SeedBlink Blog

technology Trends

The Pandemic Paradigm Shift: Exploring the Evolution of HealthTech and MedTech

From pre-COVID progress to post-pandemic acceleration, let’s explore the journey of HealthTech and MedTech in the startup funding landscape.

The COVID-19 pandemic catalyzes rapid transformation across industries, and healthcare is no exception.

The pre-pandemic era witnessed a steady rise in technology adoption in healthcare, with digital health solutions gaining traction. However, the pandemic acted as an accelerant, highlighting the urgent need for advanced technological interventions and ushering in an era of unprecedented growth in HealthTech and MedTech.

However, the question in investors’ minds is — Is this trend here to stay for the future? Today, we’ll try to demystify the funding landscape and what is coming next in the healthcare sector.

Key Insights

If you’re only here for the key insights, here you are. I’ll be diving deeper into them in the article.

- The COVID-19 pandemic has acted as a catalyst for the rapid adoption and acceleration of technology in the healthcare industry, particularly in HealthTech and MedTech.

- HealthTech refers to using technology to improve healthcare services, while MedTech focuses on developing and manufacturing medical devices and equipment.

- HealthTech funding witnessed a significant decline in 2022, with a year-over-year drop of 57%. Still, HealthTech startups raised higher funding than pre-pandemic levels, and values are historically high.

- MedTech deal activity rebounded at the end of 2022 after a decline from the record-breaking levels seen in 2021. However, VC funding for MedTech will decrease in 2022.

- European venture capital funds are increasingly recognizing the potential of HealthTech and actively investing in the sector, contributing to the growth of the European digital health ecosystem.

What is HealthTech?

HealthTech refers to using technology to improve healthcare services across different touchpoints. From software applications to devices, new innovative solutions improve the diagnosis, treatment, monitoring, or delivery of healthcare services.

The field of HealthTech is rapidly evolving, driven by the need for increased efficiency, improved patient outcomes, and the growing availability of advanced technologies. It holds great potential to transform healthcare delivery and empower individuals to take a more active role in managing their health. The pandemic has accelerated the adoption of remote healthcare solutions, allowing patients to receive medical consultations and follow-ups from the comfort of their homes.

This shift towards virtual care has improved access to healthcare services and revolutionized the patient experience, providing convenience and reducing unnecessary visits to healthcare facilities.

HealthTech vs. MedTech

HealthTech and MedTech are closely related terms often used interchangeably but have slightly different meanings and scopes. MedTech, short for Medical Technology, has a narrower focus.

MedTech refers to the application of technology in developing and manufacturing medical devices, equipment, and tools used to diagnose, treat, and monitor medical conditions. MedTech encompasses many physical devices, such as surgical instruments, imaging systems, implantable devices, diagnostic equipment, and more.

It also includes software applications specifically designed for medical purposes, like medical imaging software or medical device connectivity solutions.

