the sky; it's also the ambitions of these startups, making waves worldwide.

So, let's dive into the exciting world of the French startup ecosystem, where croissants meet the techy world of startups and innovation.

France’s strong pillars

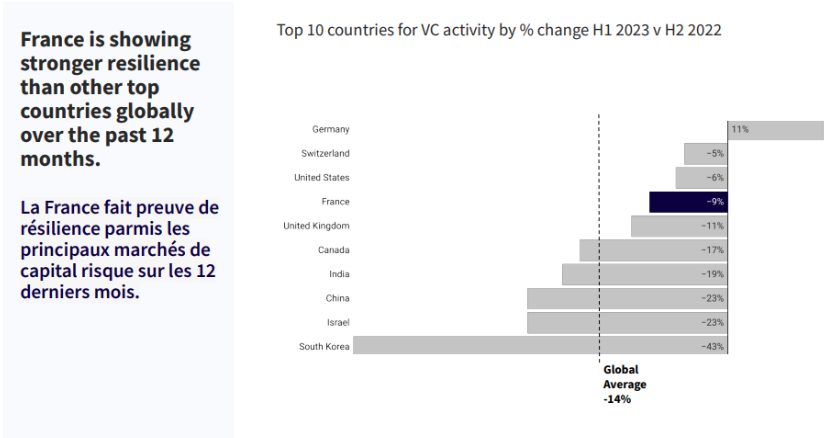

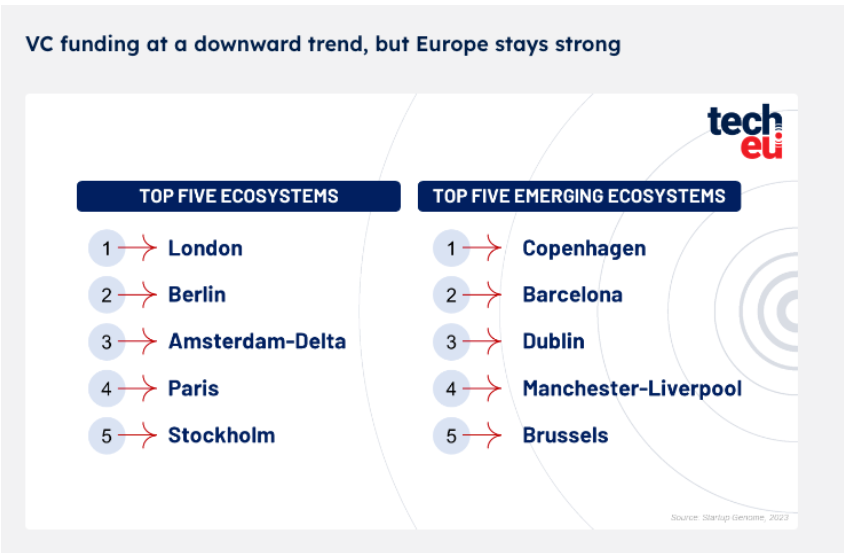

France is the only largest European tech ecosystem that has continued to grow despite the uncertain times we are living in. At the same time, in 2022, this emerging community became the second ecosystem, gaining its position right behind the UK and ahead of Germany.

Cultural Heritage

The country has always been at the forefront of culture and creativity, and that translates beautifully into the startup world. The country has a rich artistic and cultural heritage and is listed among the countries with the most world heritage sites. Eventually, this leads to a unique backdrop for innovative thinking.

From fashion tech to culinary innovations, French startups are harnessing their cultural DNA to create exciting new ventures. Their efforts are recognized worldwide, as they are among the first economies in The Global Innovation Index.

Strong Education

With a strong emphasis on engineering, mathematics, and the sciences, France churns out skilled professionals ready to tackle the most challenging problems.

Universities like Sorbonne and INSEAD are known for nurturing future business leaders, while coding boot camps turn enthusiasts into tech wizards. For example, 4% of the INSEAD graduates in 2022 were entrepreneurs, of whom 69% were first-time founders.

So, universities in France are a talent pool that fuels the fire of innovation in French startups.

Constant Support and Investment

The French government has been rolling out the red carpet for startups.

Initiatives like the French Tech Visa and La French Tech make it easier for international talent to join French startups. The French Tech Visa is a simplified, fast-track scheme for non-EU startup employees, founders, and investors to obtain a residence permit for France.

Besides, France is also home to Station-F, the biggest startup campus in the world, and numerous other incubators and accelerators that provide startups with the mentorship and resources they need to thrive. Also, tax incentives for research and development have been game-changers.

