SeedBlink Blog

all Things Equity

The Rise of the Digital Retail Investors and Their Revolution

The retail investor revolution took over the world of investments aiming to democratize the power of individuals. Let's discover what you should know about it!

The retail investor revolution is a global phenomenon already and took the world over after Reddit's community r/wallstreetbets rushed to invest over GameStop. These events powered by individual people are supported by the ongoing development of new digital trading and investment tools to bring more transparency and democratize this sector.

In this article, you will find a short guide to help you look at this new phenomenon and understand its most essential elements. You'll be going through the new concepts formed, what made them stick, who created this trend, and how the market is changing its shape around it.

What is a retail investor?

Retail investors are individual people, amateur or professional, who actively invest their money and assets, just like professional investors do. A significant difference between traditional institutional investors and retail is that this new category uses its own money. Retail investors run their investments through dedicated platforms that ease their processes, such as Robinhood, or who use the financial services of a professional advisor.

The past two years have seen a series of events that supported the growth of individual investors across the world. Two years of pandemics made people think more about how they use money and make smarter decisions for their future. Many of those people started to invest, and new technology products entering the market are empowering the trend on a global scale.

United Fintech defines the common traits in the profile of this new breed of investors as a young person, under 35, a new entrant in the stock market, with a wide range of experience levels, who primarily buy and sell trades in the equity and bond markets, and who invest smaller amounts than regular institutional investors.

This retail investor uses social media and internet sources as its central place of research, is willing to take higher risks than a traditional investor, and has greater freedom to run experiments.

However, not everything is as good as it looks, and an investor's recommendation is to take everything with a pinch of salt. The main reasons to be aware before making a decision based on this trend are:

- You have more accessible and open access to resources and learning, but we need time to process and understand these fully as human beings.

- Companies are still developing the trading technology behind platforms aiming to decentralize the investment area.

- The investment market in this area is not fully regulated, which might lead to different actors taking different advantages of your investments.

- Last but not least — as in all areas of investments, there are some risks, and you better conduct a thorough due diligence process before taking an impulsive decision.

What is the retail investor revolution?

The retail investor revolution is a recent phenomenon from recent years where small investors proved to have more power over traditional ones, especially when social media communities empower them.

The case of GameStop powered by the r/wallstreetbets subreddit is probably one of the early examples supported by social media that proved what type of impact they have. Adding this to the continuous development of mobile trading apps that continue to make online investments simple and accessible to everyone contributed more to the appearance of this revolution.

Financial Times describes this as a mushrooming boom taking over the world and happening in different places, such as online communities, forums, subreddits, and even audio rooms on Clubhouse. People are learning more about the untapped potential of their money and becoming more tech-savvy in using investment and trading apps.

They embraced retail trading and personal wealth management and are exploring all the opportunities they have to improve it at the individual level. So, this is slowly contributing to the global democratization of capital markets.

