SeedBlink Blog

all Things Equity

Product Updates: Winter Release brings Portfolio Insights

SeedBlink launches new platform capabilities for investors to build diversified portfolios

We are glad to share the new platform features we have released for our investors. We are a startup too, and as our founders say: “business is ahead of our technology”. During the past few months, after many consultations with our users, we rushed to deliver several capabilities to lower this gap. We are grateful for your support!

Our product mission is to provide individual investors with the professional tools, insights, and infrastructure, so they can execute their venture capital strategies and get shares in emerging startups, side by side with reputable VCs & angels, and on the same terms.

Read on for the highlights, or log in to your SeedBlink account to see our new features in action.

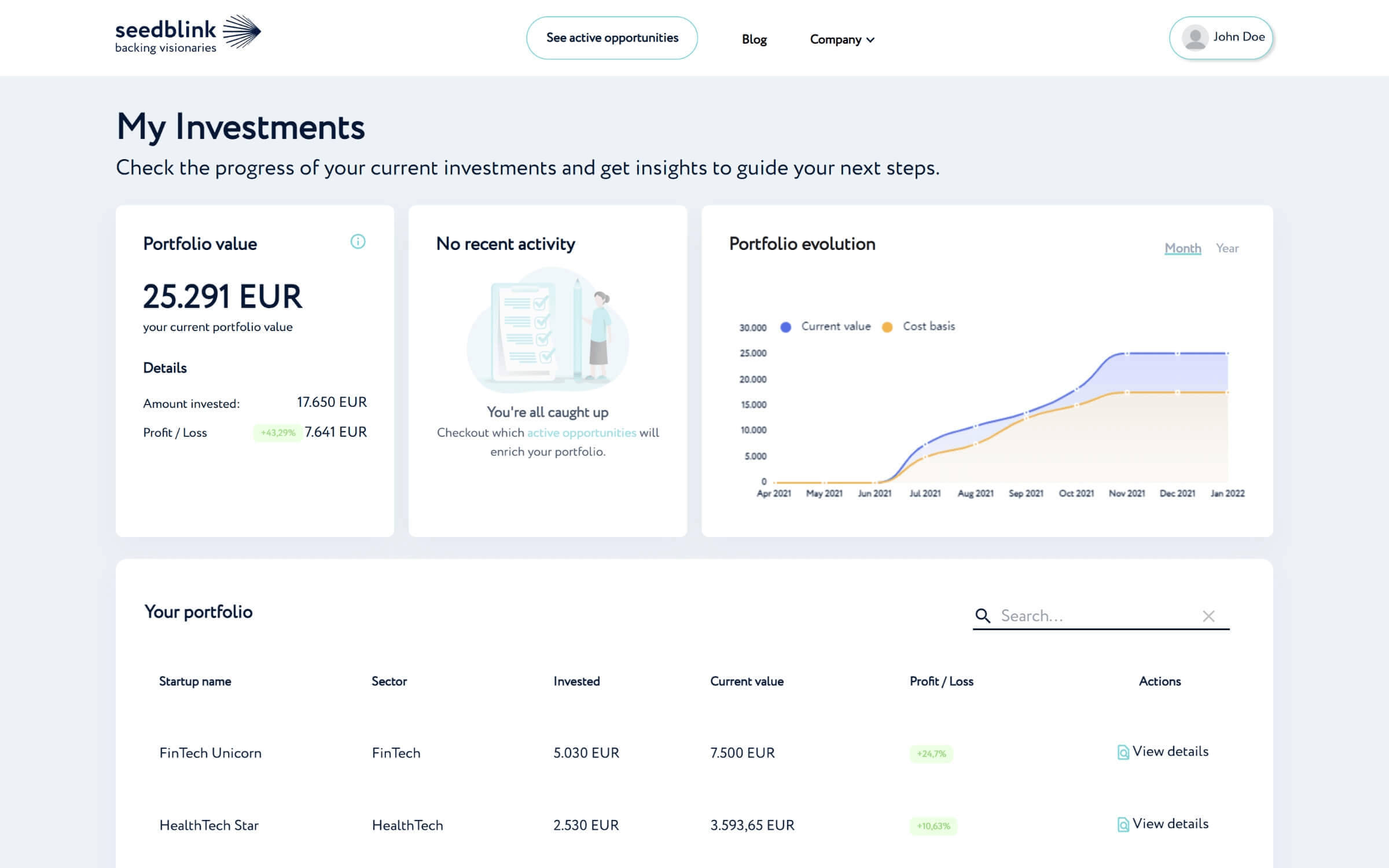

1. Thesis aligned portfolio insights

Your Portfolio

We are ready to remove the Beta tag in “Your Portfolio”. This new version brings:

● More insights: better structuring of data providing a more transparent representation of your portfolio (costs, value, profit/loss evolution, your startups' documents, and their quarterly reports)

● Easier to use: new design, mobile optimized

● Investment tracking - support for new rounds and follow-on updates

"What I like about the My Portfolio feature is that I can quickly and visually see how much I have invested, in which companies, and what updates those companies have released, so I can easily check how my investment portfolio is performing," says Dragos Nicolaescu, one of SeedBlink's returning investors.

Thesis definition (Your profile)

Your profile includes now additional information to define your investment preferences, the communication level, and involvement you want with the community and with your peer shareholders in the startups you own. Also, it covers the risk qualification criteria and guidance according to EU Crowdfunding Regulation, for investors' protection.

This profile customization is the first step towards opening access to private deal rooms based on matching the expertise/investment thesis of the investors with the founder’s needs, beyond the investment amounts.

2. More controls to build your portfolio

Freedom to browse deal by deal and invest on the same terms with professional investors also requires an easy-to-use platform that allows you to be efficient as you discover, assess, and complete, public or private investment opportunities.

Updates on campaign pages:

● We have restructured and standardized the information presented about the investment opportunities (e.g. contextual insights on round details, like pre-money valuation, price per share, lead investor details, founder’s team profiles)

● Allowing more flexible investment amounts (lower increment, improved investment process).

● Offering access to public/private deal rooms incl. early access (pre-registration).

● Built-in support via new FAQs, glossary, SeedBlink Academy, and Ask me anything events for our community

● A new automation tool was implemented to keep you updated on the progress of the investment completion, with our Alumni partner Plant an App.

3. Liquidity enablement

In less than two years since our launch, we have had many preemption rights (follow-on investment) exercised for our investors.

We’re now laying the foundation for a secondary market by running our first pilot for introducing liquidity enablement for the shareholders of an SPV. This is destined for companies closing their Series A, the share price being set by the round (i.e. fair market price).

Stay tuned - we are working to introduce this in your portfolio!

What’s next

We continue the journey to transform mere data into insights and look to provide you with easier metrics & benchmarks on aggregated portfolio performance and startup-investors reporting. The thesis definition will drive customization of the deal proposals, aligned to your portfolio strategy.

As always, please let us know if you have any feedback—we’d love to hear from you.

SeedBlink S.A. is registered in the Register of the Romanian Financial Supervisory Authority (ASF), under number PJR28FSFPR/400001, as of 03.11.2022 with an EU passport as per European Securities and Market Authority (ESMA) register of crowdfunding services providers.

Peeked at the footer? Don't let your curiosity end here and explore more!

© 2024 All Rights Reserved

EN