The Startup Funding Landscape in France

The startup funding landscape in France is flourishing, offering a promising playground for entrepreneurs seeking capital to turn their ideas into reality. With a robust venture capital ecosystem and a growing number of angel investors, startups here have ample opportunities to secure funding.

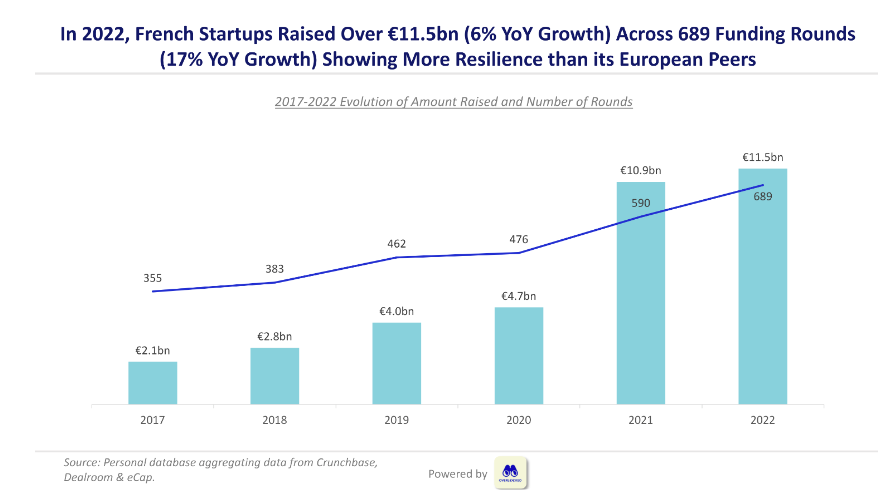

Source: The State of the French Tech Ecosystem 2022

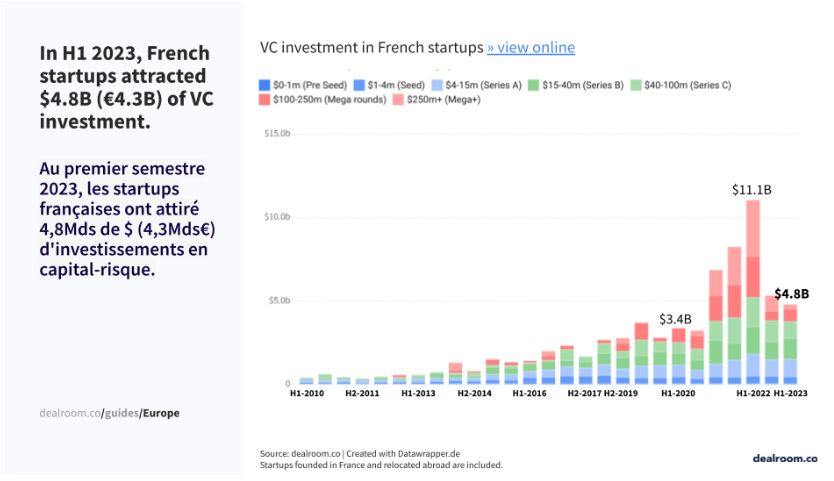

In 2022, the French startup ecosystem experienced a remarkable surge, raising a total of €11.9B in funding, with 358 startups securing an average of €33M each. In the first half of 2023, the French startup scene demonstrated remarkable strength, securing an impressive €4.3B in venture capital investment.

This substantial influx of capital firmly establishes France as a prominent player in the global startup landscape.

Source: Startups & VC in France — H1 2023

The country earned the 3rd rank in Europe and an impressive 6th globally for venture capital investment during this period, underlining its emergence as a dynamic hub for innovation and entrepreneurship.

What's even more remarkable is that France managed to capture a significant share, a quarter to be precise, of the total funds raised within the European Union, highlighting its growing allure to investors and startups alike.