The growth of the retail investor revolution

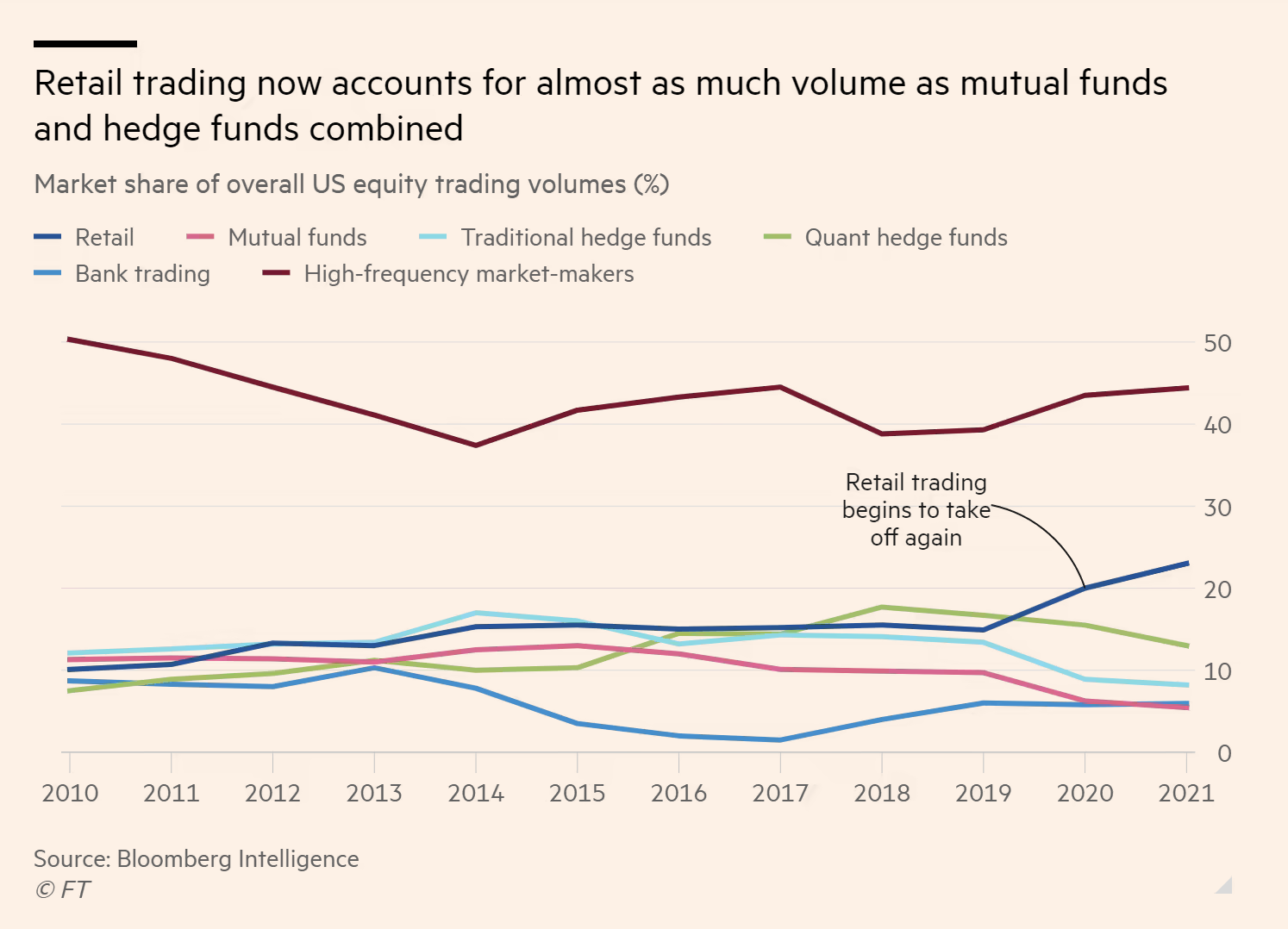

Source: Rise of the retail army: the amateur traders transforming markets__

Today, the question is about what gave more power to those individual investors to create a retail army?

Robinhood was the early support that made investment tickets more accessible to everyone. For example, with Robinhood, you have an average account size of $3,500, compared to $100,000 on E-trade and $240,000 with Charles Schwab. On top of this, retail investors proved to have more courage in uncertain industries and areas for risky investments than institutional investors. Their boldness paid off in many cases helping them have a more significant impact on the market and even making retail investing even more attractive in front of experienced investors.

How meme stock was born

You often see memes around the internet, but you have never thought they will become a robust stock or a cryptocurrency like Dogecoin?

