SeedBlink Blog

all Things Equity

Unveiling Italy's Startup Scene: A Promising Journey of Growth and Innovation

Discover how Italy's startup ecosystem is gaining momentum, carving its path in the European tech landscape.

Italy's startup ecosystem is gaining momentum and showing promising signs of scaling as it carves its path in the global tech landscape.

As we delve deeper into Europe’s evolving startup ecosystems, we are taking a moment to explore Italy’s successes, growth areas, and untapped potential that lie ahead when it comes to the innovative ecosystem. During this journey, we examine the local ecosystem, major funding trends, and the secret sauce of Italy - beyond the plates.

Italy’s Strong Pillars

The Italian startup ecosystem is a relatively new but thriving and fast-growing one. This country has been steadily growing as a startup ecosystem in recent years, with several essential pillars contributing to its success.

Entrepreneurial Spirit.

Italy has a rich history of craftsmanship and entrepreneurship, especially for building high-quality leather goods to aerospace, from apparel to MedTech, and from AgroFood to Industrial. It provides a strong foundation for startup culture.

The country's entrepreneurial spirit has always supported innovation and risk-taking, fostering a vibrant startup ecosystem.

Strategic Location.

Even though the community is still underperforming compared to other European countries, it shows promising internal growth and progress.

Italy's strategic location in Europe provides easy access to markets within the European Union, facilitating trade and collaboration. Additionally, Italy is a gateway to Southern European markets, including those in North Africa and the Middle East.

The local startup ecosystem is ranked 15th in Western Europe and 30th globally and is among the most active European ecosystems, with +40 cities listed in the top 1000 startup hubs.

Quality of Life & Industry Specialization.

Italy is a globally recognized country for its excellence in various industries, including fashion, design, automotive, food and wine, manufacturing, and tourism.

Startups in these sectors can leverage Italy's expertise, access local resources, and tap into established networks to accelerate their growth.

Italy's Foodtech is in the top 19 in Western Europe, with a concentration of 138 of the region's total Foodtech startups.

Italy's high quality of life, cultural richness, and desirable living conditions make it an attractive destination for entrepreneurs. The country's diverse landscapes, culinary heritage, and vibrant arts scene contribute to a positive work-life balance, attracting talent worldwide.

The Italian startup ecosystem's main challenges are the institution of a more favorable regulatory environment to stimulate the birth of startups, more favorable tax policies, and greater involvement of the private sector and SMEs.

However, Italy also took some essential recent steps to support the Italian tech ecosystem, including the CDP Venture Capital and the National Startup and Innovation Fund.

The Startup Funding Landscape in Italy

Italy's startup ecosystem has impressive growth, with a combined enterprise value of $33 billion. Venture capital funding in the country has reached $1.7 billion this year, projected to grow by a spectacular 64% year on year, while European investment has seen a decline of approximately 9%.

