SeedBlink Blog

all Things Equity

Unlocking Bulgaria's Potential: How the Startup Ecosystem is Fueling the Country's Future

Bulgaria's startup ecosystem is rapidly gaining attention for its innovation, growth, and potential. The country's strategic location, highly educated workforce, and supportive government policies have helped create a vibrant community of entrepreneurs, investors, and accelerators driving growth and innovation.

The Bulgarian startup ecosystem is a growing and dynamic community home to several innovative and successful companies.

On March 3rd, Bulgaria celebrates its National Day. We would like to take this opportunity to emphasize the local ecosystem and explain why we think Bulgarian entrepreneurs should be on your radar for investment because we have a great deal of respect for the nation at the heart of the Balkans.

Bulgaria’s key strong pillars

The Bulgarian startup ecosystem is still in its early stages of development. Still, it has a strong foundation and many promising startups attracting attention and investment worldwide. With continued growth and support, it has the potential to become a major player in the global tech industry.

Here are some key features and characteristics of the Bulgarian startup ecosystem:

- Location: Bulgaria is strategically located at the crossroads of Europe and Asia, which provides easy access to markets in both regions. The country is also a member of the European Union, which provides access to EU funding and resources.

- Education: Bulgaria has a strong tradition of science and technology education, with many universities and technical schools offering high-quality programs in fields such as engineering, computer science, and mathematics.

- Talent: The Bulgarian startup ecosystem benefits from a highly skilled and educated workforce, with many young people choosing to pursue careers in technology and entrepreneurship.

- Government support: The Bulgarian government has taken steps to support the growth of the startup ecosystem, including creating programs and funding opportunities for startups and providing tax incentives for investors and entrepreneurs.

- Accelerators and incubators: Bulgaria has many accelerators and incubators that provide support and resources for early-stage startups, including funding, mentorship, and workspace.

- Funding: The Bulgarian startup ecosystem is still developing its funding infrastructure, but there are a growing number of venture capital firms, angel investors, and crowdfunding platforms that are supporting the growth of the ecosystem.

- Strong industries & sectors: The Bulgarian startup ecosystem has strengths in some areas, including fintech, cybersecurity, health tech, and e-commerce, among others.

A snapshot of the startup funding landscape in Bulgaria

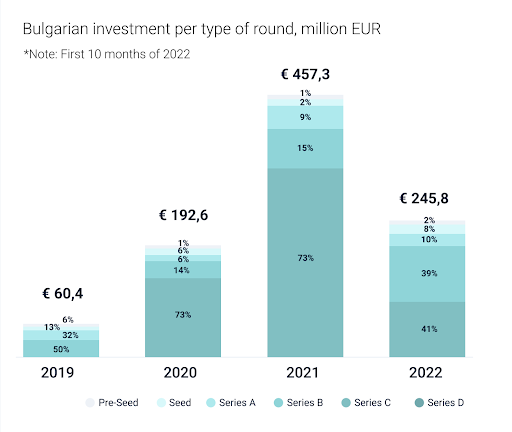

- 2x more rounds in 2021 and 2022 compared to the previous years, despite the recession, bringing the country's untapped potential to the surface.

- Pre-seed and Seed rounds took 20% of the total level of funding in 2022.

- Series C and Series D take most of the shares from the total funding, showing that local startups are growing and the ecosystem is maturing.

- Series A and funding rounds for early-stage companies, such as Pre-seed and Seed, present the highest growth in the level of funding received in 2022.

Here is a quick overview of the Bulgarian investment performance over the past years, analyzed in the SeedBlink 3 Years Report launched in December 2022.

Source: SeedBlink Annual Report

Bulgaria is currently a high-performing investment hub in CEE and is attracting the interest of both regional and international investors. Sofia, Varna, and Plovdiv are the countries' main startup cities. Organizations such as BVCA - Bulgarian Venture Capital Association, BESCO - The Bulgarian Startup Association, and Endeavor Bulgaria support the activity within these local ecosystems.

Let’s continue diving deeper into Bulgaria’s investment landscape by taking a quick look at the major investors in the country.

Bulgarian venture capital funds

Bulgaria has a new wave of funds from all CEE countries that emerged since 2012, with the highest amount raised in 2022. The country is also leading with a high number of local-based VC funds compared to other countries in the region, according to a recent report published by Dealroom & BVCA.

These are just a few examples of VCs actively investing in local startups and the CEE region.

- Eleven Ventures - One of Bulgaria's most active early-stage VC funds, investing in software, mobile, cloud computing, digital media, and consumer internet startups.

- LAUNCHub Ventures - A seed and early-stage venture capital fund investing in Central and Eastern Europe technology startups, focusing on Bulgaria, Romania, and Greece.

