SeedBlink Blog

technology Trends

Navigating regulations, investments and key trends in Europe’s AI

Exploring Europe's AI trends - how the continent navigates through evolving regulation, funding, ethical debates, and critical challenges.

Europe is stepping into the AI spotlight with a bold mix of innovation and new regulations. The European Union has published the world’s first comprehensive AI law, the EU AI Act, designed to set clear rules for high-risk systems and generative models.

While these regulations aim to ensure transparency and safety, they also spark debates about whether strict rules might slow down European startups compared to their US counterparts.

This article explores the key trends shaping Europe’s AI future, from evolving regulations and major funding initiatives to the rise of generative AI, healthcare innovations, and Europe’s urgent need for AI-specific chips. The article is Part 2 of our AI deep-dive series, featuring European investment trends and success stories.

The paradox between the need for accelerated innovation and strict regulations

The European policy environment plays a significant role in AI development and investment.

The European Union has established a comprehensive regulatory framework for AI through the EU AI Act, which became the world's first broad AI law when it was officially adopted in March, 2024. The regulation entered into force on August 1, 2024, with implementation rolling out in phases over the next two years. More concretely, the first obligations regarding prohibited AI systems and general-purpose AI models took effect in August 2024, while most other provisions will apply starting August 2025 and February 2026.

The EU AI Act imposes specific rules, especially on higher-risk systems and generative AI models. For example, providers of generative AI in Europe will be required to meet transparency standards (disclosing AI-generated content, training data usage, etc.) and assess and mitigate risks for very large models.

However, the EU’s wide-ranging AI Act, currently the world's most comprehensive set of AI rules, may soon undergo a “fitness check” to ensure it remains true to its purpose. Critics argue that stringent regulations could make it harder for European startups to compete against US firms.

This tension was recently noticed when Dutch unicorn Bird, having raised over $1B from investors such as Atomico and Accel, announced plans to relocate most of its operations outside Europe. Bird cited AI regulations as a barrier to “true innovation.”

Another significant aspect is that the EU Commission is working to simplify its regulatory framework, scrapping some burdensome proposals and exploring a unified “28th regime” designed to create a startup-friendly environment akin to Delaware in the United States. This would apply to all startups, not just AI-focused.

Europe's multi-billion euro AI investment initiative

Europe is backing up its AI ambitions with major public funding and strategies. The EU’s Digital Europe program has earmarked €2.1 B specifically for AI development from 2021 to 2027, and the Horizon Europe research program also funds AI projects.

In early 2025, a coalition of European investors and companies launched a proposal to mobilize €150 B for European AI startups over five years – an initiative supported by industry leaders (from Deutsche Bank to Spotify to France’s Mistral AI) to supercharge the continent’s AI scale-ups.

National governments are complementing EU efforts with their own AI policies. In France, French President Emmanuel Macron announced a major initiative at the Paris AI Action Summit: a €109B commitment to data center infrastructure. Over 60 companies have joined the EU AI Champions Initiative, pledging an additional €150B in investments over the next five years.

The European Union also topped this with an additional €50B as part of its new mission to sharpen European competitiveness. Similarly, Spain’s government has rolled out €150 M in new subsidies to help companies integrate AI into business and industry.

These efforts have visible effects over the European ecosystem, and Europe is counting an impressive number of AI startups raising funds and including several unicorns. Here are some European success stories that show how European AI startups are attracting substantial capital.

- Helsing (Germany) - AI defense software startup focused on autonomous military systems and decision support. Valued around $5.4 B after a €450M (~$489M) funding round in 2024, making it one of Europe’s most valuable AI pure-plays. Helsing’s AI is used to enhance drone and fighter jet capabilities, reflecting a trend toward defense and security applications of AI.

- DataSnipper (Netherlands) – An AI-driven document automation startup from Amsterdam. DataSnipper’s Excel-integrated AI tool for audit and finance caught on globally, and in 2024, it raised $100 M at a $1 B valuation. It became the Netherlands’ first AI unicorn, showing that smaller European ecosystems now produce world-class AI companies (in this case, specializing in financial process automation).

- Mistral AI (France) – A Paris-based AI startup specializing in open-source large language models. Founded in 2023 by former researchers from Meta and Google's DeepMind, Mistral AI quickly gained prominence for its innovative approach to AI accessibility. In June 2024, the company secured a €600 M Series B funding round, elevating its valuation to €5.8 B. This rapid ascent underscores France's burgeoning role in the global AI landscape, demonstrating how European startups can swiftly scale and challenge established industry players.

- Poolside AI (France) – A Paris-based AI startup focused on streamlining software development for engineering teams. Poolside AI develops advanced AI-powered tools designed to enhance coding efficiency, automate repetitive programming tasks, and support developers in writing and debugging software. In 2024, the company raised $400M in funding from top investors, including BCV, DST Global, Bpifrance, and Felicis Ventures. This substantial investment underscores the growing appetite for AI-driven solutions in software engineering, positioning Poolside AI as a key player in the rapidly evolving AI-assisted coding landscape.

Generative AI: the new gold rush in European tech funding?