The State of HealthTech & MedTech in 2023

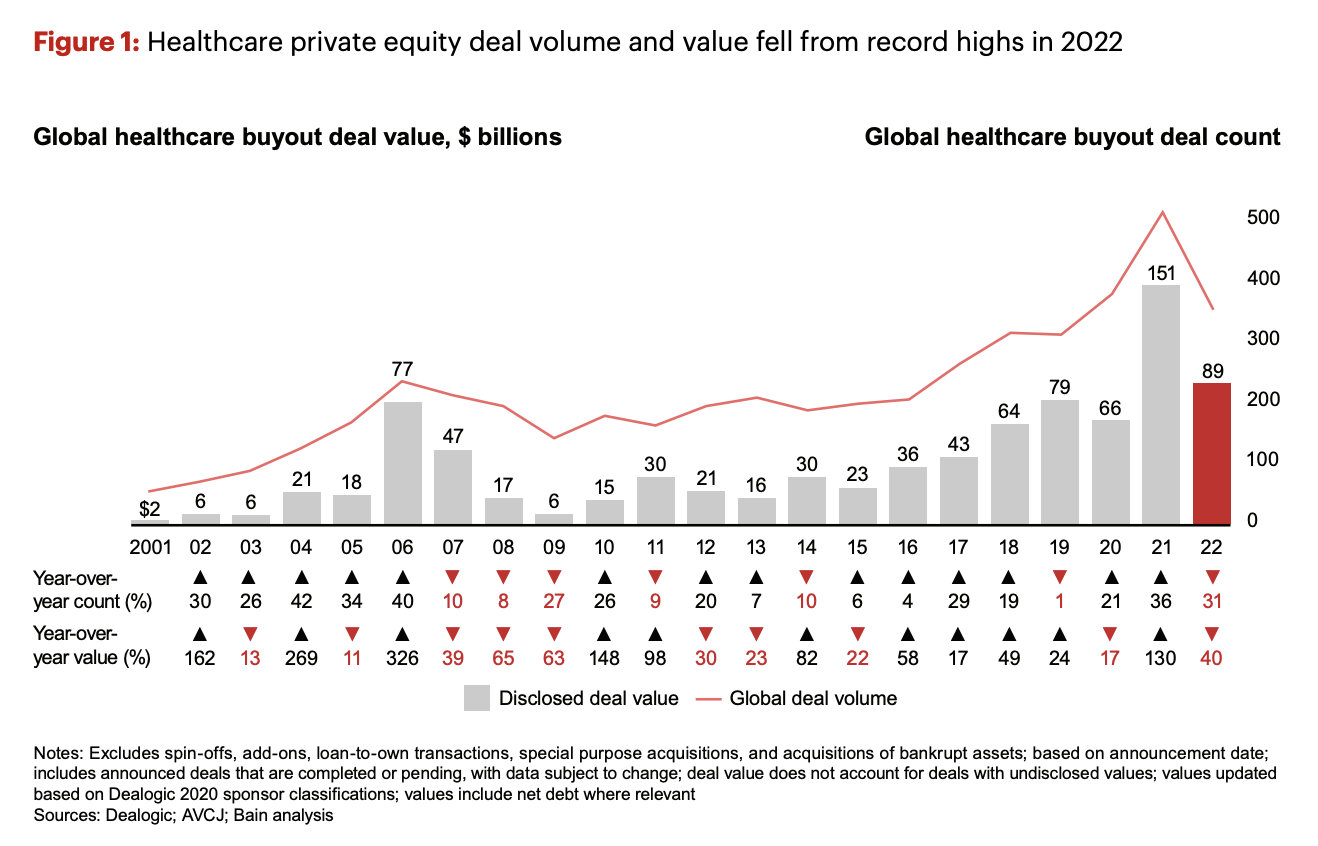

Despite facing various challenges, private healthcare equity demonstrated resilience in 2022. It was the second-highest year on record for private equity in terms of disclosed deal value, even though overall activity declined significantly from the previous year's record-breaking highs.

In response to the changing landscape, funds in the healthcare private equity market shifted their focus worldwide, aiming to identify pockets of opportunity in specific subsectors and geographies.

Ample dry powder and a track record of returns ensure that healthcare will remain a priority for top firms, even though securing deals may require a more specialized and creative approach.

Source: Global Healthcare Private Equity and M&A Report 2023 — Bain & Company 2023

HealthTech — Funding Overview

The evolution of HealthTech funding in 2022 witnessed a significant decline, with a YoY drop of 57%. Digital health funding fell to $25.9B, marking a substantial decrease from the previous year's record-high of $ 59.7 B.

This decline is visible across all quarters, with Q4'22 representing the lowest quarterly funding in the past five years.

The number of deals in the digital health space also experienced a decline of 33% compared to 2021, reflecting the cautious investor sentiment during the period. Furthermore, Q4'22 marked the first quarter since 2018, with no new unicorn births in the digital health sector.

According to the same report by CB Insights, amidst the overall decline in funding, there was a notable increase in median angel deal size by 29%. Angel investors bucked the trend, with the median deal size growing for the third consecutive year, reaching $4 million in Q4'22.

However, other investor types experienced a decrease in median deal size. Asset/Investment Management, for example, saw a 64% drop in median deal size compared to 2021, highlighting the shifting dynamics of investment patterns in the HealthTech sector.

