SeedBlink Blog

all Things Equity

Tech Investors Academy #2 | Predicting and understanding growth with Sergiu Neguț

This is the summary of our second masterclass from Tech Investors Academy with Sergiu Neguț, an angel investor, co-founder & CFO of Fintech OS. In this masterclass, Sergiu pointed out the core indicators investors have when looking at companies that are most likely to outperform and scale fast.

This is the summary of our second masterclass from Tech Investors Academy with Sergiu Neguț, an angel investor, co-founder & CFO of Fintech OS. In this masterclass, Sergiu pointed out the core indicators investors have when looking at companies that are most likely to outperform and scale fast.

With an extensive experience in general management, Sergiu has a great background across different industries, such as healthcare, pharmaceuticals, commodities and business development, including M&A and startups. He is an active speaker in leadership HR development and health care conferences.

Sergiu is also an active angel investor and advisor for a few local startups, including successful examples such as FruFru, 2performant, intemedicas.com, and others. Before starting Fintech OS, he invested nondifferentiated in a few tech and non-tech startups by understanding the business model and staying with the founders as an advisor. His portfolio of investments includes companies like Soleadify, The Outfit, and Aggranda and investment platforms such as Seedblink and Cleverage VC.

In this masterclass, he started with an informal questions game to make sure everyone was comfortable and ready to explore topics such as:

- Critical indicators for companies with high growth prospects.

- Filtering out high-profile startups.

- Understanding the market conditions & prospects.

- Successful startup founder & team profile.

The investment game — The luck of the beginner

He introduces us to investments by drawing parallels between investors and people passionate about playing games. When you are a beginner at a new game, you’ll most likely win and continue playing because the first experience was pleasant.

Sergiu thinks the same applies to venture capital investments, too. Those lucky to invest in their first companies that succeed will continue their journey as investors. As beginners, you can also build and prove what you believe in by accessing all the necessary learning resources.

“As an investor, the trends show that individual investors are more likely to obtain larger returns on their first-time investments with founders who are also trying to build something for the first time.

From another perspective, more established companies are obtaining smaller returns, but who are coming more frequently and consistently.”

Our investment philosophy should be driven less by the impact it creates in the universe at large if it’s successful.