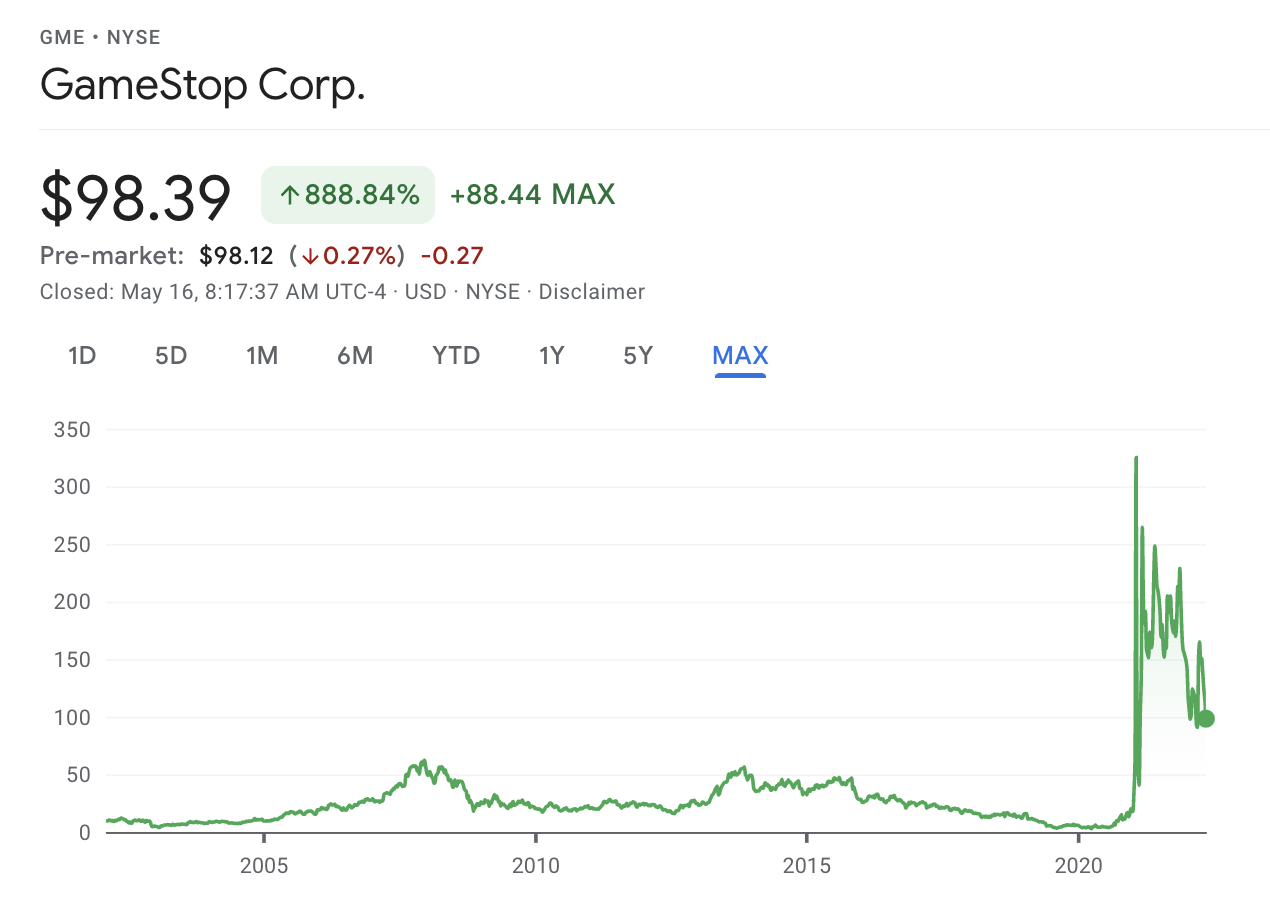

GME — The first meme stock that came to life was connected to the GameStop event mentioned earlier and described in more detail below. In the summer of 2020, Keith Gill, an active member of the subreddit r/wallstreetbets, posted a video explaining that the stock of GameStop Corp had the highest short interest in the market, many short positions being held by hedge funds. Keith knew that in case of a massive short squeeze, the stocks would be taken higher.

After that, Ryan Cohen, an individual investor, purchased a series of GME stocks to own a 10% share in the company and make the stock's value go back to $20. What Keith Gill suggested in his video came to life at the beginning of next year, when GameStop's shares reached a value of $500. This made hedge funds panic and shut down due to the multiple heavy losses.