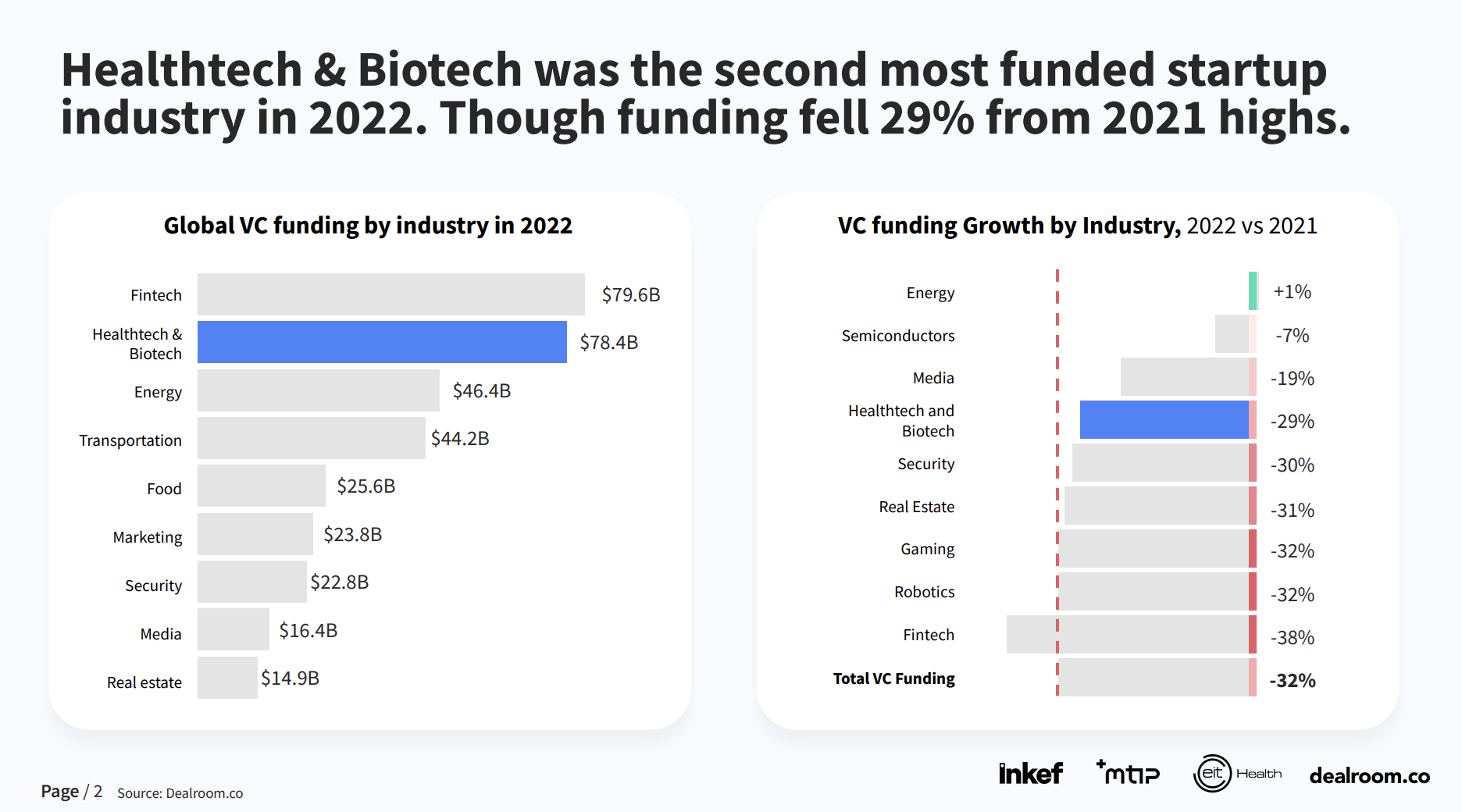

Italy's increasing startup funding levels and supportive environment demonstrate its potential as an attractive destination for entrepreneurs and investors. Notably, FinTech Health & Biotech sectors have attracted a significant share of funding, following the European trend, with Foodtech emerging as a leading sector for Italy.

Source: Dealroom & Italy Tech Week 2022

While Italy's startup ecosystem has made significant progress, it is important to note the most significant challenges. It includes bureaucracy, access to late-stage funding, and the need for further regulatory reforms.

The intricate administrative procedures and regulatory requirements often need to be revised for startups, slowing their growth and hindering their ability to operate efficiently. The Italian government's complicated bureaucracy, slow justice system, and cumbersome tax regulations are often cited as reasons why the country struggles to attract foreign investment and create jobs.

Another critical challenge lies in access to late-stage funding, a challenge also found in other European areas. While Italy has witnessed a surge in early-stage investments and angel funding, securing significant funding during the later stages of growth remains a hurdle for many startups.

Source: Italian Tech Scene Data

Per capita funding in Italy still needs to catch up to other European countries, with Italian startups raising only $18 per capita in the first half of 2022, compared to $750 in Estonia and $300 in the UK.

Source: Dealroom & Italy Tech Week 2022

Moreover, the country is yet to attract the attention of top European and international venture capital firms, signaling untapped investment opportunities and prompting startups to explore new strategies for securing funding.