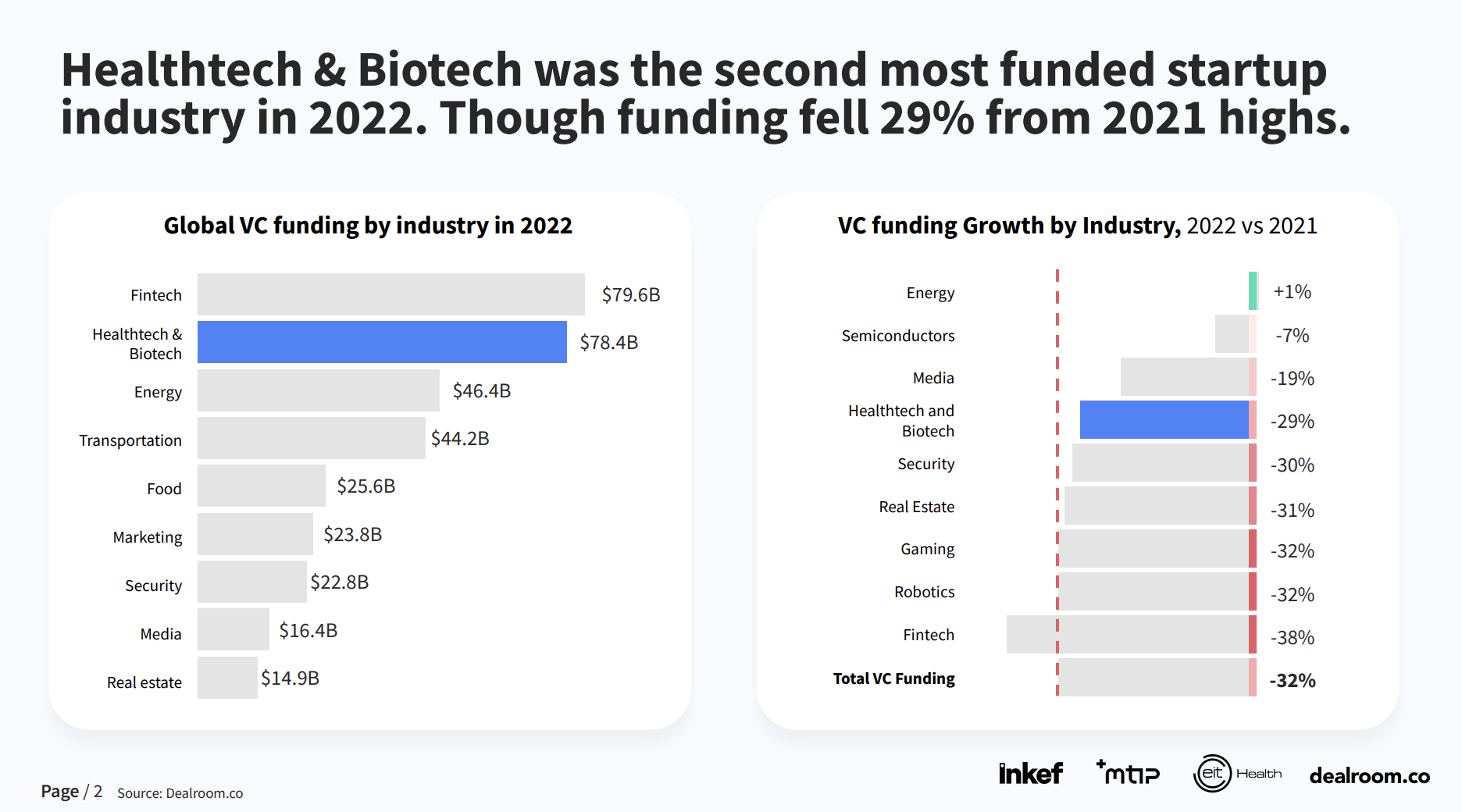

However, despite global funding falling compared to previous years, HealthTech & Biotech was the second most-funded startup industry in 2022. And HealthTech startups worldwide have raised higher than pre-pandemic levels and are valued the highest in history, at $1.9T.