Source: Startups & VC in France — H1 2023

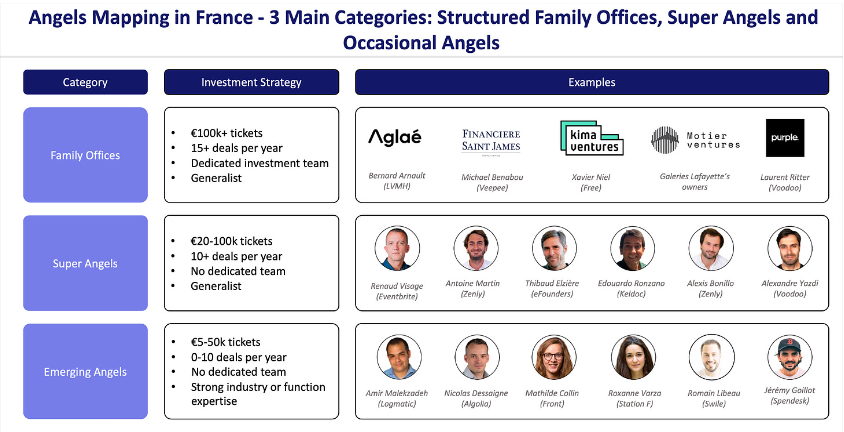

The country also has a strong angel investors community that has matured over the years, today counting multiple layers of individual investors, such as structured family offices, super-angels, and emerging angels.

Source: The State of the French Tech Ecosystem 2022

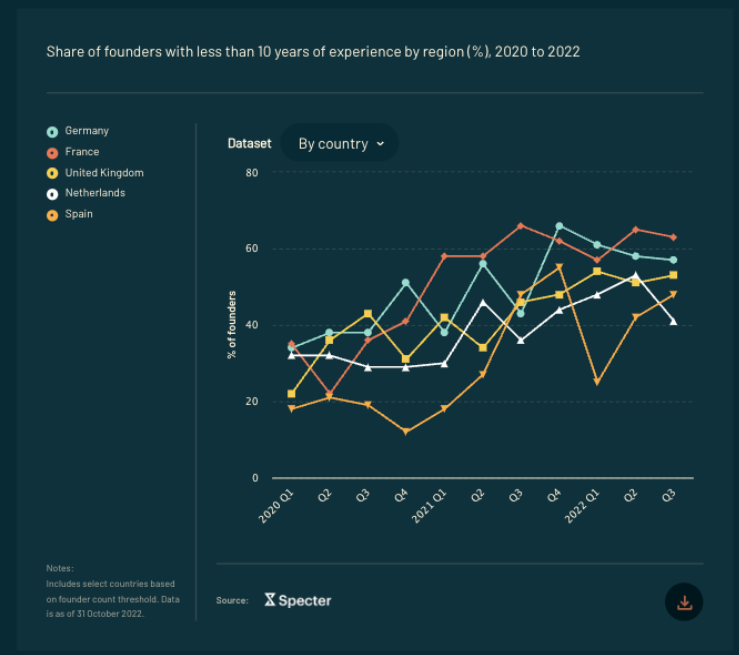

The trend is also visible if we look at young founders, whereas in France, we find that +60% of entrepreneurs who started companies have less than ten years of prior experience.

Source: State of Tech — First Look 2023 by Atomico

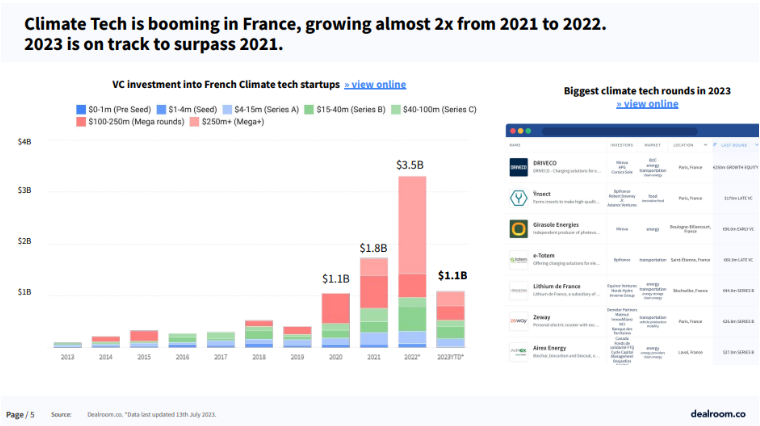

France's startup landscape has impressive strengths across various sub-sectors, fueling innovation and growth. Fintech, Cleantech, and Artificial Intelligence are the major industries performing well in the ecosystem.