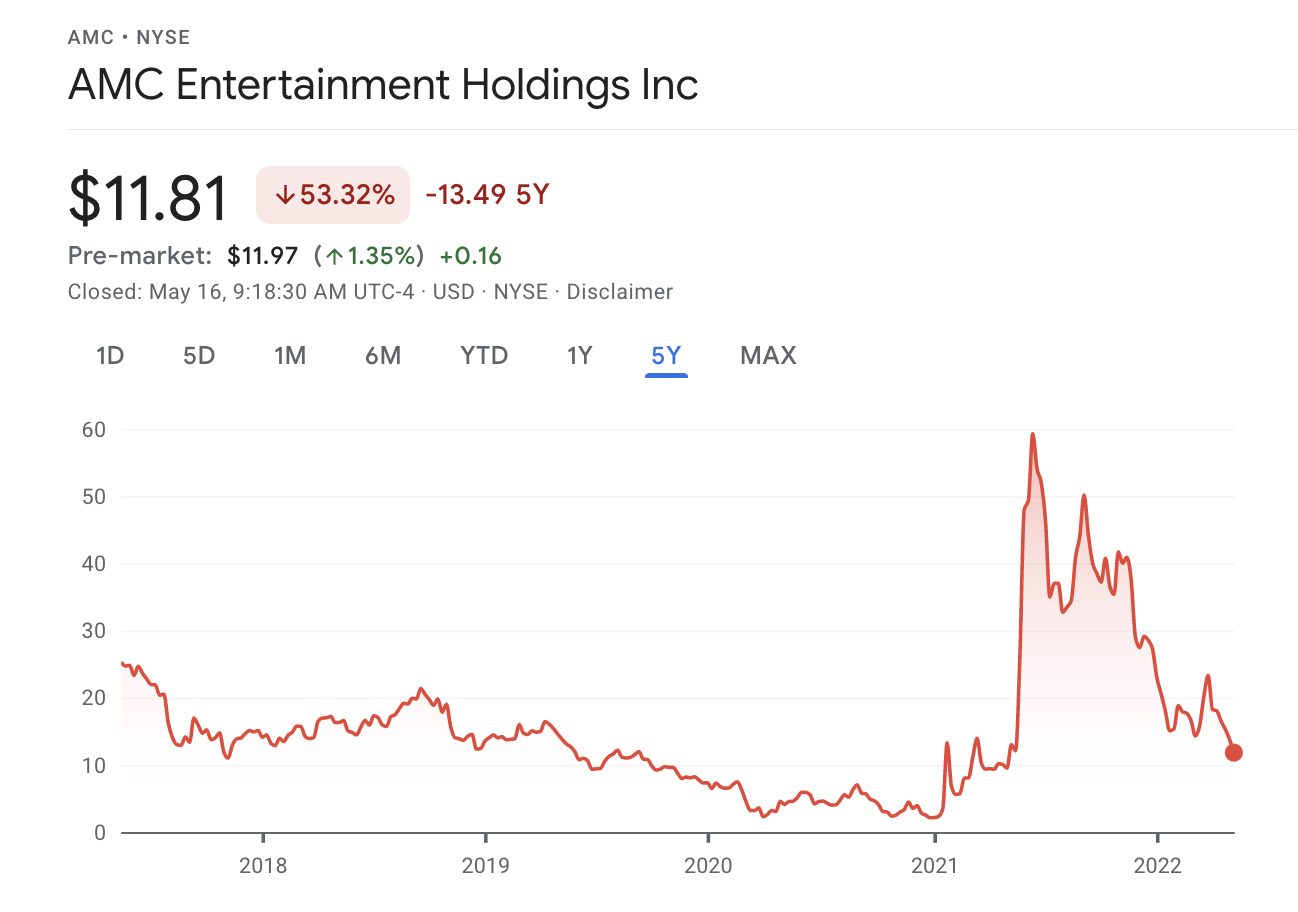

Right after GameStop's first meme stock, r/wallstreetbets found other cases to follow, such as AMC — AMC Entertainment Holding, BB — Blackberry Limited, BBY — Bed Bath & Beyond Inc., or HOOD — the one for Robinhood Markets Inc.

GameStop and Reddit’s /wallstreetbets

GameStop (GME) was the largest video game and entertainment software with thousands of retail stores worldwide. However, their financial activity started to underperform before last year, having their stock price decrease from $28 to less than $3 per share.

As you previously saw earlier, one active member of the r/wallstreetbets spotted this volatility and formed an entire online community where individuals started to invest in GME and launch a short squeeze. This made the stock value hit a value of $500 per share and nearly bankrupt Melvin Capital, the hedge fund with the largest position in the company.

Source: GameStop stock price history via Google Finance__

AMC Entertainment

Source: AMC Entertainment stock price history via Google Finance__

A similar situation to what happened with GameStop also applied to the AMC — AMC Entertainment company, which faced bankruptcy and has its stock value below $2 at the end of 2020. AMC Entertainment is a U.S. cinema chain that was also spotted by the r/wallstreetbets community, who decided to rescue it, making its stock value go up to close to $59 in June 2021.

This race of retail investors, mainly powered by r/wallstreetbets, is at the centre of this global phenomenon, attracting more attention to their side, even from high profiles, such as Elon Musk. Individual investors offered their help to Elon in Twitter's take-over negotiations.

The Benefits of The Retail Investor Revolution

There is a constant conversation over this global phenomenon and how its series of events will continue to shape investments and the stock market.

Let's see some of the highlights from the positive outcomes so far!

- Investment markets and processes are disrupted by new perspectives and technologies that can bring this sector closed to individual people.

- Investors get more and more access to essential information that directly impacts their investments.

- The industry has more transparency, giving more data and more financial statements that are easier to find than before.

- Commission rates perceived by new investment platforms are decreasing, and investors are getting a lower fee that encourages them to invest more.

However, the retail investor revolution is not only rainbows and sunshine because this made both investors and institutions realize there is still much work to be done. Financial markets need more input from regulators to improve their current activities, and retail investors have the right to take any action against toxic restrictions.

What's left for you as an investor to do?

Stay connected to what happens, try to learn and understand the state of events, see how the market is changing, and see how you can protect your portfolio of investments.

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.