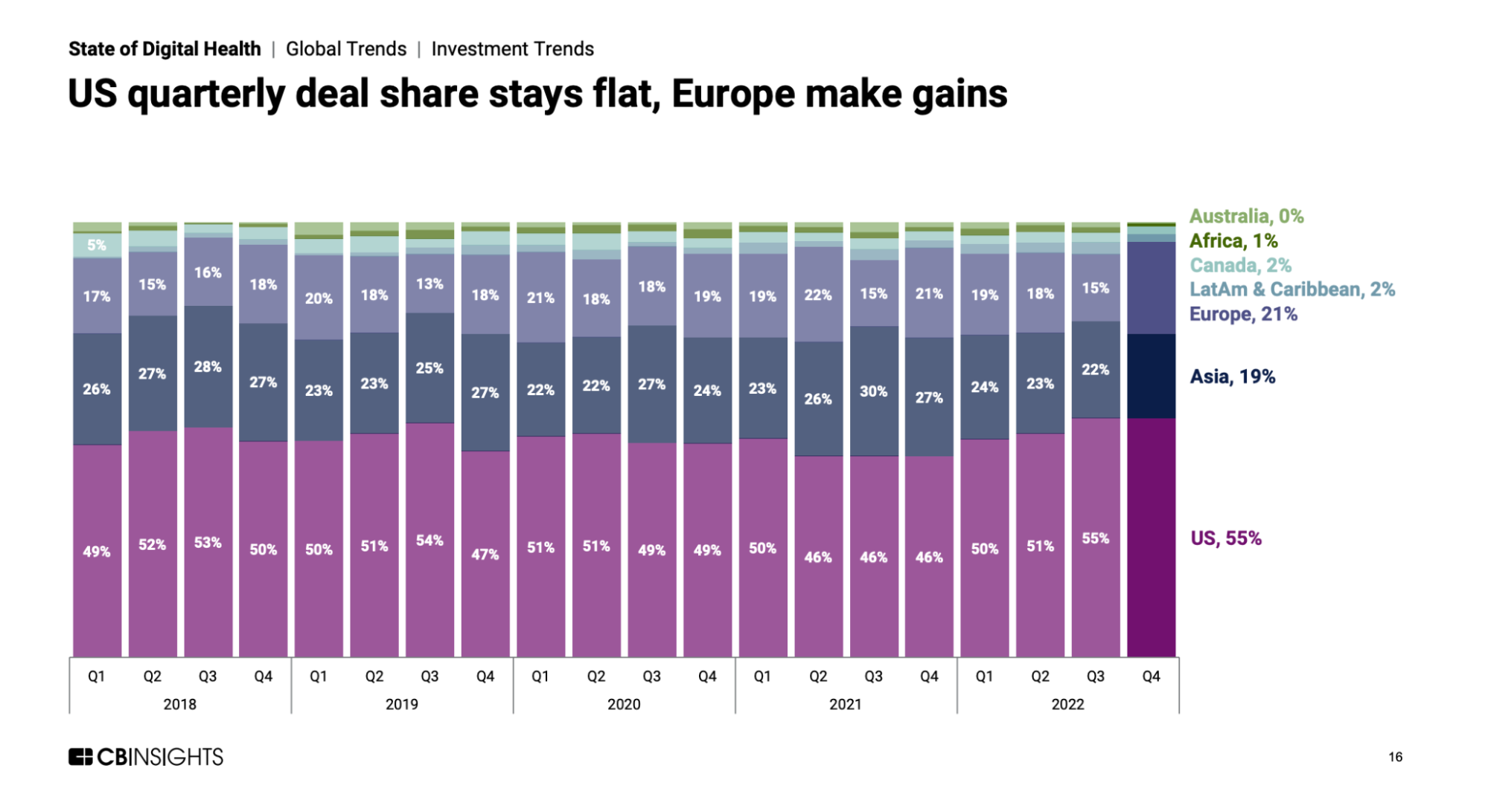

In 2022, the US fund activity surged by 14 percentage points, while Asian VCs surpassed a record 7% proportion of total financing in 2022. Domestic investment has dropped from 78% in 2016 to around 38% this year.

Source: Italian Tech Scene Data

In conclusion, Italy's startup ecosystem has experienced significant growth and evolution. Its annual solid GDP growth, improving ease of business, and complimentary internet and smartphone usage rates provide a solid foundation for startups.

Italy’s Major Startup Communities

Italy's growing startup ecosystem is propelled by its key communities and major cities that serve as thriving hubs for innovation and entrepreneurship.

From the bustling streets of Milan to the historic capital of Rome and the tech-savvy city of Turin, Italy offers a diverse range of startup communities that foster collaboration, networking, and knowledge sharing.

Milan

Milan is the financial capital of Italy and a leading startup hub. It offers a dynamic ecosystem with numerous accelerators, such as PoliHub and Impact Hub Milano, providing mentoring, networking, and funding opportunities.

Milan also hosts events like the Milan Digital Week, which bring together startups, investors, and industry experts. The city is home to major universities and research centers, including Politecnico di Milano, fostering collaboration and knowledge exchange.

Source: Italian Tech Scene Data

Rome

Rome has a thriving startup ecosystem supported by initiatives like Roma Startup and Lazio Innova. It offers accelerators like LVenture Group and Digital Magics, which provide support, resources, and access to funding.

Rome is known for its strong presence in the cultural and creative industries, creating opportunities for art, design, and tourism startups.

Turin

Turin is emerging as an important startup city in Italy.

It offers a supportive ecosystem with accelerators like I3P and Toolbox Coworking, providing mentorship, workspace, and funding opportunities. Turin is known for its expertise in the automotive industry, making it an ideal location for startups in mobility, smart manufacturing, and connected vehicles.

The city strongly focuses on sustainability, and in 2023, Turin will be the European capital of social and environmental impact finance.

Italy’s Most Funded Sectors

Italy's startup ecosystem has witnessed significant growth and funding across various sectors.