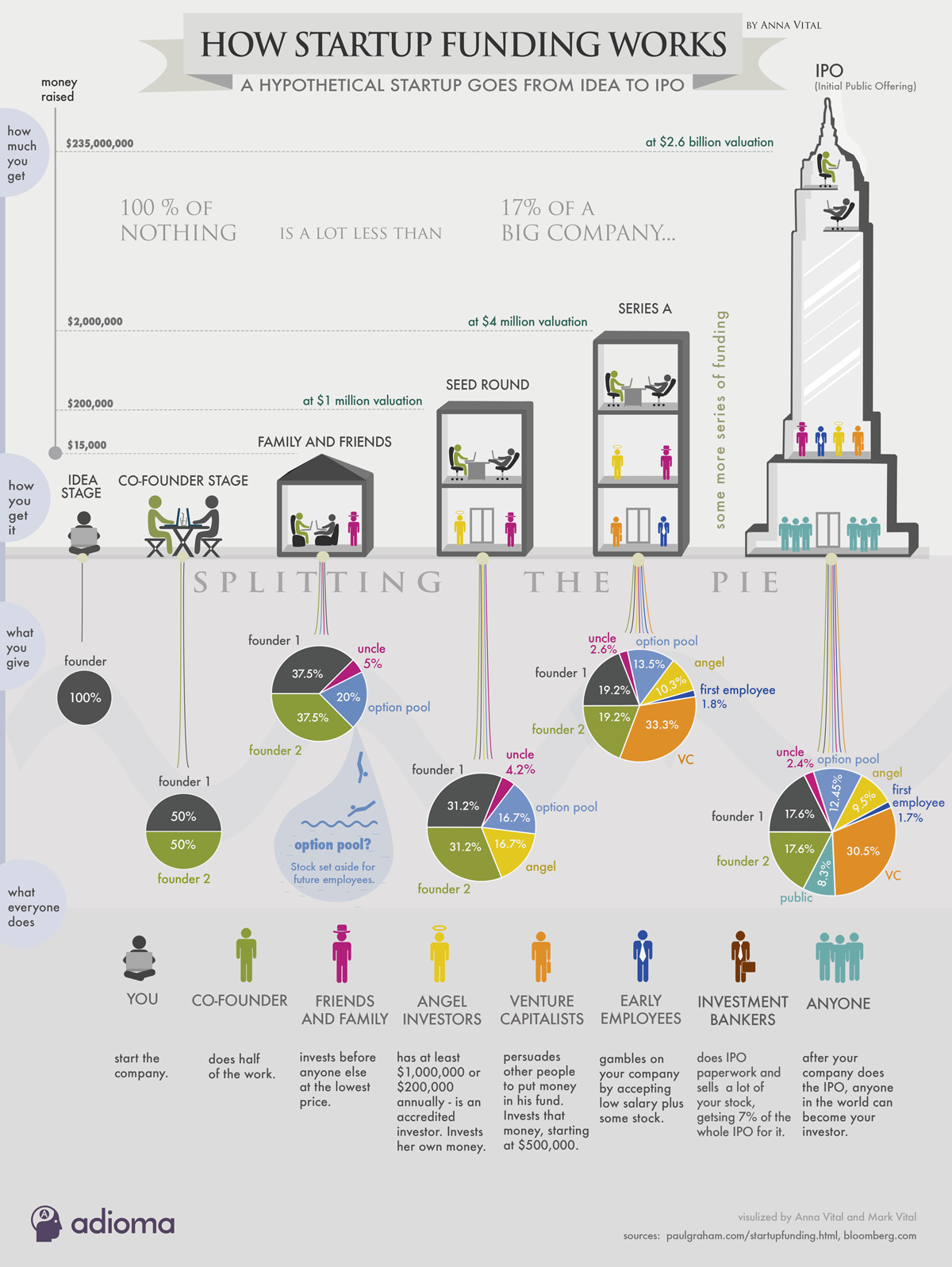

How startup funding works

Source: How Startup Funding Works via Adioma

Investors are diluted when a company reaches the exit phase, heading to IPO. In our current markets, dilution happens very aggressively.

For example:

As investors, if you invest your money into a company worth 1% of the company. By the time of the final exit, if multiple rounds were successfully raised, there is a high chance the percentage will have a value way less than that.

A company goes through multiple stages of financing where you have money from bootstrapping, angels, or VCs until it finally reaches the exit or IPO stage, or, worst, bankruptcy.

The exit and IPO are two predictable stages, but it’s more challenging to spot the one who will fail. These types of companies might generate enough money for founders, but they are not interesting for us as investors. This allows us to plan how to take care of our portfolio and what we would keep or sell if we could.