- Neveq Ventures - A venture capital fund investing in technology companies at all stages of development, from seed to growth, across a range of sectors.

- Morningside Hill - A seed-stage venture capital fund investing in Bulgarian and Southeastern European startups in software, consumer internet, and digital media.

- BlackPeak Capital - A venture capital fund investing in technology startups in the CEE region, focusing on Bulgaria, Romania, and Serbia.

Bulgarian angel investors

Bulgaria has a growing community of active angel investors in startups. The CEO Angels Club gathered most of them under the same table for better cooperation, but there are also a few smaller angel networks. Here are a few examples of angel investors, part of Telerik Mafia or having a strong portfolio of investments:

- Vassil Terziev - A Bulgarian entrepreneur and angel investor who co-founded Telerik, a software development company acquired by Progress Software in 2014. Terziev is also the co-founder of Eleven Ventures, a leading Bulgarian venture capital fund.

- Svetozar Georgiev - An angel investor and co-founder of Telerik, which was acquired by Progress Software in 2014. Georgiev is also the founder of Telerik Academy, a software development school in Bulgaria.

- Ivo Evgeniev - An angel investor and co-founder of the software development company BULPROS. Evgeniev has invested in several Bulgarian startups in software, digital media, and e-commerce.

- Lyuben Belov - An angel investor and founder of the Bulgarian startup accelerator LaunchHub. Belov has invested in several early-stage startups in Bulgaria and the wider CEE region.

- Alexander Lefterov - An angel investor and founder of a local Bulgarian startup accelerator. Lefterov has invested in several Bulgarian startups in fintech, e-commerce, and digital media.

- Ivan Vachkov - An angel investor and co-founder of Eleven Ventures. Vachkov has invested in several Bulgarian startups in software, mobile, and consumer internet.

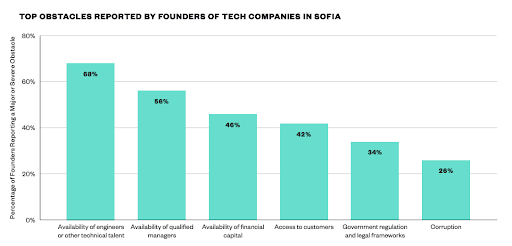

What do Bulgarian founders need to scale? According to Endeavor’s Insights Report analyzing the tech sector in Sofia, in 2022, a series of obstacles are still blocking Bulgaria’s potential.

Source: Mapping Sofia Tech Sector - Endeavor Insights Report

Access to technical and leadership talent, especially in finding great software engineers, was the most common challenge mentioned by more than half of the interviewees. While Bulgaria and many countries in Eastern Europe are well recognized for the tech talent coming out of local universities, the new dynamics of the region fostering a fast-growth community highlighted an increasing demand.

For managerial skills, the challenge is even more difficult because for some roles, such as product, marketing, or sales, the need is quite fresh on the market, and people don’t have the chance to nurture their skills.

SeedBlink’s impact in Bulgaria

SeedBlink opened its first international office in Bulgaria in March 2022 and, in approximately one year, managed to mobilize 1% of the total level of funding invested in the local ecosystem and have the following:

- €26.9M funding volume mobilized.

- €1.65M invested already in Bulgarian companies.

- ≤ 33% of each round covered by the SeedBlink community of investors.

- €4.600 is the average investment ticket for Bulgarian rounds.

- 3 Bulgarian investment opportunities, that were supported by international investors, with 10% being Bulgarian investors.

“Currently, there is no digital investment alternative in the Bulgarian market. SeedBlink’s digital solution fills a niche by playing a complementary role to any VC or business angels club.

For Bulgarian investors who are not LPs in a venture fund, SeedBlink makes it easier for them to access a class of assets that would otherwise be off-limits, namely private enterprises. Conversely, when raising capital via SeedBlink’s network of investors, Bulgarian startups will achieve far more than merely cash access: a network of individuals ready to support their growth ambitions.”

Says Angel Hadijev, Country Manager - SeedBlink Bulgaria

Unicorns & soonicorns of Bulgaria

Current unicorns in Bulgaria

The country counts seven unicorn companies: Telerik, Payhawk, smsbump, botron, LEANPLUM, FITE, and SiteGround. The most resounding success stories in the tech ecosystem came from Telerik and Payhawk. Payhawk - a Bulgarian fintech company, became a unicorn in March 2022 after raising $100M in a round led by the Silicon Valley-based VC Lightspeed Venture Partners. The successful path of the company attracted the eyes of many investors over the local ecosystem and founders who are more motivated to build their ideas.

Local investors think these successful examples bring the country's untapped potential to the surface and activate a flywheel effect to support a new generation of startups.

“The success of companies such as Payhawk or GTMhub is creating a wave of positive effects, and the co-founders of those companies are willing to invest back in other founders.”

