SeedBlink Blog

all Things Equity

Women in Venture Capital: Driving Change with Investment Power

The venture capital industry must embrace diversity and change. Female investors like Serena Williams are leading the charge. Discover why their efforts matter and how you can get involved.

Today, we are thrilled to celebrate powerful women in private equity and strong female entrepreneurs. As a testament to this, we wanted to shed light on women's amazing work in the startup investment world and why they still need more support to thrive in this ecosystem.

We’ll dive deep into this article by examining Serena William's mission of empowering more female founders and investors. Next step, we’ll continue by taking a step back and examining the current state of women active in venture capital firms and supporting women founders.

Serena Williams, the American professional tennis player ranked world no. one in singles by the Women’s Tennis Association, has joined the VC battlefield. Last year, she announced her possible retirement from the tennis world and the new mission of empowering females to embrace entrepreneurship through Serena Ventures. She was also joined by other family members, for example, Venus Williams, who recently joined the private equity company, Topspin.

The queen of the court joins the venture capital field

Serena has always had a strong passion for technology and how this has shaped our lives, encouraged throughout the years by discussions with her husband, Alexis Ohanian, co-founder of Reddit.

Starting in 2014, she gradually moved towards the startup world after opening Serena Ventures, a micro venture capital fund, with Alison Rapaport Stillman (a former JPMorgan employee). Serena started her career as an angel investor through her micro-VC firm and supported 60+ companies in nine years.

Earlier this year, Serena Ventures announced its inaugural fund of $111M and a clear mission to invest in founders who solve everyday problems through unconventional thinking and diverse points of view.

“I fell in love with the early stage, whether pre-seed funding, where you’re investing in just an idea or seed, where the idea has already been turned into a product. I wrote one of the very first checks for MasterClass. It’s one of 16 unicorns—companies valued at more than $1 billion.” mentioned Serena for Vogue.

Why is Serena betting on female founders?

The current portfolio of Serena Ventures shows +70& under-represented founders, such as +50% of female-led companies, +40& with black founders, and +10% Latino founders. The team is looking for founders with skin in the game and a strong passion for building a business powered by their unique experience.

But how did Serena end up taking such a bold mission on board?

Diversifying the venture capital game

During a JPMorgan conference, Serena Williams started investing in female founders after discovering that only 2% is going to businesses built by women in the United States. She started digging on this thread, confirming the numbers with industry professionals and facing the reality step by step.

“Seventy-eight percent of our portfolio happens to be companies started by women and people of color because that’s who we are.

On the other hand, my husband is white, and it’s important to me to be inclusive of everyone. Serena Ventures has been an all-female business until recently when we brought in our first guy - a diversity hire!” added Serena in the same Vogue editorial.

Using her personal brand to create an impact

After digging deeper into the startup world and understanding the real gender gap in the capital in this field, Serena realized she could use her image to fight for gender diversity. As we previously saw, she was already familiar with venture capital. She had been investing as an angel for nearly ten years and had an existing entity to attract more funds.

“I understood then and there that someone who looks like I needs to start writing the big checks. Sometimes like attracts like.

Men are writing those big checks to one another, and for us to change that, more people who look like me need to be in that position, giving money back to themselves.“

How does Serena’s action impact the startup community?

Serena is not the only one looking to support more female founders, as we will continue to see below. Different women-led businesses are taking place worldwide. And it's not the first time a highly influential person has joined the venture capital world, determined to bring a change.

However, when people like Serena step up in the game, the potential impact she could bring is bigger due to her community. More people are talking about it, and more people are being inspired to follow the same path. Serena has the courage and the will to motivate people, which could attract other industry professionals.

Besides creating a powerful circle and attracting more people to fight for this mission, Serena could increase those by 2%. This will bring more diversity to the venture landscape, creating new dynamics.

Women in venture capital in CEE - where we are

The initial reports released by the European Women in VC highlighted some of the main challenges women have faced in the past years. With less than 1% going to women-founded startups in Central and Eastern Europe and less than 1% of capital managed by all-women GP teams, we’ve seen flat progress and the need for more active players in this area.

In 2021, the CEE region went through a flourishing period where the venture capital scene saw record-breaking growth and success stories that investors could only dream of. There were +100B EUR invested in European startups, +100 unicorns, and a strong path for 2022. However, this massive growth barely affects the funding gap for females active in the startup world.

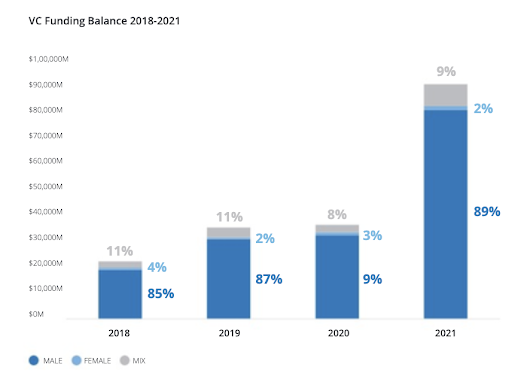

The percentage of investments was slightly better, going from less than 1% to 1.8% and 9.3% to mixed-gender founding teams, according to the latest European Women in VC report for 2021. The progress continues to be flat, and things are changing slowly. Joining the world of venture capitalists has become more attractive, and we are seeing more females in junior positions. However, according to the same report, levelling up your career in this world is a tough challenge. The employment pyramid is steep, and women drop off more often on their way to a higher level.

Things could look better if we turn our gaze over those startups funded by females in venture capital or led by mixed teams. The number is stagnating and even decreasing over time.

Source: The startup landscape - Gender Inequality persists in Europe (Women in VC report for 2021)

There is a major barrier to bringing more diversity to the tech sector of the venture capital industry. The European Commission calls “investor homophily” one of the main causes of fighting this reality. The attraction to similarity makes people invest in those familiar to them.