Source: HealthTech Annual Recap 2022 - Dealroom

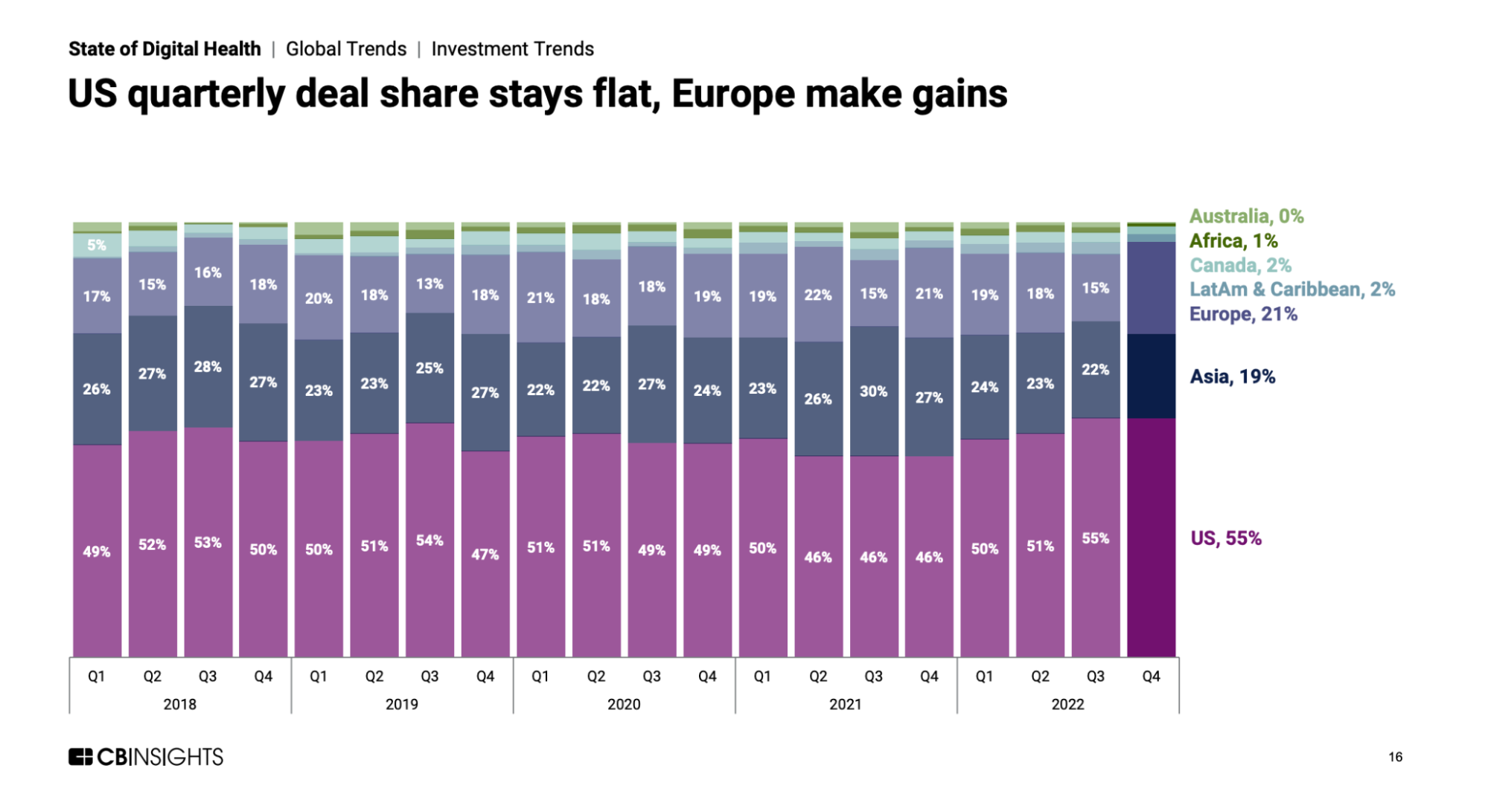

Additionally, despite the challenging environment at the global level, European healthcare is holding its position strong. Europe-based digital healthcare companies raised $3B in 2022. Despite a decline in annual deals, Q4’22 saw a 16% increase compared to Q3’22.

Source: CB Insights 2022 — State of Digital Health Report

How about MedTech?

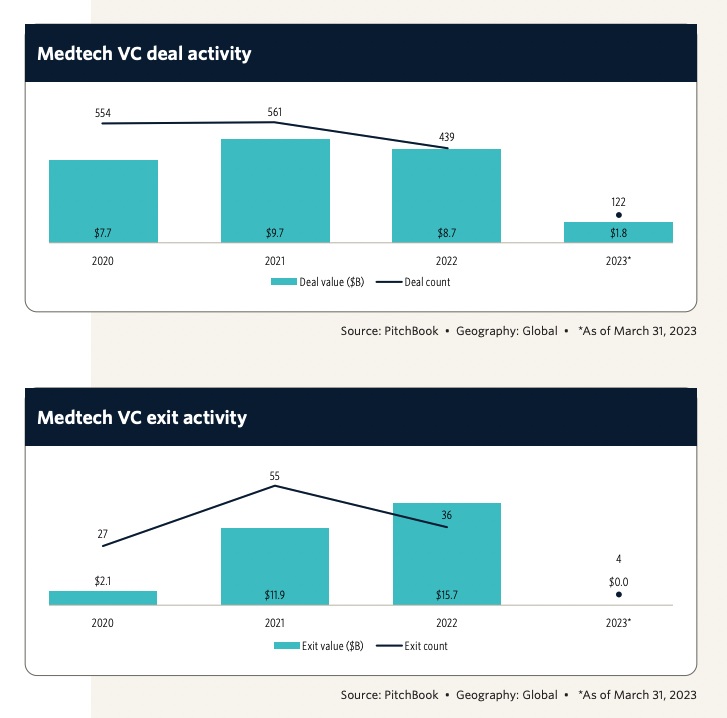

Medtech deal activity experienced a rebound at the end of 2022 after falling from the astronomical levels seen in 2021. While the third quarter showed little movement, activity peaked in the last quarter of the year.

After the remarkable performance in 2021, private equity deal activity in the first half of 2022 returned to historical averages. The third quarter faced significant challenges due to macroeconomic factors, resulting in the lowest quarterly deal count in medtech over the past five years.

Medtech, in 2022, also saw a decline in VC activity compared to the previous year, with 439 deals amounting to $8.7 billion in deal value. Although the year-over-year difference wasn't significant, total funding has decreased each quarter since early 2022, reflecting the overall deterioration in the VC funding environment.