Source: Startups & VC in France — H1 2023

France’s Major Startup Communities

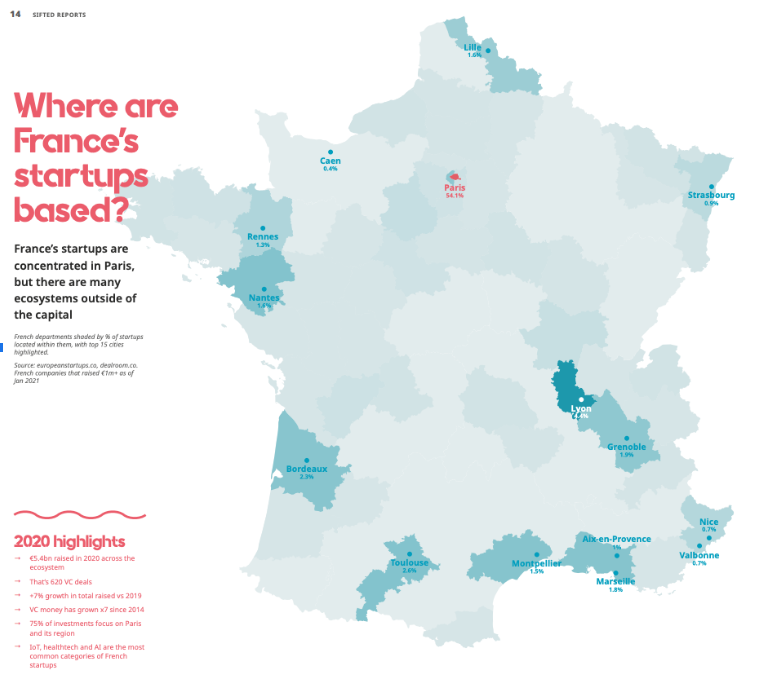

As you can expect, Paris is a thriving venture capital hub, attracting local and international investors eager to invest in innovative ventures.

Source: The French Tech Revolution Report

Paris: The Epicenter of Innovation

While Paris is famous for its romantic ambiance, it's also the epicenter of French innovation. The city is hosting +8000 startups and is ranked France's 1st best startup ecosystem, 2nd in Western Europe, and 9th globally.

Source: The 2022 Global Startup Ecosystem Report

Paris is teeming with co-working spaces, tech hubs, and networking events that bring together aspiring entrepreneurs, investors, and mentors. The French government is working hard to build on this momentum, with President Emmanuel Macron presenting a €30 billion France 2030 plan in October 2021, with nearly €15 billion dedicated to startups.

So, Paris offers fertile ground for startups to sprout and scale, from AI and fintech to healthcare and green tech.

Marseille: Going Beyond a Vacation Destination

Marseille, the second-best startup ecosystem in France and ranked 38th in Western Europe, is home to a population of 0.1 to 0.5M people, placing it at the 152nd spot globally. This vibrant city is witnessing the growth of its startup ecosystem thanks to the support of various organizations and investors.

Marseille has a wealth of expertise in six fields, the first being healthcare. The city is the second-largest in France and is the first cancer research center after Paris. Its Immunopole cluster is the first French cluster in immunology, spearheading research and development in infectiology and neurology.

Lyon: France’s Hidden Gem

Lyon, France's second-largest and second-richest metropolitan area, is a hidden gem that blends history, industry, and culinary excellence. The city has a vibrant startup ecosystem, with almost 40% of the city's tech firms being startups.

Lyon has a thriving business ecosystem, with numerous companies and startups in biotechnology, digital technology, and video games. Beyond its historical significance and reputation as a financial hub, Lyon has emerged as a thriving hub for early-stage businesses, particularly in chemical and pharmaceutical production, biotech research, and software development.

French Venture Capital Funds.

- Bpifrance — A sovereign wealth fund that invests in startups throughout the VC lifecycle, including Doctolib and PayFit. Notable exits include HalioDx and Adyoulike.

- Kima Ventures — A venture capital fund held by the French billionaire Xavier Niel's that invests in all stages and sectors. Its portfolio includes Silvr, a revenue-based financing startup, and Umiami, a plant-based food company. Recent exits include Heliogen, a solar energy company, and Radish, a serialized fiction app provider.

- Partech VC — A generalist venture capital fund focused on investments in digital and tech companies. It already supported the blockchain-based fantasy football specialist Sorare and online gardening products marketplace ManoMano.

- 360 Capital — An early-stage venture capital fund focusing on ClimateTech, DeepTech, Mass Consumption, and Business Administration.

- Idinvest Partners — An early-stage and late-stage VC focused on Europe and South Asia. Merged with Eurazeo and rebranded to Eurazeo Investment Manager in 2020.

- Alven Capital Partners — An early-stage VC focused on SaaS, marketplaces, finance, e-commerce, developer tools, Web3, frontier tech, and social and entertainment. E-commerce startup Ankorstore and challenger bank Qonto are just some recent investments from their portfolio.

- Elaia Partners — An all-stage venture capital fund investing in digital and deep-tech startups. Current investments include security specialist Shift Technology and robotics startup Eyepick.