Success stories create a network effect to power up local ecosystems.”

Says Ivaylo Simov, Managing Partner at Eleven Ventures.

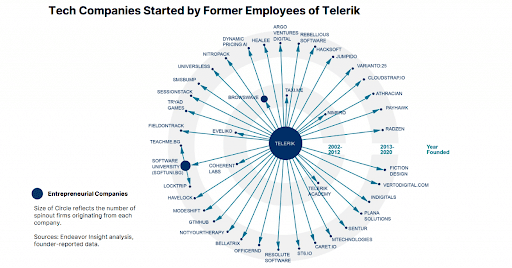

A solid testimonial from Telerik - the software company acquired by Progress and the biggest startup exit in Bulgaria. The company's co-founders and multiple employees became a new generation of startup founders and investors supporting the ecosystem, similar to the Paypal Mafia effect.

Source: Mapping Sofia Tech Sector - Endeavor Insights Report

Who are the next unicorns?

Bulgaria has a growing startup ecosystem with several promising companies that could potentially become unicorns, which are startups with a valuation of over $1 billion. Here are other examples of Bulgarian companies showing potential to become unicorns:

- Gtmhub - Gtmhub (now Quantive) is a software company that provides OKR (Objectives and Key Results) management software to help businesses set and achieve their goals. The company closed a $120 million funding round in December 2021 and works with major brands such as Skyscanner, Tesco, and Virgin Media.

- Dronamics - a Bulgarian startup that is focused on developing and deploying a drone-based transportation network for transporting cargo. The company have been rapidly growing in recent years, raised a significant amount of funding, and is on a positive track to becoming one of the next unicorns in the country.

- AYO - AYO is a health tech company that develops light-based wearable devices that help users improve their sleep, energy, and overall well-being. The company has raised over $10 million in funding and is expanding globally.

- Endurosat - Endurosat is a Bulgarian space technology company that designs and manufactures small satellites and satellite components. Endurosat has been recognized as a global small satellite industry leader and has won several awards for its innovative technology and products. The company has also partnered with several international space organizations and companies, including the European Space Agency (ESA), NASA, and SpaceX, to develop and launch its satellites.

Why invest in Bulgaria

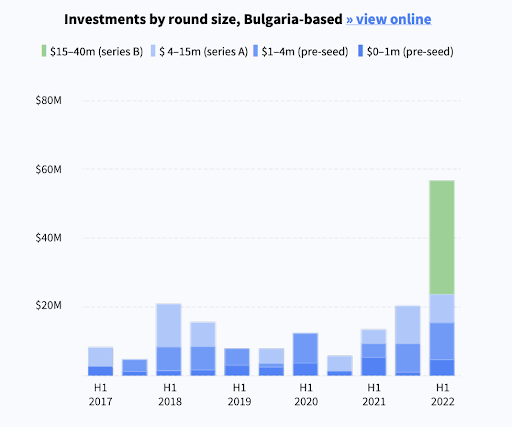

The Bulgarian investment ecosystem today has gained maturity. The number of large rounds from local VCs is increasing; however, there is still a strong lack of capital for late-stage funding.

Source: SEE Report - Dealroom & BVCA

Access to capital was among the top challenges raised by Bulgarian founders in Endeavor’s report, so Bulgaria needs a higher funding power. There are several active venture capital funds in Sofia investing in early-stage startups, and The CEO Angels Club — the largest angel network of investors counts +100 members. Still, the local community lacks funding for follow-on rounds.

The need for more follow-on capital is even more critical as the country now has multiple tech companies ready to scale. With a funding gap, founders were forced to look for support in other countries, which in some cases is difficult to raise, as those interviewees by Endeavor reported.

After regional success stories such as UiPath in Romania and Payhawk in Bulgaria, international investors became more interested in CEE. For example, Bogomil Balkansky, Partner at Sequoia Capital, had stated in an interview for The Recursive team that:

“Before UiPath became a hugely successful public company, we had a lot of explaining to do, and many investors didn’t even know where Romania or Bulgaria is.

But now, there is an awareness that something interesting is happening in both countries. That accomplishment is amazing for the Payhawk team and the entire venture ecosystem.”

What SeedBlink investors community thinks?

“Bulgaria had a head start compared to other countries in the region because they dared to launch something very early. The other reason is that we, as investors, supported many early-stage companies.

This created a network effect over the years and will continue to do so.”

Says Ivalyo Simov, Managing Partner — Eleven Ventures.

“We need more success stories to show the younger generation of entrepreneurs and those already growing that there is hope for their startups.

We believe anything is possible, and you can have your next unicorn right here, in Bulgaria, not in Silicon Valley.”

Says Elena Nikolova, Community Manager — The CEO Angels Club.

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.