SeedBlink Blog

all Things Equity

Navigating the European VC Valuations Market: Key Findings from Pitchbook's Q1 2023 Report

The report reveals that the market was cooler regarding flatter valuations and more challenging funding conditions. Still, some promising trends, such as resilient acquisition activity and improving exit valuations, indicates there is still hope and resilience.

The European VC Valuations Report by Pitchbook is out and shows contrasting trends for the rest of the year.

To help you navigate these trends, we've summarized the key takeaways from the report and what they mean for our community.

Key findings for angel investors & VCs

1. Find hidden potential in new ideas with lower valuations.

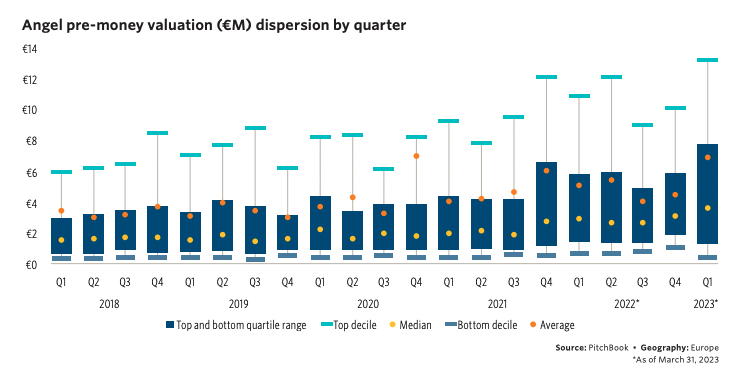

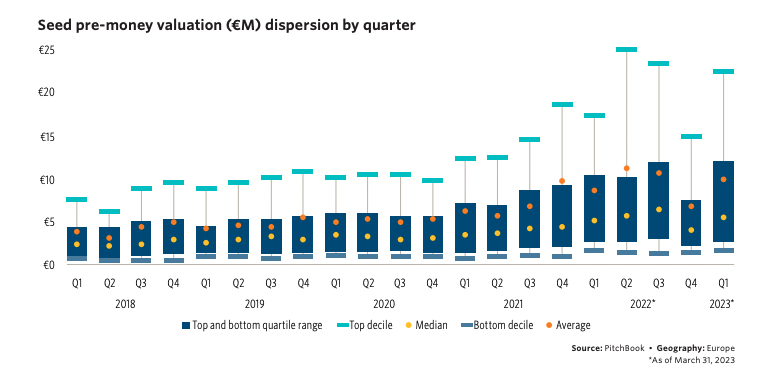

In Q1 2023, the average value of investments made by angel investors was €3.7M vs €3.0M in 2022. This could be because fewer deals were made in the quarter, and larger rounds were publicized.

Uber and Airbnb were launched during market downturns, inspiring founders to seek capital for their new ideas. So, angel investors may invest in brand-new ideas with lower valuations with solid potential to get better returns.

2. Near-Term Liquidity Becomes a Priority

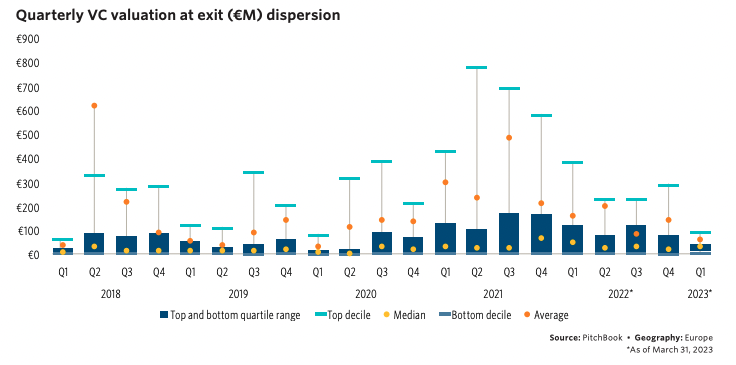

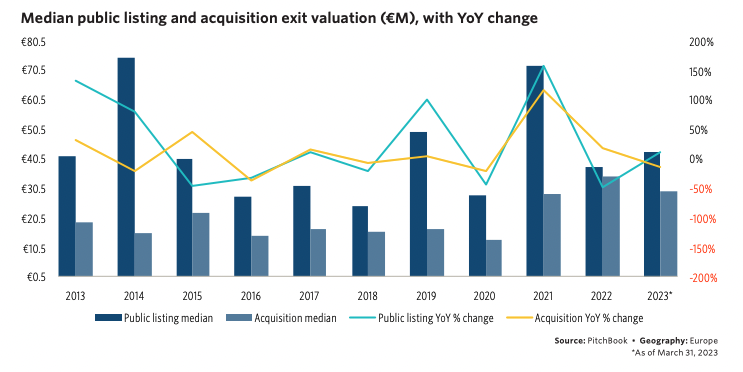

The Q1 2023 European VC Valuations Report shows a mixed picture of Europe's exit valuations and acquisition activity. While exit valuations decreased 34.8% YoY, acquisition activity was resilient, with a threefold increase in median valuation to €29.6 million.

Public listings were subdued, with a 47.1% sequential decline in valuations, although there are signs of recovery YoY. Corporate entities with scale and balance sheet firepower are in an excellent position to capitalize on buying opportunities.