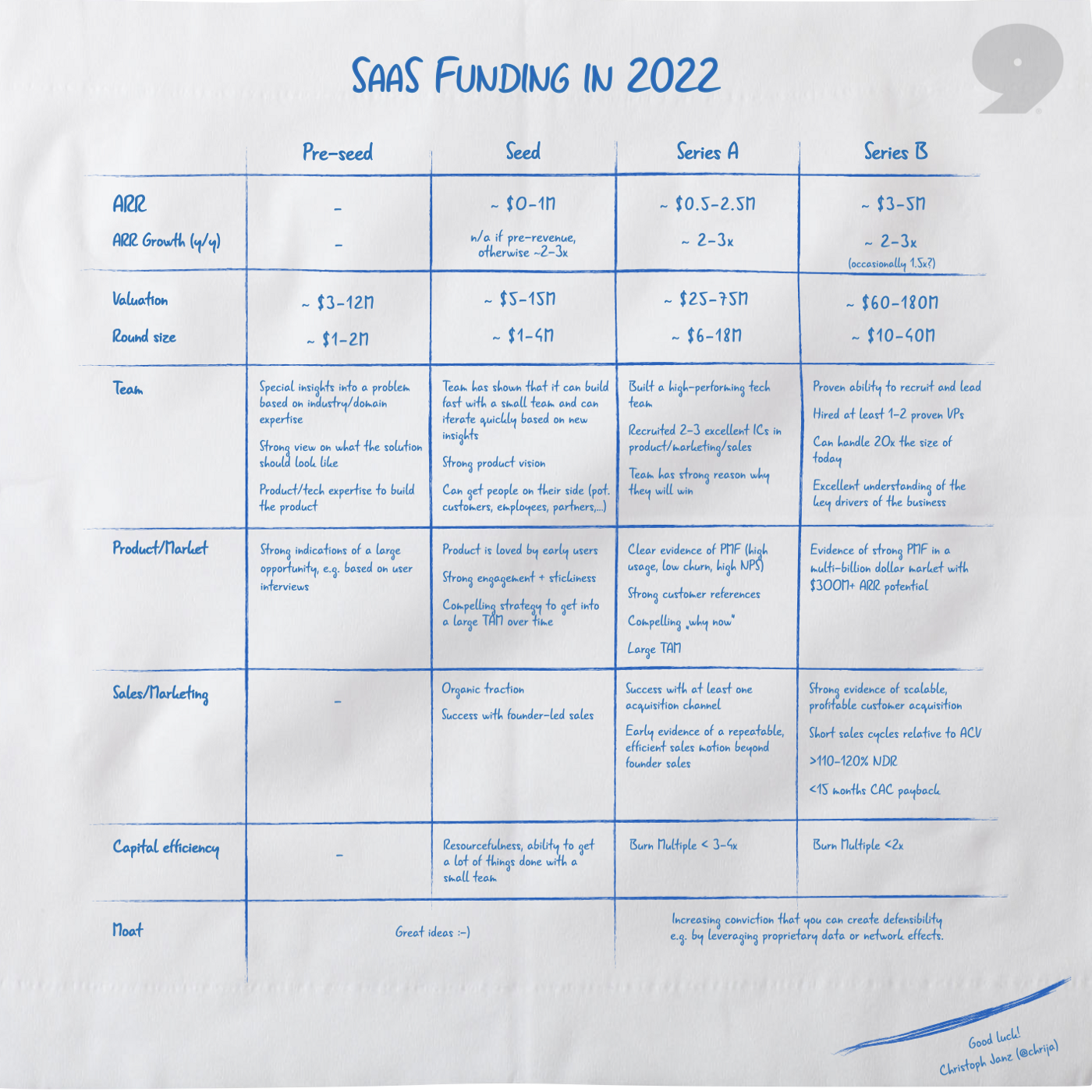

The SaaS funding process

Source: SaaS Funding Napkin 2022 by P9 Capital

Sergiu goes through the SaaS Funding Napkin framework, considered one of the most comprehensive formulas. It helps investors understand what to look for in a company they want to invest in.

Each category from each funding stage indicates the essential elements investors should consider and how to prioritize their due diligence process. The SaaS Funding Napkin is put together by Christoph Janz, the Managing Partner at Point Nine Capital.

Investment trends for 2023

Here are a few things Sergiu learned in the past two years and that he mentioned we should be aware of when looking at the following deals in 2023.

- The current markets are becoming more stable, and there is more likely we’ll not be seeing big seed rounds anymore.

- Investors are now keen to change what the market has perceived as founder friendly in 2020-2021. For example, the CEO if he is not a good fit.

- In 2020-2021 we had multiples that we’ll probably not be able to see again for an extended period. It takes around 10 years from one bubble to another.

- Sophisticated investors and VCs are more conservative on the valuation of a startup, especially when investing at the seed stage.

- What we see now with our co-investors is that they are less willing to deploy large amounts of capital based on less evidence of converging towards rapidly growing revenue.

Reading recommendations from Sergiu Neguț

On top of the information shared during the masterclass, Sergiu also recommended some articles and resources as additional learning material. The articles cover tips and tricks for angel investors, how to approach the investment landscape during the current state of the market, and a few learnings about SaaS startups.

1. Angel investing is a long-term process.

Everyone dreams of being a seed investor in companies like Google or Facebook, but the reality is that these companies are few and far between. Still, angel investing offers potential returns that can greatly exceed public markets. - Via Techcrunch.

2. What you need to know about angel investing?

For many entrepreneurs, angel investors can play a key role regardless of whether they’re good or bad investors. In the current fundraising environment, the importance of angels has only grown.

While terms in the first half of 2022 have remained founder-friendly, seed-stage valuations are reportedly declining, and some investors are taking longer to make decisions while expecting higher levels of traction at every financing stage. - via Techcrunch.

3. Are investors really sitting on mountains of cash?

Venture fundraising has continued at a robust pace, but much less cash is being deployed. The public markets have seen an extreme valuation recalibration, and it’s effectively trickling down into the private markets.

All the while, crossover funds and VCs have been watching from the sidelines — capital deployment is in somewhat of a “wait and see” mode. - via Techcrunch.

4. The SaaS Napkin by P9 Capital

Given the drastic change in the funding environment that started in February, creating the 2022 version of the napkin was particularly interesting. It was also tricky because the market has changed so much in the last few months and may continue to do so. - via P9 Capital

Other resources recommended by Sergiu are market analysis on TechCrunch following articles that look at the overall investment sentiment (such as the blog of a16z). Also, the following two books are two great starting points for anyone starting out:

- Zero to One by Peter Thiel prepares you for this investment journey because it talks about the initial jump who has all the chances to succeed.

- Play Bigger: How Pirates, Dreamers, and Innovators Create and Dominate Markets by Al Ramadan, a book about category creation.

“Whatever I recommend you now, it’s gonna be obsolete in 6 months. So, get yourself to think about where the market is heading. What do we need to know early in investing in a startup?

To sort through all this information, get educated on strategy and innovation strategy.”

Don’t forget to stay tuned for updates about the upcoming masterclasses of the Tech Investors Academy! We’ll be learning soon about:

- Building a healthy and high-performing investment portfolio with Florin Ilie on 16/11/2022.

- Live debate on a case study and enjoy a networking event on 07/12/2022.

Join our newsletter

Your go-to source for European startup news, equity trends, VC insights, and investment opportunities.