SeedBlink Blog

technology Trends

A New Era of Climate Consciousness: How Startups are Leading the Change in Sustainability

From renewable energy and sustainable agriculture to transportation and carbon capture and storage, climate tech startups are driving innovation and doing their part to support a more sustainable future. But is it the right time to invest?

Climate change is one of the most pressing issues facing our planet today, and technology has a critical role in addressing it. According to Techcrunch, the planet is warmer by 1.1°C and continues to rise. If this trend continues, we’re on track to hit 1.5°C — the “safe” limit set by the Paris Agreement — in the early 2030s.

This is one of the reasons why drastic changes are needed, and venture capital is tailor-made to tackle this type of problem.

In this article, we'll take a closer look at the rapidly evolving world of climate tech, exploring some of its essential components, how venture capital can have a definitive impact, and why it's an area worth investing in for a sustainable future.

What is Climate Tech?

Climate tech, also known as climate technology, refers to developing and deploying technology solutions to address climate change and reduce greenhouse gas emissions.

Climate tech encompasses various fields, including renewable energy, energy efficiency, carbon capture and storage, sustainable agriculture, and transportation.

Some of the key sectors within the climate tech industry include:

- Renewable energy - including solar, wind, hydro, and geothermal power, as well as energy storage solutions like batteries and hydrogen fuel cells.

- Energy efficiency - including technologies and solutions to reduce energy consumption and increase efficiency in buildings, industrial processes, and transportation.

- Carbon capture and storage - including capturing carbon dioxide emissions from industrial processes or power plants and storing them underground or elsewhere.

- Sustainable agriculture - including technologies and practices that reduce greenhouse gas emissions from agriculture, such as precision agriculture, sustainable land use, and organic farming.

- Transportation - including technologies and solutions aimed at reducing emissions from transportation, such as electric vehicles, fuel-efficient engines, and alternative fuels.

Climate Tech and Venture Capital

Climate tech is closely related to ESG, as many climate tech companies are focused on developing innovative solutions to address the environmental challenges facing the world today.

Climate tech funding worldwide in 2022 represented more than a quarter of every venture dollar invested in 2022, according to PwC’s State of Climate Tech 2022 report. By investing in climate tech startups, investors can align their portfolios with their ESG goals, supporting companies that positively impact the environment and promote sustainable practices.

However, more efforts are still needed. Despite such a high interest in climate change coming from investors, efforts are going in the wrong direction, says Techcrunch. Especially, since venture capital investors have the means to do it. Another report published by the International Energy Agency found that renewable energy investment needs to triple by 2030 to meet the goals of the Paris Agreement. The report highlights the urgent need for increased investment in renewable energy and other climate tech solutions to address the challenges of climate change.

Sustainability in Europe in 2022

Investment in climate tech has grown significantly in recent years as the urgent need to address climate change has become increasingly clear. Developing and deploying climate tech solutions are essential for achieving global climate goals and creating a sustainable future for generations.

Additionally, climate tech can lead to other market opportunities, such as job creation, especially during uncertain times. A report by the European Investment Bank found that investing in climate tech could create up to 3.5 million new jobs in Europe by 2030. The report highlights the potential of climate tech to drive economic growth and create new opportunities for businesses and workers.

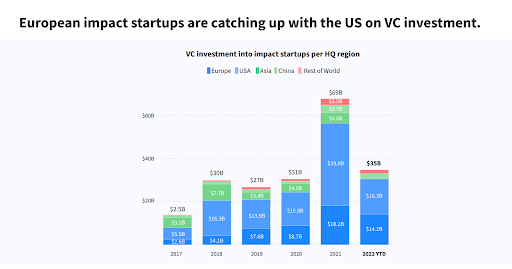

Source: Impact Startups 2022 — Dealroom report

In 2022, European startups with a keen focus on sustainability gained their momentum back, with startup investments reaching the US level, and being less impacted by uncertain times, compared to the US ecosystem. Right now, Europe has in its stable a total of 51 sustainable unicorns, of which 11 new unicorns entered in 2022.

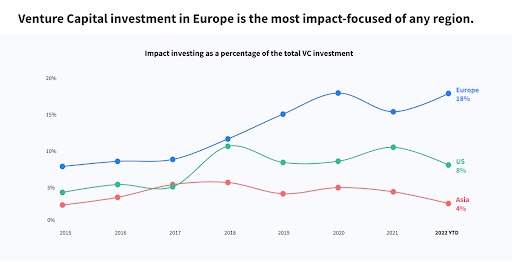

At the same time, if we look at the worldwide situation, Europe leads the way by having the highest interest in funding overall sustainable solutions all the time, even if they are not part of the Climate Tech sector.

Source: Impact Startups 2022 — Dealroom report

European Investors Betting on Climate Tech

Many European investors are actively investing in climate tech, and the investment landscape is rapidly evolving as more investors recognize the potential of climate tech solutions. Here are five of the top investors in this field:

- Speedinvest - a European venture capital firm that invests in early-stage startups across various industries, including technology, fintech, healthtech, and climate tech.