Source: MedTech Launch Report Q1 2023 — Pitchbook

The decline in funding has been most prominent in early-stage deals, experiencing a 30% decrease compared to the previous year. Inflation, higher interest rates, and a stagnant IPO market have contributed to the downward trend.

While substantial funding has been available for innovative companies, the level of investment witnessed in 2021 and 2022, totaling $18.3 billion, is unlikely to be replicated soon.

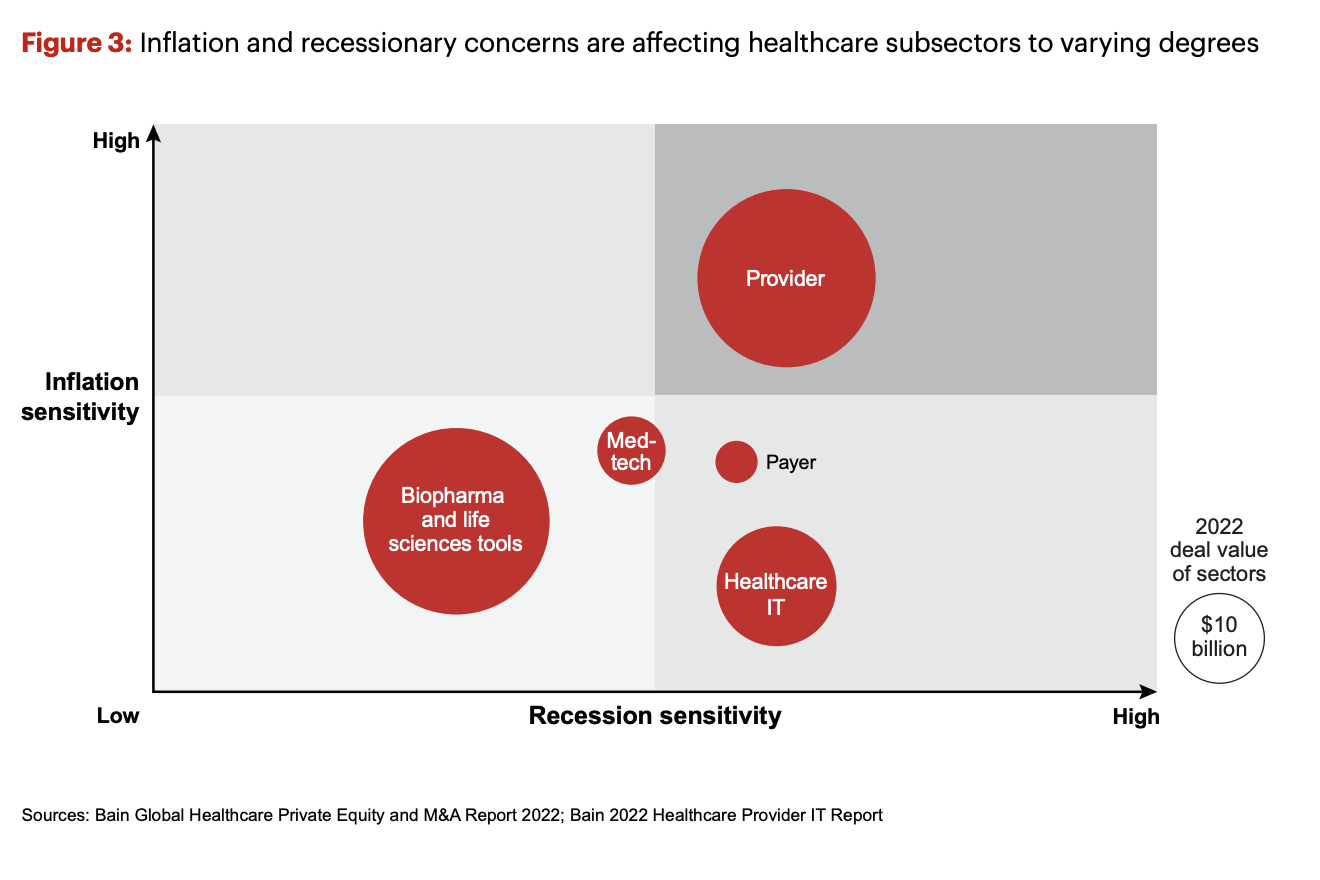

The impact of a recession and inflation will vary across different healthcare subsectors.

Source: Global Healthcare Private Equity and M&A Report 2023 — Bain & Company 2023

While the current macroeconomic conditions pose challenges for investors, they also present attractive opportunities in specific areas. Investors actively seek investment themes that align with long-term trends and demonstrate resilience during a recession. Additionally, due to capital constraints and inflationary pressures, private equity sponsors are adopting more creative approaches to execute deals.