So, it is clear why male partners manage nearly all the capital since +90% of partners in VC funds are men.

“We need more women in leadership positions and more female check writers.

Investing in women makes sense because they delivered good returns over the capital invested. Women have been proven to generate more revenue for every euro invested than male teams. Divers teams outperform, and females deliver better exits.”

Says Kinga Stanislawska, General Partner and Founder of Experior Venture Fund.

Top European women you should follow

We have seen how things are going and where we stand. Now it’s time to see who is constantly trying to create change in this sector. Below, we’ve prepared a list of European female investors and dedicated initiatives for female founders.

These are just some of the main ones we identified, but we are looking to update the list. So, please let us know if anyone else should be highlighted!

European female investors

Despite being considered a minority in Europe, the female presence in the startup investments world has a strong community. There are nearly 200+ angel investors active, with another 200+ active in venture capital funds across different cities as founding partners, managing directors, or other key decision-maker roles. Some of the most prominent female vc names we see in Europe are

- Sophia Bendz - Angel investor since 2012 and currently Partner at Cheery Ventures, a German-based fund for early-stage startups.

- Helena Torras - One of the most active investors in Spain and one of the most influential women in the venture capital world. She is also the Managing Partner at Paocapital and actively supports pre-seed companies.

- Reshma Sohoni - The Managing Partner of Seedcamp, the fund that invested in recent hot European success stories, such as UiPath, Wise, Revolut, and Hopin.

- Irina Haivas - Partner at Atomico and passionate about digital work, technology for healthcare, and enterprise automation. Irina is looking for tech startups with a bold mission in this area.

- Inka Mero - Managing Partner at Voima Ventures and actively supports the Finland startup ecosystem.

- Ewa Chronowska - Partner at Next Road Ventures and CEO of Vestbee, a community platform for early-stage investors.

In Eastern Europe, several noteworthy women investors actively support female founders in many countries. Romania, Poland, and Hungary are just some of these standing out with a great women entrepreneurs and investors community.

Here is a brief list of some of these inspiring ladies.

- Ilinca Paun - Founder of Bravva Angels, a community of business angels investing in early-stage start-ups by female founders and mixed teams.

- Carmen Sebe - CEO of SeedBlink and intensely involved in the entrepreneurial world as an investor, advisor, and mentor, working with technology start-ups to achieve success.

- Kinga Stanislawska - General Partner and co-founder of Experior Venture Fund, a leading VC fund in Warsaw and the first European one to be managed by women.

- Veronika Pistyur - General Partner at Oktogon Ventures, the CEO of Bridge Budapest, and one of the early key players in Hungarian’s ecosystem. Veronika also took us on a little tour that you can discover here.

- Diana Koziarska - Partner at SMOK Ventures, the US/Polish venture capital fund that recently announced its plans to invest in Fund II across the region. Borys Musielak, a Managing Partner, was our guest to share more about Poland’s community and SMOK plans for the near future.

- Terezia Jacova - Investment Manager at Neulogy Ventures, the first Slovakian-based venture capital fund focused on early-stage investments.

- Elina Halatcheva - Co-founder and Managing Partner at BrightCap Ventures, a Bulgarian venture capital fund focused on seed and Series A investments in the tech sector.

- Tatjana Zabasu Mikuž - Co-founder and Managing Partner of South Central Ventures, a VC fund focused on early-stage startups primarily active in the Balkan region.

European startup programs for female founders

In the past years, we’ve seen more female-led initiatives or activities aiming to improve their presence in the startup world. We tried to encapsulate a list containing some of these startup programs to make it more accessible.

- GROW F - a startup program started by a group of female founders in Austria in 2019 who opens its doors twice a year. The program accepts early-stage startups that have at least one female founder on the team.

- The Google for startups Female Founder program - an initiative started by Google for Startups UK, in 2019, as a six-week program focusing on mentoring, networking, and using Google instruments to help early-stage startups grow.

- The Venture City - is an initiative launched by Laura González-Estéfani and Clara Bullrich, two influential women aiming to bring more transparency and diversity to the technology world. It’s not a program dedicated to female founders, but each new batch of startups usually counts +20% of female founders.

- Reaktor X - likeThe Venture City program, Reaktor X is an initiative brought to life in 2017 by Diana Koziarska and Borys Musielak from SMOK Ventures. The program is not 100% dedicated to female founders, but more than half of the ones joining have at least one female founder on their team.

Other female-led initiatives

Let's go beyond the traditional startup programs targeting the next generation of female founders. We’ll discover a series of other initiatives supporting the startup ecosystem and its female founders in different ways, from fundraising, education, mentorship, and many other resources. Some of the most well-known initiatives are:

- Female Founders - the Austrian community dedicated to founders, entrepreneurial leaders, investors, and operators actively supporting ladies who build a business.

- European Women in VC - European Women in VC is the community of senior women investors (Managing Partners and founders of VC funds and Business Angels) that currently brings together over 350 women from all over Europe. It is a joint initiative of women from seven countries (Poland, Czechia, Bulgaria, Ukraine, Estonia, Slovenia, and Hungary).

- Girls Just Wanna Have Funds - is a thorough guide to investing coming out at the end of this year and launched by Camilla Falkenberg, Anna-Sophie Hartvigsen, and Emma Due Bitz, owning the community having the same name. The trio is well known for winning the biggest startup competition, joining Y Combinator, and launching the Danish bestseller Ready. Set. Invest., in 2021.

Our SeedBlink community has +70K investors from 71 countries, where female investors represent +40%. Among the group of most active investors, 26% of those are females.

What are your thoughts? How will the funding landscape change to reflect less in favour of men and create a more balanced community?

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.