Fintech startups have attracted substantial funding in Italy, driven by the increasing demand for innovative financial solutions. These startups focus on digital banking, payment systems, peer-to-peer lending, and wealth management.

Source: Italian Tech Scene Data

The Healthtech and Biotech sectors have seen a surge in funding as startups aim to revolutionize healthcare delivery, diagnostics, and therapeutics. Italy has a strong tradition of medical excellence, and startups are leveraging advancements in technology and data analytics to drive innovation in these fields.

Italy's rich culinary tradition and agricultural heritage have fueled the growth of the FoodTech sector. Startups in this space focus on transforming the food industry through innovations in Agtech, Food Delivery, Sustainable Farming, and Alternative Protein Sources.

Italian venture capital funds

P101 — is a venture capital fund that primarily invests in early-stage companies, has over €220 million in assets under management, and has facilitated many extensive agreements like Poste Italiane and Campari.

LVenture Group — LVenture Group is a venture capital firm based in Rome, Italy. The firm prefers to invest in seed-stage and early-stage companies.

B Heroes — is a sector-agnostic venture capital firm focusing on investing in companies in the early stages of development with high scalability potential.

Milano Investment Partners — Founded in 2017, Milano Investment Partners is a venture capital firm based in Milan, Italy. The firm seeks to invest in consumer goods and lifestyle sectors.

United Ventures — is a large Italian venture capital fund created in 2013 that owns MoneyFarm and BrumBrum. It manages €300 million in assets across two early-stage funds and one growth-stage fund.

360 Capital — 360 Capital is a Venture Capital firm investing in early-stage, innovative deeptech & digital enterprises across Europe. The firm has a 20-year track record of supporting talented tech entrepreneurs in developing ambitious & disruptive companies in various sectors.

Unicorns & soonicorns of Italy

Italy gained its first two unicorns only last year, in 2022, both in the Fintech payments sector — Scalapay and Satispay. With the increasing adoption of digital payments and the need for flexible financing options, Scalapay Satispay has the opportunity to tap into a growing market.

Spotlight on Future Unicorns

After two successful rising unicorns, the local startup ecosystem got a new wave of motivation. Italy is witnessing the rise of several promising startups, especially from Fintech, that have the potential to become "soonicorns," and here are a few potential names from the list:

Nexi

Nexi, a leading Italian payment provider, has positioned itself as a strong contender for unicorn status. The company operates in the fintech sector and offers innovative digital payment solutions to businesses and consumers.

With a reported valuation of €8 billion and its successful initial public offering (IPO) in 2019, Nexi has demonstrated substantial growth and market potential. The company's strong position in the Italian market and its expansion into other European countries make it an exciting prospect for investors and a frontrunner in Italy's startup landscape.

Credimi

Credimi, a Milan-based fintech startup, has garnered attention for its invoice financing platform. The company leverages technology to provide fast and efficient financing solutions for small and medium-sized enterprises (SMEs).

Credimi's innovative approach and the growing demand for alternative financing options have contributed to its success. With a reported valuation of €400M and significant funding rounds, Credimi has shown promise as a potential soonicorn. Its focus on addressing the financing needs of SMEs positions it well in the Italian market and beyond.

Why invest in Italy

“Italians are exceptional when it comes to creativity and smart problem-solving. In addition, the VC ecosystem is very late compared to other European markets, so there are a lot of opportunities to invest early stage at relatively low valuations."

Says Francesco Profili, angel investor & AgriFoodTech Enthusiast.

“We find ourselves at a turning point in the Italian startup ecosystem, wherein investments in startups are experiencing significant growth year after year (from EUR 700M invested in 2020 to EUR 2B in 2022), while such growth is slowing down in other European contexts.

Historically, Italian entrepreneurs have been regarded as less ambitious than their counterparts in other countries, primarily due to the limited resources they have had at their disposal. The reality is that being an entrepreneur in Italy has been ten times more challenging than in other European contexts, and that is precisely why, in a market moment like the present one (where no one is freely giving away more money), Italian entrepreneurship can, with the support of a rapidly expanding ecosystem and a healthy dose of realism, foster the development of the next generation of European champions.

In addition, Italian entrepreneurial talent is increasingly emerging in deep tech sectors, thanks to an increased number of investments in this field, particularly in the realm of ecological transition. By leveraging our exceptional university foundation and highlighting our historical industrial backbone, Italian deep tech startups will be able to stand out in Europe and around the world in the next 3-5 years.

Despite being partially constrained by their country, we are witnessing a new generation of Italian entrepreneurs who still choose to establish their startups in Italy, aiming to introduce innovation and talent in our country and then export this model abroad.“

Says Lucrezia Lucotti, Associate at @360Capital.

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.