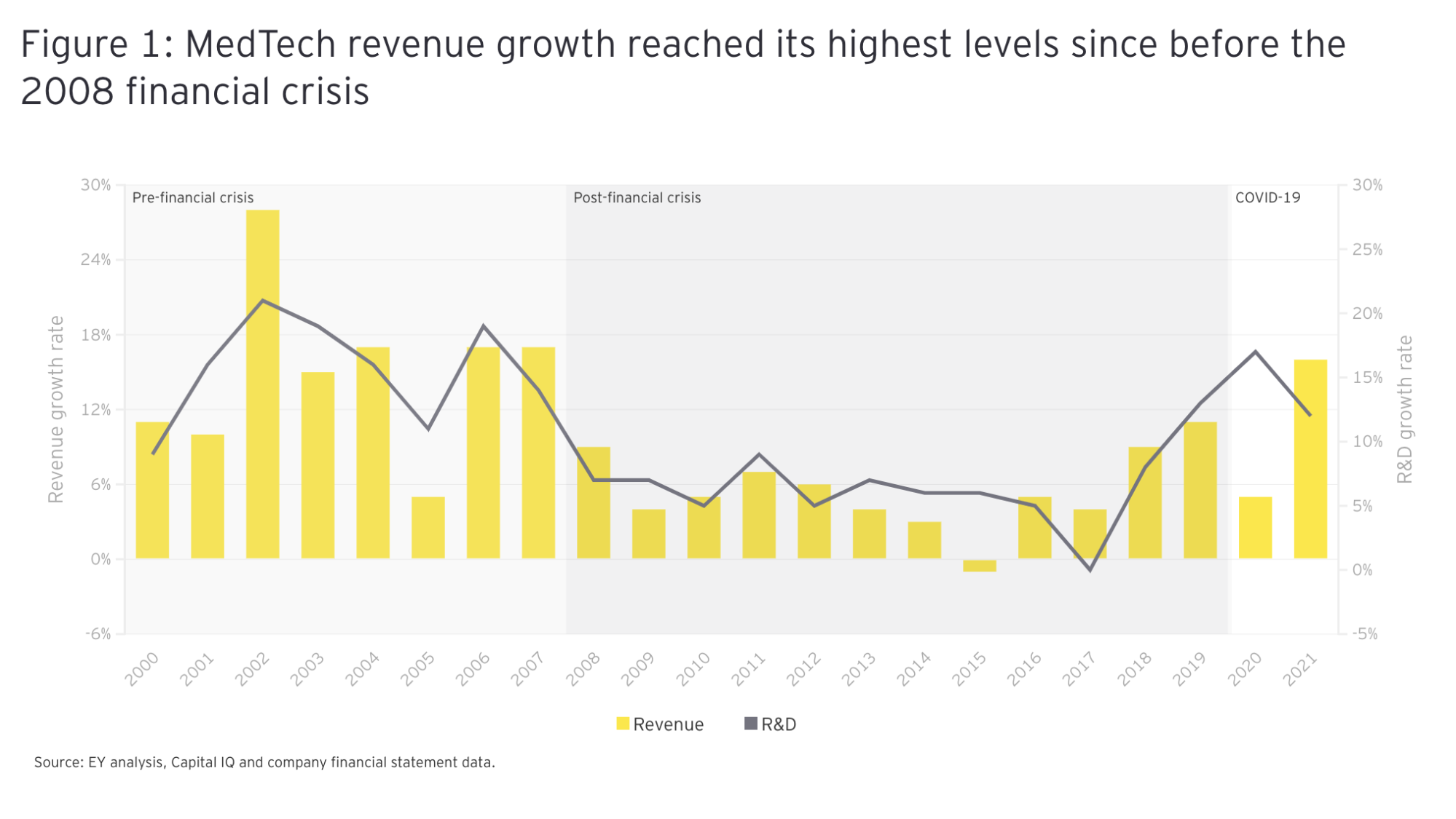

In the face of escalating conflicts, inflation, recession fears, and various challenges, the MedTech industry must navigate uncertainties in the post-pandemic landscape.

While the industry demonstrated growth and increased R&D spending in 2021, its ability to sustain this progress in the face of current challenges remains to be determined. Factors such as global chip shortages, supply chain disruptions, labor market constraints, and reduced hospital system investments pose hurdles to MedTech's ongoing innovation and growth.

Source: Pulse of the Industry — EY 2022

The industry's resilience and ability to overcome these obstacles will shape its performance in the coming years.

Future Concerns

Healthcare Brew explores the impact of digital health hesitancy on investors in startups operating in the healthcare sector. It highlights that while digital health presents significant opportunities for innovation and investment, hesitancy among patients and healthcare providers can create challenges for startups seeking funding.

