SeedBlink Blog

all Things Equity

MarTech - Vertical Overview

MarTech is a crowded landscape with thousands of existing solutions, yet untapped potential for growth in Europe.

The marketing technology industry is a sector worth nearly $350B worldwide.

Today, this industry encapsulates a wide range of solutions supporting a marketing campaign's success. With brands and agencies adopting the digital world faster and embracing innovation as never before, the market has been booming for years.

In this article, we'll navigate through the essential elements describing the marketing technology sector in Europe and how it has evolved. We'll start at ground zero, looking at the meaning of MarTech, its core differences compared to other industries, and who are the key leaders to follow.

What is MarTech — marketing technology?

MarTech is also known as the marketing technology infrastructure communication, and marketing professionals use it to plan, execute, and measure their campaigns. Many MarTech tools are automating or simplifying tedious tasks that take a lot of time or involve multiple people, who can slow the process.

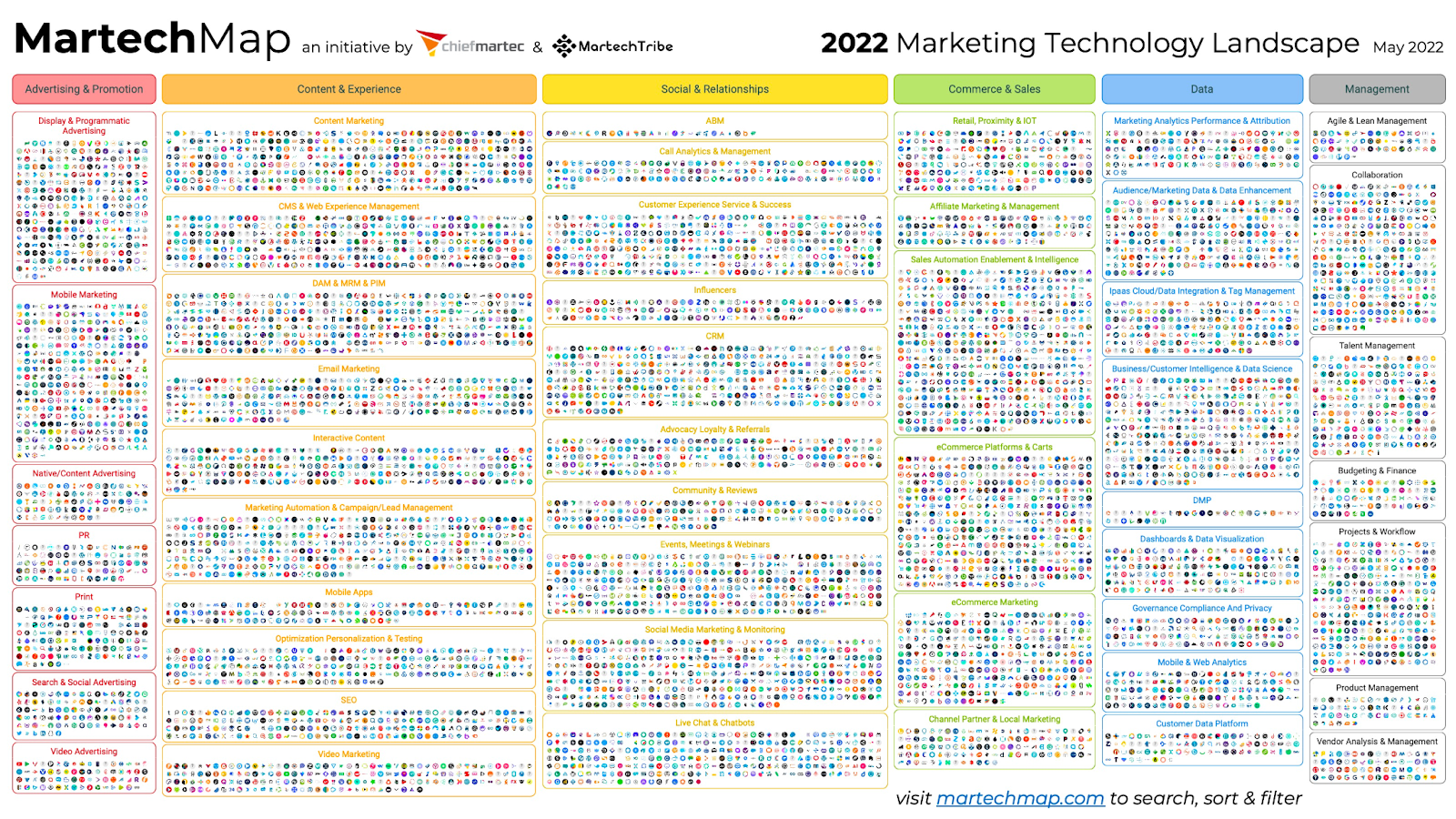

As we previously saw, MarTech is an industry worth almost $350B that owns 26.6% of the total marketing budget worldwide. Marketers worldwide are putting a strong focus on advertising and promotion, looking to automate more processes and simplify their way of work. The world of MarTech started to get the shape of the market around 2011, counting 150 solutions worldwide then. Today, we have 9,000+ solutions available to industry professionals, which is constantly growing.