Generative AI funding in Europe has already surpassed yearly records within just six months, indicating strong investor interest in model makers and proprietary application developers. Additionally, European companies spent $2.8B on GenAI tools in 2024, under half the $6B in the US.

Source: AI Europe Report by Dealroom

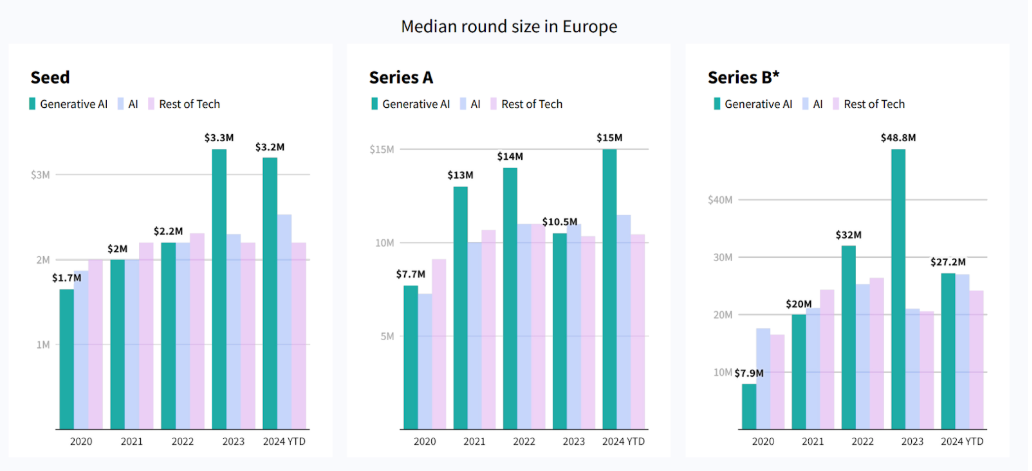

The numbers show that generative AI consistently attracts higher median round sizes than conventional AI and non-AI sectors at every stage, from Seed to Series B. The data indicates that generative AI funding surged notably in 2024, with early-stage rounds surpassing previous years.

This pattern suggests that investors are paying a premium on generative AI solutions, reflecting the technology’s rapid evolution and the market’s growing appetite for cutting-edge AI innovations.

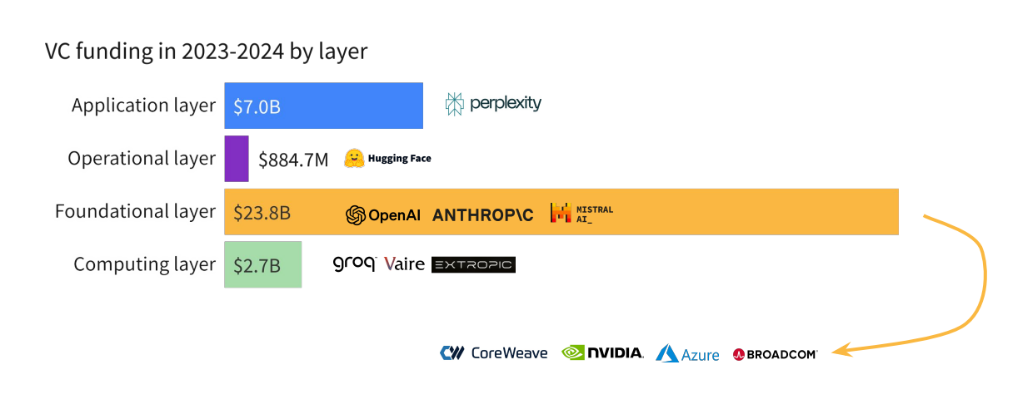

Although most generative AI startups operate at the application layer (comprising over a thousand companies), the bulk of venture funding in 2023–2024 has flowed into the foundational layer, reaching a total of $24B, far outpacing the $7 B allocated to application-level ventures.

The dynamic shows how foundational layer startups, like OpenAI and Anthropic, attract large investments, which they then channel into computing capacity from established chip and cloud providers.

Source: State of AI investing - Dealroom

Consequently, while many GenAI companies focus on end-user applications, the core infrastructure and research-driven players continue to command the lion’s share of capital.

Europe's critical hardware challenge in the AI race: more chips needed

Specialized chips are the power source behind advanced AI models like ChatGPT, Claude, and Grok. Major US tech companies have announced substantial investments in AI infrastructure, with Google planning to invest $75B, Microsoft $80B, and Meta up to $65B in chips and data centers.

In Europe, there is a heavy reliance on chips from a few US firms, primarily Nvidia, along with AMD and Intel, with Nvidia’s GPUs, which are essential for processing vast amounts of data required for AI.

Due to strong global demand and geopolitical factors, the US has imposed export restrictions on Nvidia chips. Western European countries generally face fewer limitations than Eastern European nations. This has created challenges for European startups, which often encounter extensive export control documentation.

While Europe is home to semiconductor specialists like ASML, Infineon, and STMicroelectronics, these companies cannot compete with Nvidia's capabilities.

The next opportunities for AI founders

Are you an AI startup eager to scale and looking for funding? Check out SeedBlink’s offering, from syndicated investments from your own network to strategic fundraising advice.

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.