Investor confidence may be affected by concerns around the adoption and acceptance of digital health technologies and potential barriers to market entry.

Additionally, highly active venture capital firms in HealthTech, have shared the future promising sectors in this industry in a recent article for Sifted:

- Remote chronic disease management

- Pediatric super-apps

- AI-powered digital therapeutics

- Preventative healthtech for the elderly

- Startups that incentivize patients to share their health data

Who is Investing in HealthTech?

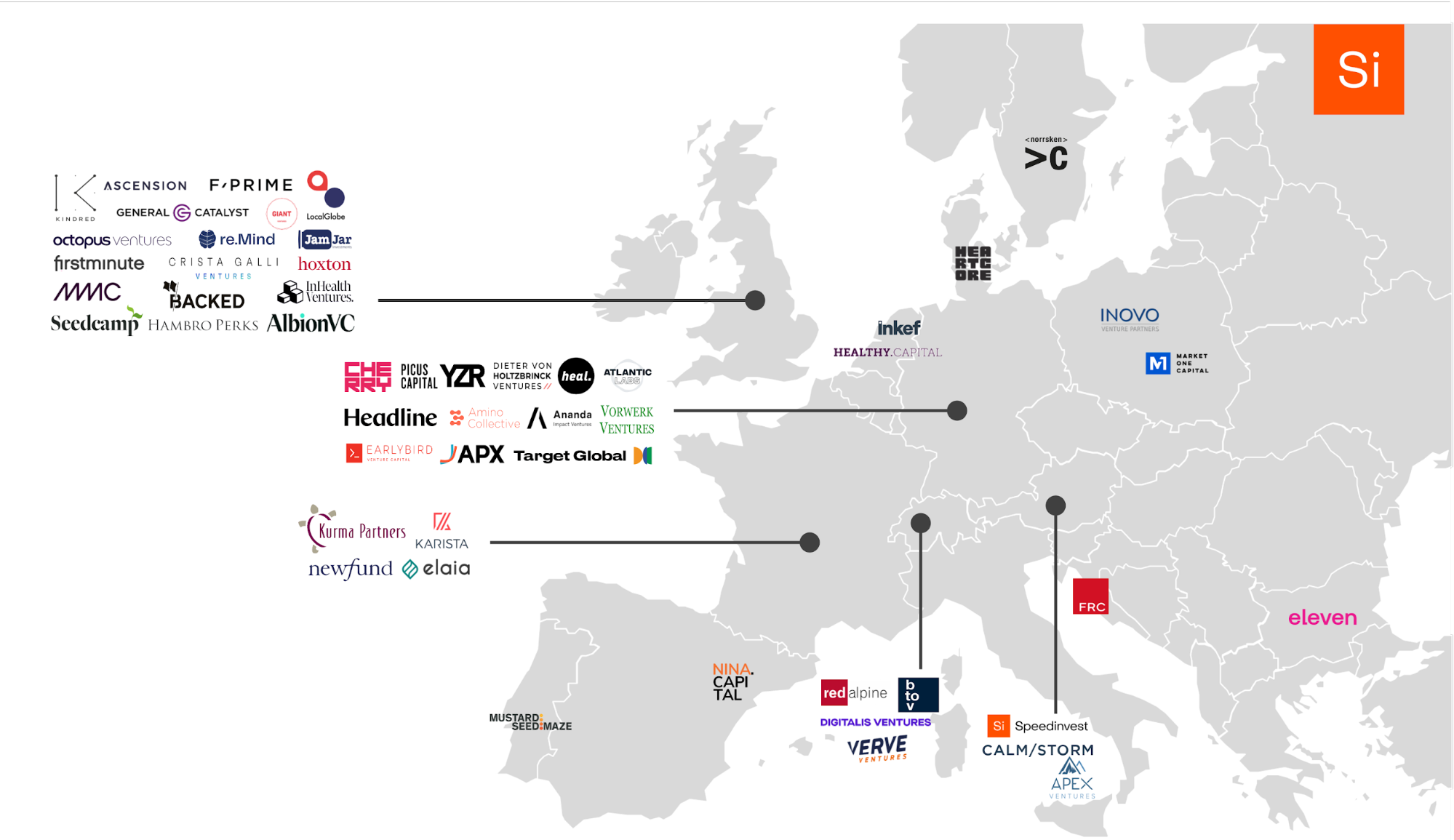

Venture capital funds in Europe are increasingly recognizing the potential of HealthTech and actively investing in the sector. The growing and maturing European digital health ecosystem has attracted the attention of VCs, who see the opportunities for innovation and disruption in healthcare. With emerging technologies and digital solutions, VCs are keen to support startups that address key healthcare challenges and improve patient outcomes.