This is what the current MarTech landscape looks like:

Source: Martech Map - May 2022

The state of MarTech in 2022

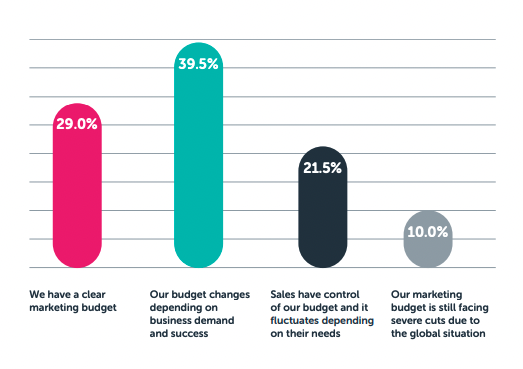

COVID-19 was the most significant influence in the past two years, significantly impacting the marketing budget companies were spending. Industry professionals say that their budget approvals are more tied to marketing campaigns' success than ever.

Source: The state of MarTech report 2021

Despite facing complex challenges during the pandemic, 73.5% of companies worldwide plan to maintain or increase their marketing budgets. So, marketing technologies are still driving revenue generation opportunities for companies and proving their worth.

The number of investments and deals shows a dense year of activity in 2021, including a few important acquisitions.

- Salesforce acquired Slack for $27.7B.

- Intuit acquired MailChimp for $12B.

- Twilio acquired Segment for $3.2B, and Zipwhip for $850M.

- Citrix acquired Wrike for $2.2B.

However, the US is not the only country counting the success of the growing ecosystem. Europe has a few notable startups that are having good momentum right now. There are 20 countries with a lot of activity in the MarTech sector, with the UK (1,179 startups), Germany (761 startups), and France (439 startups) being on top of the list.

Source: Top 10 Marketing Technology Startups in Europe

Compared to the American landscape, Europe still has a lot of room for innovation in this area, with more startups entering the league from other industries and new marketing budgets to spend.

Let's discover the most prominent ecosystem players in this part of the world and who you should watch!

Hopin is a virtual event management solution that has skyrocketed in investments and expansion since COVID-19. The company has raised $1B so far, bringing thousands of events on its platform during the two pandemic years and expanding its features map to support them.

MessageBird, a cloud-based solution from the Netherlands, simplifies client communication using various media, such as SMS, email, voice, WhatsApp, WeChat, Instagram Direct, and more. The company has raised $1.1B so far and continues to expand in other markets.

Contentful is a content management solution for enterprise teams, allowing marketing teams to publish their content across multiple channels, integrate third-party tools, launch new digital products, and build new content channels. The company raised $349.6M until right now and added notable brands to its portfolios, such as Danone, Atlassian, Vodafone, Notion, and many others.

Typeform is a no-code SaaS platform for creating forms, polls, surveys, tests, and quizzes that makes form building a pleasure for both the creator and the end-user. The company managed to take the place of existing market leaders and expand successfully worldwide.

ProductLead, a Romanian-born MarTech startup building a digital platform for content creation, has raised 600K EUR in 2021 and is currently expanding across other European countries. The company aims in gradually take over new markets, starting with Eastern Europe and following with DACH and Nordics.

Among the European investors supporting this industry sector, we have seen venture capital companies, such as Global Founders Capita, Hiventures, High-Tech Grunderfonds, Technology Development Fund, and Crowdcube.

MarTech startups who raised funding through SeedBlink

Cartloop

Cartloop — a conversational marketing tool that helps brands drive 31% extra revenue from abandoned carts in e-commerce. The platform uses real-time text conversations, offering support and product recommendations and giving customers the personal "shopping assistant" experience.

Cartloop had an active round in 2020, targeting 100.000 EUR and closing at 1888.150 EUR. The round started with 20.000 EUR pre-committed money and added 80.000 EUR raised through SeedBlink.

Hunch

Hunch is the automated creative production and media buying platform that empowers brands and agencies to grow on paid social.

Hunch Insights had an active round in 2022, targeting 3.000.000 EUR and closing at 3.055.000 EUR. The round started with 2.500.000 EUR pre-committed money and added 500.000 EUR raised through SeedBlink.

Eventmix

Eventmix — is an easy-to-use, all-in-one self-service white-label platform for virtual and hybrid events that gives organizers all the tools they need to run events under their brand. Eventmix focuses on the mid-market segment of smaller corporates, which was left significantly underserved.

Eventmix had an active round in 2021, targeting 500.000 EUR and closing at 667.500 EUR. The round started with 250.000 EUR pre-committed money and added 250.000 EUR raised through SeedBlink.

Oveit

Oveit - is a ticketing and cashless payment shopping solution. The company's vision is a world where consumers are identified and rewarded for shopping in both online and offline environments, from retail to entertainment experiences (shoptainment).

Oveit had an active round in 2021, targeting 500.000 EUR and closing at the funding target. The round started with 100.000 EUR pre-committed money and added 400.000 EUR raised through SeedBlink.

Innertrends

Innertrends - a product analytics solution with pre-built reports that use data science algorithms to help subscription-based businesses spot revenue generation opportunities. InnerTrends is offered as a SaaS product with a freemium business model that allows product teams to identify growth blockers, find pain points automatically, and understand their context.

InnerTrends had an active round in 2021, targeting 345.000 EUR and closing exactly at the funding target. The round started with 110.000 EUR pre-committed money and added 235.000 EUR raised through SeedBlink.

SeedBlink's community of MarTech startups continues to grow as more solutions start to be developed in Europe, and their campaign goes live on the platform. Keep an eye out for new investment opportunities, and create your investor profile today!

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.