- Pale Blue Dot - a venture capital fund based in Mälmo that has made ten climate tech deals between 2021-2022. The climate-focused firm is investing from its first fund of €87m. It backs companies at the pre-seed and seed stage.

- Inven Capital - Inven Capital is a venture capital fund based in Prague that invests in early-stage startups developing technology solutions for energy, transportation, and smart city infrastructure. The fund focuses on sustainability and has invested in several European climate tech startups.

- Point Nine Capital - a venture capital firm based in Berlin that invests in early-stage startups across various industries, including climate tech. The firm has invested in several climate tech startups, including Solarisbank and Tado.

How are different industries approaching sustainability?

Climate tech involves using natural resources efficiently, reducing waste and pollution, and promoting social justice and equity. It has applications in various areas of human activity, including agriculture, energy production, transportation, architecture, and urban planning.

In this sector, we also have ESG, which stands for Environmental, Social, and Governance, which is a framework for evaluating a company's performance on sustainability and ethical criteria. Climate tech is closely related to ESG, as many climate tech companies are focused on developing innovative solutions to address the environmental challenges facing the world today.

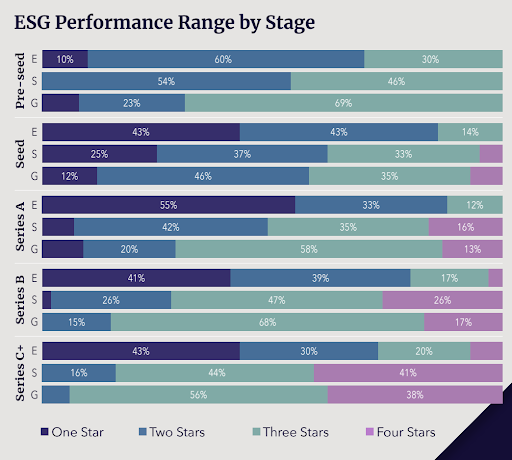

The efforts to increase the ESG performance in a startup tend to improve as companies grow, according to a recent report by ESG VC.

Source: Enabling Start-ups to Measure and Improve ESG Performance

ESG and climate tech are closely intertwined, with investors increasingly recognizing the value of investing in companies that prioritize sustainability and have a positive impact on the environment and society.

Let’s explore some of the main applications of sustainability in these sectors and find out a few startups doing wonders to drive a positive impact!

Climate Tech in Agriculture

European climate tech companies that are driving innovation and promoting sustainable agriculture practices. By developing and deploying technology solutions, these companies are helping to create a more sustainable and environmentally friendly agriculture industry.

European startups innovating agriculture:

- Agrieye — a startup based in Estonia that uses drone and satellite imagery to monitor crop health and optimize fertilizer application, helping farmers increase crop yields while reducing environmental impact.

- Physee — based in the Netherlands, has developed smart windows that generate electricity while reducing heat loss and glare, improving energy efficiency in greenhouses and reducing their carbon footprint.

Climate Tech in Transportation

The transportation industry is a significant contributor to global greenhouse gas emissions.

Many European climate tech startups are focused on developing solutions to reduce emissions and promote sustainable transportation practices. Here are some examples:

- Dott — a shared electric scooter company based in the Netherlands that aims to reduce car use in urban areas and promote sustainable transportation options.

- Volta Trucks - based in Sweden and the UK, has developed a range of electric trucks for urban delivery, helping to reduce emissions from commercial transportation.

Climate Tech in Architecture

- Solaxess - based in Switzerland, has developed a range of photovoltaic films that can be integrated into building facades and windows, providing a sustainable energy source for buildings.

- BIMobject — a cloud-based platform that allows architects and engineers to design and plan buildings more efficiently, reducing waste and improving sustainability.

Climate Tech in Urban Planning

Urban planning innovations reduce urbanization's environmental impact and positively create sustainable and livable cities.

These are two examples of European startups' innovating urban planning:

- Ecolytiq — a platform that uses AI and data analytics to monitor and reduce air pollution in urban areas, improving air quality and promoting sustainability.

- Cityzenith — a digital twin platform that allows urban planners to simulate and analyze the environmental impact of building and infrastructure projects, improving sustainability and reducing waste.

Sustainable startups raising funding through SeedBlink

CupLOOP

CupLOOP is a startup company based in Tallinn, Estonia, that offers advanced reverse vending machines that efficiently collect and refund deposits for reusable packages.

Their mission is to combat the growing issue of plastic waste pollution in the oceans and forests, ensuring a cleaner and healthier environment for future generations. Cuploop's technology ensures a speedy and hassle-free recycling process that benefits both the environment and the economy.

Cuploop has an active round on Seedblink, starting with 415.000 EUR pre-committed money and targeting a total investment of 615.000 EUR.

bonapp.eco

bonapp.eco is a Romanian startup that combats food waste. The company’s app connects users with local food retailers. Through the app, users can purchase food approaching its expiration date at a discount of up to 80%.

bonapp.eco’s mission is to turn the environmental, economic, and social challenges caused by food waste into a sustainable opportunity for the benefit of everyone.

bonapp. eco has an active round on Seedblink, starting with 165.000 EUR pre-committed money and targeting a total investment of 300.000 EUR.

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.