Speedinvest is one of the most active venture capital funds in HealthTech in Europe. The firm has been at the forefront of supporting startups in the sector and has a strong track record of successful investments.

They also did a great job mapping the other ecosystem players in the map below.

Source: Top Early-Stage European Healthtech VC Funds — Speedinvest

HealthTech & MedTech Startups on SeedBlink

These promising startups have caught the attention of investors, demonstrating their potential for growth and disruption in their respective industries.

They have successfully raised a previous round of funding on the SeedBlink platform and are paving the way for innovative ideas to flourish in the competitive business landscape.

SanoPass

SanoPass is a Romanian healthcare and wellness startup that offers a platform for healthcare and fitness services and subscriptions for companies and individuals, connecting users to private clinics for preventive medicine and gyms.

SanoPass had an active round on SeedBlink in 2020 and 2021 and an exit in 2022. The exit occurred recently after the second investment closed. The investors in the first round made an honest exit: over 2x after two years, or those who invested in the second round had a much lower exit within a year of investing.

VoxiKids

VoxiKids offers digital products bringing together speech therapists and parents to benefit child recovery. VoxiKids is a virtual clinic dedicated to speech-language pathology which brings together speech therapists, parents, and children. It is a unique telemedicine product that provides speech therapists with everything they need to sustain their sessions in the office and online.

VoxiKids had an active round on SeedBlink in 2020, targeting €290.000. The round started with €115.000 pre-committed money and added €70.000 raised on our platform.

ORIGINi

ORIGINi (ex-Oncohain) is a software company that solves specific problems regarding medical data in Oncology. Its main objective is to empower oncology health professionals, cancer institutions, and pharmaceutical companies with structured clinical data captured in daily routine practice.

Oncochain had an active round in 2020, targeting €350.000 and closing at €370.000. The round started with €130.000 pre-committed money and added €220.000 raised through SeedBlink.

Medic Chat

Medic Chat is an application that allows anyone to get quick and easy access to health advice from a network of top doctors. The company believes that getting quality medical advice should be relatively easy as getting an Uber or booking a place with Airbnb.

MedicChat had an active round in 2020, targeting €250.000. The round started with €87.500 pre-committed money and added €187.500 raised on our platform.

Telios Care

Telios Care is a telemedicine and medical consultation platform that offers convenient access to medical services. The company's platform provides medical care from well-trained and dedicated doctors online or through telephonic consultation who constantly monitor the health by contacting back, enabling patients to save the cost and time of receiving a medication recommendation or routine medical treatment.

Telios Care had an active round in 2021, targeting €800.000. The round started with €765.000 pre-committed money and added €247.500 raised on our platform.

BRAINHERO

Brainhero is a home-based Neurofeedback therapy that allows you to train your brain playfully to assist in reducing and treating symptoms of ASD (Autism Spectrum Disorder) and ADHS (Attention Deficit Hyperactivity Disorder). Children can learn to control their brain activity by measuring brain waves with an EEG (=electroencephalogram)and visualizing them in an app.

Brainhero had an active round in 2022, targeting €1.350.000. The round started with €1.150.000 pre-committed money and added €433.000 raised on our platform.

PD Neurotechnology

PD Neurotechnology has developed a monitoring device designed to track every movement of patients who have Parkinson's disease. The company's device is a wearable, non-invasive device that helps in continuous monitoring, tracing, recording, and processing of a variety of symptoms, frequently presented in the disease through the constant use of the wearable device and a mobile app to facilitate patient-doctor interaction, enabling patients and healthcare providers to improve clinical decision-making and promote patient-physician interaction.

PD Neurotechnology had an active round in 2022, targeting €5.000.000. The round started with €4.500.000 pre-committed money and added €2.210.000 raised on our platform.

BIOPIX-T

BIOPIX-T is a certified designer and manufacturer of molecular diagnostic devices for the point of care. The company targets two healthcare-diagnostics-related markets by producing instruments and standardized assays for detecting and monitoring Infectious Diseases and Companion Diagnostics.

BIOPIX-T had an active round in 2022, targeting €600.000. The round started with €300.000 pre-committed money and added €142.500 raised on our platform.

Final Thoughts

The pandemic has brought about a paradigm shift in healthcare, accelerating technology adoption and presenting challenges and opportunities for HealthTech and MedTech startups. Investors actively seek opportunities in specific areas, including remote chronic disease management, pediatric super-apps, AI-powered digital therapeutics, preventative HealthTech for the elderly, and startups incentivizing patients to share their health data.

European venture capital funds are increasingly recognizing the potential of HealthTech and investing in the sector, contributing to the growth and maturation of the European digital health ecosystem.

Despite funding fluctuations, the HealthTech and MedTech industries remain attractive for investors, with promising startups shaping the future of healthcare delivery and medical innovations.

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.