This highlights the need for near-term liquidity for investors as it may become increasingly difficult for them to realize returns on their investments through exits in the public markets.

As a result, investors may need to seek alternative exit strategies or prioritize investments with near-term liquidity opportunities, such as those more likely to be acquired by corporate entities. SeedBlink addresses early liquidity for its community of investors through its secondary market. Here, investors can sell the shares they possess from their SeedBlink portfolio.

This may also require investors to closely monitor their portfolio companies and assess their ability to weather market downturns and maintain their valuation, which may affect their ability to secure follow-on funding and realize exits.

3. Fintech Stays The Most Invested Sector.

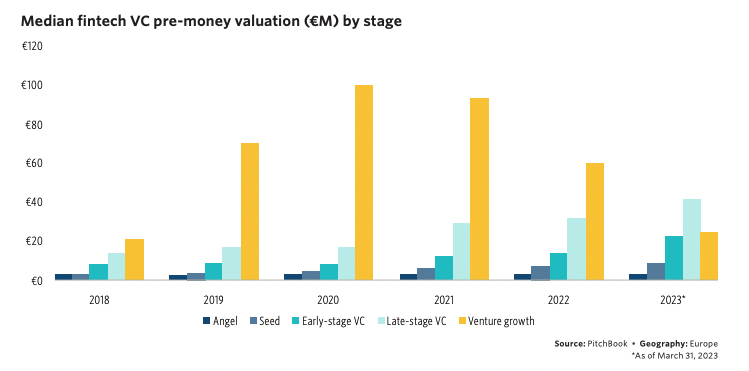

Fintech has been among the top sector preferences for European investors in recent years. In 2022, this industry sector was the number one trending in Europe, according to SeedBlink's Three Years Report.

Pitchbook's Q1 2023 European Report reveals the sector to continue on top. Here, we notice that the median early-stage Fintech pre-money valuations and deal sizes are rising, with valuations pacing above the 2022 figure.

However, despite this apparent resilience in deal activity, there are still challenges ahead for the industry amid rising interest rates.

4. VC valuations decrease. Angel & Seed Stages Increase in Benelux.

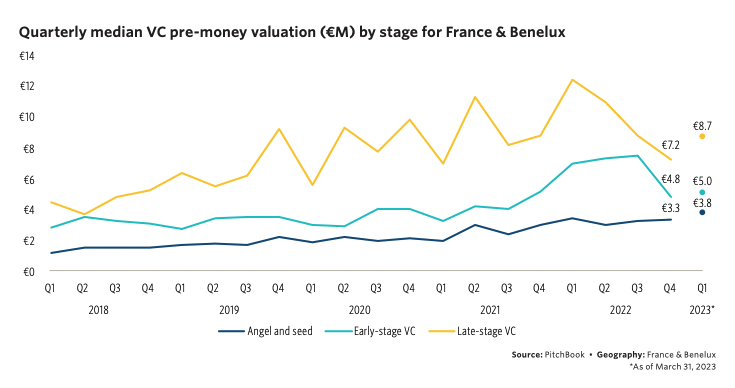

According to the report, valuations in France & Benelux have decreased for both early and late-stage pre-money valuations in Q1 2023, down by 28.6% and 30.1% YoY, respectively.

Only angel and seed stages have shown an increase in valuations to €3.8 million compared to Q1 2022's €3.5 million.

Key findings for founders

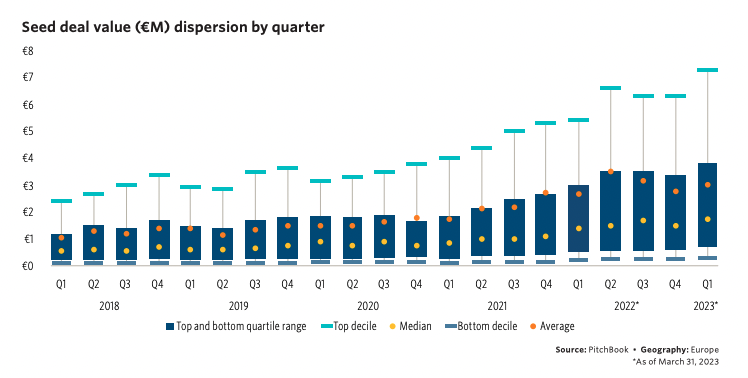

Currently, startups typically use seed funding to establish product-market fit and a go-to-market strategy and are usually years away from an exit.

Current market conditions could force investors to concentrate capital and resources on the best ideas they think could be long-term successes, creating a more streamlined pipeline of high-quality investment opportunities for investors later in the VC lifecycle.

This highlights the importance for founders to focus on building solid business models and demonstrating the potential for long-term success to attract investment in the current competitive landscape.

---

The report highlights the contrasting trends in the European VC market. While valuations have decreased for early and late-stage startups in some regions, the report reveals promising trends, including resilient acquisition activity and improving exit valuations.

Angel investors and VCs may find the hidden potential in new ideas with lower valuations while near-term liquidity becomes a priority. The report also emphasizes the importance for founders to build solid business models and demonstrate long-term success potential to attract investment in the current competitive landscape.

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.