- Hola Venture Partners — A venture capital fund that invests in and partners with fearless visionaries shaping their industry's future. Besides capital, they guide leaders on business strategy, organizational design, management, and culture for personal and professional growth.

- Unconventional Ventures — Unconventional Ventures Fund I is a 30M€ VC fund investing in startups in the pre-seed and seed stage led by diverse European founders building scalable impact tech companies.

- M Capital Partners — M Capital is an independent investment company with +€500M AuM. A unique hub where entrepreneurs can have equity finance and quasi-equity as well as permanent support to accelerate their growth.

- Newfund — Newfund is a $300M entrepreneurial VC firm dedicated to pre-seed and seed investments in France and North America in companies driving global change.

- Daphni VC — Daphni is a venture capital based in Paris, investing in tech startups with a European DNA and a strong international ambition.

Unicorns & soonicorns in France

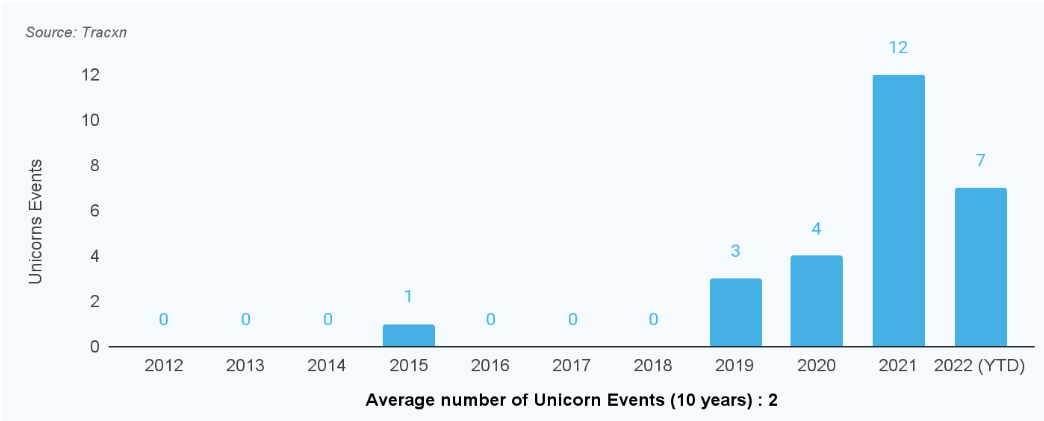

France's unicorn club has been steadily growing since 2010.

There are 25 unicorns in France, excluding those that achieved unicorn status through M&A deals or IPOs. In 2022, seven companies joined the unicorn ranks, although this marked a 42% decrease compared to the previous year.

These startups secured an average funding of $161M each on their journey to becoming unicorns, showing a modest 4% decrease from the 2022 average. On average, these unicorns took approximately four years from raising their Series A funds to achieving unicorn status, highlighting the rapid pace of growth in the French startup ecosystem.

Source: The Unicorn Club - France

Several investors have played a significant role in nurturing these unicorns, with Bpifrance, Idinvest Partners, and Kima Ventures leading the pack, each boasting eight unicorns in their portfolios.

Most of these unicorn companies have found their home in Paris, with the city housing 21. Other French cities, including Croix, Montpellier, Saint-Mande, and Levallois-Perret, have also contributed to the country's unicorn roster, showcasing the geographical diversity of France's thriving startup scene.

Why invest in France

“The growth of the French ecosystem has been in cities all across France: Bordeaux, Marseille, Lile, and Nantes is already very visible. Of 4,000 startups a year, 25% are not in Paris.

Startups have access to talent from all over the country. This is one of the key assets of the French ecosystem: it will not remain on a single front of Paris.”

Source: Sifted, says Paul-François Fournier, Executive Director ar Bpifrance

“When Emmanuel Macron came to power, he said, ‘We’re late and need to invest in tech ecosystems, or we will lose the better part of the century, and all the value will go to the US or Asia.’

While Macron wasn’t the first to pump money into startups and facilitate entrepreneurship — measures including tax breaks aimed specifically at innovation have been around for several presidencies — startups and founders view the younger, tech-savvy president as more engaged in their world than his predecessors.”

Source: Sifted, says Thibaud Hug de Larauze, cofounder of Back Market.

“I think investors seem to be chasing these people quite a bit, and we’re starting to see the mafia community come of age. That’s something that will be very visible. We see it a lot in the early stage, with a lot more companies founded by people previously in these successful companies.”

Source: Sifted, says Roxanne Varza, Director of Station F.

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.